Rogue Economics is a publisher that sells a few different investing services at the moment.

Their flagship newsletter, The Distortion Report, is being promoted heavily right now.

I'm sure before you invest money into these products you want to know if they're scams or not.

Well I have good news for you..

I've reviewed hundreds of similar newsletters and spent the day reviewing the services at Rogue Economics.

Below you'll get answers to any questions you have about this publisher.

Let's get started!

Rogue Economics Summary

Creator: Nomi Prins

Price to join: $40 to $5000

Do I recommend? No.

Overall rating: 1/5

Rogue Economics launched in spring of 2022 and it got a lot of attention from retail investors.

However, I was very skeptical because I didn't like the company launching this publisher and Nomi Prins (the lead editor) had bad customer reviews in the past.

The Distortion Report, which is the flagship newsletter, has done very poorly since launching.

Most of the stocks are down in the portfolio and some are down huge (more than 90% in under a year).

The kind of assets recommended by Nomi and her team are just bad investments in the current market.

There's a lot of baggage with the products at Rogue too and they don't treat customers well.

No need to buy anything from them.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

8 Things To Know About Rogue Economics

Before you buy anything from Rogue Economics there's things you need to know.

Here's everything you need to consider about Rogue Economics.

1) Another MarketWise Publishers (Not Good)

MarketWise is the new king of investing newsletters.

This company went public back in the summer of 2021 and have grown tremendously in that time.

They accumulated over a dozen publishers in this time and make over $500 million in revenue every year.

Rogue Economics is one of their most popular publishers.

The reason this isn't a good thing is Rogue Economics is under MarketWise's umbrella and MarketWise doesn't treat their customers well.

Here's what to expect any time you buy from them:

- Manipulative marketing

- Massive upsells

- Poor performance (most investing newsletters from them are trailing the market)

But the worst part is scammers will have access to your email address.

MarketWise employs legitimate scam artists.

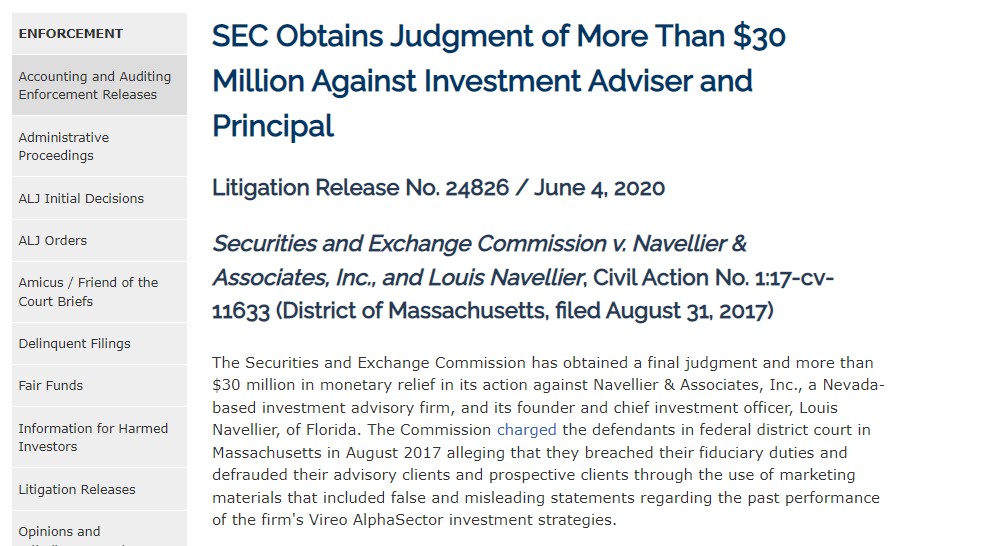

For example, Louis Navellier is one of their main faces and was recently fined $30 million for defrauding customers:

MarketWise will be promoting Louis' products to you and some of them cost $10,000+.

There's a lot more unsavory characters at MarketWise too and all of them will be promoting their services to you.

Most won't perform well and many cost thousands per year.

MarketWise exists to squeeze as much money from you as possible and their publishers all act the same way.

Unless a newsletter is very good I typically don't recommend any MarketWise services.

2) Nomi Worked For Agora (Even Worst)

There's really only one investing company that I'd say is worst than MarketWise and that's Agora.

Agora was the biggest independent publisher of investing newsletters at one point.

But publishers started to flee after a lot of bad press.

For example, a couple years ago they were fined millions for defrauding senior citizens:

Most of the publishers that were under Agora are now under MarketWise.

This includes Nomi Prins who is the face of Rogue Economics and lead editor.

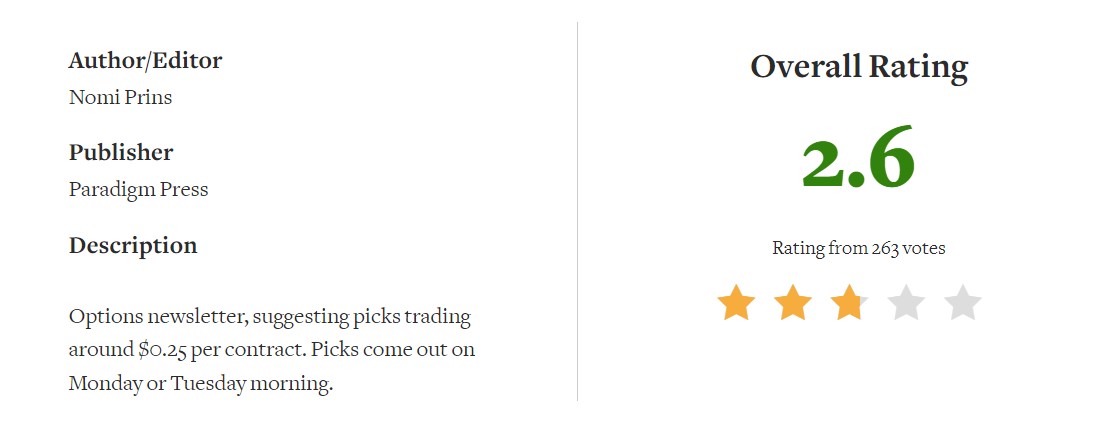

Nomi ran a service for Agora called 25 Cent trader.

This program sent out option trade alerts to customers.

However, it performed poorly and most customers were dissatisfied.

Over on Stock Gumshoe 260 customers of the newsletter voted on it and it got a 2.6/5 star rating:

Option alert services typically don't work well.

By the time you make the trade it's usually different than the price of the recommendation.

Here's one customer pointing this out:

That's why when Rogue Economics launched last year I wasn't too excited.

I had a feeling the results would be poor.

3) I Like Nomi's Work Outside Of Stock Picking

Despite not being my favorite stock picker, there are aspects about Nomi that I admire.

Nomi is a journalist of sorts and has written some very good books.

In her book All The President's Bankers, she examines Wall Street's impact on the presidency during the last 100 years.

She did an excellent job writing about this subject which isn't covered enough.

I believe Nomi is skilled at this sort of work.

The stock picking doesn't seem to be working out.

Recommended: The Best Place To Get Stock Picks

4) Signing Up For The Distortion Report Was HORRIBLE

I've reviewed 100+ stock picking services and understand upsells is common practice.

And when done right an upsell can be a good thing and add to the service.

However, the upsells at Rogue Economics are horrible and I've never experienced a worst sign up process in my life.

You are sent through a series of upsells that are extremely aggressive, confusing and makes you wish you never signed up in the first place.

The first upsells is pitch from Nomi asking if you'd like to become a lifetime member of The Distortion Report:

The price is $299 I believe.

Now I don't think The Distortion Report is worth it because it's not performing well.

But if this was the only upsell I'd say fair enough.

After this you're sent 6 more upsells!

And you have to go through all of them before you can reach The Distortion Report.

Some of the upsells cost thousands of dollars and others come from different publishers.

It's just a headache and makes it feel like you're being attacked by a bunch of pick pocketers.

After this infuriating process you're then sent an email with your sign in details:

This process just reinforces the idea Rogue Economics and MarketWise are more concerned with getting as much money from you as fast as possible.

5) Revealing Some Of The Stock Picks

Nomi puts out splashy stock teasers to get you to buy her products.

You only get the stock she's hyping up if you end up purchasing her services.

However, she leaves enough clues in the presentations to figure out the stocks.

There's a good chance if you're thinking about buying from Rogue Economics it's because you've seen one of these presentations.

Here's four of her most popular stocks from her presentations starting with "The #1 Stock For America's Great Distortion."

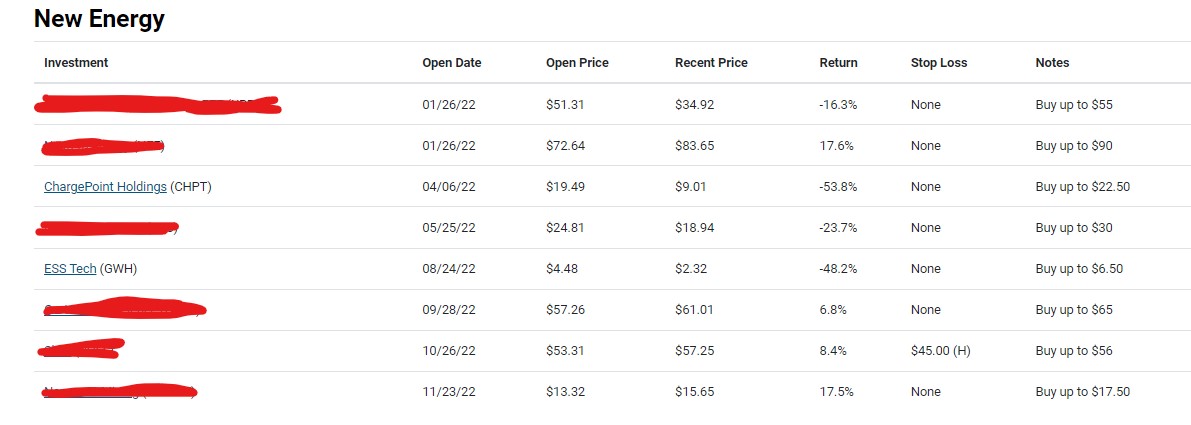

This stock was ChargePoint:

ChargePoint makes EV chargers and are the biggest in the world.

However, Nomi recommended the stock at $20 and it's currently at $10:

It gets worst, though.

In the same presentation she recommended Silvergate Capital:

The stock has fallen from $140 to $11.

That's a loss of 95% in just 8 months.. doesn't get much worst than that.

Last month Nomi finally told her subscribers to sell Silvergate.

Next, Nomi ran a presentation called the "#1 Stock For America's New Era."

This presentation wasn't as big as her previous one and in it she recommends Block (SQ).

Block is a payment processor and the idea is digital payment processors are going to become bigger.

The stock has gone up slightly since being recommended but nothing major:

The last major stock teaser Nomi has done is where she hints at a "$4 energy stock."

This is another presentation that I wrote about in depth and is currently Nomi's most popular stock teaser.

The stock is ESS Tech and they're a company that makes iron flow batteries.

Apparently they're a cheaper alternative to lithium ion batteries.

Maybe one day this company will deliver results but it's had a rough 4 months so far:

It's down about 50% since being recommended.

Recommended: The Best Place To Get Stock Picks

6) The Distortion Report Is Struggling Badly

The first product we're going to look at from Rogue Economics is The Distortion Report.

I did an entire separate review of this service that's extremely in depth.

So if you're looking for a detailed review of this product, click here.

The Distortion Report is the flagship newsletter of Rogue Economics and is probably the product you're thinking about buying.

My advice is pretty simple: Don't buy The Distortion Report.

Since it's inception this newsletter is performing very poorly.

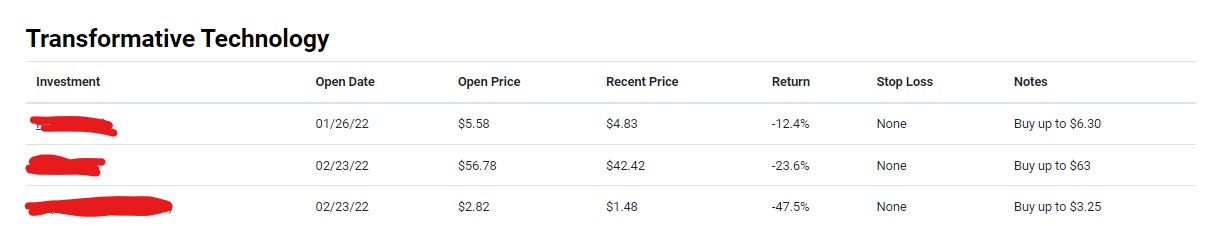

Here's a look at how the portfolio is currently doing starting with the "Transformative Technology" portfolio:

I have to scribble out the names because that information is proprietary information.

As you can see there's three stocks in the "Transformative Technology" section.

All are down currently with one being down 47%.

Next we have "Infrastructure:"

There's 5 stocks in this section and two are losing money. The biggest gainer is up 11% but the biggest loser is down 34%.

After that we have "New Energy:"

This is the section with the most stocks in it.

Since we already revealed two of these stocks I decided not to scribble them out.

There's some winners here but the losers far outweigh the winners.

Last up we have New Money:

There's three stocks here and one is down big time (56%).

Block is the only stock up.

So unless you want these stock picks I'd avoid.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

7) The Other Editors Have Bad Reputations

Nomi isn't the only person at Rogue Economics.

There's two other people including Eoin Treacy and Lau Vegys.

Eoin Treacy runs a more expensive service at Rogue Economics called the Rogue Portfolio.

However, this isn't the first investing service Eoin has run.

He previously ran a newsletter called Frontier Tech Investor for a publisher called Southbank Investment Research.

This service didn't do well either and out of 58 people who voted on it, it only has a 2.1/5 star rating:

According to this person almost all of Eoin's stock picks lost 50% or more after he recommended them.

The last expert at Rogue is a guy named Lau Vegys.

There's really nothing out there about him.

After reading through his bio it seems he's been was Agora for a long time and jumps around from Agora publisher to Agora publisher.

8) What Are Rogue Economics' Upsells?

The Distortion Report isn't the only service they're offering at Rogue Economics.

I ordinally wrote this review back in the summer of 2022.

At the time there was only one upsell and that was Rogue Portfolio.

In my previous review I predicted there would be a lot more products being launched.

That's just how all these publishers work.

And I have been proven right since then and now there's 5 upsells!

Here's an overview of each one.

Rogue Portfolio ($3500 Per Year)

Rogue Portfolio is described as a "special-situations research advisory. It’s designed to help investors protect and grow their wealth in any market environment."

It's headed by Eoin Treacy who has bad customer reviews.

This service isn't cheap and will cost you $3500 per year!

A good rule of thumb is never pay more than 1% to 2% of your portfolio on research.

If you're paying more than that your gains will likely be less than what you're paying in research.

So you'd need at least $175,000 to invest for this service to be beneficial.

Additionally, there's NO money back guarantee here.

If you're disappointed in the poor results you'll only get a credit refund.

Distortion Money Matrix ($4000 Per Year)

This service is a lot like Nomi's former option alert service called 25 Cent Trader.

Remember that product got really bad reviews and was eventually shut down.

The idea is Nomi gets "distortion" signals and then sends you an alert when to buy and an alert when to sell.

This isn't a long term investing strategy and is for quick profits.

It's very expensive at $4000 per year and there's no money back guarantee.

Using the 1% to 2% rule you'd need $200,000 minimum to invest for this service to be worth it.

Energy Distortion Monitor ($4000)

I wrote an entire separate review of this service that you can read here.

Basically this is another option alert service from Nomi.

Instead it focuses on "distortions" in the energy market.

It seems a big focus will be placing puts on overvalued energy companies.

She's calling this Enron 2.0.

Enron was an energy company with phantom revenue and eventually it collapsed from fraud.

This service is $4000 per year and doesn't offer a money back guarantee.

Rogue Strategic Trader ($4000 Per Year)

Strategic Trader is another service that gives you investment ideas every month.

However, you won't just be buying stocks here.

You'll be getting warrant picks.

Warrants are a lot like options but instead of being bought and sold between investors they're bought and sold between investors and a company.

It basically just gives you a right to buy a stock at a certain price in the future.

One investment idea she gave to her subscribers was to buy warrants in Lion Electric.

However, the investment has lost 50% of its value since being recommended.

This service is $4000 year and offers no money back guarantee.

EV Blueprint ($4500 Per Year)

EV Blueprint is the latest upsell.

This product is most expensive of all and costs $4500 per year.

So you'd need a pretty big investing account for EV Blueprint to be worth it.

This newsletter "seeks to profit from the transition from gas-powered cars to electric vehicles."

Every month you get a stock tip based on this theme.

Recommended: The Best Place To Get Stock Picks

Rogue Economics FAQ's

Still have some questions about this publisher?

Here's some answers to any remaining questions you might:

1) Are The Prices At Rogue Economics Fair?

The Distortion Report is pretty cheap at $49 a year but this is only bait.

The goal is to get you to buy this then heavily promote the upsells which cost up to $4500 per year.

That's way too much money to pay for these services.

2) Is There A Refund Policy?

In typical MarketWise fashion they only give you a money back guarantee on the cheap product and not the expensive one.

The Distortion Report comes with a 60 day refund guarantee.

All the expensive services come with a 90 day guarantee but you only get credits back.

This means you can only use the refund to get other Rogue Economic products.

This is so stupid and makes no sense.

Why give money back for the cheap product and not the one that costs thousands?

This is what I mean when I say I don't like MarketWise and how they do business.

They only care about making money for themselves!

3) Are The Experts Legit?

It's really hard to tell to be honest - I have a hard time saying anyone that works for Agora is legit.

It's such a horrible company and they use the most deceptive marketing possible.

Plus the expert backgrounds aren't that impressive.

When push comes to shove the only thing that matters is if they can pick good stocks.

Both Nomi and Eoin's records indicate they struggle in this department.

4) How Much Should I Have To Invest?

It really depends.

But we talked about the 1% to 2% rule earlier.

Most of the services at Rogue require an investing portfolio of more than$175,000.

Rogue Economics Pros And Cons

Rogue Economics Conclusion

So that's the end of my review of Rogue Economics.

I understand that the marketing for this service is top tier.

They do a good job with their presentations and they do a god job at making you want to buy their services.

They dangle huge returns in front of your face and make it seem like you're going to 10X you're money.

But when you actually investigate the real results you see a completely different picture.

The Distortion Report is down pretty significantly right now and some of the stocks are absolutely horrible.

For example, Silvergate Capital lost 95% of value in just 8 months.

ChargePoint, the stock that was used to launch this service, is down 50% in 8 months as well.

In addition to the poor results, there's a lot of baggage with this newsletter.

You'll be promoted a frustrating amount of upsells that all cost thousands per year (and don't have a money back guarantee).

And everyone at Rogue Economics has gotten bad customer reviews in the past.

There's simply nothing to like here and I don't recommend that you buy any of Rogue Economics' products.

Here's A Better Opportunity

I'd pass on Rogue Economics and basically anything having to do with MarketWise.

The good news is there's still a lot of good places to get stock picks.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Rogue Economics is properly name – it is a SCAM !

Nice review. Difficult to find information about her. The division of wealth and security is real but this is a grift.

Regarding Charge Point and EV investing, natural gas companies and Lithium are better investments , IMO. (AR< RRC<SWN/LAC<, ie)

Thanks for your insights!

Excellent article Dylan, I read Ms Prins article. In aus and NZ we have a saying BS baffles brains. Mr Buffett wrote ” the only value of stock forecasters is to make fortune- tellers look good.”

Haha I like that quote!