The Blue Collar Investor is an investing service that promises to teach you how to make money with options.

Is this a legit opportunity or another investing scam?

We'll get to the bottom of that in this review.

Additionally, we'll look at what exactly is being offered and if there are any red flags.

By the time you're done reading, you'll know if Blue Colar Investor is right for you.

Let's get started!

The Complete Investor Summary

Creator: Alan Ellman

Price to join: Depends on service

Do I recommend? Not really

Overall rating: 3/5

The Blue Collar Investor seems like a decent place to learn how to trade options if you're looking to do that.

I just wouldn't recommend them to most people.

This is a risky investment strategy that involves a lot of research and work.

Additionally, I've reviewed a lot of option alert services, and none of them seem to produce good results.

The reason is that by the time you make the trade, the price of the stock has changed.

There are plenty of scenarios where people who sell option alerts make money and their customers lose money.

So if you're going to do this, just stick to the educational packages and do it yourself.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

The Problem With Option Alert Services

There are a lot of low-quality investing services out there, and a bunch of people are claiming to give you option trades that'll make you money.

I've reviewed a decent amount of them.

However, there's one big problem with option alerts: they rarely make customers money.

And the craziest thing I've seen is programs where the person giving the option alerts makes a ton of money and customers lose money.

This happens all the time.

The reason for this is that the price of the asset in the alert invariably changes after the alert goes out.

This is the case for all short-term alert services, whether they deal with options or just stocks.

The only way to make option alert services work is if you can punch in the trade the second it goes out.

If you wait, the price is going to change because people will be making trades already.

Who is Dr. Alan Ellman?

Dr. Alan Ellman is the founder of Blue Collar Investor, and he's a dentist from Middle Island, NY.

I personally don't consider being a dentist the most blue-collar job, but maybe things are different down there on Long Island.

Ellman started this company in 2006 and has been running it and cleaning teeth ever since.

Besides running Blue Collar Investor, Alan has also written books that you can find on Amazon.

The main topic that he writes about is covered calls, and all his books have good customer reviews.

On top of all this, he has a YouTube channel where he talks about options for free.

Recommended: The Best Place To Get Stock Picks

The Strategy: Covered Calls And Selling Puts

There are two main option strategies you'll learn about in Blue Collar Investor: covered calls and selling puts.

Covered calls are when you own a stock and want to earn income on the shares.

You sell call options on a stock you own and collect a premium from the buyer if they exercise their right to buy the covered calls.

Covered calls are best on stocks that you think are going to stay neutral in price or rise just a little.

This way, you can collect premiums on a stock that's not gaining much.

Selling puts is the opposite strategy.

Selling puts is an options trading strategy where an investor sells put options with the intention of generating income or potentially acquiring the underlying stock at a lower price.

When selling puts, the investor assumes the obligation to buy the underlying stock at a predetermined price (the strike price) if the put option buyer decides to exercise their right to sell the stock.

So in this scenario, you don't own the stock but must buy it if it goes under the strike price.

This requires sufficient funds in your account so you can actually buy the stocks in the agreement.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Blue Collar Investor FAQs

Still have questions about Blue Collar Investor?

Here are the answers to any remaining questions you might have:

1) What services are being offered?

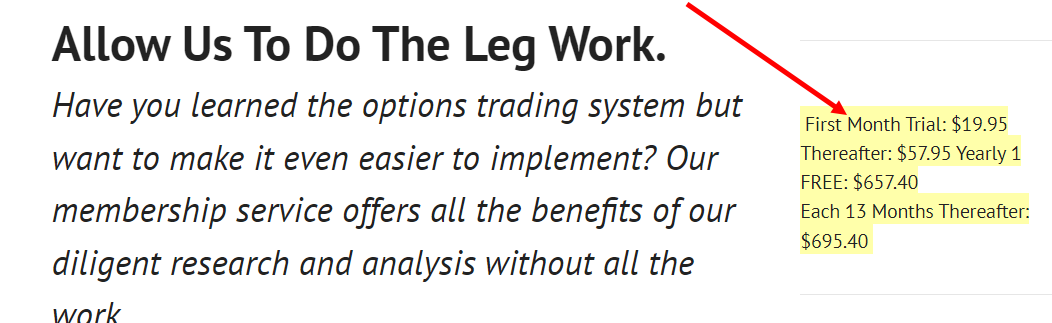

The main service at BCI is premium membership.

The pricing for this product is strange, and I'm not sure I fully understand it.

Here's what's listed on the website:

I think that means $19.95 for the first month and $57.95 for every month after.

I'm not sure what the $657.40 means, though.

Maybe that's just what you're paying after a year.

Anyway..

With this service, the folks at BCI will screen stocks for you and give you potential option trade ideas.

You'll get a weekly stock screen and watch list, a top-performing exchange-traded fund report, and a high-dividend stock with LEAPS.

Besides this, there are a bunch of educational programs that range in price from a couple hundred to over $1000.

They teach covered calls and selling puts.

2) Are there refunds?

I couldn't find anything about refunds.

I looked all over the place and couldn't even find a terms and conditions section.

So my assumption is no, because otherwise they'd show it.

3) Is Alan Ellman legit?

Yes, I think he is.

First of all, he's a dentist, so he's not dumb.

Some of my college friends became dentists, and they worked really hard to do it.

So you know Alan is at least smart.

Secondly, he's been running Blue Collar Investor for a long time now.

In the last few years, I've seen some young people with no investing background start selling option services.

These are people you shouldn't trust.

Alan has experience, though.

4) Are options smart?

If you're willing to put in the work, these strategies can definitely help you make money.

I've seen very competitive people say selling puts is the best way to invest because the odds are most in your favor.

Just keep in mind that you need a pretty sizeable trading account to sell puts.

Recommended: The Best Place To Get Stock Picks

Wrapping Things Up

So that's the end of my review of The Blue Collar Investor.

I personally would just recommend that you invest in stocks that you like without covering calls or selling puts and options.

I don't really look at stocks as a way to get rich; instead, I think of them as a way to save for retirement and stuff like that.

But if you want to make a full-time living trading options, this is one way to do it.

You'll need a lot of money to begin with, and you'll need to do a lot of studying.

This kind of investing is pretty advanced.

If you'd rather just stick to old-fashioned investing, click below to see my favorite stock-picking service:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Hi Dylan,

I liked your article on trading options. I sold my manufacturing business a while ago. We learned to trade some fifteen years before that while still owning the business. I kept the trading side and retired at 82, and I have been trading options full time in retirement. One does not need this type of service mentioned in your article. We started off with Motley Fool at about $100 a year and learned from them. Once one learns the fundamentals of options and picks a suitable stock, such as checking out it’s ratings, financial market, earnings date, monthly charts for direction, strength, volume, trend, etc., one can go from there. We started with $25,000. Each year, except for 2022, we beat the sox off the DJIA, Nasdaq, S&P 500, and Russell 2000. We can’t even publish how much, as no one would believe it anyway.

Cheers, and good luck investing! Harry

That’s great! Congrats on figuring it all out Harry!