Weiss Crypto Investor is run by Juan Villaverde, and he claims he can help you find little-known cryptos to invest in.

Can this newsletter help you make money, or is it all one big scam?

We'll get to the bottom of this question in this review.

Additionally, we'll look at any red flags that I find, and you'll see important background information.

You'll know if Weiss Crypto Investor is worth it by the time you're done reading.

Let's get started!

Weiss Crypto Investor Summary

Creator: Juan Villaverde

Price to join: $129 per year

Do I recommend? No.

Overall rating: 2/5

Weiss Crypto Investor isn't a newsletter I would recommend anyone buy.

It recommends investing in smaller cryptos, which are extremely risky.

They recommended one crypto that completely collapsed, and Crypto Investor customers lost millions from it.

Remember, it's currently 2024, and the majority of people who have invested in crypto have lost money.

With small cryptos, the numbers are even worse.

Avoid.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

I Wouldn't Invest Much Into Crypto

I understand the appeal of crypto.

Who wouldn't want to invest in something that was worth $100 and eventually was worth over $60,000?

But the story of crypto is much more complicated than huge gains and creating millionaires.

There are a lot of reasons to avoid crypto.

Here's the main one:

It's not a Hedge against inflation.

One of the big selling points of Bitcoin and crypto is that they will help you if there's high inflation.

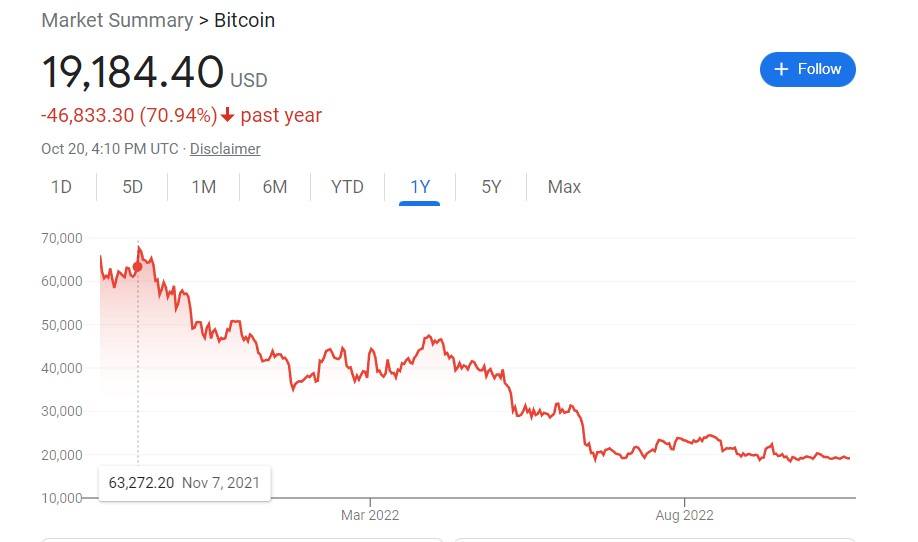

Well, inflation is through the roof right now, and what happened to crypto?

It crashed.

There's a very simple explanation for this.

When rent is due and you need to buy groceries, are you going to hold on to your digital currency that you can't buy anything with?

Of course not.

You sell your crypto for money and then use the money to pay your bills.

Crypto is something that's valuable when times are good.

I like to compare it to baseball cards or beanie babies.

They have value, but at the end of the day, you can't really do anything with them.

And when times are tough, the prices of these things drop because people don't have disposable income.

Just look at the price of Bitcoin this year if you don't believe me:

The second price started going up. Bitcoin dropped fast.

Edit: Bitcoin has recovered since this massive crash and is up to around $44,000 as of January 2024.

So it's gained 160% in the last year.

That's a good amount in a year and beats most stocks in terms of performance.

Still, I'm not much of a believer in Bitcoin.

At the end of the day, the only thing you can really do with Bitcoin is exchange it for cash.

You can't buy anything with it.

So if you're just looking to ride the waves and exchange for actual cash to buy things, I guess that can work.

But still, I'd caution against it.

I really do believe one day Bitcoin is going to get wiped out, and a lot of people are going to lose serious money.

Completely Unregulated

Another reason to avoid crypto is that it's completely unregulated and susceptible to scams.

The most popular kind of scam is a pump-and-dump.

This happens when a crypto has no real value and pumpers are inflating the price superficially.

Because the price is skyrocketing, many people start buying, thinking they're going to make money.

Once the price gets to a certain point, the pumpers sell all their crypto, and the price crashes.

Anyone who bought after the pumpers lost all their money.

Here's a video of a pump and dump happening in real time (the market cap went from trillions to zero in a matter of seconds):

That's how fast a pump and dump works.

There's no warning and no chance to pull your money.

In the blink of an eye, you can lose everything.

Crashes are very common.

You don't even need to be in a pump and dump to lose all your money quickly with crypto.

There are many "legit" coins that are worth hundreds one day but then lose all their value overnight.

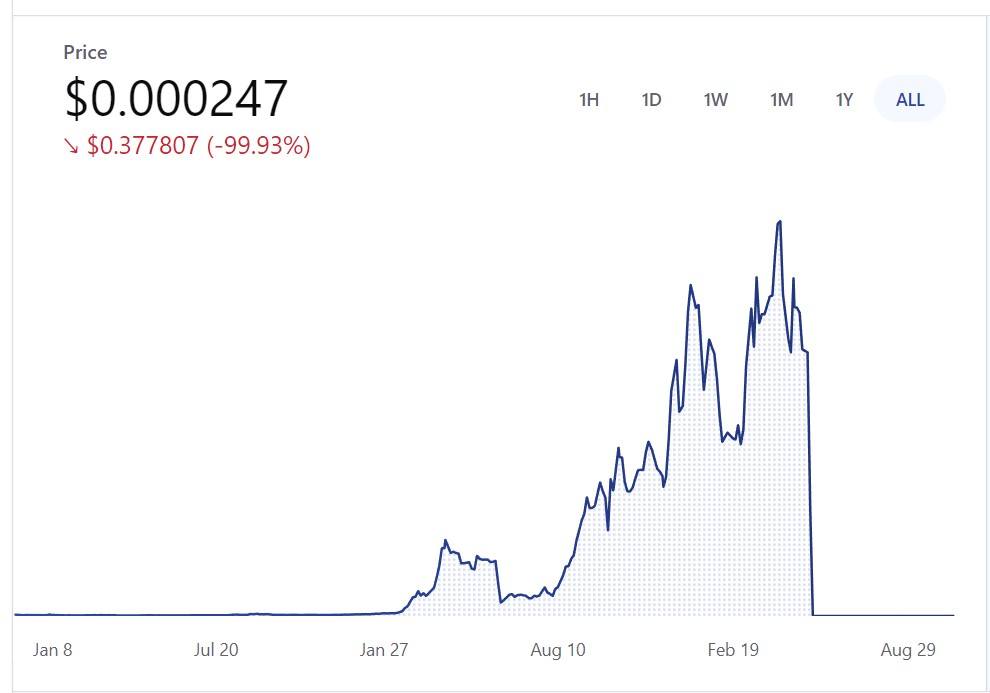

Take Luna, for example.

Luna was supposed to be a "stable coin," which means it wasn't supposed to be susceptible to crashes.

Despite its supposed stable nature, $60 billion in market capital was wiped out in a matter of days.

It was worth over $100 per coin and is now worth fractions of a single penny.

After the crash, a Taiwanese man killed himself after losing $60 million.

Another South Korean man lost $3 billion.

And guess what?

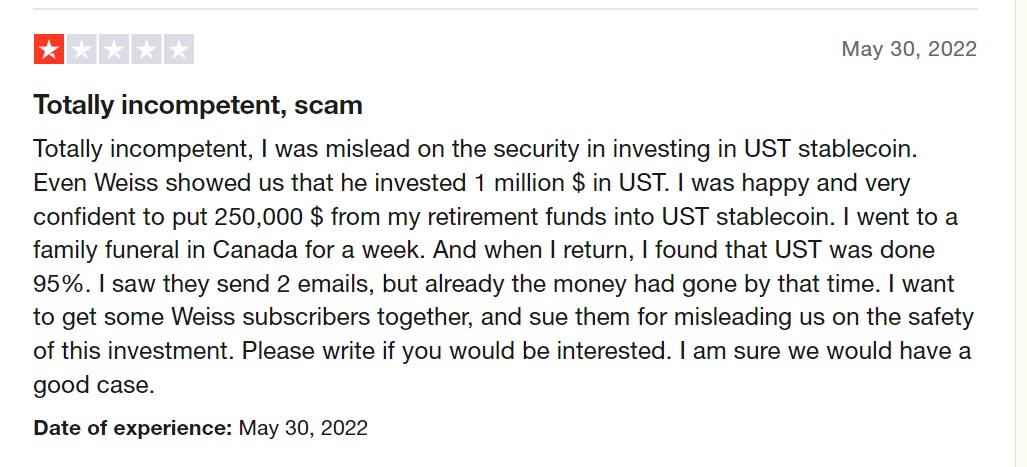

Weiss Crypto Investor rated Luna a safe crypto and recommended their customers invest in the coin.

Everyone knows the success stories of crypto, but not a lot of people know about the losses.

I personally would just stick to regulated assets like stocks.

Recommended: The Best Place To Get Stock Picks

Weiss Ratings And Juan Villaverde

The publisher of Weiss Crypto Investor is Weiss Ratings, and the lead editor is Juan Villaverde.

Weiss Ratings has been around for a long time and launched all the way back in 1971 (50 years ago).

They're most known for their ratings of different stocks, mutual funds, and ETFs.

They rate over 56,000 different assets, and they claim their performance beats that of Goldman Sachs, JP Morgan, Merrill Lynch, Morgan Stanley, and more.

However, I have my doubts about this.

First off, Weiss rated Luna crypto, which we addressed in the last section, as safe.

Here's a customer complaining that they lost $250,000 of their retirement money in a single day:

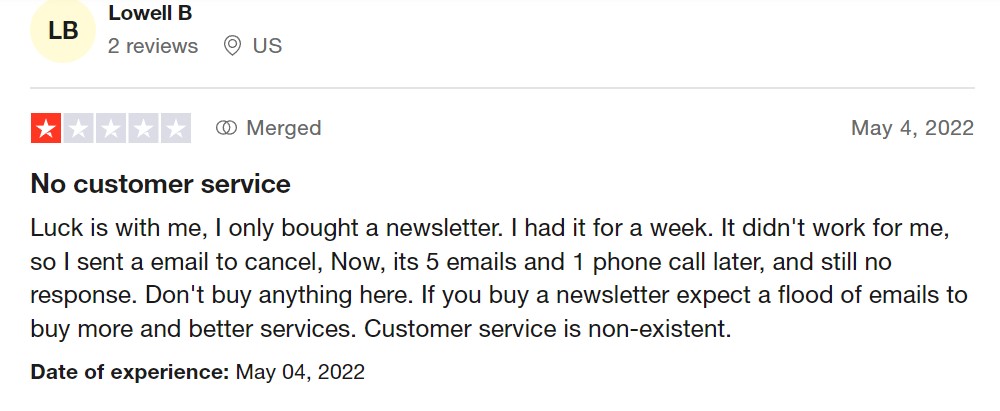

Overall, the customer reviews are brutal for Weiss Ratings.

They have an average rating of 2.5/5 over on Trustpilot:

This is especially bad because Trustpilot allows companies to moderate customer reviews.

So it's not like this is just getting review bombed or that it's full of fake reviews.

Most of the bad reviews focus on the bad customer service and the bad recommendations.

It seems like a lot of people lost money with Luna.

So while Weiss may have a lot of history, customers aren't loving it right now.

As far as Juan goes, there's not a lot of information out there about him.

Weiss claims Villaverde "He discovered a long-term Bitcoin boom-bust cycle made up of four 320-day cycles, which, in turn, are composed of four 80-day cycles."

It sounds like a load of BS to me.

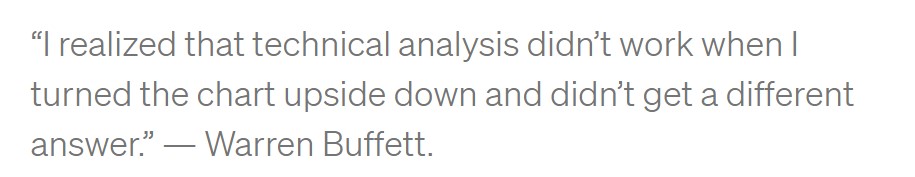

Anyone who claims they can forecast prices based on price action, patterns, and technical analysis should not be trusted.

Don't take my word for it, either.

Take Warren Buffet's word:

What I Weiss Crypto Investor Offering?

Overall, Weiss Crypto Investor is your standard investing newsletter offer.

Here's an overview of everything you get:

Monthly Newsletter

This is pretty much the main thing that you're paying for.

Every single month, you'll get a new digital copy of Weiss Crypto Investor.

In this newsletter, you'll get market analysis and new crypto investing recommendations.

Model Portfolio

Another big thing that you're paying for is the model portfolio.

Once you sign up, you'll get information on the cryptos that you should be buying right away.

They'll come with ratings and how much you should be buying.

Bonuses

There's a bunch of different bonuses if you buy Weiss Crypto Investor too.

Your subscription comes with the following:

- Ethereum and crypto yield guide

- Index fund of cryptos

- How to buy cryptos

- A daily newsletter called Weiss Crypto Daily

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Weiss Crypto Investor FAQ's

Still have some questions about this newsletter?

Here are the answers to common questions about Weiss Crypto Investor:

1) How Much Does Weiss Crypto Investor Cost?

This newsletter is $129 per year.

This is an introductory newsletter, and this is about what you'd expect to pay for a product like this.

There are much more expensive newsletters at Weiss that will be marketed to you after you buy them.

2) Is there a Refund policy?

Yes, there's a good one for this newsletter.

You get a whole year to get your money back.

Something to keep in mind, though, is that Weiss only does this for their cheap newsletters.

If you were to get one of the upsells, then there wouldn't be a money-back guarantee. Just a credit refund you can use to buy other products.

3) Is Juan Villaverde legit?

There's not a lot out there about him; however, I don't like his style of investing.

I think investing in small-cap cryptos is a huge mistake and can lead to you losing a lot of money.

Additionally, I don't trust Juan's ability to forecast the price of cryptos.

There's no secret pattern for predicting prices.

4) What Are Common Customer Complaints?

The biggest complaint I saw was about customer service.

Most people seem to not get much help from Weiss or aren't even able to connect with customer care.

Another common complaint is how Weiss spams you with emails once you buy.

This is something most investing publishers do.

They know that once you buy one product, you're more likely to buy another and spend more.

The last thing I saw customers complaining about was losing money.

Like we covered, some customers lost enormously with Luna.

One unfortunate guy lost $250,000 of his retirement money from this investment.

That's the risk you take when investing in unregulated assets.

Recommended: The Best Place To Get Stock Picks

Weiss Crypto Investor Pros And Cons

Weiss Crypto Investor Conclusion

That's the end of my review of Weiss Crypto Investor.

I've reviewed other Weiss products and was a little more positive before.

But I'm not a fan of this newsletter at all.

This year has been brutal and revealed crypto as being a lot more volatile than people thought.

This is especially true for small-cap cryptos, which are the ones recommended by Weiss Crypto Investor.

I understand you want to be rich and want to hit it big with the next big crypto.

But you're more likely to get involved in a scam coin like Luna and lose big.

There's a handful of cryptos worth investing in, and they're well known.

You don't need a newsletter to tell you to invest in them.

Here's A Better Opportunity

I'd pass on Weiss Crypto Investor; there's just too much risk involved.

The better option is to invest in stocks.

I've reviewed hundreds of newsletters that give out stock picks.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: