Nomi Prins is back again with a new stock teaser..

This time she's claiming to have a $4 liquid energy stock that will bring about a "$130 trillion new energy revolution."

She even claims $5 billionaires are all buying this stock at the moment.

Hmmm.. sounds pretty interesting.

There is one big problem, though.. she won't reveal the stock unless you pay for her newsletter, The Distortion Report.

Well, I have good news - I was able to figure out the name of the stock being teased here and reveal it below.

Plus you'll get information on the stock and Nomi to determine if it's worth buying.

Let's get started!

Liquid Energy Stock Summary

Stock: ESS Tech

Symbol: GWH

Price (10/7/22): $4.18

The Stock being pitched by Nomi is ESS Tech.

Apparently they make iron flow batteries which have the potential to be cheaper and safer than lithium ion batteries.

This company has had some set backs in the past and they are cautioning investors about delays in the future.

They have cash on hand to build up production and should be ramping up production in the near future.

If one were to buy you'll have to wait a few years to see any real production and sales from them.

2023 Update:

It's now been about 5 months since Nomi recommended ESS Tech and the stock is down pretty significantly in that time.

It was originally recommended at $4.48 and is currently $2.46.. meaning it's down 46% in just 5 months.

I originally told people interested in this stock to be very patient and this still remains.

It's a high risk, high reward.

Right now you're seeing the risk - will it recover?

They still have a lot of cash on hand but there's been a lot setbacks so far with this company.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Figuring Out The Stock

Nomi Prins is someone I've covered a lot on this website.

I've reviewed two of her newsletters - The Distortion Report and Energy Distortion Monitor.

I've also revealed a few of her stocks before including her #1 stock for America's great distortion.

Now she backs hyping up what she calls "liquid energy."

Like all of Nomi's previous stock presentations this one is long and throws a lot facts and figures out you..

But she left enough clues in the presentation to figure out the name of the company she's hyping up.

Nomi is claiming a new battery is being developed that's better than the lithium ion batteries currently being used in Telsa's.

She claims a bunch of billionaires including Bill Gates, Bezos and Bloomberg are all betting on a company that will make this battery.

Nomi even runs a science experience to show how safe this new battery technology is by drinking water used with it:

She claims the source of this battery is much cheaper too.

Nomi shows off a chart claiming lithium is $150 a pound and this mystery liquid is only $0.05 per pound.

After this Nomi really starts hyping up this "liquid energy."

She posts many articles hinting how this technology will defeat lithium ion batteries and how many investors are pouring money into this new battery tech.

Nomi claims $130 trillion will be invested into energy as a result of new energy demands.

Next, Nomi starts talking about energy storage and how Elon Musk's energy storage products can cost over $1 million.

You begin to see where Nomi is heading at this point in the presentation.

Her stock pick have to do with energy storage and will rival Elon's lithium ion energy storage products.

At this point we can figure out the stock based on news article clippings Nomi shows.

For example, she claims Bloomberg said this company "could eat lithium's lunch,"

I found this article and in the headline talks about iron-flow technology and the company behind it, ESS.

So liquid energy is iron flow technology and the company Nomi is teasing is called ESS.

Here's a presentation where you can see this company talking about the battery they're developing.

Recommended: The Best Place To Get Stock Picks

Is ESS Worth Investing In?

Ultimately this is a decision you need to determine for yourself.

I'm not a financial adviser and don't want to give you advice on what stocks you should or should not buy.

However, I'll give you my thoughts and show you what I was able to find about this company:

Another SPAC Deal

SPAC deals were really hot last year and SPAC stands for special purpose acquisition companies.

Basically a group of investors get together and form a SPAC.

You invest in this group on the promise they'll acquire a company in less than two years.

You don't know what company they're going to buy and you're basically just betting on the group getting it done.

If they don't buy a company in two years you get your money back.

The company that merged with ESS was called ACON S2 and the deal brought in $200 million for ESS.

This money is used to grow and ramp up production.

There's Been Many Set Backs

SPAC deals all pretty much go the same way.

They get very hyped and are pretty much overvalued right from the start.

The reason is the valuation comes from what the company expects revenue and production to be in the future.

However, it almost never works out the way the company predicts.

This is what has happened with ESS.

Their original forecasts was revenue to be $37 million in 2022 and $300 million in 2023.

Now the forecasts are $3.5 million for 2022 and $109 million for 2023.

Also, costs are higher than expected.

They Have $192 Million In Cash To Survive

The good news is ESS still has a lot of money from their SPAC deal - $192 million.

This should last them a few years until they become profitable.

So you're pretty much betting on ESS being able to increase revenue and raise more money before this cash runs out.

It wouldn't hurt to sit back and see if ESS can reach some of the goals they've been predicting before throwing down any cash.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

The Distortion Report FAQ's

The whole point of this presentation is to get you to buy Nomi's investing newsletter called The Distortion Report.

Here's everything you need to know about this offer:

1) Who Is Nomi Prins?

Nomi Prins is the woman in the presentation and the creator of The Distortion Report.

She's a former Wall Street executive and she claims she left over the corruption.

However, she's worked for some seriously bad companies after leaving Wall Street.

For example, she worked at a very unethical company called Agora.

Agora has recently been fined for defrauding senior citizens and is constantly getting in trouble for things like this:

So her claims of just wanting to help the little guy falls flat for me.

Additionally, her past services weren't well reviewed.

There are some things to like about Nomi, though.

She wrote a book about banking corruption and Washington DC power that looks interesting.

2) Is The Distortion Report Legit?

I don't think it's the worst investing newsletter out there and it's very cheap.

The theme of this newsletter is there are distortions in the market that lead to overvaluations and undervaluations.

The goal is find the distortions and make investments based on them.

This newsletter was only created earlier this year so it's too early to determine if it's good or not.

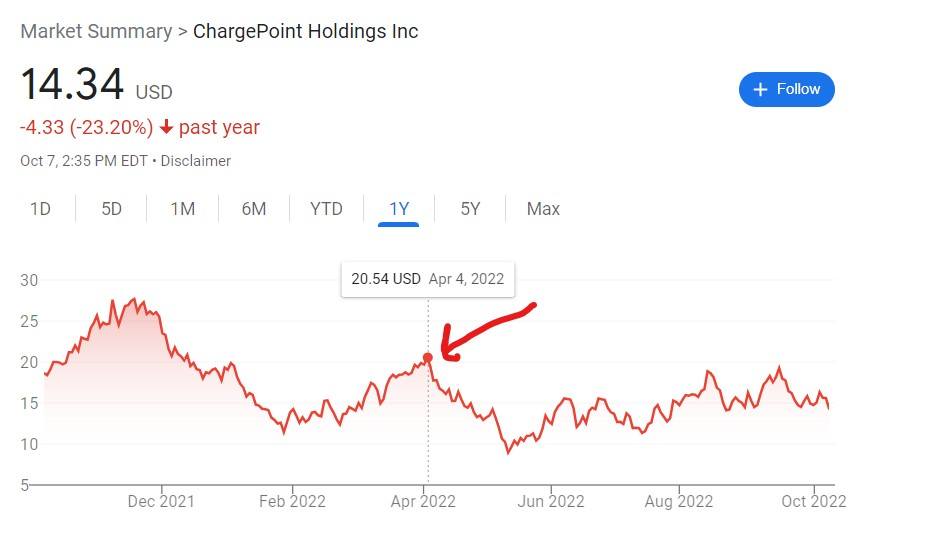

The main stock promoted for this newsletter is Chargepoint.

The red arrow below shows when Nomi made the recommendation:

The stock is down overall but it's a stock you're expected to hold for many years before seeing big returns.

3) How Much Does The Distortion Report Cost?

If you buy The Distortion Report through this promo it will cost $49 for the first year ad then $129 per year after.

This is exactly what all introductory newsletters cost and what you'd expect to pay.

However, this is a bait product meant to get you into the sales funnel.

Once you're in the sales funnel Nomi will try and sell you products that cost thousands.

4) Do I Recommend The Distortion Report?

Not really.

It's just your typical investing newsletter owned by a huge company.

Nomi isn't independent and this product is owned by a publicly traded company called Marketwise.

They make hundreds of millions a year selling investing newsletters.

They employ some real scumbags too.

So I personally wouldn't want to get involved with a Marketwise newsletter.

Recommended: The Best Place To Get Stock Picks

Want High Quality Stock Picks?

The Distortion Report is just your average investing newsletter.

There's much better options out there.

I've reviewed hundreds of these newsletters..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: