Motley Fool offers a discount on three of their most popular services and they call it The Epic Bundle.

They believe the combination can help you turn $50,000 into $1,000,000 or more.

Is this true or all one scam?

You'll get an answer to that in this review.

Additionally, you'll get insights into this service that you won't find anywhere else.

This includes a look at performance, the good and the bad.

You'll know if The Epic Bundle is worth it by the time you're done reading.

Let's get started!

Motley Fool Epic Bundle Summary

Creator: Motley Fool

Price to join: $499 per year

Do I recommend? Yes!

Overall rating: 4.5/5

The Motley Fool Epic Bundle is an excellent service and combines three of Motley Fool's best services together.

Each newsletter covers a different market and you combine the research to build your perfect portfolio.

At $499 this is a steal and I definitely recommend!

What Is The Motley Fool Epic Bundle?

There's a couple companies that control the investing newsletter industry.

The biggest is a place called Agora which is a very unethical company - they're constantly getting sued by the government for their behavior.

The Motley Fool is definitely one of the major players in this industry and they have one of the best reputations of all.

They've been in business since the 90's and have millions of customers.

Over the decades The Motley Fool has launched tons of services and newsletters and they all focus on different investing strategies.

It would be pretty expensive to buy them all.

The Epic Bundle gives you a discount on three of the most popular services at The Motley Fool.

These services are:

- The Stock Advisor

- Rule Breakers

- Everlasting Stocks

Each of these services focus on different investing strategies and compliment each other perfectly.

The Motley Fool Investing Strategy

The reason the Motley Fool has been so successful over the years is because they recommend the best investing style.

The Motley Fools recommends buying 25 stocks and holding them for 3 to 5 years.

Additionally, they suggest diversifying your portfolio with different kinds of stocks.

This ensures one stock won't ruin your portfolio and if there's a market downturn you won't lose too much.

The combination of Stock Advisor, Rule Breakers and Everlasting Stocks ensures you have a diversified portfolio.

Stock Advisor looks at large cap stocks that are hot, Rule Breakers looks at smaller companies that are higher risk/higher reward (and cheaper) and Everlasting Stocks looks at stocks you can hold forever.

This is more than enough to build a strong portfolio.

For example, you can pick 10 stocks from Stock Advisor, 10 stocks from Rule Breakers and 5 from Everlasting Stocks.

The odds of not only profiting but beating the market will be in your favor if you get The Epic Bundle.

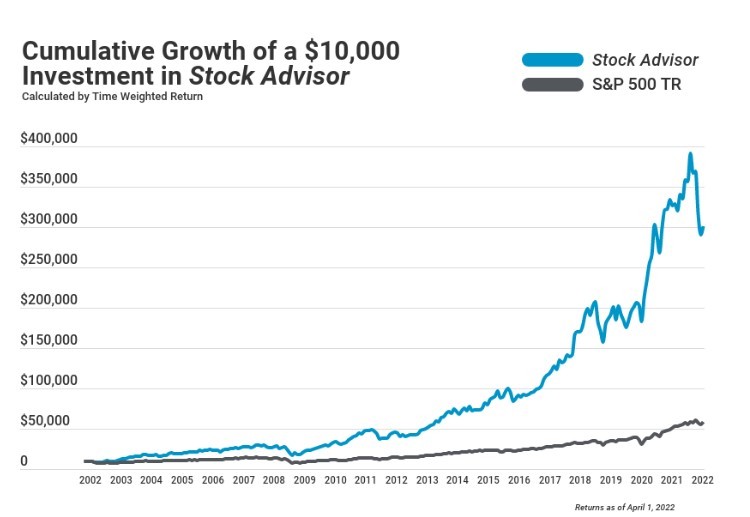

Stock Advisor has beaten the market by 3X over the last two decades:

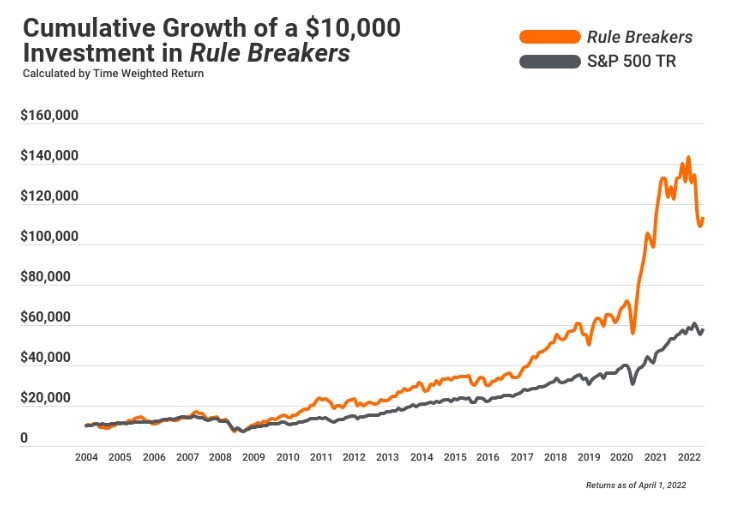

Rule Breakers has beaten the market by 2X:

So you're in good hands if you decide to buy this bundle!

Ready To Get Stared? Try Motley Fool Epic Bundle Today

Epic Bundle Track Record

You can actually look at every stock recommended by the newsletters once you sign up.

However, it's all proprietary information and I'll get sued if I just give you the stock picks.

The good news is Motley Fool does free stock presentations to sell newsletters.

They hype up a stock and withhold it, only giving you the company name if you buy the newsletter.

There's usually enough clues in the presentations to figure out the stock, though.

They've done a ton of these over the years and it's a good way to see how their stocks picks have done.

Here's a bunch from the last few years:

The Trade Desk 2017 to 2021

The Trade Desk is a company that is always being pitched by Motley Fool and it's their number one rated stock in Stock Advisor.

Most recently this stock was pitched as a "five star" pick and is one of their famous double down recommendations (a stock they recommend more than once through out the years).

Whether it's been a good stock picks depends on when you bought the stock:

If you bought when it was first recommended you are up quite a bit - it's gone from around $8 to as high as $100.

However, lately the stock hasn't done as well because of the market downturn and growth/tech stocks being down overall.

Motley Fool still loves this pick and believes it will go up higher, though.

American Tower Over The Last Decade

American Tower is the world's largest REIT (Real Estate Investment Trust).

These opportunities pay dividends.

Most recently Motley Fool pitched this stock as "like buying McDonalds In 1965."

Here's how it's performed since the latest pitch in 2019:

The stock has done well in the recent downturn and is up overall.

Additionally, the dividends have increased every quarter from $1 to $1.40.

So this has been a steady and good pick.

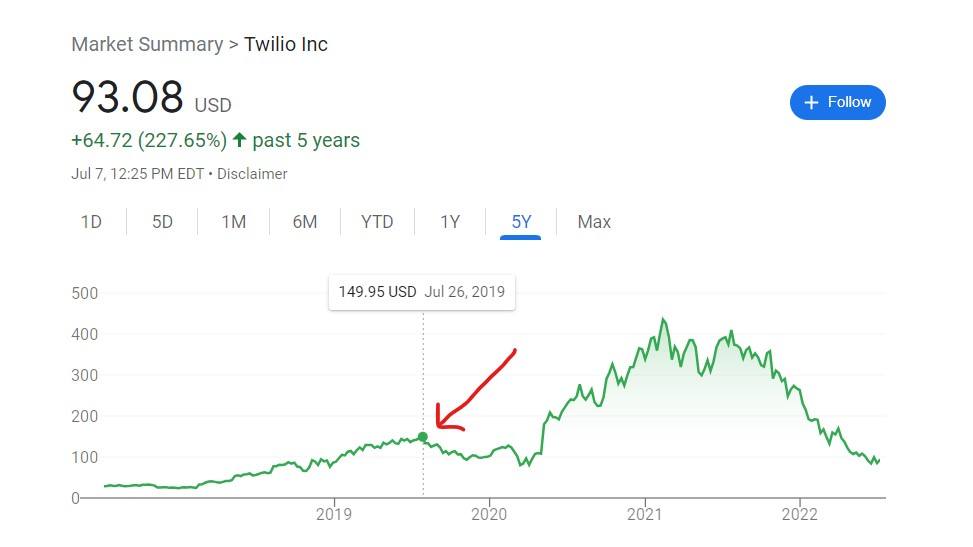

Twilio In July 2019

Twilio is a company that Motley Fool marketed as a "hidden 5G superstar."

In the presentation Motley Fool made the pitch this stock was poised to skyrocket.

Here's how the stock has done:

I guess how much success you had depends on if you sold it 2021 or not.

This stock was recommended at $150 and shot all the way up past $400.

So if you were smart you could have more than doubled your money in less than two years.

However, if you held onto it your down 30%.

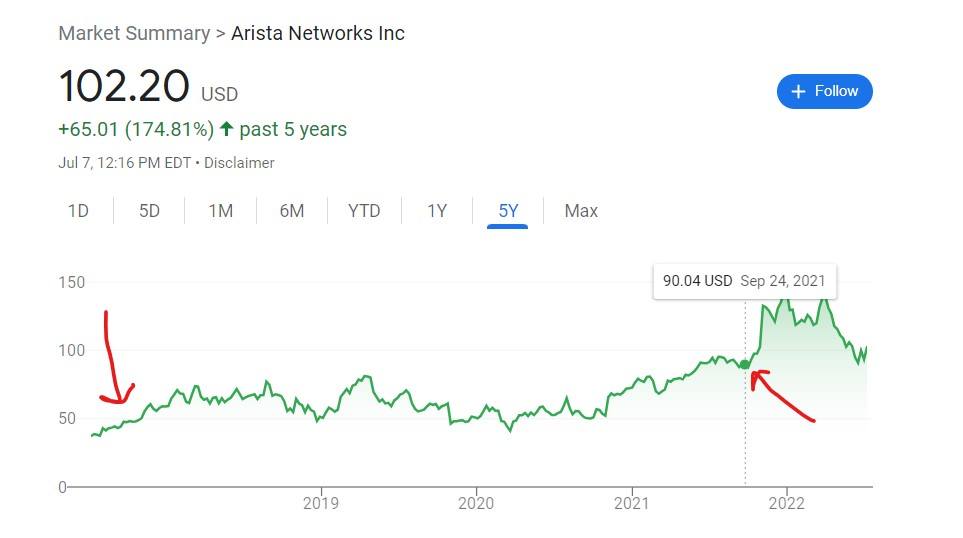

Arista Networks From 2017 To 2021

Arista Networks is another one Motley Fool's famous double down recommendations.

The presentation in this pitch even went on to say this stock could one day end up in the hall of fame of Motley Fool stock picks.

Lofty claim!

Here's how the stock has done through out the years:

Regardless of when you bought Arista you're still up - however the earlier you bought the better.

Will this one day be a hall of fame pick?

Guess we'll just have to wait and see.

Markel For The Last 15 Years

You've heard of the double recommendation but what about the triple recommendation??

Well that's the case with Markel.

In 2021 Markel got the super rare triple recommendation.

Most recently it was marketed as a "mini-Berkshire."

Here's how the stock has done:

As you can see this is a very, very expensive stock.

However, if you look at who Motley Fool is comparing it to, Berkshire Hathaway, it's still cheap (Berkshire's stock is over $400,000!).

So who knows how high a stock like this can eventually go.

Guardant Health In March 2019

Back in 2019 Motley Fool pitching Guardant Health as a "small company with a $147 billion opportunity."

This was alluding to them selling lung cancer diagnostic blood tests.

Here's how the stock has performed since being recommended:

There was a window to double your money in early 2021.

I'm sure a good amount of people did just that.

If you held onto to it, though, it's down nearly 50%.

Shopify Since 2016

Shopify is one of the best stocks Motley Fool has ever recommended.

They're constantly re-packaging this stock pick in different presentations.

One of their most recent was in 2019 where they connected it to the marijuana industry.

It was a pretty loose connection but pot stocks were hot then so they just kind of mushed it in there.

It's been a good stock, though:

It's gone down like all tech stocks have but it's still been an excellent stock pick.

It's price is at a bargain at the moment too!

Ready To Get Stared? Try Motley Fool Epic Bundle Today

What Do You Get With The Epic Bundle?

You get three different newsletters in this bundle.

Here's an overview of each one:

Stock Advisor

Stock Advisor is the flagship newsletter at Motley Fool.

It was started by the Gardner brothers back in 2002 and has been one of the most successful stocking picking services since.

It has over 1,000,000 subscribers and has 3X'd the S&P500.

Here's a video review I did covering this newsletter:

I wrote a review as well which you can read here.

The service is pretty simple.

You get "Best Buy" stocks that should be in your portfolio.

The first category is "Timely Stocks" and these are the hottest stocks you should own for the next 3 to 5 years.

These are updated a couple times a month.

Next there's "Foundational Stocks" which are the cornerstone of your portfolio.

This is where you'll find the Amazon's and Shopify's of the world - these are stable stocks.

These get updated quarterly.

Lastly, there's the top 5 ETF's to invest in.

Next you get two new stocks picks per month.

These come in reports that give you all the information on why it's a good stock pick.

This includes financial details like revenue and debt and more.

The last major aspect of Stock Advisor is the stock screener.

The stock screener ranks and rates all the stocks in these three newsletters.

This means you'll get a rating ranging from high, positive, neutral and negative.

It ranks the stocks in order as well so you can see which are the best buys from the portfolio.

Rule Breakers

Rule Breakers works in basically the same way as Stock Advisor.

For example, 25 stocks is still recommended and holding the stocks for 3 to 5 years is too.

Also, it's suggested you regularly invest savings into the stocks.

The one big difference is the stocks targeted.

Stock Advisor focuses on very stable stocks and Rule Breakers focuses on more risky stocks.

The stocks tend to be a little cheaper and have a higher ceiling.

You don't want an entire portfolio high risk/high reward stocks but you do want a healthy mix in there.

That's why combining Stock Advisor and Rules Breakers is such a good idea.

Everlasting Stocks

The last service is Everlasting Stocks and it's completely different than the other two.

Instead of getting monthly stocks picks you only get stock picks every quarter.

The reason is these stocks are growth stocks that you need to hold for more than 5 years.

It would be no use sending you a ton of these stocks a month.

You only want a certain percentage of your portfolio to be made up of them.

Ready To Try The Epic Bundle?

Click below to try Epic Bundle Today!

Epic Bundle FAQ's

Still have some questions about this service?

Here's some answers to any remaining questions you might have:

1) How Much Does Epic Bundle Cost?

The price of this service is $499 per year which is an excellent deal.

There's many other newsletters that cost way more than this and don't give you anywhere the same quality.

Additionally, Epic Bundle is basically all you'll need in terms of stock research.

You'll have access to hundreds of stock picks.

You'll easily be able to put together a portfolio with this service.

2) Is There A Refund Policy?

Yes, there's a 30 day refund policy.

This isn't enough to test out the stock picks or anything like that.

However, it's good enough to see if you like the service.

You'll be able to look at the stock picks and read the special reports.

3) Is Motley Fool Legit?

For sure!

I've reviewed hundreds of investing services over the last couple of years.

I don't recommend most because most are very low quality and will lose you money.

Some are straight up scams.

Motley Fool is a good publisher and has proven they're stock picking prowess over a period of decades.

4) Is The Investing Strategy Legit?

Yes!

Too many people have turned to day trading, options and fast profits.

This has lead to disastrous results and many people losing a lot of money.

Motley Fool does it the right way.

They don't promise fast profits and instead promote long term investing.

They suggest holding stocks for 3 to 5 years and picking a diverse portfolio of 25 stocks.

This is the best way to build wealth with the stock market.

5) Is There Anything You Don't Like?

Motley Fool is very aggressive with their marketing and promotions.

Once you buy they start sending emails for you to buy more expensive programs.

It's pretty annoying.

Ready To Get Stared? Try Motley Fool Epic Bundle Today

Motley Fool Epic Bundle Pros And Cons

Wrapping Things Up

Motley Fool is a brand that's proven themselves over the years.

There's a reason so many people trust them and they have so many members.

There may be publishers as good as Motley Fool but none are better.

The three newsletters that make up The Epic Bundle are some of their best products too.

They've proven to beat the market and their strategy is sound.

The Epic Bundle is really almost perfect.

You'll have access to so many stocks that building your portfolio should be easy.

If you're ready to get started, click below:

Try Epic Bundle Today!

Epic Bundle is $499 and you can try it today by click below: