The Robust Trader is a company that offers various swing and day trading services.

The owner, Hakan Samuelsson, says that with his strategies and trade signals, he can help you make money.

Is this true, or is this all one big scam?

We'll get to the bottom of this in the review.

Additionally, we'll cover any red flags that I find, and you'll get an overview of what's being offered.

You'll know if The Robust Trader is worth it by the time you're done reading.

Let's get started!

The Robust Trader Summary

Creator: Hakan Samuelsson

Price to join: Varies by service

Do I recommend? No.

Overall rating: 2/5

The Robust Trader is your typical day trading or swing trading service, and that's not a compliment.

The owner pretends he's transparent by showing his trading history but doesn't actually tell you how much he's up, most likely because he's trailing the market.

There are fake testimonials throughout the website, and some of the products are extremely expensive (over $6,000).

Day trading and swing trading have a success rate around 1%, and there's no reason to think anything at The Robust Trader will change that.

I'd stick to long-term investing.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Day Trading/Swing Trading Is A Mistake

I am a day trader and, to a lesser extent, a swing trader.

And it really just boils down to the fact that, basically, no one succeeds with these short-term trading strategies in the long term.

Every once in a while, you might get lucky on a trade, but if you do it long enough, you're pretty much guaranteed to lose money.

This angers some people to hear, but please trust me—if day trading worked, I'd recommend it enthusiastically.

It just comes down to results.

Here are some facts about day trading so you can understand my position on the topic.

Less Than 1% Succeed

There are a lot of reasons why this is the case, but it basically comes down to it being impossible to guess where the price of a stock will be in a few days.

There are a million things that can change a stock's price in the short term, and there's no chance you can develop a system that makes you money in long-term day trading.

This is because it's a coin flip.

And even if you manage to win more trades than you lose, you'll still end up losing money.

There are many fees involved with day trading, which make it almost impossible to profit.

Every trade can cost up to $100; you'll have to pay for tools and signals and pay 28% on all profit.

This is why, in a massive study that followed 300,000 day traders, they found only 1% could profit.

There's no improvement with day trading.

At this point, you're probably thinking, "Well, these people clearly didn't take the right training, blah blah blah."

However, it's been proven in more studies that the more you day trade, the worse you do.

Meaning this isn't a skill that you can develop over time.

If you look at day trading as gambling, then this makes sense.

If someone went to the casino five times vs. 100 times, you'd expect the person who went less to lose less.

The same happens with day trading.

The more you day-trade, the bigger your losses.

This isn't something that can be learned.

Technical Analysis Won't Save You

The last argument a "day trader" will go with is that losers don't know technical analysis.

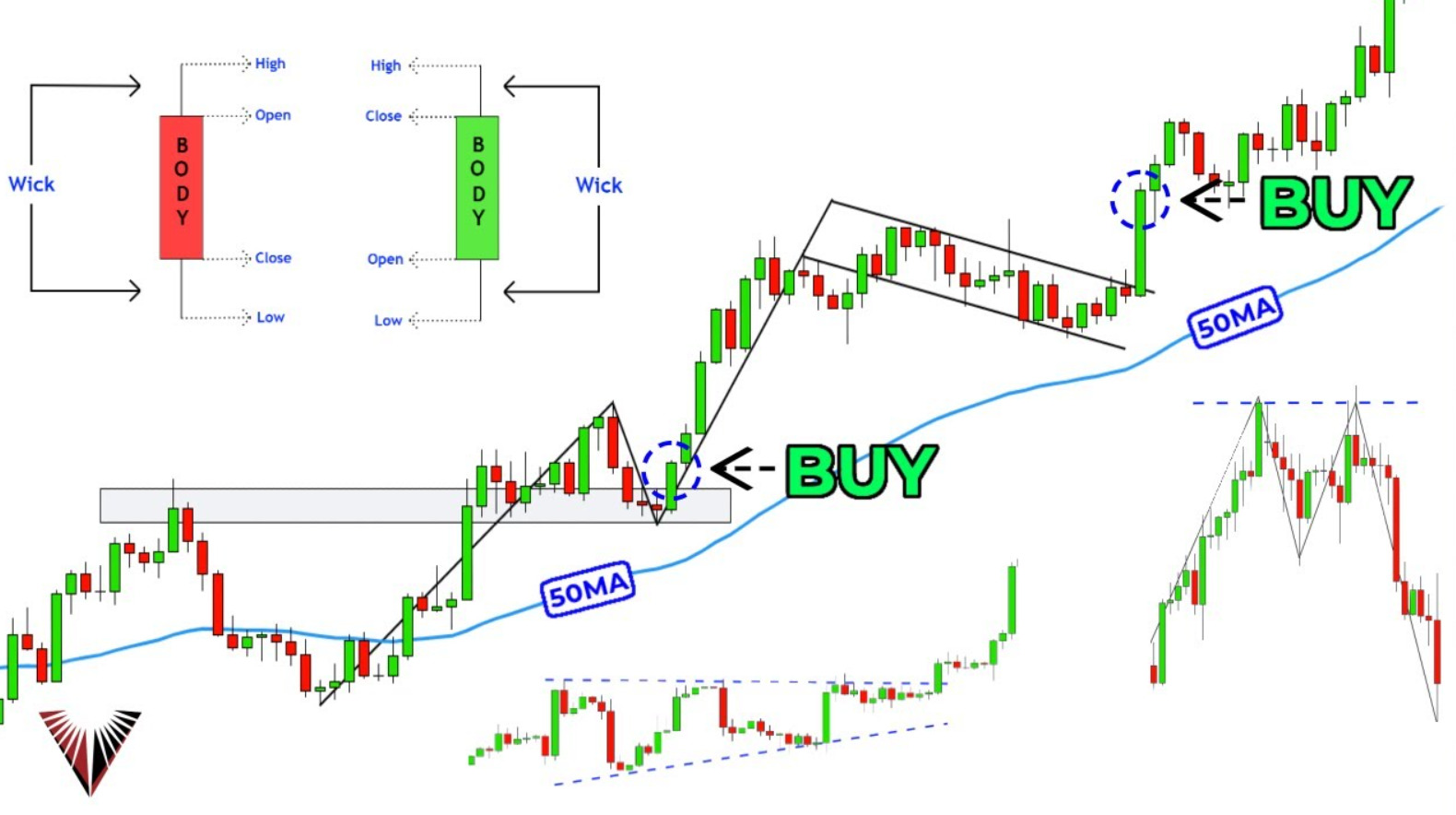

Technical analysis is the idea that you can guess where a stock's price is headed based on its movements.

Here's an example of a chart using technical analysis:

The problem with technical analysis is it's completely fraudulent and doesn't tell you anything about where a stock's price is headed.

You don't have to take my word for it either.

Here's what Warren Buffet has to say about the matter:

No one that's a serious investor uses technical analysis.

You won't find it on Wall Street or being used by the major investing banks.

Recommended: The Best Place To Get Stock Picks

Fake Testimonials Being Used

So let's move on to a major red flag that I found when looking at the Robust Trader website.

And that's why fake testimonials are being used.

Many people do this online, which is why you should never just accept what a trader says about themselves without real evidence.

And if a trader is willing to lie about testimonials, they're willing to lie about other stuff, too.

Here's the proof:

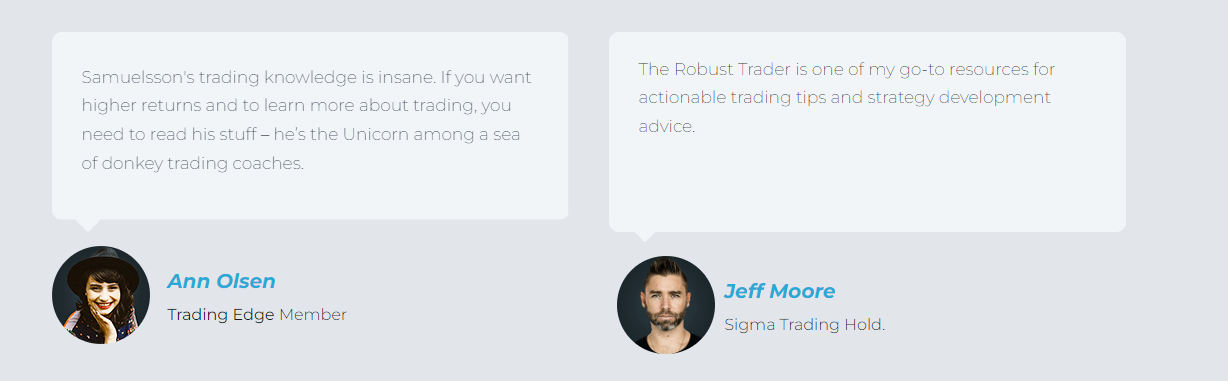

On the front page, you'll see these two testimonials:

Now I've reviewed hundreds of courses online and know a fake testimonial the second I see it.

These are perfect headshots, which indicate that they're models and not real people.

But just to be sure, I did a reverse image lookup on both people, and both came back as models.

Here's "Ann:"

This same picture shows up in 500+ other places on the internet.

Now here's "Jeff:"

As you can see, this is just a model, and you can buy his pictures from stock image websites.

Finally, we have a testimonial that's a little hard to see.

This one is "Kevin Swanson" from "VP Markets:"

This is another stock photo that you can buy and is found on 400+ other websites:

A day trader that fakes testimonials - not a good sign!

I Don't Believe The Robust Traders Beat The Market

The Robust Traders makes a big deal about how "transparent" they are but in reality that's not true.

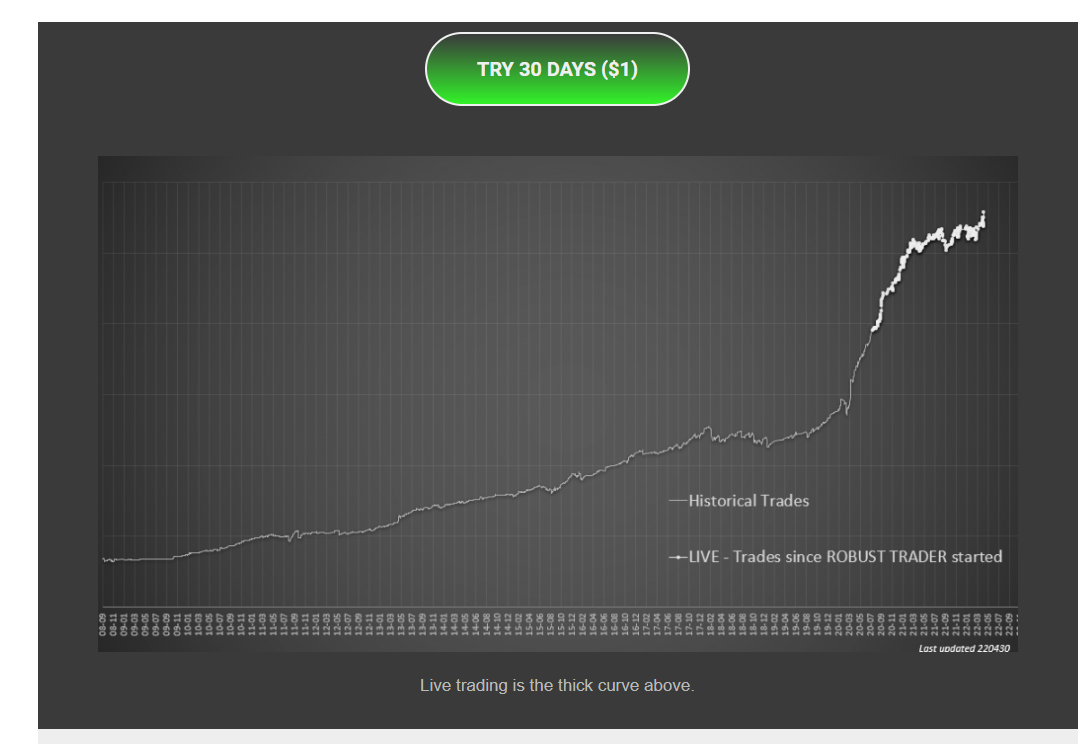

This graph is their proof of transparency:

The light part of the line isn't actual results and is just "backtested" results (meaning they ran a simulation of their strategy on past stocks), and the dark part of the line is the live training.

However, there's one big thing missing from this graph—the percentages of the gains.

You have no clue if the line above represents a 5% gain or a 100% gain.

There's really only one reason the people at Robust Trader wouldn't show the percent gains, and that's because they're most likely not beating the market.

Day trading requires a tremendous amount of effort and is usually treated like a full-time job.

You can just invest in a market index, and it takes about 15 minutes a month to maintain.

So if your day trading results aren't beating the market, people will naturally just do the lesser work for better gains.

Also, the "results" stopped at the beginning of 2022 when stocks started struggling.

So I'm guessing results haven't been great since then.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

The Problem With Trading Signals

There's another big flaw with how The Robust Trader works.

They sell trading signals.

The problem with this is that stock prices are constantly changing, and the price at which you'll have a chance to buy out will be different from the signal you get.

This doesn't matter with long-term investing.

because a $1, $2, and in some cases, $10 difference doesn't matter over 3 years when a stock is increasing 100%.

But the margins are smaller with swing trading and day trading.

You're chasing small gains with this strategy.

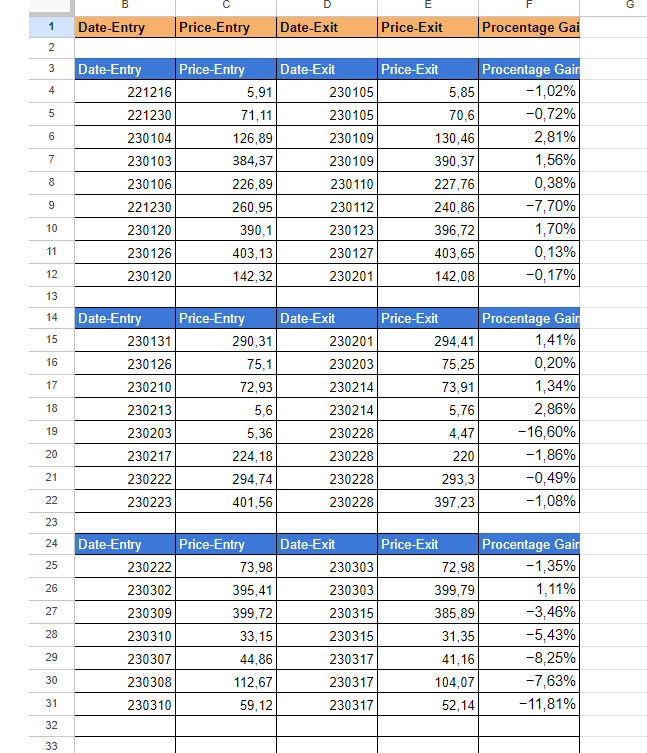

For example, here's the list of results from January 2023 for the robust trading signals:

As you can see, most trades were losers (the market was up 10% at this time), but notice how small the gains are.

1.7%, 0.20%, 1.11%, etc.

Because there's a lag between the time you get the signal and when it's first being sent out, your results will be different.

There are going to be many times when The Robust Trader profits and you don't.

The Robust Trader FAQ's

Still have some questions about this service?

Here are answers to any remaining questions you might have:

1) Who runs The Robust Trader?

The two men who run this company are Hakan Samuelsson and Oddmund Groette.

Hakan is a Swede who apparently runs a very big Swedish trading website.

The Robust Trader is just the English-speaking version.

He claims he worked for Merrill Lynch, but I have no clue if this is true or not.

Additionally, Hakan doesn't mention in what capacity he worked for Lynch.

Remember, there are fake testimonials at Robust Trader. So if Hasan will mislead about that kind of stuff, he'll definitely mislead about his resume.

There's not really much out there about Oddmund.

However, Hasan and Oddmund run another trading website called Quantified Strategies as well.

That website focuses more on training than selling signals.

2) What is being offered at The Robust Trader?

There are basically two things being offered: various trading courses and signals.

They range in price from more reasonable to very expensive.

For example, their swing trading signals are $49 per month, which is pretty reasonable.

Their ETF signals are also reasonable at just $5.95 per month.

Then you have your trading signals that come out to $129 per month, which is very expensive and should only be bought by people with big trading accounts (over $120,000).

Some of the trading courses cost several thousands of dollars as well.

3) How much do I need to day trade?

In America, there are laws that regulate day trading.

If you want to buy and sell more than three stocks per week, you need a minimum of $25,000 in your trading account.

If you go under, you'll be prevented from making more than three trades.

But since you're paying for signals, you'll need more.

There's a 1% rule when it comes to investing: never spend more than 1% of your account on research.

If you do, it'll make it too hard to profit.

So you'll need less if you buy the ETF signals compared to the futures signals.

4) Is Robust Trader legit?

I don't think day trading is legit, so it's hard for me to say The Robust Trader is legit.

If I had to guess, the two owners make the most of their money from selling various trading-related products.

This is the case for basically every day-trading guru.

For whatever reason, day trading has a following, and there's a demand for day trading services.

Recommended: The Best Place To Get Stock Picks

The Robust Trader Pros And Cons

The Robust Trader Conclusion

The Robust Trader is your typical day trading or swing trading service.

They give you training on various strategies and sell you signals.

The training isn't going to be of much value because there's not much you can do to increase your odds of succeeding.

The best thing you can do is have some risk management strategies to reduce your losses.

But even then, you're probably going to lose money.

same with signals.

They're going to be different by the time you go to buy them.

This means a winning trade for Robust Trader can end up being a losing trade for you.

So my advice is the same for The Robust Trader as it is for all other day trading programs. Just avoid it and learn how to invest long-term.

Here's A Better Opportunity

Over time, day traders are going to lose money; long-term investing is exactly the opposite.

Over time, long-term investors make around 10% a year.

There are even a few newsletters that can help you beat these gains.

To see my favorite long-term stock picking service, click below:

Get High Return Stocks!

Click below to get free expert stock picks: