Alpha Investor is an investing service run by Charli Mizrahi.

He claims you'll get access to ground breaking investment ideas if you sign up.

Is this a legitimate offer or another newsletter scam?

Well I have good news for you...

I review these products for a living and spent the whole day researching this product.

Below you'll get answers to any questions you have.

You'll find information on this service you won't find anywhere else..

Let's get started!

Alpha Investor Summary

Creator: Charli Mizrahi

Price to join: $47 to $129 per year

Do I recommend? Not really

Overall rating: 3/5

Alpha Investor is a typical investing newsletter.

It's high on hype but doesn't really deliver - the stock picks I looked at from Charles aren't that impressive.

There's other deal breaking red flags as well.

I'd pass.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Agora's Fingerprints Are All Over Alpha Investor

A MAJOR flag is Alpha Investor comes from Agora (Agora owns Banyan Hill, the publisher of Alpha Investor).

Agora is a terrible and predatory company that sells legitimate scams.

The problem is once you buy one product from Agora, they start selling you all their others.

Most aren't anywhere near the quality Alpha Investor is.

Here's a couple reasons why you never want to be in an Agora Marketing Funnel.

They Don't Care If They Get In Trouble

If you heard someone in your neighborhood was stealing from all the elderly people, would you trust this person?

Would you welcome them into your home and give them your credit card details?

Of course you wouldn't.

This is why you should avoid anything that comes from Agora - they literally target senior citizens with both financial AND health scams.

Just last year they had to pay $2 million dollars for doing it.

The financial scams fraudulently claimed seniors could get thousands from the government every month.

Believe it or not the health scam is even worst.

Agora promised to cure diabetes in older people in just 28 days without exercise or diet changes.

This is an obvious lie.

You would think such a big fine would deter Agora from these practices but it hasn't:

The reason Agora doesn't change anything after being fined is they make too much money.

It's reported Agora makes HUNDREDS of millions a year.

They've calculated the cost of selling scams and breaking the law - it pays for them to commit the crimes.

$2 million is nothing to them.

Aggressive Marketing

Another reason you don't want to buy from Agora is you don't want to be in one of their marketing funnels.

Agora is one of the most aggressive companies on earth and once you buy from them, you become a target.

Every day your inbox will be flooded with promotions and offers.

Agora uses every dirty trick in the game to get you to buy.

Watch this video below to see just how ridiculous their marketing is:

The worst part is the upsells are very expensive and will cost THOUSANDS a year.

Most don't come with a refund policy either.

It's just such a pain to deal with Agora and my advice is not to get involved with them.

Recommended: The Best Place To Get Stock Picks

Charles Mizrahi Stock Performance Isn't Great

Agora doesn't release the stock performance of its editors.

But the good news is there's still a lot of stock picks that Charles has made publicly that we can look at.

Agora runs teaser presentations for stocks to sell their newsletters.

These teasers hype up a company or stock and then pitch their product at the end.

If you buy the product you get the stock.

This is likely how you hear about Alpha Investor.

These teaser stocks are supposed to be the best and most exciting picks.

Let's take a look at how some of them have performed in the past.

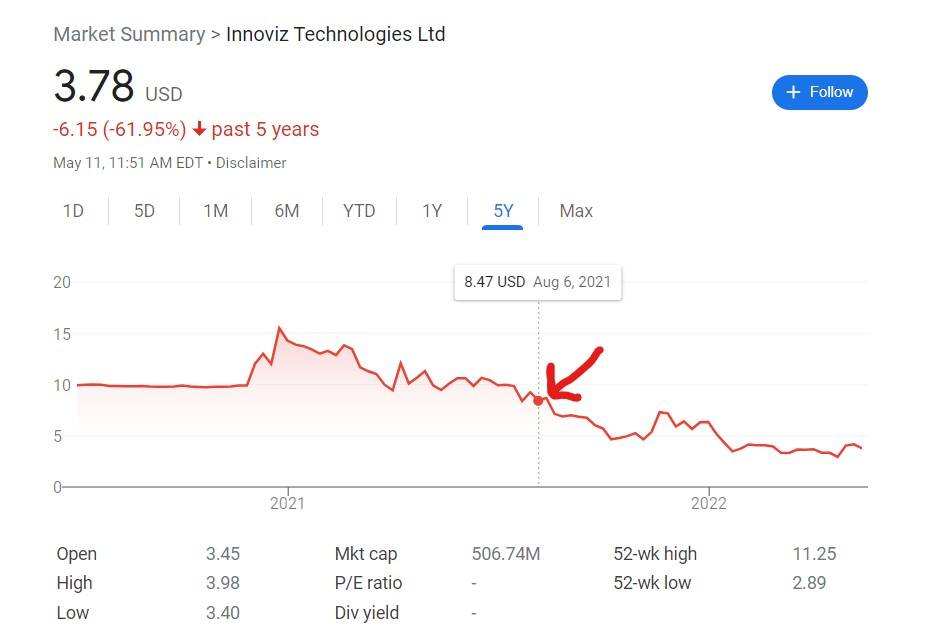

Innoviz Technologies In August 2021

Last year Charles ran a teaser campaign with the title "#1 Autonomous Vehicles Stock Of The Decade."

The company he's talking about is Innoviz Technologies and they were in the LiDAR (light detection and radar) market.

At the time they weren't earning any real revenue but had struck a deal with BMW.

Here's how the stock has performed since then:

It's done very badly and has lost more than half of its value since the recommendation.

Cerner In March 2021

In March 2021 Charles ran a campaign called "IOMT: The Hottest Stock To Buy Right Now."

IOMT stands for Internet of Medical Things.

They're basically medical devices that you wear.

The company he's talking about is called Cerner.

At the time of this pitch they were a major play in this field and had a relationship with about a third if US hospitals.

Here's how the stock has performed:

The stock has done well in the last year and is up around 25%.

Zuora In April 2021

Zuora is a company that Charles pitched in April 2021.

The presentation claimed Zuora was doing well in the SoE market (subscription of everything).

Essentially, they build subscription products and benefit in the rental economy (as opposed to the buyer economy).

However, the stock hasn't done well in the last year:

Iridium In February 2020

In February 2020 Charles ran a very sensational teaser presentation with the title "The #1 True Alpha Stock To Own Right Now."

The company being hinted at is Iridium and Charles claimed it had a "virtual monopoly on global communications.

Many investors believe this is a very long term stock buy but has gone up since the recommendation:

It's nothing significant but it's moving in the right direction.

The Brink's Co In May 2019

In 2019 Charles made the claim Brink's was "Wall Street's best marijuana stock secret."

Brinks doesn't actually grow marijuana or anything like that.

They are an armored truck company that transfers money.

At the time of this teaser they had struck some deal with marijuana growers to transfer their money.

The reason Charles is calling this a marijuana stock is marijuana stocks were really big a few years ago.

This is what people like Charles typically do - they hop on to trends.

Here's how Brinks has performed since the recommendation:

It crashed pretty bad during covid and got back to breakeven point for a little.

Overall, it hasn't performed well.

So 3/5 of the teasers have been losers with 2/5 being moderate winners.

Overall if you invested an equal amount into all of these stocks you'd be down.

Recommended: The Best Place To Get Stock Picks

What Is Alpha Investor Offering?

Alpha Investor is a pretty typical investing service and reminds me a lot of other Agora newsletters.

Here's everything that you get:

Monthly Newsletter

This is the core part of the offer and what you're basically paying for.

Every month you'll get a newsletter that looks into a new investment idea.

You'll get a full report on the stock Charles is targeting and all of his research.

Model Portfolio

The model portfolio is the other core part of this offer.

Once you sign up you'll see all the open positions Charles has as well as additional information on them.

You'll see the price to buy and sell there.

Additionally, you'll get weekly updates on all of the positions in the portfolio.

You'll get a breakdown of any news that would effect these stocks.

Trade Alerts

Sometimes the market moves fast and you can't wait until your monthly newsletter or weekly updates.

In these cases you'll get an alert on what to do.

This can mean buying or selling is something unpredictable happens.

Special Reports

Once you buy Alpha Investor you get a bunch of special reports.

These special reports are much like the teaser stocks we looked at in the last section.

One thing to note: These special reports are constantly changing.

So by the time you read this they may be different than the ones today.

The special reports today are:

- The Power Compounding: How To Build A $1 Million Retirement

- True Alpha: How To Spot Stocks That Will Soar 5-fold

- America's Alpha Stock: The Company Leading a $708 Billion Revolution

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Alpha Investor FAQ's

Still have some questions about Alpha Investor?

Here's answers to any questions you might have:

1) What Is The Price Of Alpha Investor?

Alpha Investor costs anywhere from $47 to $129 per year.

The price isn't bad for what you're getting and is what all introductory investing newsletters cost.

However, keep in mind you're dealing with Agora.

Once you sign up for Alpha Investor, you'll be marketed products that cost thousands of dollars.

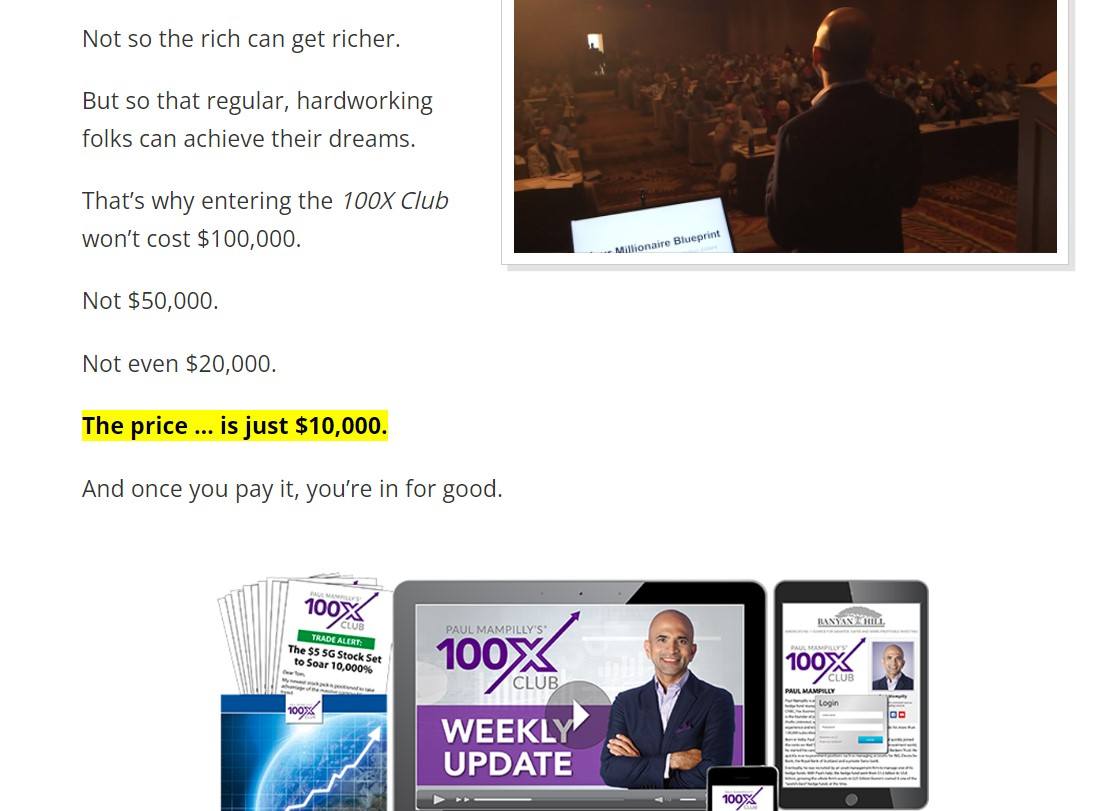

Banyan Hill (publisher of Alpha Investor) has products that cost $10,000 and more:

Just realize the promotional efforts won't end.

2) Is There A Refund Policy?

Yes, there's a 365 day refund policy.

However, if you're paying only $47 to get your money back it's not that big of a deal.

Additionally, if you're asking for your money back after a year, it's likely because you lost thousands of dollars.

3) Is Charlie Mizrahi Legit?

It's hard for me to say anyone that works at Agora is legit.

They use such scummy marketing techniques and everything they sell is over the top.

How can someone be legitimate and participate in this kind of stuff?

Beyond that the stock picks I saw from Charlie aren't that great.

In the end, I'll leave this one up to you to decide.

4) What Are Customers Saying?

I've read both good and negatives reviews about this service.

For instance, someone says the stock picks in this newsletter are very good and you just need to be patient to see results:

This is a pretty recent review and the person claims most of the stocks are doing great.

However, other people have called this newsletter a disappointment:

For an Agora newsletter I actually think this one isn't the worst.

Recommended: The Best Place To Get Stock Picks

Alpha Investor Pros And Cons

Alpha Investor Conclusion

To be completely honest if Alpha Investor wasn't from Agora there's a chance I'd recommend it.

The stocks I looked at underperformed but there's enough positive reviews out there that maybe they were just flukes.

But it's not good enough to overcome the Agora stench.

Once you get into the marketing funnel you'll be bombarded with pricey upsells.

Your email will likely become useless because you'll get so many promotions.

My advice is to save yourself the headache of dealing with Agora.

Here's A Better Opportunity

I'd pass on Alpha Investor.. it's not the worst investing newsletter but comes with Agora baggage.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: