Andy Snyder of Manward Press is out with a new teaser for his newsletter Venture Fortunes.

This time he's hyping up what he calls "The King Of E-Fracking."

Snyder believes investing in this mystery stock will get you returns as high as 740% but only if you act now by buying his newsletter!

The good news is Andy left enough clues in the presentation to figure out the name of the stock so you don't need to spend any money.

I reveal the name below along with some additional information on whether it's a good company to invest in or not.

Let's get started!

The King Of E-Fracking Summary

Creator: Andy Snyder

Newsletter: Venture Fortunes ($1495 per year)

Stock: ProFac Holding (ACDC)

The stock Andy Snyder is teasing as "The King Of E-Fracking" is Profac Holdings.

Snyder refers to them as "E-Fracking" because they're pushing to create green technology for their products.

Instead of running on diesel they want their water pumps to run on natural gas or electricity.

This isn't anything new and many other fracking companies are doing the same thing.

The company is pretty strong and has decent financials.

They're also a family run business that have proven to be able to run these kinds of businesses.

However, you're at the mercy of the bust and boom cycles of the energy sector.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Figuring Out The Stock

Andy Snyder wants $1495 to learn the name of the new stock he's pitching.

Let's see if we can figure it out before we spend the money.

Here's a breakdown of the stock presentation:

The Energy Sector Is Booming!

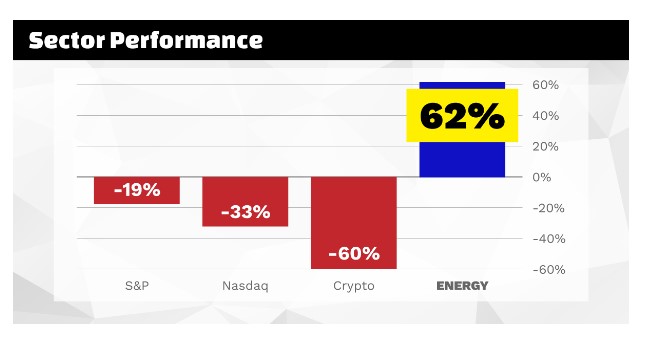

Andy starts the presentation showing how well the energy sector has done compared to other common investments in the last year:

So while common assets like the S&P, the Nasdaq and crypto were all down big time, the energy sector had an amazing year.

Snyder rattles off various companies like PBF Energy, KLX Energy and Nine Energy Service which all saw triple digit returns.

And Snyder doesn't believe this bull run is ending any time soon quoting Matthew Lak of U.S. Energy Development of saying "We’re in the opening innings of an ultra-long-term energy super cycle bull market."

Biden's War On Energy

A good stock presentation needs drama and a foil that needs to be defeated.

And in this case that dastardly man is President Biden.

According to Snyder Joe Biden and his "greenies" are trying to destroy American energy independence and ruin our country's ability to drill oil.

Andy drops a quote from Biden claiming he wants to "ban new oil and gas permitting on public lands and waters."

Other energy destroying policies Biden has implemented includes:

- Killing the Keystone Pipeline

- Proposing tax increases on oil companies

- No no gas leases on federal lands

But according to Andy Snyder this is all to your benefit as an investor.

These steps have driven the price of oil up which in turn creates more profit.

In return this has created a new bull market in the oil industry.

And Snyder knows the company you need to invest in to take advantage of this bull market.

A Company That Will Revolutionize Oil And Gas

Snyder claims he knows the company that can bypass political issues in American and revolutionize the energy sector forever.

And he claims the company just went public.

This is all for Snyder's newsletter Venture Fortunes that focuses on Pre-IPO or early stage companies.

So it makes sense it just went public.

At this point Snyder drops a few hints about the company which includes that it is NOT:

- An ocean driller

- Oil company

- Refinery

And that instead "it uses a completely new method to extract crude from the ground."

Also that "Because its patented new method can potentially ELIMINATE emissions, it could completely change America’s energy landscape."

This must mean the company in question uses electric for their products.

And later in the presentation Snyder reveals the company in question is a fracking company.

We're Talking Electric-Fracking

Snyder starts getting more specific about the kind of technology he's hinting at.

After showing several quotes from different people it's clear the technology he's talking about is electric fracking.

Andy shows a picture of how traditional fracking operations work:

The fire is from "waste gas" being burned off from the fracking.

With the company Snyder is hyping up they can turn that waste gas into energy to spin turbines and create electricity.

This apparently cuts down on CO2.

He also lists the following facts about the company:

- Revenue jumped 255%

- Net income is up 420%

- Operating income rose 5,197%

When you put all the clues together you get Profrac Holding

Profrac Holding went public last year for $18 (now around $21) and is currently creating electric water pumps for fracking.

You're probably wondering if the stock is worth investing in.

I'll explain that in the next section:

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Is ProFrac Holding Worth Investing In?

At this point you're probably wondering if ProFrac is worth investing in or not.

Here's some information about the stock so you can determine if it's right for you:

It's Not All That Special

You might think it's odd that with this giant green push and extra scrutiny on the oil industry only one company is trying to go green in the fracking industry.

That's because it's simply not true and Snyder just makes it seem like that.

Every major fracking player is going green and figuring out different ways to go electric to reduce carbon emissions.

However, the transition has been slow and that's the case with Profrac as well.

These diesel powered machines are very expensive and many companies are still financing them.

They're not just going to throw out millions in equipment to appease some Washington politicians unless forced.

The country needs oil and we're not going to stop drilling anytime soon.

So this is going to take some time before we start seeing a mass transition to electric.

Experienced Family Run Business

One thing that you should like about this company is they're headed by very experienced people.

The owners are brothers named Matt and Ladd Wilks and they have experience in the fracking industry.

Their previous company was called FTS International and they sold it for $3.5 billion 10 years ago.

When covid hit and dropped the valuation of FTS International the Wilks brothers bought the company back for $400 million under ProFrac Holding.

So it shows they know how to play the boom and bust cycles of the energy sectors.

Speaking of which:

Susceptible To Boom And Bust Cycles

One thing Andy is telling the truth about is we are indeed in a bull run for the energy sector.

However, investors seem unsure how long this boom will last.

In the energy industry, a boom and bust cycle is a pattern of alternating periods of economic expansion and recession.

These cycles in the energy industry are frequently influenced by shifts in supply and demand, as well as variations in the cost of commodities, technological advancements, and governmental regulations.

A "boom" cycle is characterized by the energy sector's rapid growth and expansion, rising demand for energy-related goods and services, high pricing, and increased investment and activity.

This may result in an influx of new businesses, increased competition, as well as a large boost in employment and the economy.

These boom cycles can, however, also result in overproduction and oversupply, which may ultimately drive down prices and weaken demand.

This can start a "bust" cycle when businesses may need to scale back output, cut back on investments, and fire employees, which will cause the economy to contract and the energy sector to become less active.

Because of its high capital expenditures and lengthy lead times for new projects, the energy industry is particularly prone to boom and bust cycles.

This is why you see so many of these fracking companies with stock prices that seem too good to be true.

The Pros And Cons Of "Early Stage Investments"

Lastly, you need to consider if "early stage investing" is right for you.

There's pros and cons to investing in a company like Profrac Holding.

Let's start with the the pros:

- High return potential: Early-stage businesses have the potential to expand quickly and achieve great success, which might result in significant financial gains for investors.

- Opportunity to promote innovation: Putting money into early-stage businesses can help finance fresh, creative concepts that could have a big global impact.

- Possibility to have an impact on the business: As an early-stage investor, you may be able to offer direction and counsel to the company's founders and management group, which may shape the business.

However there are negatives.

Here's a few of the biggest cons of investing in these kind of companies:

- High risk: Since many early-stage businesses fail to succeed or even survive, investing in them carries a high degree of risk. There is no assurance that your investment will generate a profit, and you run the risk of losing all you put up.

- Lack of liquidity: Early-stage investments are frequently illiquid, which means you might find it difficult to sell them or get your money back quickly. If you need to get to your money fast, this can be an issue.

- Limited information: It might be challenging to determine an early-stage company's likelihood of success because they may not have a long track record or other important financial data. Making an informed investment could be difficult due to the lack of knowledge.

- Long time horizon: Early-stage investments can be difficult to recoup, and you might have to wait years before you start to see any profit. If you anticipate using the money for other things in the near future, this could be an issue.

All things considered, making investments in early-stage firms can be a potentially profitable but dangerous idea that should be carefully thought out and researched before you make any decisions

Recommended: The Best Place To Get Stock Picks

The King Of E-Fracking Conclusion

So that's the end of my post covering Andy Snyder's "The King Of E-Fracking" stock presentation.

You now know the company Andy is teasing is called Profrac Holding.

So no need to pay $1495 to learn it.

You also got a bunch of information to determine whether it's a good investment or not.

There's definitely some things to like - the company is owned by experienced brothers, the stock price is pretty cheap and we are experiencing a nice energy boom right now.

However, investors don't seem too sure how long this cycle will last.

Snyder makes it seem like everyone believes it's going to last a long time but that's not true.

What do you think?

Does Profrac Holding seem like a good investment to you?

Let me know below in the comments!

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: