Jason Simpkins is back with a new stock teaser, and this time he's hyping up what he calls "Project Wingman."

He claims a mystery military contract is going to explode because of its new AI pilot program.

Simpkins' wants you to pay him thousands of dollars to learn the name of the stock, but I have good news!

He left enough clues in the presentation to figure out the stock, and I reveal them below.

Additionally, I will give you information on the stock so you can determine if it's worth investing in.

Let's get started now!

Project Wingman Summary

Creator: Jason Simpkins

Newsletter: Secret Stock Files ($1999 per year)

Stock: Kratos (KTOS)

Jason Simpkins believes new fighter jets and military aircraft will require AI pilots to operate because of how many g-forces they generate.

And the company he believes will be behind this is Kratos.

Kratos Defense & Security Solutions, Inc. is an American technology company that develops and fields transformative, affordable technology, platforms, and systems for national security and communications needs. The company is headquartered in San Diego, California, and has approximately 2,700 employees.

Kratos makes various products, and Simpkins is talking about their AI pilot program, which they started earlier this year with Shield AI.

Apparently this is in response to Ukraine losing so many drones in their war against Russia.

The idea is to create AI pilots that can run without communications or GPS.

Is this stock worth investing in?

Keep reading to find out.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Breaking Down The Teaser

Everyone is throwing around their favorite AI stocks these days and trying to market them in unique ways.

Today, Jason Simpkins is doing just that and recommending a new AI stock in the military defense sector.

This one has to do with the "$133.75 billion military aircrat market," and Simpkins believes this mystery contractor will eventually be as big as Raytheon and other large weapon manufacturers.

The idea is that new military planes are too fast for human pilots, and AI will remedy this.

There's a lot of information in this presentation that makes finding the company easy.

Here's a section that gives a ton of clues:

And here's a screenshot showing they're tasked with developing an AI pilot program:

So Kratos is 100% the company Simpkins is hyping up.

Let's take a look at what Kratos does now.

What is Kratos?

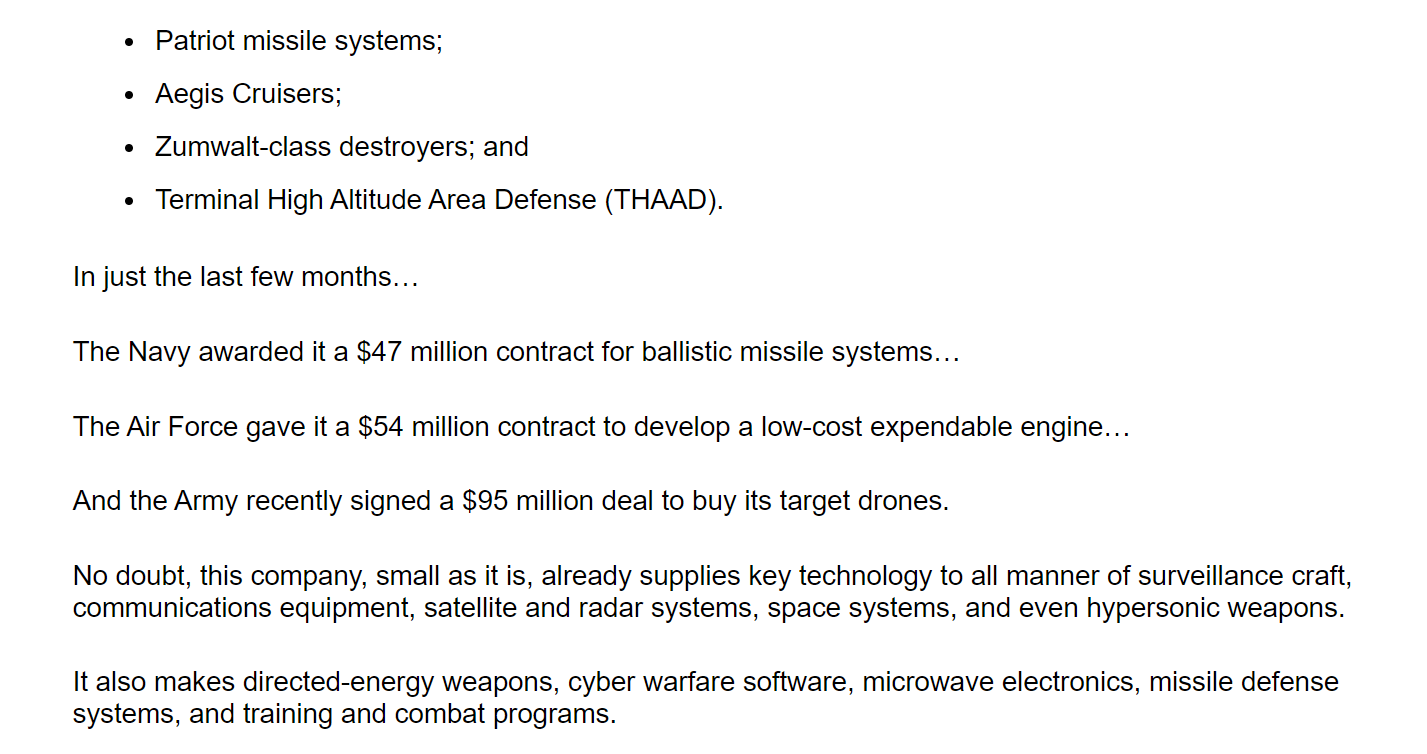

Kratos Defense & Security Solutions, Inc. is an American technology company specializing in directed-energy weapons, unmanned systems, satellite communications, cyber security/warfare, microwave electronics, missile defense, training and combat systems. Customers include the U.S. federal government, foreign governments, commercial enterprises and state and local government agencies.

Kratos is organized into six major divisions:

- Defense and Rocket Support Services

- Microwaves Electronics

- Modular Systems

- Public Safety and Security

- Technology and Training

- Unmanned Systems

Kratos is known for developing and producing innovative technologies that meet the needs of its customers in challenging and demanding environments. For example, Kratos is a leader in the development of directed-energy weapons, which have the potential to revolutionize warfare. Kratos is also a major player in the unmanned systems market, developing and producing a variety of drones for military and commercial applications.

In addition to its defense and security business, Kratos also has a growing commercial business. For example, Kratos provides satellite communications services to commercial customers and is developing new technologies for the renewable energy market.

Overall, Kratos is a diversified technology company that is playing a leading role in the development of new and innovative technologies for defense, security and commercial applications.

Here are some specific examples of Kratos products and services:

- Unmanned systems: Kratos develops and produces a variety of unmanned systems, including the Valkyrie unmanned aerial vehicle (UAV), the Mako-ST unmanned surface vessel (USV), and the XQ-58A Valkyrie unmanned combat aerial vehicle (UCAV).

- Satellite communications: Kratos provides satellite communications services to commercial customers and is developing new technologies for the satellite communications market, such as its low-Earth orbit (LEO) satellite constellation.

- Cybersecurity: Kratos provides cybersecurity products and services to government and commercial customers.

- Directed-energy weapons: Kratos is a leader in the development of directed-energy weapons, such as its high-energy laser (HEL) and microwave weapons.

- Training and simulation: Kratos provides training and simulation systems to the military and other customers.

Kratos is a growing company with a strong track record of innovation. It is well-positioned to continue to play a leading role in the development and production of new technologies for defense, security and commercial applications.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Pros Of Investing In Kratos?

Here are some of the pros of investing in Kratos Defense:

- Strong revenue growth: Kratos Defense has seen strong revenue growth in recent years, with revenue increasing from $650 million in 2018 to $1.2 billion in 2022. This growth is expected to continue in the coming years, driven by strong demand for the company's products and services.

- Favorable industry trends: The defense industry is expected to benefit from increased military spending by the US government and other countries. This is due to rising geopolitical tensions and the need to modernize militaries around the world.

- Strong competitive position: Kratos Defense is a leading provider of unmanned aerial vehicles (UAVs), electronic warfare systems, and other defense products and services. The company has a strong competitive position in these markets, due to its expertise and experience.

- Government contracts: Kratos Defense has a large and growing backlog of government contracts. This provides the company with a steady stream of revenue and earnings.

- Experienced management team: Kratos Defense has an experienced management team with a track record of success. The team is focused on executing the company's strategy and growing the business.

Overall, Kratos Defense is a well-positioned company with a strong track record of growth. The company is benefiting from favorable industry trends and has a large and growing backlog of government contracts. Kratos Defense is a good investment for investors who are looking for a company with exposure to the defense industry.

Cons Of Investing In Kratos

Here are some of the cons of investing in Kratos Defense:

- Customer concentration: A significant portion of Kratos Defense's revenue comes from the US government. This means that the company is reliant on a single customer for a large portion of its business. If the US government reduces its spending on defense, or if Kratos Defense loses a major contract, it could have a significant negative impact on the company's revenue and earnings.

- Execution risk: Kratos Defense is rapidly scaling up its production capacity to meet increasing demand for its products. However, there is a risk that the company may not be able to execute on this plan effectively. This could lead to delays in deliveries, cost overruns, and quality issues.

- Valuation: Kratos Defense's stock price has risen significantly in recent years. This means that the company's stock is now trading at a premium to its peers. This could make it difficult for investors to generate attractive returns on their investment.

- Volatility: The defense sector is cyclical, and Kratos Defense's stock price is likely to be volatile as a result. This means that investors could experience significant losses if they invest in Kratos Defense at the wrong time.

Overall, Kratos Defense is a well-positioned company with a strong track record of growth. However, investors should be aware of the risks associated with investing in the company, including customer concentration, execution risk, valuation, and volatility.

Wrapping Things Up

So there you have it.

The stock Jason is hinting at is Kratos in hopes the military buys their AI pilot products.

There's definitely some things to like about this company and they seem to be trending in the right direction.

What do you think?

Are you going to invest in this company?

Let me know below in the comments!

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: