Hey, what's going on?

Today we're going to be looking at The Dividend Hunter by Tim Plaehn.

This service promises to find you high yield stocks that can help pay your bills.

Is Tim telling the truth, or is this one big scam?

We'll get to the bottom of this question in this review.

Additionally, we'll look at some background information, look at the portfolio, and even reveal some stocks.

You'll know if The Dividend Hunter is right for you by the time you're done reading.

Let's get started!

The Dividend Hunter Summary

Creator: Tim Plaehn

Price to join: $49 per year

Do I recommend? Sort of

Overall rating: 4/5

I've been a member of The Dividend Hunter for a couple years now and think it's definitely worth buying.

This is a solid investing newsletter, and it's definitely better than most out there.

Tim is a straight-forward guy, and his picks do well compared to other investing newsletters.

You get exactly what's being promised to you here: income-producing investments.

Some are volatile because of interest rate changes and the whackiness of the current economy, but they are still worth buying, in my opinion.

Just make sure not to buy any of the upgrades or other upsells the publisher of this newsletter tries to sell you.

They're not worth it and are too expensive.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

16 Things To Know About The Dividend Hunter

There's things you should know about The Dividend Hunter before purchasing.

Here's everything you need to consider about this newsletter:

1) I Actually Bought The Dividend Hunter

There are a few different places that review investing newsletters, but none of them are really honest.

You either have people that are getting paid to write the review, people that didn't actually buy and are just copying the marketing material, or people that just don't know what they're talking about.

I've reviewed 100+ investing newsletters in the last few years.

I actually bought The Dividend Hunter and know what to look for in an investing newsletter.

This review will be very straight forward and I'll tell you exactly what I like and don't like.

This should help you determine if it's right for you.

2) Investors Alley Is A Typical Investing Publisher

I've reviewed Investors Alley and some of their other newsletters before, like The 20% Letter.

Investors Alley is your typical investing publisher.

This isn't really a good thing, but I wouldn't say it's worse than average.

The investing newsletter industry is crazy. The marketing and return promises is out of control.

Investors Alley is definitely designed to get you to spend a lot of money.

There are many newsletters and services offered there, and they're aggressive about getting you to buy from them.

Some of them are expensive and cost up to $1000.

This is just how it works, and there aren't many publishers that don't do this kind of stuff.

So if you do end up buying The Dividend Hunter, make sure you know the upsells are coming.

Also, make sure you resist them because The Divedend Hunter is the best newsletter at Investalley.

3) The Sign Up Process Is Very Annoying

This is where The Dividend Hunter is a little worse than other services.

Every investing newsletter is going to throw some upsells at you after you buy.

But the Dividend Hunter is very aggressive and makes you go through a series of them before you access the product.

Right after you buy, you're pressured to upgrade to a lifetime membership.

At least the "I'm not interested" button is big.

I reviewed a newsletter yesterday where the "I'm not interested" button was in tiny print, so you couldn't see it.

That's not all, though.

After you hit not interested, you're brought to the next upsell:.

This one is to access the Weekly Income Accelerator, which will cost $995 per year.

After you hit not interested you're brought to another upsell!

This one is for Automatic Income Machine and it costs $595 per year:

Tim's not done with his upsells yet..

There's one more after you hit not interested.

This one is for a lifetime membership to Dividend Hunter and Dividend Hunter Insiders.

We're not quite done yet..

The last one prompts you to call Tim's team so they can try to sell you another service called Income For Life:

These aggressive upsells always feel so wrong to me.

It's like a bunch of pickpocketers trying to grab my wallet.

My advice is simple: DON'T BUY ANY UPSELLS UNTIL YOU'RE COMPLETELY SATISFIED WITH THE ORIGINAL PRODUCT.

Many of these expensive upsells might not come with a refund policy.

Typically, investing publishers only offer refunds on their cheap products and credit refunds on their expensive ones, meaning you can use the money to buy other products at Investors Alley.

Recommended: The Best Place to Get Stock Picks

4) Tim Plaehn Is An Interesting Guy

The lead editor and investment analyst for The Dividend Hunter is Tim Plaehn.

He's had an interesting life and has worked at many diverse places.

Before entering the world of finance, Tim flew F-16's and was an instructor for the Air Force.

So you know Tim is going to be a disciplined and capable guy.

After this, he became a stock broker and certified financial planner.

According to his LinkedIn, he spent 4 years as a salesman at Western Truck and Equipment (the average salesman makes $150,000 a year there!).

After a freelance writing career focusing on investing, Tim began working at Investors Alley.

He's been featured in places like:

- USA Today

- The Motley Fool

- Newsmax

and other financial companies.

5) Revealing Tim's #1 Buy, Hold And Retire Stock (Tim's Trade Of The Decade)

I can't just tell you the stocks in Tim's portfolio because that's proprietary information.

We'll talk about the portfolio and look at some numbers later, but there is one stock I can reveal, and it's Tim's favorite.

I can reveal it because he did a public stock presentation hyping up the stock.

He doesn't reveal the stock name in the presentation because he's trying to sell his newsletter by offering the stock name.

But he left enough clues to figure it out.

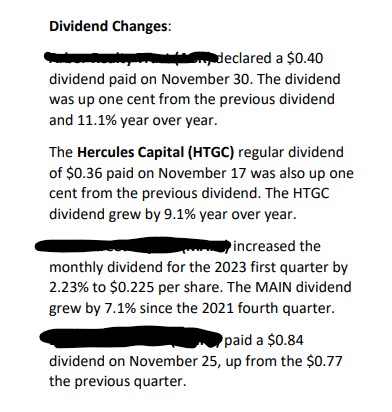

Tim's "#1 Buy, Hold And Retire stock" is Hercules Capital and I did an entire write up detailing this stock here.

Tim recommended this company back in January 2022 and here's how it's performed since then:

So the stock hasn't done too well.

Hercules Capital is a bank that lends money to medium and small businesses (the kind that's too small for Wall Street to be interested in).

Rising interest rates have hurt the market overall, and Hercules Capital isn't an exception.

When Tim recommended the stock, it was at a high point (it typically trades between 1X book value and 1.5X book value, and it was recommended at around 1.5X book value).

However, the dividend has been great.

It's currently paying a little over 10% with a supplemental dividend of 5% (bringing it to around 15% right now).

There is some risk associated with investing in a company like this.

They lend to startups, and they have recently been lending to a lot of biotech companies.

These kinds of businesses have been struggling lately, and if they default on their payments to Hercules Capital, that could hurt them.

As long as borrowers keep paying, this should be a good stock.

Bonus:

Tim likes to put out teasers to sell Dividend Hunter and recently launched a new teaser promising "three high dividend plays" that will help you "earn $700,000 of dividends over the next decade."

He launched this teaser in December of 2023.

The three picks he made in this presentation are Reaves Utility Income, Oaktree Specialty Lending, and Ship Finance Limited.

These are all very high-yield offers that Tim believes are going to continue offering high dividends for the next decade.

The yields for each stock are 8.5%, 11%, and 9%, respectively.

The risk here is that these companies are volatile in the current market because of high interest rates.

If interest rates come down, then the dividend payments should remain high.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

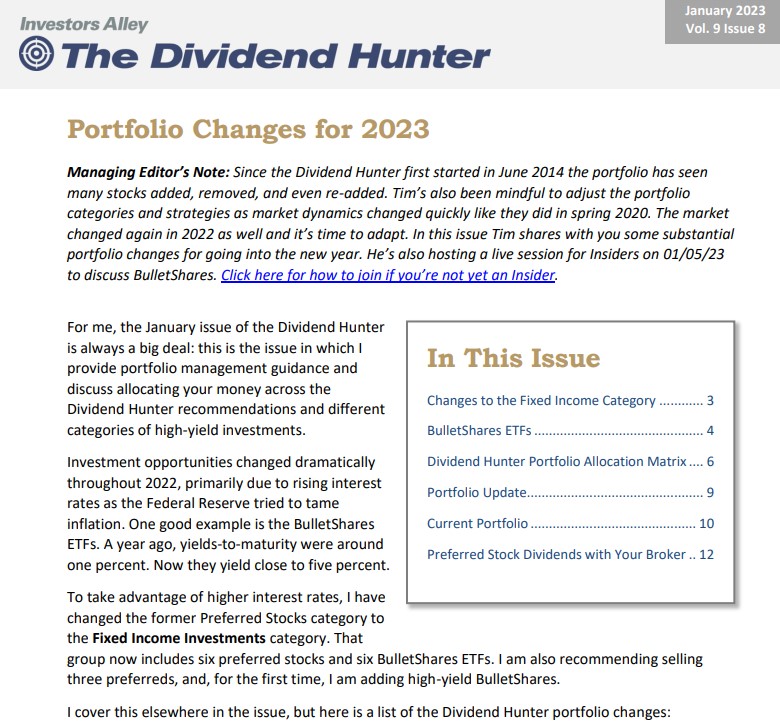

6) You Get A Monthly Newsletter

This is the main thing that you're paying for.

Every month, you'll get a new copy of The Dividend Hunter.

In each newsletter, you get about 10 to 12 pages of market research and commentary from Tim.

Most of the newsletter is about going over the current positions and commenting on the changes.

When a company releases earnings, Tim will dive into the numbers and let you know what everything means.

Additionally, he covers dividend changes here:

Lastly, you'll get new stock recommendations and sell alerts here.

Overall, the newsletter is easy to read and concise.

You're not overwhelmed with information, and you'll learn everything about the portfolio that you need.

7) Several Different Special Reports

The special reports act as a sweetener to entice someone to buy the newsletter.

I'm sure if you're reading this review, it's because you watched a presentation about one of Tim's reports.

In total, there are 22 special reports!

One of the main ones is titled "How to Collect Pre-IPO Cash From The Hottest Silicon Valley Start-ups."

It also goes by "Tim's Trade of the Decade."

We revealed this stock already and it's Hercules Capital.

They invest in Pre-IPO startups and many are from Silicon Valley.

Another one of the main reports is "The Supercycle Backdoor:"

The pitch here is to earn dividends from an ETF in stocks that have to do with renewables and electric utilities.

The next big special report is "The #1 Strategy That Turns 25K Into Income For Life:"

This report details a way to turn $25,000 into a full-time income stream.

Basically, you invest in high-yield dividends and then reinvest the dividend payments back into the stocks.

Over time, you'll grow your account and your dividend payments until they're a full-time income stream.

This kind of strategy would take a lot of time to payout, though, like 30 years.

So this is good if you're young and want to create an income stream for when you're retired.

The 36-Month Accelerated Income Plan is a special report that Tim likes to market as well.

This plan is similar to the special report you just saw but is for people who are close to retiring.

This strategy involves a lot more capital (hundreds of thousands), and the goal is to create a full-time income stream in 3 years.

8) You Get A Dividend Calendar

It can get a little confusing to keep track of when each company pays its dividends.

Most companies pay quarterly, but some do pay monthly.

It's important to keep track of future dividend payments so you can plan accordingly.

Tim helps you out here by creating a dividend paycheck calendar:

This calendar is for the entire year and ensures you can plan properly.

Recommended: The Best Place To Get Stock Picks

9) 2022 Was A Rough Year For The Portfolio

2022 was a rough year for the stock market.

After an insane 2021 things really cooled off last year and the S&P was down a whopping 19%.

The Dividend Hunter was hurt by this as well.

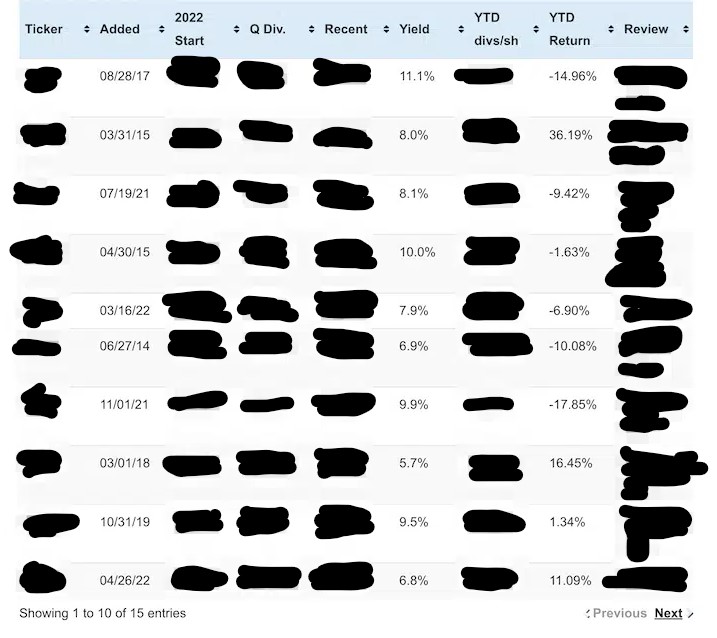

Here's a look at how some of the stock picks performed in 2022:

Out of 38 positions, 28 were down and 10 were up for the year 2022.

Keep in mind that these aren't the returns since the stocks were recommended.

Instead, it's just the returns from 2022.

Most of the stocks still had a yield higher than 5%, and many were double digits.

10) I Will Keep You Updated About 2023

Every year, Tim basically resets the portfolio.. so you can only see the returns for that year.

I'm writing this on January 16, 2023 so you can't really judge this year yet.

However, most of the stocks are positive in these 16 days, so maybe The Dividend Hunter will have a rebound year after a rough 2022.

What I'm going to do is update this section of the review every couple of months so you can see how the portfolio is performing.

11) The Start Out Portfolio

It would be pretty unrealistic to sign up for The Dividend Hunter and have enough money to invest in each of the stocks.

There are 34 open positions, and realistically, you want at least $5,000 in each stock you invest in.

So unless you're jumping in with $150,000, you likely will only want to invest in a handful of stocks.

This is where the start-out portfolio comes in.

There are five high paying dividend stocks recommended here.

They're all in different sectors as well. One is a REIT, another is an ETF, the third is in energy, the fourth is a preferred stock, and the last one is a business development company (Hercules Capital).

12) How Much Does The Dividend Hunter Cost?

I've seen a lot of different prices for The Dividend Hunter.

On the website, it's $199, and I saw another reviewer claim the price is $49 every quarter.

However, I was able to get it for $49 for an entire year.

This is basically how all investing newsletters price their introductory newsletter.

The real goal is to get you into the sales funnel, where the more expensive products are pitched to you.

There's many products that cost several hundred dollars a year and even up to $1000.

All will be promoted to you.

13) Is There A Refund?

I've actually seen a couple different refund policies floating around, and all of them are pretty good.

You can expect anywhere from 60 days to 365 days to get your money back.

That's more than enough time to see if you like the newsletter or not.

Just beware; you most likely won't get cash refunds on the expensive upsells.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

14) How Much Should You Have To Invest?

This one depends on where you are in life and what your goals are.

If you're close to retiring and want a few thousand dollars a month from dividend payments, you'll need a pretty significant amount of money.

Let's say you're following Tim's 36-month plan to earn dividend payments.

If you were to invest $200,000 in Tim's favorite dividend stock, Hercules Capital, and reinvest the dividends back into the stock for 3 years, you'd end up with a dividend payment of $24,000 per year after the 3 years.

Again, this would be someone who has worked and saved their whole life.

Let's say you're younger and don't have $200,000.

Let's say you have $25,000 and want to follow Tim's strategy for creating a full-time income with dividends over time.

Again, let's say you put the $25,000 in Hercules Capital and reinvested the dividend payments over a 20-year period.

In the end, you'd be making thousands per month.

So this strategy works if you have a lot or a moderate amount.

However, I think $25,000 is a good place to start.

15) Customer Reviews Are Good

Another positive for The Dividend Hunter is that it has very good customer reviews.

StockGumshoe is the best place to read customer insights about a stock newsletter.

500 people have voted on this newsletter, and it gets 4/5, which is very good for Stock Gumshoe.

Most comments are pretty positive but I did find some negative ones too.

The negative comments tend to focus on the aggressive upsells.

Customers just don't like that kind of stuff!

16) Here's Some Similar Newsletters

There's a bunch of newsletters that are pretty similar to The Dividend Hunter.

Some include:

- Behind The Markets

- The Distortion Report

- Oxford Income Letter

- Palm Beach Letter

- Stansberry Investment Advisory

- Strategic Intelligence

- Green Zone Fortunes

- Innovation Investor

- Stock Advisor

- Hidden Alpha

- Energy Investor

- The Near Future Report

And plenty of more - there's no shortage of investing newsletters!

Recommended: The Best Place To Get Stock Picks

The Dividend Hunter Pros And Cons

The Dividend Hunter Conclusion

So that's the end of my review of The Dividend Hunter.

I hope you found everything informative and that all your questions were answered.

Now might not be the best time to invest in dividend stocks because of high interest rates.

During times like this, people like to turn to risk-free government bonds and stuff like that.

However, the stocks you'll be investing in have a very high yield, so they'll outpace interest rates.

The stock value might take a beating, though.

That's what happened in 2022.

The stock price lost value on most stocks, but the dividends paid out well despite this.

If creating income through high-yield stocks is what you're looking for, this newsletter will certainly help you do that.

Just avoid the upsells. The Dividend Hunter is Tim's best product.

Here's A Better Opportunity

The Dividend Hunter is a good investment newsletter.

However, there's still better out there.

I've personally reviewed over 100 stock-picking services.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Thank you for your very informative opinion. I find it most helpful!

No problem!

Can anyone provide to me a contact telephone number or email to cancel a 7 day old trial subjection to The Dividend Hunter? I’m having difficulties in forwarding my membership cancelation.

Thank you