Whitney Tilson is back with a new stock teaser.

This time he's claiming "EoD" (everything on demand) will "mint millionaires in the coming months."

According to Tilson, he knows 4 stocks that will help build the future of delivery.

He wants you to buy a subscription to his newsletter Empire Stock Investor to learn the name of the companies.

The good news is he left enough clues in the presentation to figure out their names though!

I reveal them below and give you information on whether they're good stock picks.

Let's get started!

EoD Stock Picks Summary

Creator: Whitney Tilson

Newsletter: Empire Stock Investor

Stocks: Amazon, Shopify, NVIDIA and Aptiv.

Whitney Tilson has released similar presentations in the past.

Many are trying to predict what the future will look like and the companies that will benefit from that future.

This time Whitney is trying to paint a picture of a society where deliveries happen in a few minutes instead of a few days.

For this to happen there needs to be developments in AI processing, fulfillment technology, ecommerce and self driving cars.

The companies Whitney believes that will benefit from all of this are Amazon, Shopify, NVIDIA and Aptiv.

Amazon would lead the way in fulfillment technology, Shopify helps build local businesses ecommerce websites, NVIDIA makes chips that'll be used in all of this and supplies AI processing hardware/software and Aptiv is a supplier for self driving cars.

All are good companies and trading at a much cheaper price compared to last year.

It'll be a while until this fantasy is a reality so expecting short term gains from all of this would be a mistake.

This is more of a long term investment.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Figuring Out The Stocks

Whitney Tilson is claiming "EoD" is going to be creating millionaires in the not so distant future.

There's a handful of stocks Whitney is pitching in this presentation..

Let's see if we can figure them out.

Here's a breakdown of the presentation:

What Is EoD?

EoD is the focus of this pitch but Whitney doesn't explain what it is right away.

Instead he builds up anticipation of how this term can make you money.

He claims "EoD" is being "sought after by some of the biggest companies in the world."

This includes:

- Microsoft

- Apple

- Amazon

- Walmart

- McDonalds

Whitney insists major investment banks are putting in billions to this new trend.

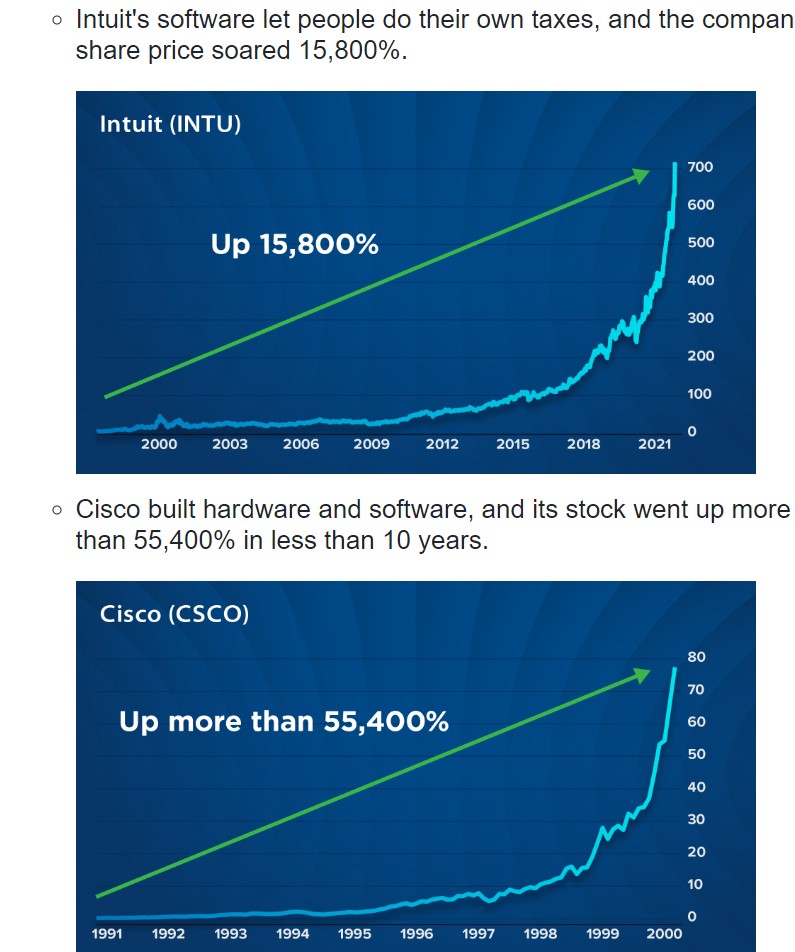

To illustrate the type of gains you could see he talks about previous major technology trends like personal computers.

He shows charts of several stocks that exploded because of the new technology:

Whitney links online retail and smartphones to all of this too.

What Tilson is trying to claim is we're entering a new technological age that will be similar to personal computers, online shopping and smartphones.

After all of this Whitney finally reveals what "EoD" stands for.. Everything on Demand.

The idea is shipping is basically the most important factor to online shoppers:

There's going to be a race to who can deliver goods the fastest and Whitney Tilson believes shipping will be done in minutes not days.

3 Technologies Will Converge And Change The World

Another theme of this presentation is it's always a merger of technologies that really changes things.

Some companies get all the press like Microsoft and Apple but these companies alone can't drive change.

Other companies need to supply them with chips and processors to make their products, infrastructure needs to be updated and built and so on.

According to Whitney there's three technologies converging to create the "everything on demand" world of the future:

- Ecommerce

- Artificial Intelligence

- Autonomous driving

And Whitney already gives examples of this already happening.

For example, there's already 1 hour delivery in Baltimore:

Additionally, he talks about the smaller self driving vehicles that are on the road right now:

And many different corporations are promising to deliver things much faster in the future:

What Are The Stocks Whitney Is Talking About?

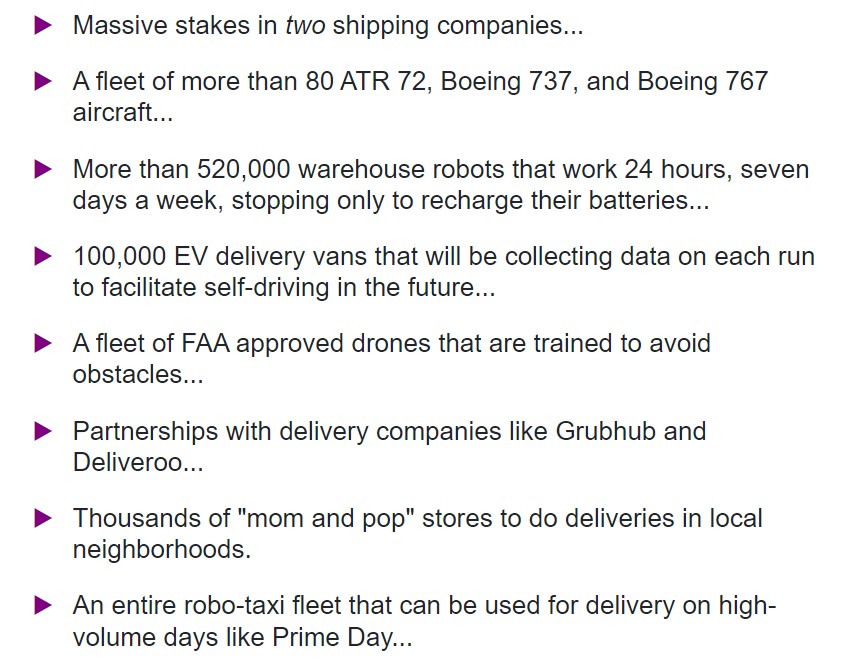

Whitney reveals one of the stocks in the presentation and that's Amazon.

His reasoning for investing in Amazon seems pretty self explantory.

Amazon is an ecommerce giant and their two day shipping made them a household name.

According to Whitney they're growing their capabilities and will own "EoD" with their recent business moves which includes the following:

The next stock Whitney calls "the next Amazon."

He claims this mystery company is 1/10th the size of Amazon and their revenue has grown from $24 million to $4.61 billion in the last decade.

Whitney drops a quote from the CEO of "the next Amazon."

The company Whitney is talking about is Shopify.

Shopify is an ecommerce company that helps build many smaller and mid size business' websites.

I've used Shopify in the past and it's a great platform.

The stock has been on quite a ride in the last few years and skyrocketed during covid.. only to crash in 2022:

It's stabilized since the stock was seemingly in free fall and back to where it was pre-covid.

It's definitely a good company but there's risk involved.

And you'll most likely have to be very patient with this stock.

After talking about Shopify Whitney moves onto his third and fourth stock that combined "own the two technologies for the front end of EoD."

These two companies are NVIDIA and Aptiv.

NVIDIA is a chip maker and the more things become automized the more chips the world needs.

Additionally, they supply AI processing hardware and software.

This relates to the overall theme of the presentation because NVIDIA owns a DRIVE system that is used in a lot of self driving vehicles.

Aptiv is a spinoff company from GM and they supply hardware and software to autonomous driving companies.

Aptiv's current stock and near future stock movements will be closely linked to car sales in general (especially GM car sales).

So don't expect "EoD" to pay off with Aptiv for a long time.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

What You Need To Know About Whitney Tilson

You're probably wondering if Whitney Tilson is worth listening to.

Here's what you need to know about Tilson:

Has Trouble Beating The Market

There's two kind of stock pickers.. ones that beats the market and ones that doesn't.

Sometimes stock pickers can beat it and in other instances they can't.

This is the case with Whitney.

He used to run a fancy hedge fund called Kase Capital.

In its first 11 years he made his clients 184% in gains which was better than the market.

But since 2008 Whitney has struggled to get market beating returns.

As a result Tilson had to close down his hedge fund.

He launched Empire Stock Investor in 2019 and hasn't been able to market since inception either.

Other Stock Presentations Have Done Poorly

Whitney's stock presentations in the last couple years haven't done exactly well.

For example in early 2022 Whitney claimed he knew a company that would be the next Microsoft and it only cost $4.

He went as far as to say he'd bet his wife's entire portfolio on this single stock.

The company Whitney was teasing is Ginkgo Bioworks which makes biotech products.

As you can see the stock has lost more than 50% in just 8 months:

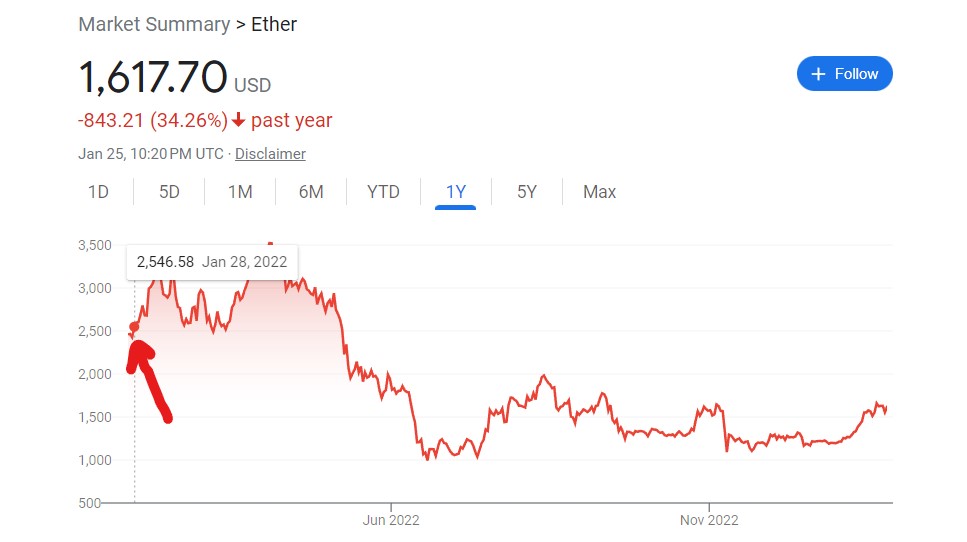

Additionally, Whitney had a big presentation from January 2022 about metaverse stocks.

That presentation reminded me of the EoD presentation.

Mainly because it was Whitney attempting to guess what the future would like and guess the companies that would be building it.

One of the stocks was Facebook.. here's how that company has performed in the last year:

Another stock that's down more than 50%.

In the same presentation Tilson recommended Ethereum:

This is anther recommendation that's down big time since Whitney recommended.

So as you can see Whitney can whiff on these presentations about the future.

And you need to remember current economic conditions.

Just because you think a company will grow in the future you still have to consider what they're doing NOW.

Every company is a risk in the moment and many of the stocks from the "EoD" presentation can be harmed in the short term.

Conclusion

So that's the end of my take on Whitney's "EoD" presentation.

Whitney is painting a picture of a future where automation plays a bigger picture and goods are shipped in minutes.

This will use various technologies to happen and Whitney believes he knows the companies that will lead the way.

That's Amazon, Shopify, NVIDIA and Aptiv.

These are all good companies but they do come with some risk.

The impact from "EoD" won't be felt for these companies for years.

This future Whitney is painting is years away if it ever comes.

Make sure these are companies you like NOW and not just expect to lead some technological revolution.

The revolution might never come and if it does it might be lead by other businesses.

Anyway that's my take!

Let me know what you think of these stocks below.

Additionally, if you're looking for the place to get stock picks, click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: