Hello, and welcome back to the website that steals stock picks from stock picking experts and gives them away for free.

Today we're going to cover one of the biggest names in stock picking: Nomi Prins.

She has a new stock teaser called "The AI Ultimatum."

She claims a tiny firm that you can buy for 26 cents is about to be sent into the stratosphere.

The only problem is that she wants several trillion dollars to reveal the stock pick.

But I have good news!

Nomi left enough clues in the presentation to figure out the name of the stock, which I'll reveal below for free.

Additionally, I'll give you information on the stock so you can determine if it's worth investing in.

Let's get started now!

The Complete Investor Summary

Creator: Nomi Prins

Newsletter: Rogue Strategic Trader ($1750 per year)

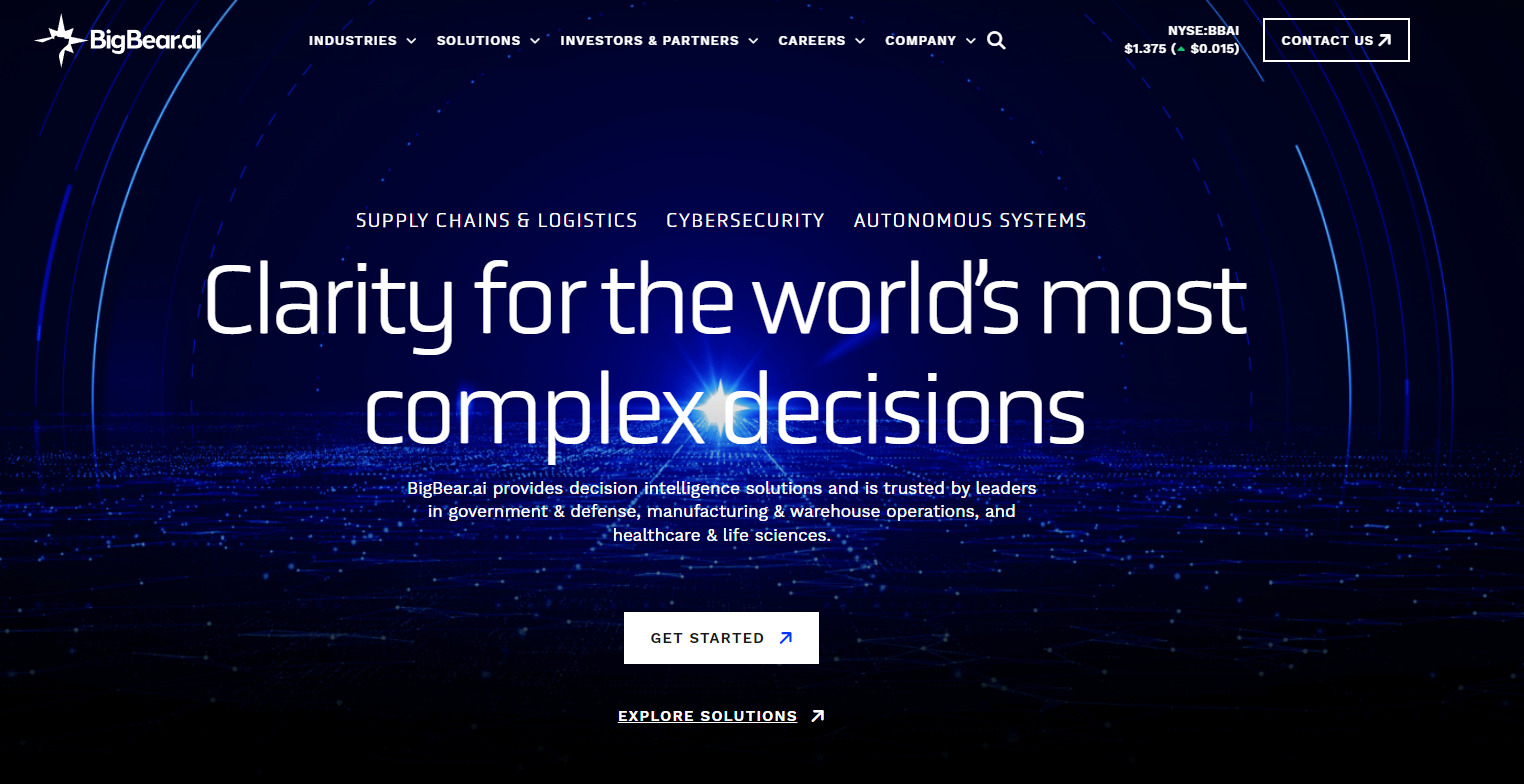

Stock: BigBear.ai

The stock that Nomi is teasing in this presentation is BigBear.ai.

BigBear.ai is an artificial intelligence (AI) software company that provides decision intelligence solutions for supply chains and logistics, enterprise operations, manned-unmanned teaming in autonomous systems, and cybersecurity.

However, she's not recommending that you buy common stock.

She's recommending buying warrants for 26 cents (the price has increased to 50 cents now).

A warrant works like an option where you can cash in your warrants if the price of the common stock gets over $11.50 (it's only $1.33 now).

The deadline for this to happen is in 3 years.

So you're betting this stock will go up about 800% in the next few years.

Is this a smart bet?

Read on to see what I think.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

What Is A Warrant?

Nomi Prins is recommending an AI stock like all other stock pickers at the moment are.

Nomi's pick is BigBear.ai.

However, the difference is she's recommending warrants into the company and not buying the common stock.

Here's what a warrant is:

A stock warrant is a type of derivative security that gives the holder the right, but not the obligation, to buy a specific number of shares of a company's stock at a predetermined price within a certain time frame. Warrants are typically issued by companies as a way to raise capital or as part of an employee compensation package.

Warrants are similar to stock options in some ways, but there are some key differences. For example, warrants are typically issued by the company directly to investors, while stock options are traded on exchanges. Warrants also typically have longer expiration dates than stock options.

There are two main types of stock warrants:

- Call warrants give the holder the right to buy shares of the company's stock at the strike price.

- Put warrants give the holder the right to sell shares of the company's stock at the strike price.

The strike price is the price at which the holder can buy or sell the shares of stock. The expiration date is the date after which the warrant can no longer be exercised.

Warrants can be a risky investment, but they can also be very profitable. If the price of the underlying stock rises above the strike price before the expiration date, the holder of the warrant can exercise the warrant and buy the shares at a discount. However, if the price of the stock falls below the strike price, the warrant will expire worthless.

Here is an example of how a stock warrant might work:

- A company issues a call warrant with a strike price of $10 and an expiration date of one year.

- An investor buys the warrant for $1.

- If the price of the stock rises above $10 before the expiration date, the investor can exercise the warrant and buy 100 shares of stock for $10 per share, even though the stock is trading at a higher price in the market.

- If the price of the stock falls below $10 before the expiration date, the warrant will expire worthless and the investor will lose the $1 they paid for it.

Warrants in BigBear.ai Are REALLY Risky

If you're going to buy warrants on BigBear.ai, you have to understand the specific details.

Right now, a warrant costs 50 cents.

In order for these warrants to have any value, the stock of BigBear needs to reach $11.

If the stock doesn't get to that price in the next 3 years, all the money you invested in the warrants will be lost.

Additionally, if the stock trades over $18 for 20 days, BigBear can exercise their right to cash in your warrants.

So really, the best you can do is to buy BigBear for $11.50 per share if the stock reaches $18.

It's just a big gamble that BigBear's stock will go up that much considering it's well under $2 as I'm writing this.

Pros To Investing In BigBear.ai

You can still invest in BigBear.ai's common stock.

Here's the pros to doing that:

Here are some of the pros to investing in BigBear.ai:

- Leader in decision intelligence: BigBear.ai is a leading provider of decision intelligence solutions, which help organizations make better decisions faster. The company's AI-powered platform is used by customers in a variety of industries, including government and defense, manufacturing and warehouse operations, and healthcare and life sciences.

- Strong growth potential: The decision intelligence market is expected to grow significantly in the coming years, as more and more organizations adopt AI to improve their decision-making processes. BigBear.ai is well-positioned to capitalize on this growth, given its strong track record of innovation and its growing customer base.

- Experienced management team: BigBear.ai is led by a team of experienced executives with a deep understanding of the decision intelligence market. The company's management team has a proven track record of success, having previously led other successful technology companies.

- Financial strength: BigBear.ai is a financially sound company with a strong balance sheet. The company has a significant amount of cash on hand, which will allow it to invest in growth and innovation in the coming years.

In addition to these pros, BigBear.ai is also a relatively new company with a low market capitalization. This means that there is the potential for significant upside for investors who are willing to take on some risk.

Overall, BigBear.ai is a compelling investment opportunity for investors who are looking for a company that is well-positioned to capitalize on the growing demand for decision intelligence solutions.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Cons Of Investing In BigBear.ai

BigBear.ai is extremely risky, though

Here are some of the cons of investing in BigBear.ai:

- Unprofitable: BigBear.ai has not yet been profitable, and it is not clear when it will become so. The company has been investing heavily in growth, which has led to losses. It is important to note that many high-growth technology companies are unprofitable in their early years.

- Competitive landscape: The decision intelligence market is becoming increasingly competitive, with a number of established vendors and new entrants offering competing solutions. BigBear.ai will need to differentiate itself from the competition in order to maintain its market share and grow its business.

- Customer concentration: BigBear.ai relies on a small number of large customers for a significant portion of its revenue. If any of these customers were to reduce their spending or switch to a competitor, it could have a significant negative impact on BigBear.ai's business.

- Regulatory risk: BigBear.ai's products and services are subject to a variety of regulations, including those related to data privacy and security. If any of these regulations were to change in a way that is unfavorable to BigBear.ai, it could have a negative impact on its business.

Overall, BigBear.ai is a high-risk, high-reward investment opportunity. Investors should carefully consider the cons listed above before investing in this company.

It is also important to note that BigBear.ai's stock price has been volatile in recent months. This is due in part to the overall market volatility, as well as to some specific concerns about the company's business. Investors should be prepared for the possibility of further volatility in BigBear.ai's stock price in the future.

Stock Analysts Don't See BigBear Getting To $11

Analyst opinions on BigBear.ai are mixed. Some analysts are bullish on the company, citing its strong growth potential and its leadership position in the decision intelligence market. Other analysts are more cautious, pointing to the company's lack of profitability and the competitive landscape.

Overall, the consensus analyst rating on BigBear.ai is "Moderate Buy". The average analyst price target for the company is $4.50, which represents an upside of over 180% from the current price.

Here are some specific comments from analyst reports on BigBear.ai:

- HC Wainwright: "We believe BigBear.ai is well-positioned to capitalize on the growing demand for decision intelligence solutions. The company has a strong track record of innovation and a growing customer base. We initiate coverage of BigBear.ai with a Buy rating and a price target of $5.00."

- Roth Capital Partners: "BigBear.ai is a leader in the decision intelligence market. The company's AI-powered platform is used by customers in a variety of industries to make better decisions faster. We believe BigBear.ai is well-positioned for growth in the coming years. We maintain our Buy rating on BigBear.ai with a price target of $4.25."

- Stifel Nicolaus: "BigBear.ai is a high-risk, high-reward investment opportunity. The company is unprofitable and the competitive landscape is challenging. However, BigBear.ai is a leader in the growing decision intelligence market and has a strong track record of innovation. We maintain our Hold rating on BigBear.ai with a price target of $3.75."

Wrapping Things Up

So that's the end of my post covering Nomi Prins' "AI Ultimatum."

She's recommending warrants on BigBear.ai, which seems too risky to me.

But maybe you think differently.

Are you thinking about investing in this company?

Let me know in the comments below!

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: