Hedgeye sells various products related to trading and claims they deliver hedge fund level research to investors..

Is this true or is it all one big scam?

We'll get to the bottom of this question in this review.

Additionally, you'll see everything you need to know about Hedgeye including a look at their performance, what they're offering and more.

You'll know if these services are worth buying by the the time you're done reading.

Let's get started!

Hedgeye Summary

Creator: Keith McCullough

Price to join: Depends on service

Do I recommend? Absolutely not.

Overall rating: 1/5

I'd pass on Hedgeye.

It's been proven that their trade alerts aren't worth it and you won't make any money from them.

Any potential returns Hedgeye claims you can get is greatly exaggerated.

Additionally, the owner is on the record saying he doesn't actually trade.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Don't Expect To Make Money With Hedgeye

Hedgeye has been around for a long time and there's been a few illuminating articles written about them.

This one from Business Insider is the most fascinating.

Back in 2014 Hedgeye sued a man named Carmine Pirone for writing a review about Hedgeye.

Eventually the matter was settled with Carmine not having to admit fault.

Pirone basically proved that Hedgeye's alerts were worthless.

He tracked them over a year and the results were a dismal .3382% returns:

So basically after a year of trading the alerts from Hedgeye you would breakeven.

However, there's costs involved with swing trading, which Hedgeye is made for.

It can cost up to $100 per trade and you have to pay 28% in taxes on all of your trades.

This likely means .3382% returns will lose you money.

There's more proof Hedgeye's alerts won't make you money too.

Griffin Asset Management created a fund based on these alerts - it only lasted a year and shut down for poor performance.

Recommended: How To Beat The Market By 3X

The People At Hedgeye Don't Actually Trade

You might be a little confused why Hedgeye claims their alerts get high returns and even though there's evidence proving they don't.

Are they lying?

It's not exactly that simple.

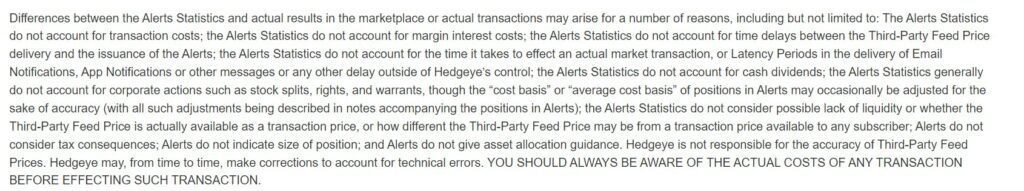

On their website they have a disclaimer explaining the discrepancy between the alerts and the results you might get:

If that's too small to read it basically gives a bunch of reasons why you can't expect to get the same results as Hedgeye claims their alerts get.

Some reasons for this include:

- Transaction costs

- Time delays

- Margin interest costs

- Position sizes

- Actual errors in alerts

Now you might be thinking "what about the results Hedgeye gets for themselves."

Well it turns out no one at Hedgeye actually trades these alerts.

According to Keith:

So everything you see from Hedge is completely hypothetical.

Any returns they claim are based on imaginary trades and no one at Hedgeye is risking anything with these alerts.

You're the only one risking anything.

Not A Fan Of Swing Trading

A major focus of Hedgeye is swing trading which is not a good investment style in my opinion.

Swing trading requires buying and selling an asset in a short period of time - usually a couple days to a couple of weeks.

The reason this is a bad strategy is it's basically impossible to predict where a stock's price will be in a couple days.

Hedgeye will claim their alerts can detect good trade opportunities through charts and technical analysis but that's all garbage.

You don't even have to take my word for it either.. here's what Warren Buffet has to say about technical analysis:

Swing traders will tell you it's all about discipline and recognizing patterns and stuff like that.

The truth is swing trading's success rate is abysmal and most people lose money doing it.

Most studies show 95% of people lose money.

This is because swing trading is simply a coin flip because there's too many factors that can effect a stock's price.

Except it's worst than a coin flip because you have to pay transaction fees and taxes.

This pretty much guarantees loses.

Recommended: How To Beat The Market By 3X

Hedgeye Products Overview

Hedgeye offers a ton of different products and services.

Here's an overview of each one:

The Macro Show ($49.95 Per Month)

The Macro Show is like a cable news show that focuses on stocks.

It goes live every trading day at 9 AM and is hosted by Hedgeye CEO Keith McCullough,

The goal of the show is to give you "everything you need to know to start your risk management morning."

The Call @ Hedgeye Plus ($49.95 Per Month)

This is another morning show offer.

It differs from The Macro Show and instead of being like a cable news program, it focuses on Hedgeye's morning research conference call.

You get the full audio meeting between Keith and the research analysts at Hedgeye.

They'll be talking about their favorite investment ideas for the day.

Bitcoin Trend Tracker ($14.95 Per Month)

This is a tool that tracks Bitcoin.

The goal is to give you buy prices and sell prices for people that are looking to swing trade Bitcoin.

I think swing trading Bitcoin and crypto is a big mistake.

It's a volatile asset and you'll have better results if you just buy and hold.

Real Time Alerts ($49.95 Per Month)

Real Time Alerts focuses on buying, selling and shorting stocks and ETF's.

These alerts "employ Keith McCullough's quantitative risk range model to help investors risk manage their core investing ideas."

Besides the alerts you'll also get details on why the calls are being made.

Risk Range Signals ($29.95 Per Month)

The risk range signals help you risk manage your positions.

Every day you'll get 20 buy/sell signals on major markets and currencies.

Early Look (29.95 Per Month)

Early Look is the daily newsletter that Hedgeye sends out.

This newsletters looks at the markets and the economy and gives you investing ideas.

It's broken up into a few different sections including the big picture, the macro grind and risk ranges.

Investing Ideas ($29.95 Per Month)

Investing Ideas is focuses on long term stocks instead of swing trades.

This is a weekly newsletter that puts together the best stock picks from the Hedgeye team.

Additionally, you'll get updates on recommendations along the way.

ETF Pro Plus ($39.95 Per Month)

This services is monthly and focuses on ETF's.

This newsletter uses macro analysts to research the global economy for investing ideas for ETF's.

Market Edges ($14.95 Per Month)

Market Edges is a weekly investing newsletter that "analyzes the week's most important global economic developments."

The goal is to help you prepare your portfolio for what's next.

Hedgeye Pro ($899 Per Year)

This is just a combination of all the services mentioned before and bundles them for a discount.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Hedgeye FAQ's

Still have some questions about Hedgeye?

Here's answers to any remaining questions you might have:

1) Are The Prices Fair At Hedgeye?

I actually don't think the prices are that bad.

They are monthly in most cases so they add up but they're not overly expensive.

Additionally, the bundle plan let's you get everything for just $899 per year.

You're getting a decent amount for that price.

2) Is There A Refund Policy?

I couldn't find one anywhere on the website.

Usually if there isn't one displayed that means there's no refund policy.

3) Is Keith McCullough Legit?

This is up for debate in my opinion.

I think he's a competent business man and what he's built is impressive from a business standpoint.

However, the returns seems to be really small to the point you probably won't profit from the alerts.

For an entire year the returns were a fraction of 1% and a hedge fund using Hedgeye alerts closed down the fund.

Also, he explicitly states he doesn't trade.

Can you call a guy that sends out trade alerts that don't make money and who also doesn't trade a legit investment personality?

4) Is The Trading Style Legit?

According to Keith there's over 40 analysts working at Hedgeye and he himself has loads of experience.

Despite this the trade alerts aren't making money.

Why is this?

It's because swing trading isn't a good way to trade and it's almost impossible to profit after you account for transaction fees.

It's also impossible to guess where a stock's price will be in a few days.

If a team with a massive budget and a lot of experience can't figure it out, what chance do you have.

This is why it's better to just invest long term - it's much easier to predict.

Recommended: How To Beat The Market By 3X

Hedgeye Pros And Cons

Hedgeye Conclusion

Hedgeye has been around for a while now and it's definitely a controversial company.

However, you can look past all of this if Hedgeye can help you make money.

All indication is this isn't going to happen, though.

The alerts and trade ideas have been tested and in basically every case money was lost.

Even if you do make 1/4th of 1% you're likely going to lose money because of transaction fees.

If you just invest in the S&P 500 you'll make 10% returns every year which is 40 times more than Hedgeye.

You won't have to obsessively trade short term assets either.

My advice is simple: Stay away from swing trading and all swing trading services - invest long term.

Here's A Better Opportunity

I'd pass on Hedgeye.. at the end of the day the returns are just too low.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Subscribe for a year to macro pro and follow the process. I use strictly macro, have saved my clients tons of money this year! Also those 1% trades are not trades, they are the movements are in the stock. They utilize mainly options for trades greatly increasing returns. All of their trades are time stamped from inception for subscribers. Lastly they do trade, Keith even provides his moves in the macro pro daily. Maybe a bit more research on your side is in order.

A successful Hedgeye subscriber

Wow! The authorities take a dim view of touting investment track records – I take an even darker view of anyone critiquing investment returns from ONE YEAR. Hedgeye and Keith McCullough have been around for quite a few years, correct? One might impute from the length of time the company has been in business that they are doing something right. In other words, to endure for as long as they have, they must have provided VALUE. As to your statement that founder McCullough does not trade, that is a factually incorrect statement. Flat out false. Keith trades his own capital and has capital at risk each and every day. He nor any of the analysts employed at Hedgeye do NOT trade in any of the securities that the Hedgeye research team recommends – buy or sell. That would be an obvious conflict of interest which the firm as a policy will not allow. Finally, Hedgeye counts among its clients some of the largest institutional assets managers in the world as well as thousands of individuals seeking to profit from a mathematically-derived methodology designed to provide investors with a probabilistic framework for making investment decisions in all asset classes in all global markets. NO ONE is right all the time. But if you’ve drawn three aces in a hand of poker, you likely have a pretty good chance of winning that hand. Hedgeye is definitely an ace or two or three! Do your research before writing hackneyed, factually incorrect “reviews”. Yes, I am a subscriber.

Strange you wrote this entire thing and never once mentioned how much you’ve made with Hedgeye

Most people would probably be reticent to share financial details to someone online, including myself but I will say that Hedgeye helped me and my family earn enough to purchase 3 homes in LA. Not chump change.

lol suuuuuuuuuuure