StartEngine is a crowdfunding platform that helps regular people invest in private equity deals.

I bet if you're here you're wondering if this company can help you make money..

Or if it's all one big scam.

We'll get to the bottom of this question in this review.

Below you'll find everything you need to know about StartEngine including what the sign up process is like, how much money you need to invest, regulations and more.

You'll know if it's right for you by the time you're done reading.

Let's get started!

StartEngine Summary

What is it? Crowdfuning platform for private investments

Price to join: Free, $275 per year for Owners Bonus Membership

Do I recommend? Not really

Overall rating: 3/5

The idea of investing in the next great company does sound appealing.

You can read stories of how much early investors made from Uber and Lyft and be seduced by the numbers.

But I wouldn't recommend StartEngine for most investors.

These investments are very risky and speculative and many will end up losing you a lot of money.

Any success you do have will take years to materialize and will require extreme patience.

Plus there's A LOT of bad customer reviews that raise a lot of red flags.

Lastly, they were fined hundreds of thousands for allowing companies to mislead investors on their platform.

Not good!

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

What Is StartEngine?

Before we take a deep dive into the pros and cons of StartEngine, let's first talk about what StartEngine is.

In the past investing in private companies was difficult for the average investor.

To get in on many private deals you'd need to be an accredited investor.

In order to be an accredited investor you need an annual income of $200,000 if you're an individual or $300,000 joint income between you and a spouse.

Alternatively you need to have a net worth of $1 million to be considered an accredited investor.

The reason for these rules is to protect people.

Private deals are often VERY risky and this ensures less people get scammed.

However, a new law passed that allows non-accredited investors to buy into riskier private deals through crowdfunding websites.

This is where StartEngine comes in - non-accredited investors can invest in private companies through SEC registered intermediaries through crowdfunding.

And that's exactly what StartEngine is.

What Regulations Are There On StartEngine?

Now there's still regulations put on investors that sign up for StartEngine.

There's Regulation A+ and Regulation Crowdfuning.

These exist to protect investors from losing all their money.

Here's an overview of both regulations:

Regulation A+

Regulation A+ deals restrict how much non-accredited investors can invest.

Non-accredited investors won't be able to invest more than 10% of their annual income or 10% of their net worth per year (which ever is greater).

So if you're making $60,000 per year you wont be able to invest more than $6,000 into a Regulation A+ deal.

Regulation Crowdfunding

This regulation is for non-accredited investors with a yearly income or net worth less than $107,000.

If you make less than that you can only invest a maximum of 5% of the greater of the two.

If you make more or have a net worth bigger than $107,000 you can invest up to 10%.

If you're an accredited investor you don't to worry about these restrictions.

Recommended: The Best Place To Get Stock Picks

What Is The Sign Up Process Like?

Now that you know who StartEngine is for and the rules to play I'm guessing you want to sign up now.

Here's what the sign up process is like.

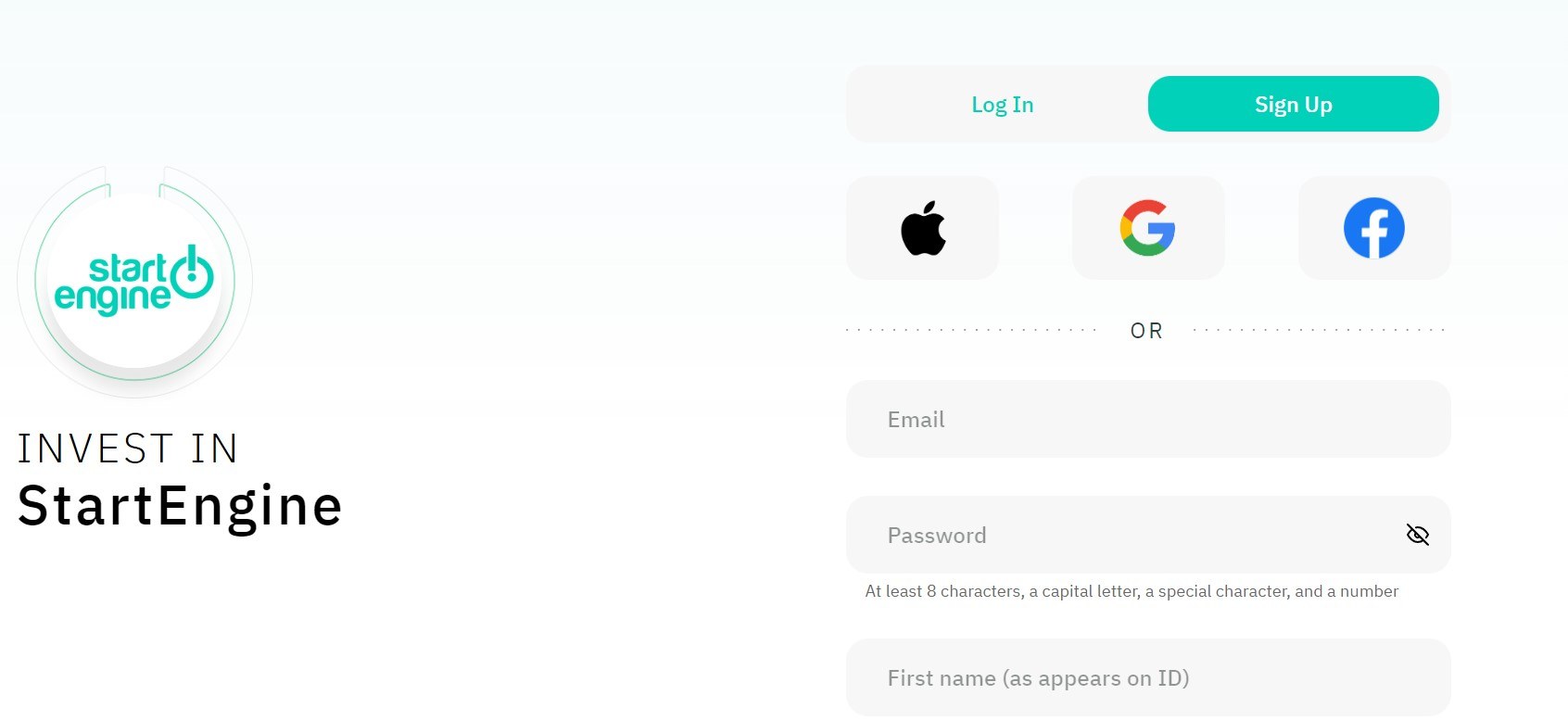

First you have to sign up and you're brought to the page below:

The sign up process is very easy.

You can just use your Apple ID, Gmail or Facebook to sign up.

If you don't feel like that doing that you can just use your email address.

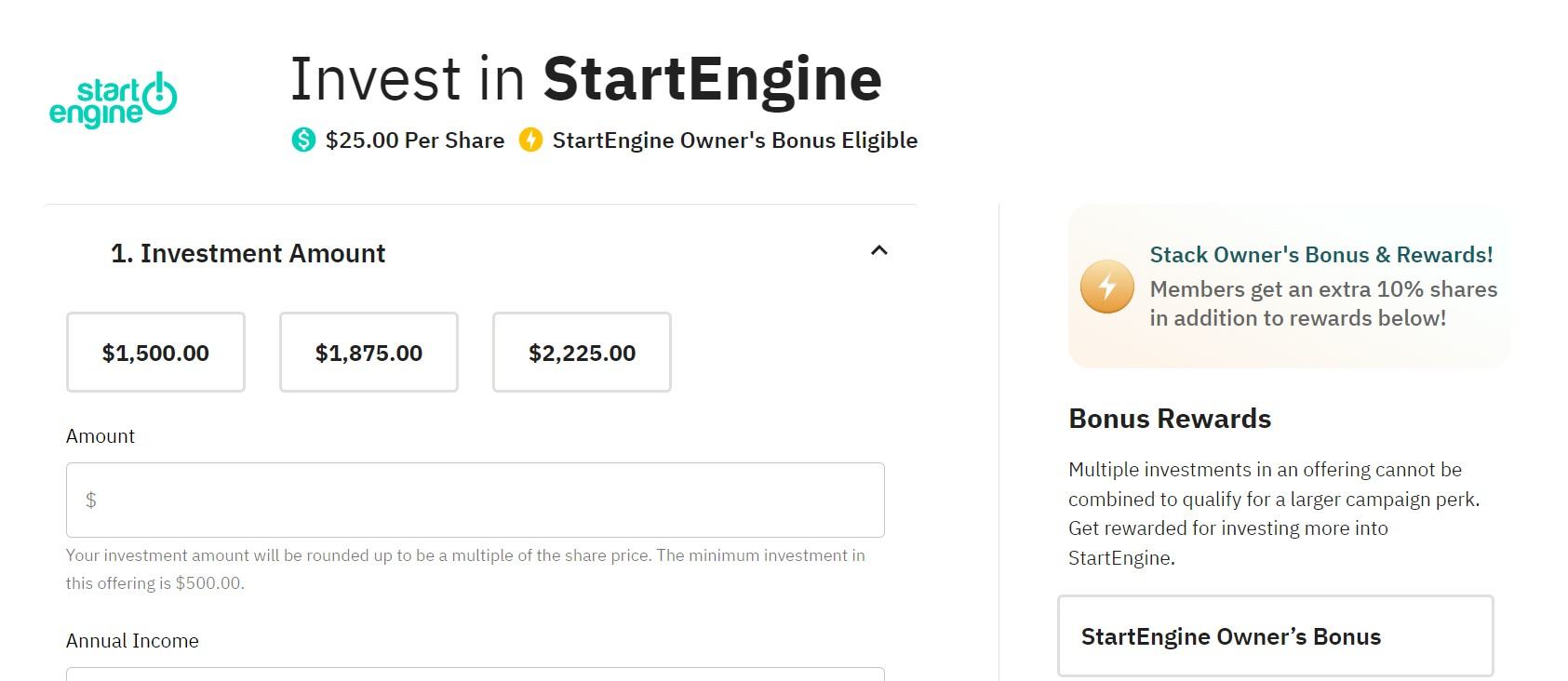

After this you're brought to a page to invest in StartEngine.

Not going to lie I wasn't expecting this!

The minimum investment is $500 and each share costs $25.

Of course you don't have to investing in StartEngine if you don't want to.

However, there's really not a button to leave the page.

You need click one of the menu buttons to get out there. This can be a little confusing and is probably done on purpose to make some naïve investors think they have to invest.

Seems a little underhanded to me.

If you can manage to leave the page you are now free to browse the investment opportunities.

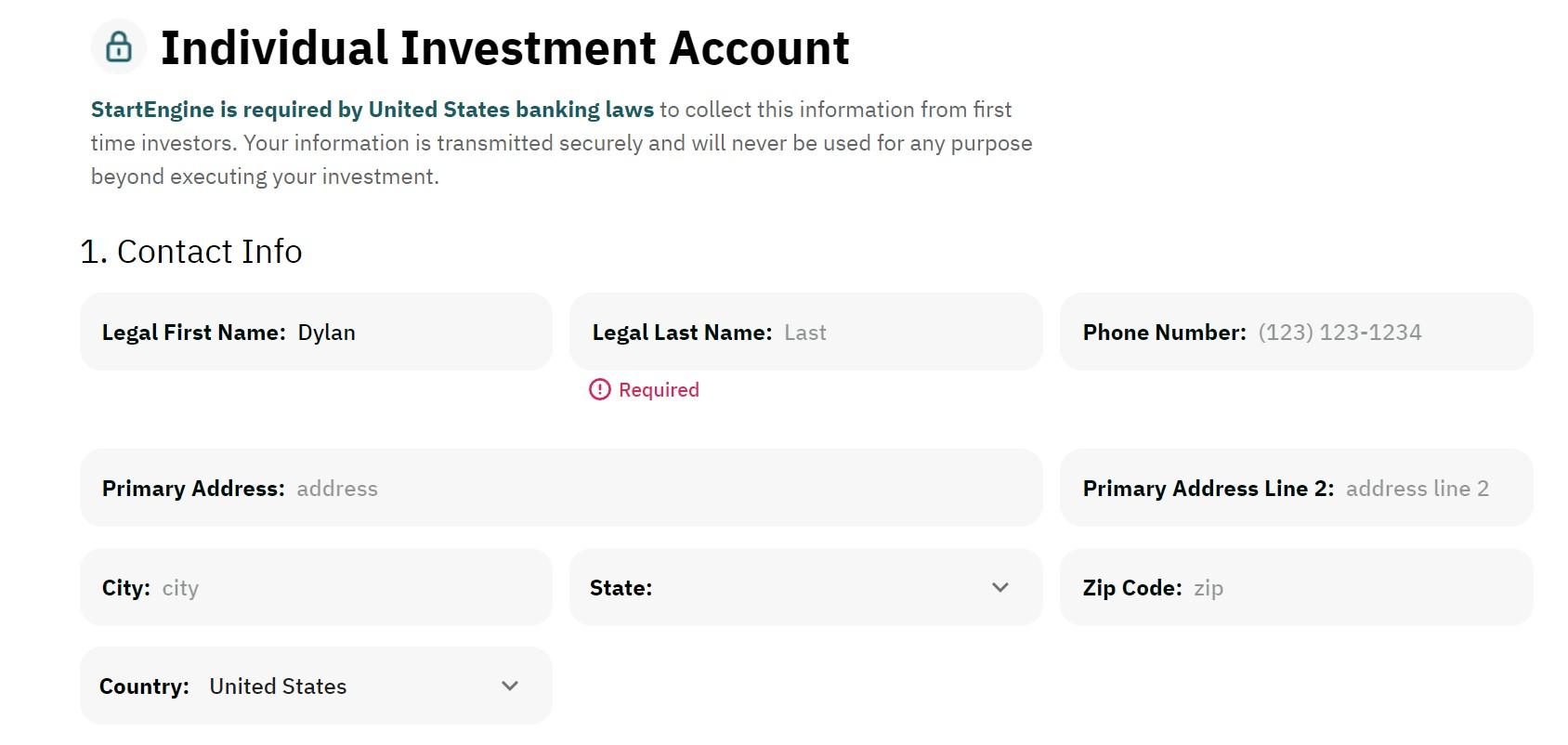

However, when I clicked collectibles I was brought to another page where I needed to add information about myself.

According to StartEngine US banking laws make them collect this information.

First you need to put in your contact info:

Below this you need to add your personal information which includes:

- Relationship status

- Number of dependents

- Citizenship

- DOB

- SSN

- Employment and employment status

- Employer

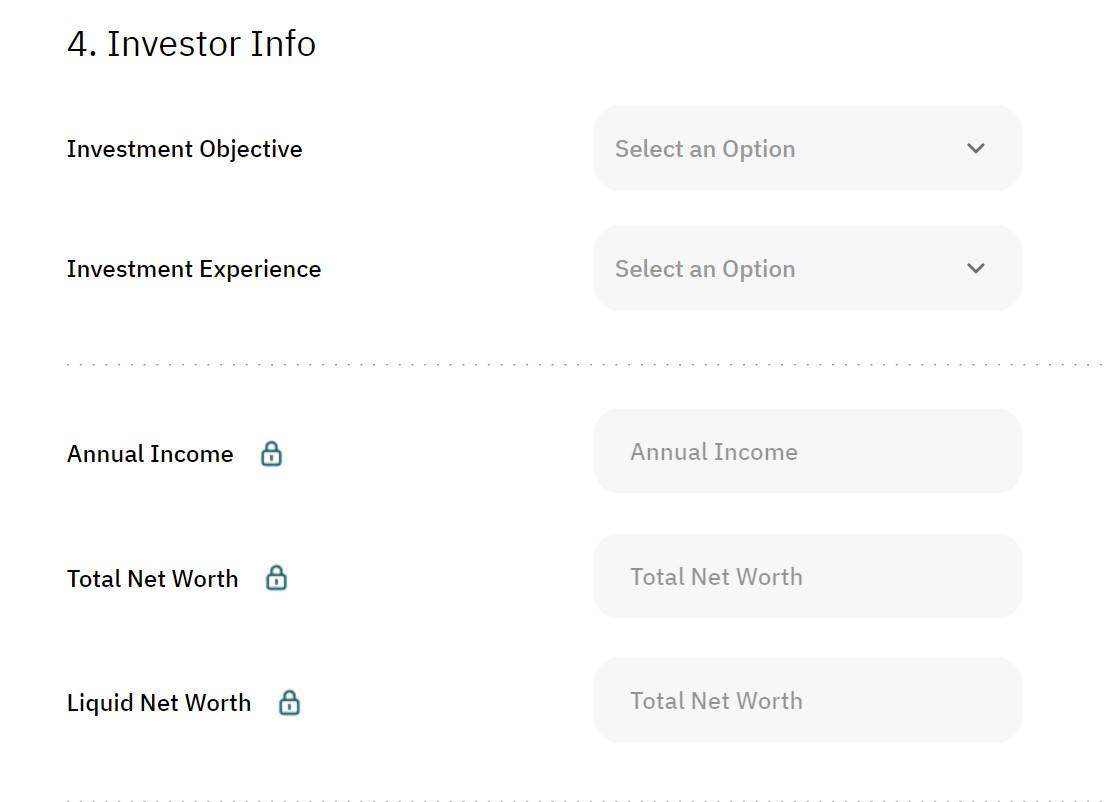

Next you have to put in your investor info:

After this you're brought to the StartEngine Agreement.

This is very long and is pretty much the terms and the conditions to use this platform.

There's 50 different sections.

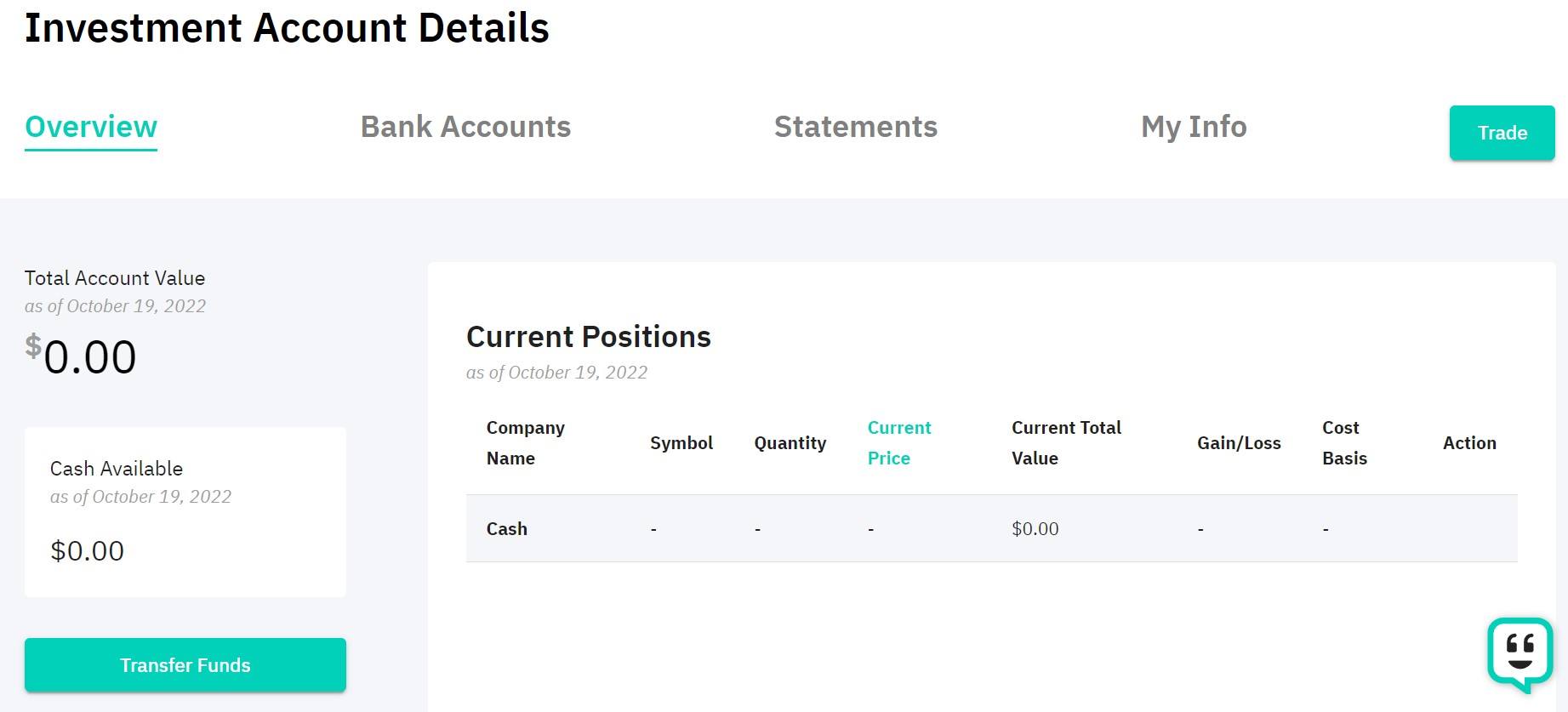

Finally you're brought to your account where you can see an overview of your investments, bank accounts, statements and personal information:

Overall the sign up process is pretty simple and much easier than I thought it would be.

It took me about 5 minutes to go through everything.

Once you put in all this information you're free to explore the different investment opportunities offered at StartEngine.

What Can You Invest In At StartEngine?

Now that you're all signed up the fun begins (or the horror show of losing a lot of money).

There's basically two kind of investments you can make at StartEngine:

- Early stage startups and companies

- Collectibles.

Here's an overview of both:

Early Stage Companies

This is probably what you're thinking about investing in.

There's hundreds of different companies to invest in and they vary in the sector they're in.

For example, there's companies in:

- Real estate

- Trading

- Solar panels

- AI

- Travel

- Housing

- Construction materials

- Alcohol

And more.

The most famous investment on StartEngine is probably Boxabl.

Boxabl is a very interesting company that I learned about a couple years ago.

It's a company that makes mass produced houses that can be assembled quickly by just unfolding them.

Here's a video demonstrating how it works:

I remember wanting to invest in this company when I first learned about it but stopped once I realized it wasn't public.

I didn't know about StartEngine back then!

Apparently this company has raised over $70 million through different crowdfunding platforms.

In this round of fundraising it's raised over $3 million on StartEngine with the goal of reaching $10 million.

Each share is $0.80 ad you need to invest a minimum of $1,000 if you want in.

Collectibles

Additionally, you get the ability to invest in rare collectibles.

This is a pretty unique feature and something I also wasn't expecting.

These collectibles include:

- Rare comic books

- Wine

- Art

- Sports trading cards

- Watches

And they will soon be selling NFT's.

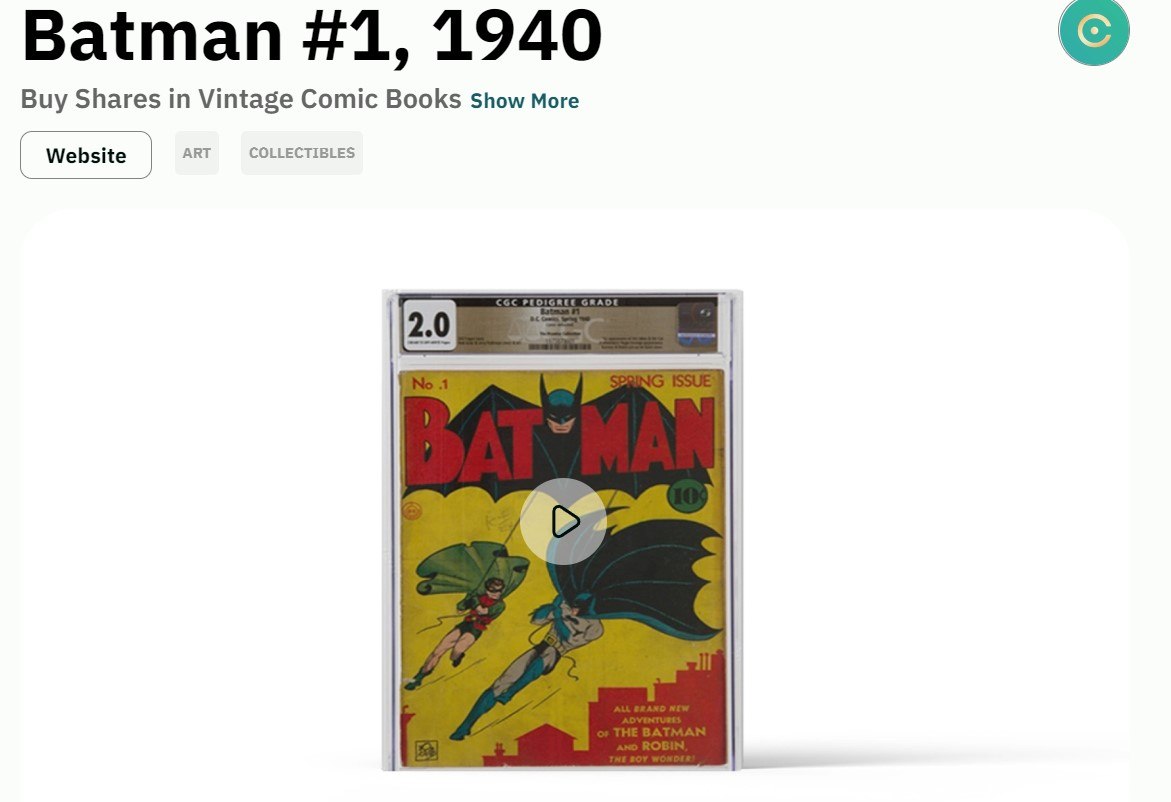

An example of one of the collectibles you can invest in is a vintage copy of Batman:

This is the first standalone copy of Batman and there's only been 280 of these that have been certified by a grading company.

It's received a grade of 2.0 which makes it very desirable.

So far over $217,000 has been raised with the valuation being $288,000.

The minimum investment is $150.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

How Does StartEngine Make Money?

You might be wondering how StartEngine makes money and how they're able to provide their services (you might also be thinking about hidden charges they might use on you).

The good news is StartEngine lets you use the platform for free.

The companies you invest in may charge you a 3.5% processing fee but that's not a charge from StartEngine.

Here's the various ways StartEngine makes money:

Investments

You can invest in StartEngine the same you way you can invest in any other company on the platform.

Like I mentioned before the second you sign up you're prompted to invest money right away into the company.

They've been able to crowdfund up to $65 million so far from 37,000 investors.

The current round of fundraising has raised over $8 million and if you want to invest you'll need a minimum investment of $500.

Charging Companies To Be Listed

Instead of charging customers to invest StartEngine charges companies that want to list on their platform.

So far $650 million has been invested through this platform and companies will pay to access this.

Owner's Bonsues

Another way StartEngine makes money is by offering memberships that are called Owner's Bonuses.

This is a program that provides investors with extra benefits.

This includes:

- Early access to launches

- earning 10% extra shares on investments that are participating in the Bonus Program

- 20% discount on seller fees when selling shares through the secondary marketplace

- Exclusive access to collectible launches

- Priority access to oversubscribed companies

How Do Investors Make Money On StartEngine?

Alright we've covered a lot of ground so far in this review.

But now you might be asking how you make money in all of this.

Investing in private companies is different than investing in public ones.

Here's how you make money:

Company Gets Sold For More Money

When you invest in a company you become a part owner of that company.

For example, StartEngine is selling each share in their company for $25 ($500 minimum investment).

If you're investing in StartEngine you're hoping the company continues to grow and is eventually bought by a bigger company.

The current CEO of StartEngine, Howard Marks, was one of the founders of Activision in 1991.

Activision was sold to Microsoft in 2021 for $68 BILLION.

Imagine being one of the early investors in that company..

Company Goes Public

Another outcome that can lead to you making money is if the private company that you're investing in goes public.

This is good for you as an early investor because going public allows a company to get more capital.

Once a company has more capital they can continue to grow and increase the value of the company and stock.

Secondary Market

There's a third way for you to make money with your shares using StartEngine's secondary market.

This allows you to sell shares to other users of StartEngine.

If a company is oversubsribed you may be able to sell your share of the company for a profit.

Something to keep in mind, though, is not all companies participate in the secondary market.

And there's a seller's fee if you do sell shares there.

Auctions

This is for the collectibles that you can invest in.

You make money on these products once they go to auction or get sold.

For example, if you buy into Batman and it sells for more than it's currently valued you'd make more money than you put in.

If it sells for less then you lose money.

Recommended: The Best Place To Get Stock Picks

What's NOT To Like About StartEngine?

There's a lot to not like about StartEngine and these kind of private investment crowdfunding platforms.

Here's a list of things I don't like about this company:

Sued For Misleading Investors

The main thing to dislike about StartEngine is they seem to value the needs of the companies more than the investors.

Because of this they've allowed companies to mislead investors in the past.

This isn't just my opinion either.

FINRA is a watchdog group that has the power to fine companies that break regulatory laws in finance.

They fined StartEngine $350,000 allowing a company to use false information to investors.

One case involved a home robot company using misleading marketing about the capabilities of their product.

Additionally, the company was allowed to use exaggerated and misleading claims to get investments.

StartEngine was aware of these misleading claims and did nothing to correct them.

You can read the settlement here.

This is a major red flag.

Bad Due Diligence

I was reading another review of StartEngine and the person noted that the vetting process for companies joining the platform is really bad - probably the worst among all crowdfunding companies like this one.

Basically there's only a two page Google Doc you have to fill out.

StartEngine doesn't share how many companies they deny access to which is alarming.

For example, a main competitor only accepts 1% to 2% of companies that apply to join.

And they have a 5 step vetting process and invests in these companies.

The fact they've allowed companies to mislead investors and they're not open about the vetting process is definitely a big deal.

A LOT Of Customer Complaints

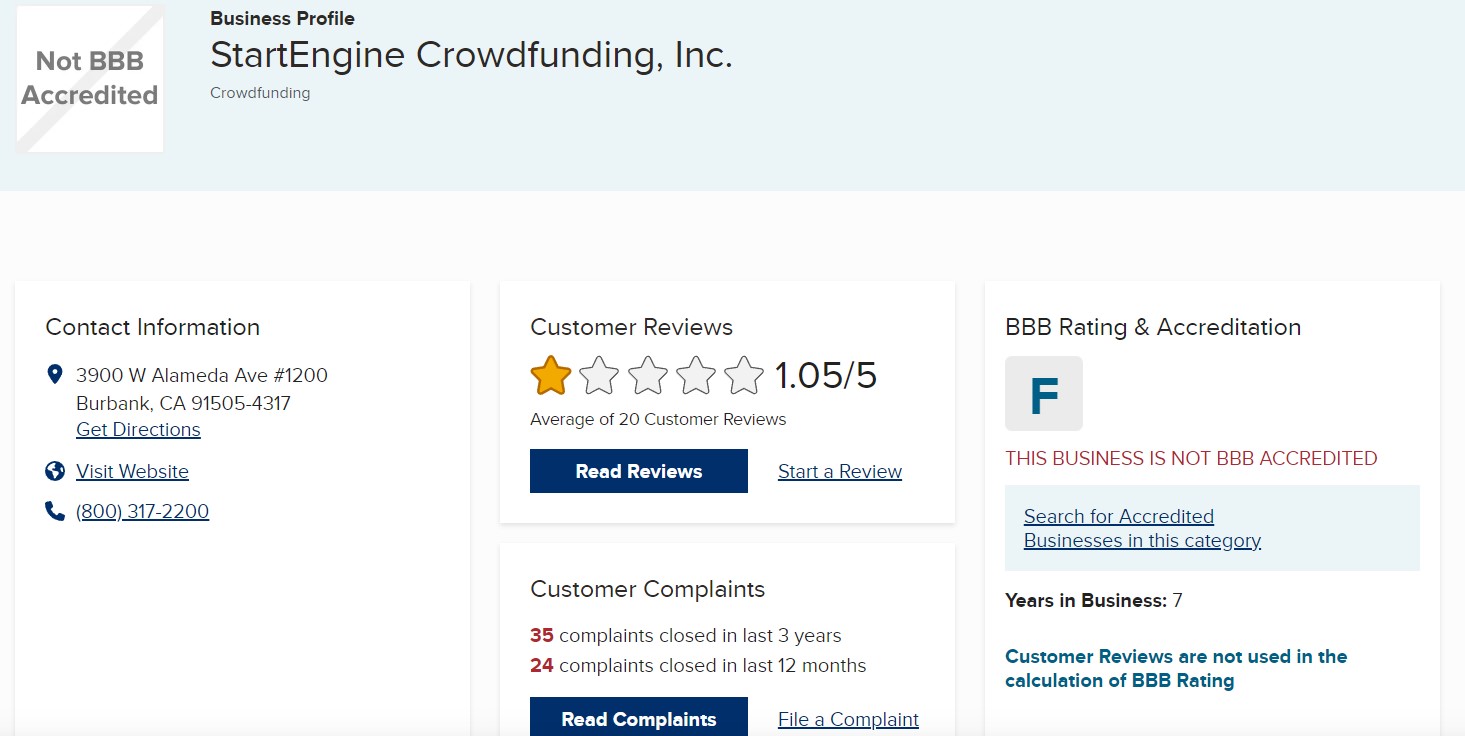

One of the really alarming things about this StartEngine is just how many bad reviews there are.

For example on Sitejabber it has 113 reviews and only has a rating of 3/5.

On Better Business Bureau's website it only has a 1.05/5 rating:

A lot of these complaints have to do with customer service and things of that nature.

However, more concerning is multiple complaints about money being lost or misused.

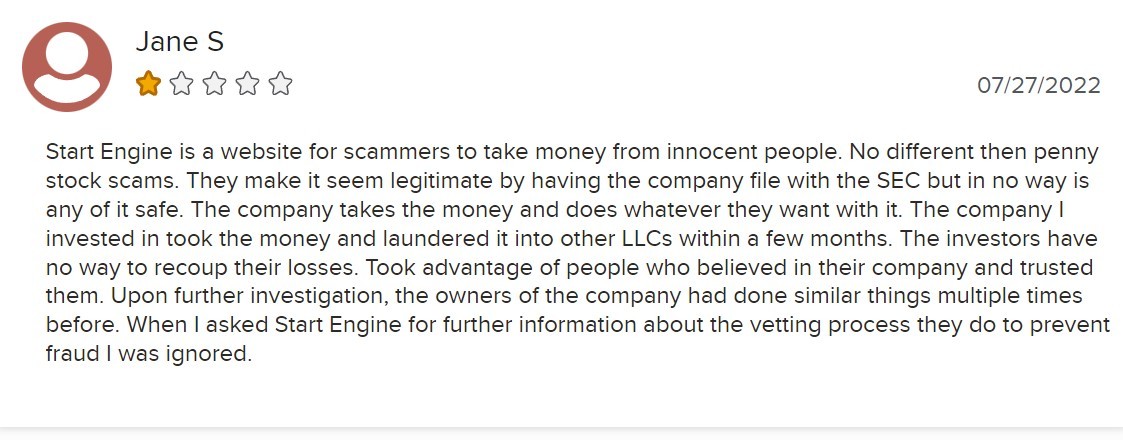

For example, Jane claims she invested money into a company who turned around and invested that money into various LLC's:

Another customers claims they have $1000 just sitting in their account for over a year now.

They've tried to get it out but they just keep getting error messages:

There's dozens of similar customer reviews like this one.

Overall I'd say there is more negative reviews than positive ones.

Long Time To See A Return

Another thing to consider is these investments are in startups.

Meaning these companies have a long time before they mature and become profitable.

In many instances you might need to wait up to a decade and more to get a return on your money.

A good amount of companies will completely collapse as well.

I personally wouldn't want to wait 10+ years for an investment to pay off.

High Volatility

Another thing to beware of is the volatility of these kind of assets.

Private companies have different rules than public companies.

They don't have to submit paperwork to the SEC or anything like that.

This can make it very hard to find good information about that company you're investing in.

Like I mentioned earlier the due diligence done by StartEngine is not great.

This can lead to companies that aren't well run to get on the platform.

Many of these companies will not exist in 5 years and if that happens 100% of your investment is lost.

This isn't like stocks where you can just sell your shares (unless the company participates in the secondary market).

StartEngine Conclusion

Alright, let's wrap up this review.

I hope all your questions have been answered.

I like the idea of StartEngine and I'm sure there's some people making money using the platform.

I just don't like it for most people.

There's a reason many of these deals were restricted to accredited investors in the past.

It's not a scheme to keep you poor and the rich wealthy.

It's to protect you from losing money with these risky investments.

In the end that's exactly what these investments are - risky.

StartEngine doesn't do a great job vetting the companies on their platform and they've been fined $350,000 for allowing companies to mislead investors.

That's really, really bad.

Additionally, there's a ton of poor customer reviews and some are very troubling.

If you have disposable income it might be worth it to invest some money.

But if you're just a regular person, making regular money I'd avoid these investments.

There's a good chance you could lose everything.

Here's A Better Opportunity

StartEngine and private equity investments might work for experienced investors but should be avoided by most people.

The best way for the average person to make money is by investing in stocks.

There's many newsletters that will give you stock picks and I've reviewed HUNDREDS of them..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: