Andy Snyder of Manward Press is out with a stock teaser hyping up a new investment.

He claims to know "the one electric vehicle stock that could help fund your retirement."

Andy goes on to say this "new $25 startup could dominate the upcoming $7 trillion EV market."

The problem?

Snyder wants you to sign up for his newsletter to learn the name of the company.

Well I have good news! I was able to figure out the stock based on the clues Andy left behind in the presentation.

I reveal it below along with some additional information so you can determine if it's worth investing in.

Let's get started!

#1 EV Stock To Fund Your Retirement Summary

The stock Andy is hyping up is Lucid Group and they make luxury electric cars.

While I find their cars very cool and they have some awesome features (fast charging, high performing, very nice looking) I'm not thrilled about the stock.

Andy first marketed this stock at $25 and it's fallen a lot since then.

In just 6 months the stock fell to around $7.

As I'm writing this the stock has bounced back to around $12 in the last couple days because there's a rumor Saudi Arabia will be buying the company.

This kind of deal (not guaranteed and just a rumor) could save the company.

It's burning through cash and is nowhere near profitable.

Lucid can only survive if it gets outside capital and investments.

I personally would hold of on investing until the company seems more likely to be profitable.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Figuring Out The Stock

Andy Snyder wants you sign up to Manward Letter to learn what his #1 EV stock to fund your retirement is.

Before we spend any money, let's try to figure out the stock based on the clues in the presentation.

Let's get started:

Tesla's Worst Nightmare?

If there's one thing stock pickers LOVE to do it's to invoke the name of Elon Musk.

Every week it seems there's a new stock presentation that hypes up the company that Elon fears most or that will bring an end to Tesla's reign as the #1 electric car company.

Today we're going to be learning Andy Snyder's pick to disrupt Tesla's position.

He claims the company he's teasing has created a car that has the following features:

- 1100 horsepower

- 0 to 6 time of 2 seconds

- Top speed of 170 miles

All of this makes this mystery car faster than "Ferrari’s F8, McLaren’s 720S and Porsche’s 911 Turbo."

And Andy draws even more connections to Tesla claiming this mystery EV company's stock could perform like Tesla's did, going from $5 to $700.

Andy goes on to say the CEO of the stock he's teasing "was the mastermind behind the Tesla Model S itself" and "he and his team created the car that transformed Tesla from a little-known company to the giant it is today."

The EV Company Is Lucid

Andy drops a lot of hints in this presentation and it makes figuring out the stock pretty easy.

For example, here's some top clues:

- 10,000 pre-orders

- 370 partnerships with automakers

- CEO was an engineer for the Model S prototype

- First car to use high end audio technology called Dolby Atmos

All the clues point to the company being Lucid Group and I'm 100% sure of this.

The CEO of Lucid is Peter Rawlinson and if you read is biography you'll see he was an engineer for the Tesla Model S.

Here's an article stating Lucid will be the first car to use Dolby Atmos.

Additionally, all the specs Andy rattled off earlier perfectly match the car specs of the products Lucid is creating.

What Andy Got Wrong

This teaser was originally created in August 2021 when the stock was $25.

I think Andy is running the ad again because of the Saudi Arabia takeover rumors which has caused the stock to gain 100% in just a few days.

Andy made a lot of predictions and claims about Lucid that ended up being wrong.

For example, Snyder claimed Lucid would sell 20,000 EV cars in 2022.

That ended up being WAY off.

Because of supply chain issues Lucid lowered their prediction to 14,000 cars in early 2022.

Lucid lowered their prediction again in the summer of 2022 to around 6,000 cars, once again citing supply chain issues.

In the end Lucid sold 7,000 cars in 2022 which is 1/3rd of the original projection.

As a result revenue was down a lot too.

The stock corresponded with these bad numbers:

Is Lucid A Good Stock To Buy?

Since Andy recommended this stock it's been on quite a ride.

At one point it more than doubled and then quickly crashed in 2022:

2022 was a tough year for stocks like Lucid.

Supply chain issues, high inflation, high interest rates, etc hurt stocks like this one.

Tesla, Facebook, Amazon, etc were all hit hard too.

Lucid missed projections by 70% so you saw a big crash.

Recently, though the stock has been surging.

This caused the stock to double in just a week.

What's been fueling this stock rally is a rumor Saudi Arabia will be buying the company and making it private.

Saudi Arabia's Public Investment Fund already owns 70% of the company and the rumor is they'll buy the remaining 30%.

This would help because Lucid is currently burning through cash and losing $600 million every quarter.

Apparently they have just over $1.2 billion cash on hand.

So without raising money this company will eventually fold.

Not everyone believes this is going to help the struggling EV company.

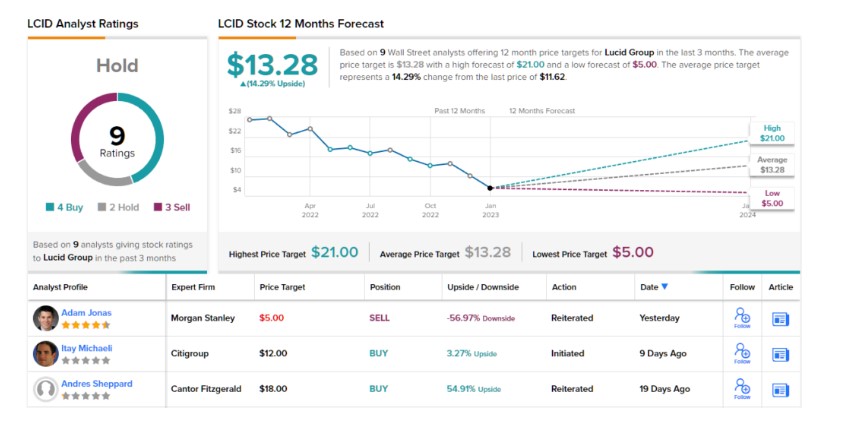

Morgan Stanley is very bearish on the stock and have a price target of $5 for Lucid.

This would represent a 60% loss on the current stock price.

Other analysts are more bullish on the stock, though:

The average price target for this stock is $13 according to Tipranks:

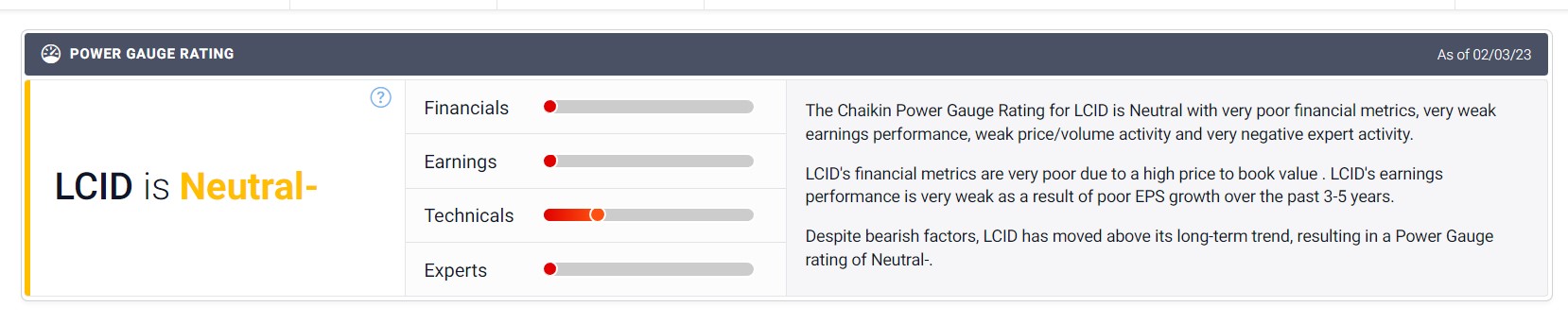

Chaikin is neutral on the stock with much of the fundamentals pointing to bearish:

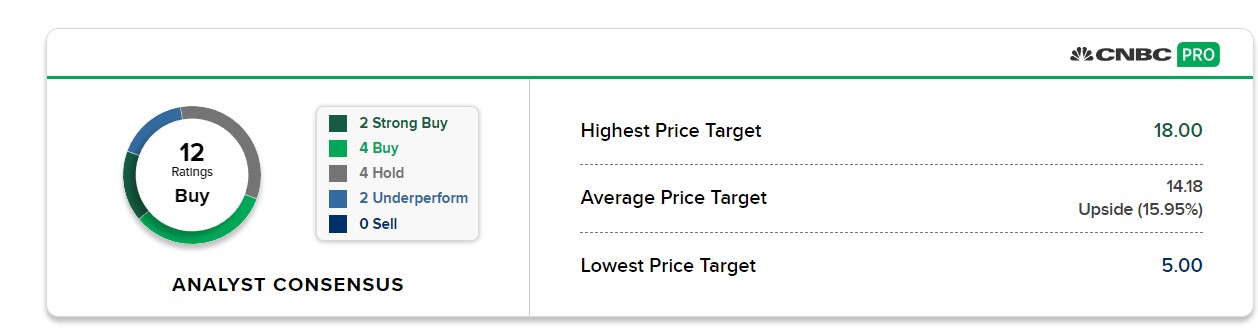

And CNBC shows most analysts projecting the stock to be around $14:

So it would seem most analysts believe the stock will continue to rise slightly.

My Opinion On Lucid

So now you know what Andy thinks about Lucid and what the Wall Street analysts think about the stock.

Here's my take:

I think Lucid's cars are incredible.

Here's a full review of their $170,000 Lucid Air so you can see just how cool this company is:

This car is just as fast as the fastest Tesla, has more range, charges faster and has some really slick features.

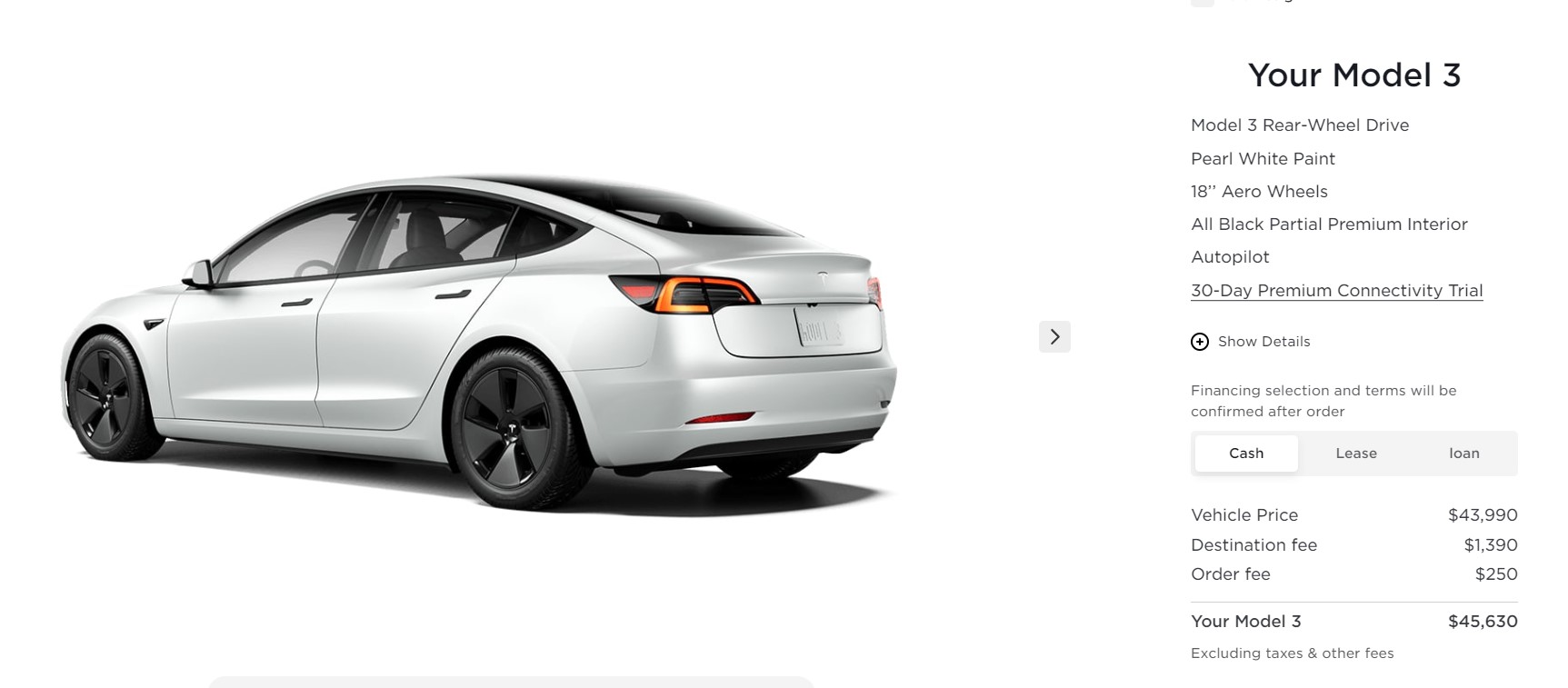

It's very expensive, though, and much more expensive than Tesla.

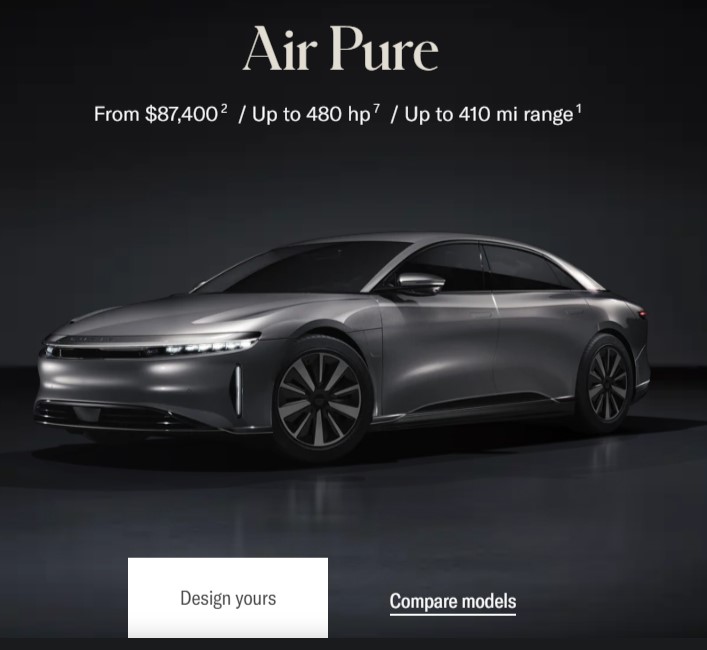

The cheapest Lucid model is $87,000 but once you add on some basic features it gets over $100,000:

So as much as I love Lucid and their products I just don't see where they fit in currently.

Tesla's cars perform pretty similarly and you can buy the cheapest Tesla for about half the price:

Lucid markets itself as a luxury electric car and definitely is that - which is why it costs so much.

But well known luxury car makers like BMW, Mercedes and Audi and going heavy on electric as well.

For example, BMW has an electric car called the i4 eDrive 35 that's only $52,000:

The base Lucid Pure is faster and holds a charge longer but is it worth $40,000 more than an electric BMW?

I personally won't be investing in this stock at the moment.

There's a lot of competition and Lucid is very, very far from being profitable.

However, I'm going to keep my eye on the company.

Their products do seem very special and sometimes that can propel you.

I'll wait until their financial situation is a little better before tossing money into it.

If it does end up being a real Tesla competitor the stock will sky rocket and getting in at $7 or $15 won't make too much of a difference.

Recommended: The Best Place To Get Stock Picks

Conclusion

So that's the end of my post summarizing Manward Press' #1 EV stock.

Ultimately Andy is trying to get you to buy his newsletter with this pitch which you don't have to do now.

The company being hyped up is Lucid.

Lucid is a very interesting company that makes exceptional cars.

The cars are loaded with features and the performance of their vehicles is off the charts.

They're fast and they hold a charge well.

However, it's too early for me.

They're burning through cash at an alarming rate and they're not even close to being profitable.

Their sales were also a 1/3rd of what they expected in 2022.

EV is a competitive market and there's already a lot of established brands in the space.

Tesla, BMW, Audi, Mercedes, Volkswagen, Ford, etc... everyone is going electric.

Will Lucid become the premier luxury electric car brand?

Only time will tell.

And I'm willing to let some time pass and tell me more about the company before investing.

What about you?

Do you plan on throwing some money on Lucid?

Let me know in the comments!

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: