Today we're going to be reviewing Utility Forecaster by Robert Rapier.

This newsletter claims they can help you generate income with utility dividends.

Is Robert telling the truth or is this one big scam?

You'll get an answer to that below.

Additionally, you'll see some information you won't find anywhere including a look at Utility Forecaster's track performance.

You'll know if this newsletter is right for you by the time you're done reading.

Let's get started!

Utility Forecaster Summary

Creator: Robert Rapier

Price to join: $39 per year

Do I recommend? Yes!

Overall rating: 4/5

Utility Forecaster is a solid investing newsletter run by a real energy expert.

The investment advice in this newsletter is very good and most of the stocks I looked at are money makers.

Additionally, the stock picks pay dividends so you're going to be earning income at the same time.

And the price is awesome!

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Who Is Robert Rapier?

The publisher for Utility Forecaster, Investing Daily, has been in business for more than 40 years.

In the past Utility Forecaster was managed by Roger Conrad and now it's run by Robert Rapier.

So many times you see investing publishers allow unqualified people to run newsletters but that's not the case here.

Robert is an expert in energy and utilities, which is the focus of the newsletter.

He has 20 years experience as a chemical engineer and worked internationally with chemicals, oil, gas and renewable energies.

Robert Ran a team of engineers in Scotland working oil and gas projects.

He's had stints in Texas working a petrochemical plant and was a butanol engineer in German.

Robert was also the chief technology officer for a company that invests in renewable energies.

So Robert seems like a guy you can trust in this field.

He knows all about utilities and understands how to evaluate a utility company.

Recommended: The Best Place To Get Stock Picks

What Is Utility Forecaster's Investing Strategy?

Obviously with a name like Utility Forecaster you're going to be investing in utilities and markets similar to that.

But this newsletter mainly focuses on dividends and income earning opportunities in the utilities world.

Here's the pros and cons of investing in dividends:

Pro: Great For Retirement

Dividends is an excellent way to set yourself up for your retirement.

The reason is you can earn a full time income if you have enough money to invest.

If you plan the right way you can retire with a dividend portfolio that brings in $5000 per month.

Con: Need A Lot Of Money For Full Time Income

On the downside dividends only pay a full time income if you have a lot to invest.

You'll likely need $500,000 MINIMUM to see anything close to a full time income from dividends.

If you're younger this means you'll need to invest around $10,000 and re-invest your dividends back into the stocks.

If you have the patience for it you can grow $10,000 into a full time income by the time you retire,

This is definitely a slow and steady investing strategy.

Pro: Stable Companies

The type of companies that offer a dividend are ones that are extremely stable and well known brands.

Some popular dividend stocks are Chevron, Coca-Cola, Procter & Gamble, Walmart, etc.

Popular utility stocks include Verizon, AT&T, NYSEG and more.

These are brands you don't have to worry about going bankrupt and have been around for decades - in some cases 100+ years.

Con: No Major Growth In The Stock

On the downside you won't get any large returns from the stock.

Again, you're investing in these for the stable stock price and dividends.

You're not expecting huge gains or drops.

You'll never invest in one of these dividend companies and get 1000% gains or anything like that.

You'd need to invest in riskier growth companies for that.

Overall, investing in dividends is an excellent strategy if you're patient. These stocks tend to be less risky and will benefit you over a long period of time. You can start small when you're younger and build your way to a full time income by the time you retire. However, don't expect massive gains like you would with other stocks.

Utility Forecaster Track Performance

Every once in a while Utility Forecaster will put out a teaser presentation hyping up different stocks.

They withhold the stock unless you pay for the newsletter.

We can look back on these presentations to get a good idea of how well their recommendations do and what they like to recommend.

AT&T, Verizon, Comcast and Telefonica In 2014

When you invest in a dividend stock you hold it for a long time.

So dividends recommendations in 2014 are stocks that you'd still be holding today and into the future.

These are the staples of your portfolio.

In 2014 four dividend stocks were recommended in Utility Forecaster and they were teased as "not your typical utilities."

The pitch were these companies were going to be used to create the "Jetson's Home Of The Future."

Basically companies that will be used in smart home technology.

The four companies pitched were AT&T, Verizon, Comcast and Telefonica.

Here's how each has performed starting with AT&T.

The stock has been pretty steady and is down around $5 since the presentation launched.

That's not that big of a deal.

In that time the dividends have been going up and went from $0.46 in November 2014 to $.052 in 2022.

Next up we have Verizon:

The stock has been very steady over the last 8 years.

The dividend has went from $0.55 to $0.64 in this time as well.

Next is Comcast:

You might look at this and think it's done better than AT&T and Verizon but that's not necessarily the case.

The stock has done well and at one point doubled and is still up $10 since being recommended.

However, the dividend payment is lower, which is why you see more volatility out of this stock.

In 2014 the dividend was $0.22 and now it's $0.27.

So more stock growth, slower growing and smaller dividends.

Last we have Telefonica:

This stock has really went down since being recommended and has lost nearly 75%.

That's not good!

The dividend have gone down as well.

It went from $0.35 in 2014 to $0.15 now.

So this is the big loser of the group but the other three have done very well.

Consolidated Water Company in 2009

Consolidated Water Company was a stock recommended in Utility Forecaster all the way back in 2009.

At the time it was teased as a source of "endless income stream of safe money."

So again, a stock that you buy and hold forever.

Here's how it's done over the last decade plus:

The stock has been remarkably steady since being recommended and is up overall a tiny bit.

Additionally, the dividend has been going up as well.

In 2009 the dividend was $0.28 and is now $0.34.

Overall a very good stock pick and has been as safe as advertised.

Recommended: The Best Place To Get Stock Picks

What Is Utility Forecaster Offering?

This newsletter is pretty standard in what it offers.

Here's a breakdown of everything that you get:

Monthly Newsletter

This is one of the core parts of offer and is essentially what you're paying for.

Every month you'll get a new issue of Utility Forecaster that focuses on utility stocks and other essential service stocks.

You'll get recommendations, market commentary and updates to the portfolio.

Model Portfolio

Once you sign up you'll have access to the model portfolio.

This portfolio is full of utility and dividend stocks that you can buy right away.

You'll also get all the information necessary to make smart investments.

Access To Archives And More

With your subscription you'll get access to the private website.

There you'll find the portfolio and every newsletter ever put out by Utility Forecaster.

Additionally, you'll see buy prices and safety ratings of every stock.

Weekly Updates

The stock market moves fast and waiting until the monthly issue of Utility Forecaster is sent out won't always work.

This is where the Weekly Updates come in.

Every Friday you'll get updates on the portfolio and an overview of any news affecting your investments.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Utility Forecaster FAQ's

Still have some questions about Utility Forecaster?

Here's answers to any remaining questions you might have:

What Does Utility Forecaster Cost?

The price is only $39 per year which is absolutely amazing.

Sometimes newsletters will offer the first year at a discount and then double or triple the price when the product renews.

That's not the case with Utility Forecaster, though.

It simply costs $39 per year which again is amazing.

Is There A Refund Policy?

Yes and again it's very good.

You get 3 months to get your money back.

You might not be able to test the stocks out for a long time but it'll give you plenty of time to see if you like the service.

You'll be able to look at past newsletters, the portfolio and more.

So 3 months is plenty of time.

Is Robert Rapier Legit?

Yep!

I've reviewed hundreds of investing newsletters and so many times the editor won't be an expert on the topic of the newsletter.

I've literally seen publishers just slide in new people as the head of an investing service and not a change a thing.

But Robert is a legitimate expert in utilities and investing.

He spent years working with energy and utility companies and years working in renewable investments.

He knows how to gauge a stock and a company.

How Much Do I Need To Invest?

This is probably the biggest negative for the newsletter - you'll need a decent amount to invest in.

If you're young and have patience you can start with $10,000.

You can just re-invest your dividends for 30 years and eventually have a full time income stream when you're ready to retire.

If you're about to retire and want to start investing in these stocks you'll need at least $500,000 and possibly more.

If you have it, though, dividends are a nice safe investment.

Recommended: The Best Place To Get Stock Picks

Utility Forecaster Pros And Cons

Utility Forecaster Conclusion

I typically don't recommend investing newsletters.

The industry is full of sharks and some of the investing services out there make me sick.

Many of the stock picking gurus do as well.

But Utility Forecaster is a good newsletter that has proven over the years to get good results.

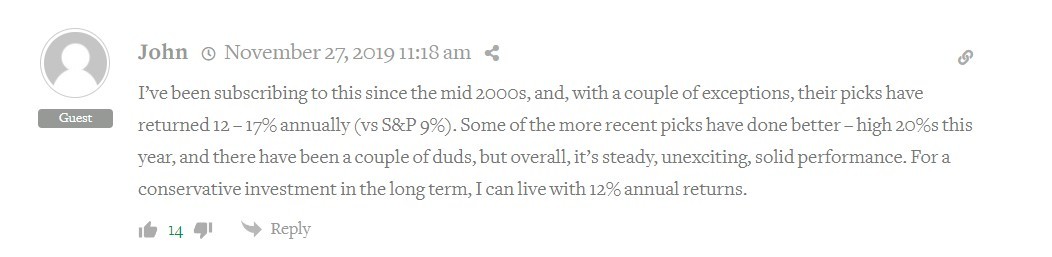

This comment from a subscriber really sums this product up well:

It may not be the most exciting newsletter ever.

You might not hit on a stock that gives you 1000% returns but it's reliable.

Year in and year out you can expect positive returns and to work your way to a full time income.

There's also way less volatility.

Overall I really like this newsletter and currently think it's one of the best 5 that I've reviewed!

Here's A Better Opportunity

Utility Forecaster gets my seal of approval.

But there's still better out there.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: