Whitney Tilson is out with another stock teaser.

This time he's promising to deliver you massive gains - or a "1000% windfall" as he puts it.

The problem is Whitney wants you to sign up for his newsletter that costs $2500 per year to learn the name of the company he's pitching.

But I have good news!

Tilson left enough clues in the presentation to figure out the stock and I reveal it below.

Plus I'll give you some info on the stock so you can determine if it's worth investing in.

Let's get started!

Whitney Tilson's 1000% Windfall Summary

Creator: Whitney Tilson

Newsletter: Energy Supercycle Investor

Stock: Tellurian

There's a lot of pitches for natural gas companies coming from stock pickers these days.

The 1000% windfall presentation from Tilson is another that focuses on this sector.

The idea is America will be expanding natural gas exports because of the Russia/Ukraine war.

Tilson's pick for this is Tellurian which is the second time he's pitched this stock.

He pitched it 6 months ago when the stock was $4 (it's now under $2).

Tellurian is definitely a gamble.

They're not a big company and they're trying to finance a project called Driftwood which will cost tens of billions.

With interest rates high and partners pulling out it's not clear whether the project will actually get financed or not.

Either way it'll take a while for this stock to pay out but there is 1000% potential here if all goes to plan.

But that's a big IF.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

FAQ's About The "1000% Windfall"

Let's answer any questions that you might about this presentation now.

Here are some common questions you might have about this teaser:

1) What Is The Theme Of The Presentation?

All stock presentation come with some sort of theme or story to connect with the audience

It makes the whole thing more entertaining and keeps the viewer more engaged.

The theme of this presentation is natural gas (LNG) and how America is going to go through an energy boom in the next few years.

There's many reasons for this according to Whitney.

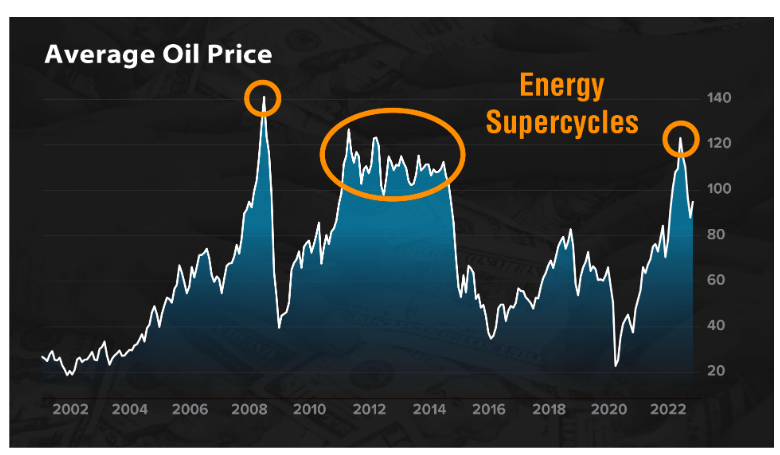

First off, he claims there's "Supercycles" in the energy sector where prices of oil and gas rise and fall dramatically.

He illustrates this with the picture below:

Another reason for this boom is the Russia/Ukraine war.

Russia has slashed its gas exports to Europe over the conflict and the idea is America will step up and increase their exports.

This is a logical conclusion because Europe will need to get its gas from somewhere and America has the commodity to spare.

We're already the biggest exporters of natural gas in the world.

However, it does take time and an insane amount of money to ramp up natural gas exports.

New pipelines have to be built which costs billions and will run into political problems.

New exporting facilities will need to be built which again costs billions.

And then you have to transport the gas from America to Europe which isn't easy.

There's no pipelines between the continents and you have to build special ships which cost hundreds of millions each.

So while it's a good bet we'll see an increase in LNG exports just realize it's years away from manifesting.

2) What Is The Stock Being Teased?

There isn't really one stock being teased in this presentation and instead Whitney is teasing a "1000% Windfall Watchlist."

These are natural gas plays that Whitney believes are going to explode over the next few years.

However, there is one company that's teased that I was able to figure out.

And that's Tellurian.

This is the second time Whitney has teased this company in the last 6 months.

When he did so back in September 2022 the stock was around $4:

As you can see the stock has fallen pretty dramatically since Whitney first started pitching this stock.

There's been fears brewing amongst investors about Tellurian's ability to finance it's Driftwood project (LNG exporting facility).

This has caused the stock to drop well under $2.

Recommended: The Best Place To Get Stock Picks

3) What Is Tellurian?

As mentioned before Tellurian is one of the companies referenced in Whitney's pitch.

Tellurian is a LNG company that was founded in 2016 by Charif Souki who previously founded Cheniere Energy (another LNG company).

The reason many investors are interested in this company is their Driftwood project.

Driftwood is a LNG exporting facility that's being developed in Louisiana.

The project consists of a liquefaction facility, storage tanks and a marine terminal that experts 27.7 tonnes of LNG per year.

Apparently Tellurian developed proprietary liquefaction technology that reduces the cost of the liquefication.

Additionally. Tellurian is using a modular design to build the facility using pre-fabricated modules that can be assembled on site.

This apparently will bring down costs as well.

4) What Are The Pros Of Investing In Tellurian?

Despite some setbacks in the last year there's some hype around Tellurian.

Here's some reasons why an investor would want to invest in this company:

Growth Potential

Tilson is correct that there's potential for this stock to grow 1000%.

If you look at Tellurian's history there's plenty of times it's 10'xd in the past:

Right now it seems to be at a low point compared to its previous highs.

Besides just looking at the price movement of the stock their Driftwood project is a tangible thing that can bring in a lot of revenue.

If they can secure funding and develop low cost natural gas projects in the future they'll be able to export a lot of gas.

Competitive Advantages

As I stated before LNG is expensive to export.

It's a complicated process and a very pricey one.

Tellurian believes it has the breakthroughs to cheapen the process which means they'll have a pretty big advantage over competitors.

This will lead to cheaper exports and more business for them.

Industry Trends

America is expected to export more natural gas because of the Russia/Ukraine war.

But it goes beyond that.

Demand for LNG is growing in America as well.

Natural gas burns cleaner than coal and oil and lets off less greenhouse gases.

For example, it's expected that coal will be phased out for use in electricity and natural gas will take its place.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

5) What Are The Negatives Of Investing In Tellurian?

Tellurian is not without its risks, though.

Here's why you might want to avoid this stock:

Trouble Getting Financing

Tellurian has run into a serious amount of setbacks in their pursuit to build Driftwood.

They've lost partners and growing interest rates has made it more difficult to secure funding.

A recent setback includes losing Gunvor Ltd and their 10 year, $12 billion commitment to buy LNG because of lack of financial go-aheads, project financing and construction delays.

This has caused the stock to fall consistently for the last 6 months.

Competition

Tellurian may have technology that gives it an advantage over competitors but there still are a lot of competitors in the LNG sector.

Because of this Tellurian has to compete with other companies to secure funding and financing.

Every company will have its pros and cons and investors will have to weigh each LNG company's benefits to decide who to invest in.

Regulatory Risks

Natural gas is extracted through a very controversial method known as fracking.

Fracking extracts natural gas from shale rock formations using water, sand and chemicals.

However, this causes a whole host of problems.

It takes a ton of water to frack and can cause water contamination if the water is not properly treated.

Fracking also releases pollutants in the air including methane.

Additionally, fracking has been known to cause earth quakes by causing rocks underground to shift.

On top of all this building pipelines is a very political issue as well.

Certain political parties and administrations seem very hostile to natural gas and it could make it hard to ramp up production because of this.

6) Is Whitney Tilson Trustworthy?

Whitney Tilson has been in the investing world for a long time and has had many ups and downs in his career.

He ran a successful hedge fund called Kase Capital and was able to beat the market for many years.

However, he lost his touch after the 2008 recession and failed to beat the market for a number of years.

This caused him to shut down his hedge fund.

He launched Empire Financial a few years ago and it's owned by massive investing newsletter publisher MarketWise.

I've covered a few of Whitney's stock teasers over the last couple years and while some of the stocks have done well, many have not.

I think it's safe to say Whitney is once again trailing the market.

7) What Is The Newsletter Being Pitched?

In the end Whitney is only doing this presentation because he wants you to buy his newsletter called Energy Supercycle Investor.

This is a new newsletter that focuses on small energy stocks.

The stock picks are all going to be very high risk, high reward because of this.

The price is very expensive for this newsletter, though, and it costs $2500 per year.

There's a rule when it comes to stock research - never spend more than 1% of your portfolio on research.

If you spend too much on research then it starts to eat into your gains too much.

So for this newsletter to make sense you'd have to have a portfolio that's $250,000 or more.

If you were to only have say $50,000 to invest, Energy Supercycle Investor would represent 5% of your portfolio.

Good luck beating the marketing when you're starting 5% in the hole.

Recommended: The Best Place To Get Stock Picks

Wrapping Things Up

So that's the end of my post detailing Whitney's "1000% Windfall" presentation.

In the end this is all a pitch for his expensive new energy newsletter.

This newsletter will look at small energy companies and then recommend them to you.

The consensus seems to be that LNG will grow in America.

Are there going to be some road blacks?

Sure.

Large parts of the country are going to resist any new pipelines and new fracking projects.

In fact, many states have already banned fracking.

It's also very expensive to build LNG infrastructure and it's going to take many years to do so.

But the world seems to be moving to natural gas.

Much of the world uses coal for electricity and many believe natural gas will be a safer alternative.

Additionally, it looks like Europe is going to need our natural gas to survive Russia cutting them off.

The world seems to be heading towards multi-polarity and America has massive gas reserves.

So it looks like the country will benefit from this trend.

Is Tellurian the right pick for the LNG boom America might experience?

It has its risks but it does have a ton of potential and hype.

What do you think about the stock?

Let me know below if you plan on investing in this company!

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: