Hey, what's going on?

I just got an email from Nomi Prins (who I've covered several times already) talking about Enron 2.0.

This is a presentation where Nomi talks about distortions she sees in the energy markets.

In the end this presentation is meant to sell her new investing service called Energy Distortion Monitor.

In this post we review this service and give you all the background information you need to decide if it's right for you.

We also give you an explanation of what Enron 2.0 is.

Let's get started!

Energy Distortion Summary

Creator: Nomi Prins

Price to join: $4000 per year

Do I recommend? No

Overall rating: 2/5

Energy Distortion Monitor is a service that recommends stock picks in the energy markets.

You'll not only get stock picks but option calls and put recommendations too.

I've reviewed Nomi in the past and don't think she's worth buying from.

Her picks seem to be average at best.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

The Big Red Flag About Energy Distortion Monitor

Before we get into what Energy Distortion Monitor is offering I want to talk about who owns this newsletter.

Nomi Prins is the editor and Rogue Economics is the publisher but there's a bigger company that's behind this product - Marketwise.

Marketwise is a publicly traded company that formed last year.

There's over a dozen publishers under the umbrella of Marketwise and they all pretty much function in the same way.

Here's what you need to know before you buy a Marketwise product:

Extremely Persuasive Sales Funnels

Marketwise is really big and their revenue will be over $500 million this year!

They do this by milking their customers of every penny that they can.

Once you buy one product from a Marketwise publisher you become a target and will be promoted to every single day.

Many of these products will cost thousands of dollars a year.

Your inbox will be flooded with manipulating presentations with promises of high returns.

It's very annoying to deal with.

So understand if you buy Energy Distortion Monitor you will be heavily promoted to after.

Many Scammers In The Network

Another thing you need to realize is the publishers cross promote with each other in Marketwise.

So you'll be getting promotions from other publishers too.

Many of these publishers are headed by some of the worst people in the industry.

For example, Palm Beach Research Group is owned by Marketwise which is headed by Teeka Tiwari.

His products will get promoted to you and he'll be marketed as a trusted expert.

However, in reality Teeka was involved in so many scams in his career he's banned from Wall Street permanently.

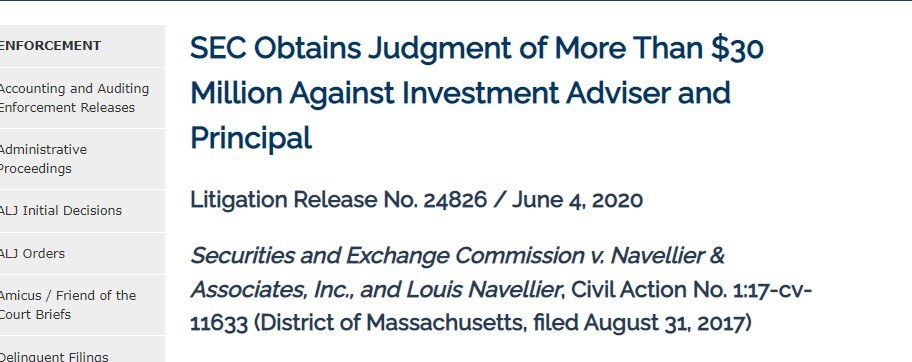

Louis Navellier is another guy under the Marketwise umbrella. He's marketed as a trustworthy expert too.

A couple years ago, though, he was fined $30 million for misleading investors about a stock:

Any reputable company wouldn't let Louis close to their company or customers.

This is who you're going to be dealing with if you buy Energy Distortion Monitor.

I personally wouldn't like giving my money to people like this.

Recommended: The Best Place To Get Stock Picks

Who Is Nomi Prins?

Nomi Prins is the creator of Energy Distortion Monitor and I've covered her a bunch of times on this website.

I reviewed her more popular newsletter called The Distortion Report, I reviewed her publisher Rogue Economics and revealed a couple stocks in different presentations.

I consider Nomi an enigma.

I like some of the work she does and she has an interesting book connecting bankers and the Office of Presidency for the last 100 years.

However, I think she's a bit of a hypocrite.

She claims she left her career on Wall Street to fight against the destructive nature of the industry.

However, in the past she worked for a horrible publisher called Agora.

Agora is not a more moral company than Goldman Sachs or Morgan Stanley.

In fact, they've been caught defrauding senior citizens many times and have paid millions in fines for doing so:

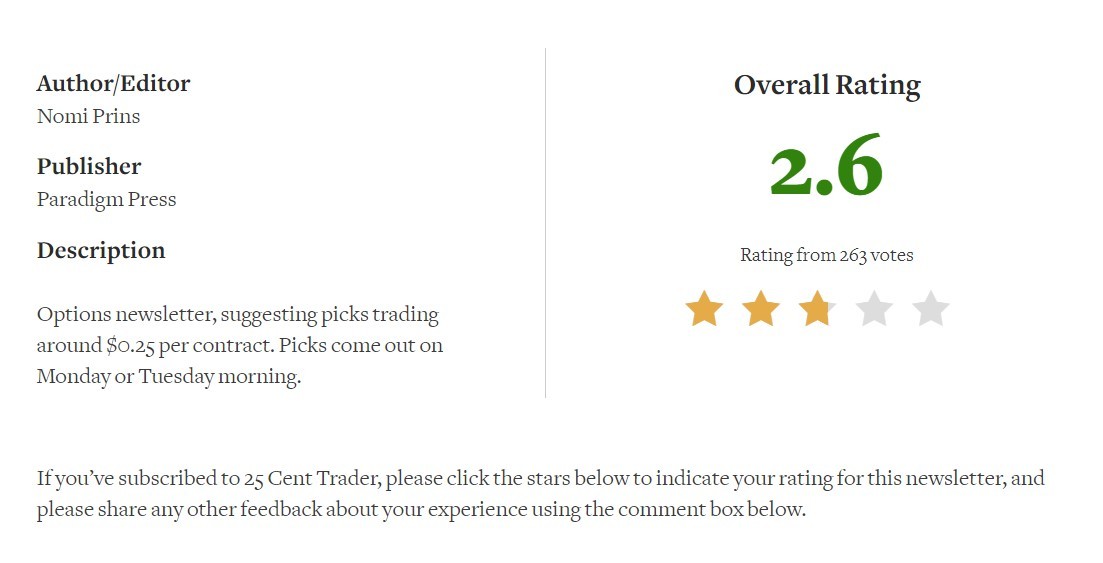

Nomi's services at Agora weren't well reviewed either.

She had an option alert service that only received a 2.6/5 from over 200 customers:

The biggest complaint was the option alerts lost money because the price would change by the time you took action.

So I find Nomi interesting but I've never been blown away by her investing services.

What Is Enron 2.0?

The pitch for the newsletter currently is something Nomi calls Enron 2.0.

These branded presentations are how every stock picker sells their services.

It's done in the exact same way as other stock pickers too.

The presentation is very long and is over a hour to get through.

Nomi pitches you the idea that there's a great distortion in the energy markets leading to "Enron 2."

Her point is Enron was ultimately brought down by a bad deal with Blockbuster.

Enron used some unethical accounting to claim revenue they never made based on a 20 year plan they had with Blockbuster.

However, 9 months after the deal was signed they cancelled.

This caused the Enron house of cards to fall.

Nomi calls this making the wrong deal at the wrong time.

That's the point of Enron 2.0 - there's a bunch of money flowing into companies and industries that aren't viable yet.

For example, there's companies getting massive subsidies from the government and this is overinflating stock prices.

She's predicting many of these companies will collapse along with their inflated stock prices.

For example, she gives an example of a company that makes lithium batteries for electric cars that has lost a lot of value this year:

This stock was high because it was getting a lot of government cash but it doesn't have viable products.

Nomi claims she'll help you make money by betting against these distorted companies.

In this case Nomi would recommend shorting the company.

Recommended: The Best Place To Get Stock Picks

Back Testing Isn't Real Results

One thing to keep in mind with Energy Distortion Monitor is there aren't real results yet.

All the returns they claim you can get is completely hypothetical and just based on back testing.

Back testing is just hindsight.

So Nomi develops a strategy and looks at past stock movements to come up with potential results.

That's why she says you can make 100% returns in a month and stuff like that.

Back testing isn't real, though, and everyone's back testing results are always better than their real results.

For example, I did a review about a program called Mindful Trader.

The creator of this program is a math wiz and a former Stanford graduate.

He back tested for over 20 years and his average return was 143%..

However, since trading his system in real time he's lost 20%!

So just because Nomi has good back tested results doesn't mean her results will be good in the future.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

What Is Energy Distortion Monitor?

This is a pretty standard service and offers what a lot of other similar products offer.

Here's what you get:

- A bunch of special reports that cover different topics and investment opportunities

- Model portfolio and analysis on each stock pick

- Buy and sell alerts

Again, this is what every service offers.

A major theme of this newsletter seems to be buying options.

You're going to be shorting energy companies that are bloated from government subsidies and you're going to be calling traditional energy companies (think oil).

Keep in mind this is the second option service Nomi has run and the last one didn't do well.

I'm guessing this newsletter will have similar issues.

Unless you can punch in the trade the second it comes to you the price you buy at will be different than what Nomi recommends.

This creates a scenario where Nomi makes money and you don't.

Energy Distortion Monitor Conclusion

Nomi has been putting out a lot of products in the last year as she tries to build out Rogue Economics, the publisher that sells her services.

I like Nomi in some regards and think she's competent.

I also share her views on a lot of topics including Wall Street corruption and collusion between bankers and politics.

But this isn't a review of just her beliefs.

She's selling a product and the results it gets you is the only thing that matters.

There isn't a track record yet but Nomi does have a stock picking past we can look at.

I personally am not impressed at Nomi's track record or previous products.

I think you should pass on this one as well.

Here's A Better Opportunity

It's too early for me to recommend Energy Distortion Monitor and I doubt that I do in the future.

The good news is there's plenty of good alternatives out there.

To see my favorite place to get stock picks (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: