Energy Investor is an investing newsletter from Keith Kohl.

He claims he can help you profit from America's booming energy sector.

Is Keith telling the truth or is this all one big scam?

You'll get an answer to that in this review!

Plus you'll get insights into Energy Investor that you won't find anywhere else.

This includes a look at the portfolio performance, red flags and more.

You'll know if this service is worth buying by the time you're done reading.

Let's get started!

Energy Investor Summary

Creator: Keith Kohl

Price to join: $49 to $79

Do I recommend? No.

Overall rating: 1/5

The Energy Investor is not worth your time.

Over an 18 year peroid the average return on all recommendations is a miniscule 23%

Inflation is up over 50% since this time and the the market is up 350%.

Things have gotten worst recently too.

Stocks that Keith has recommended since 2021 are down over 40% on average.

The S&P 500 is about even during this time.. so just putting your money into a market index would have saved you a lot of money.

There's a lot of baggage with Energy Investor as well.

You get sent massive upsells the second you sign up and the company that owns it treats their customers horrible.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

12 Things To Know About Energy Investor

If you're considering Energy Investor there's some things to know about it before buying.

Here's a list of things that every potential customer of this newsletter should consider:

1) I Actually Bought The Newsletter

There's a lot of different places that review investing newsletter.

However, most of the people doing it shouldn't be trusted.

You either see people that don't actually own the product and just copy marketing material as their review..

Or you get people that don't know anything about stocks reviewing these products.

The third group knows about stocks but are too afraid to get sued to say anything negative.

Many of these stock pickers will threaten to sue you if you say anything bad.

The fourth group are actually paid to write positive reviews.

I want to assure you in this review you're going to get an HONEST review of Energy Investor.

Keith Kohl doesn't pay me, I know what I'm talking about and I actually own the newsletter.

So with that, let's start digging into Keith and Energy Investor.

2) Scum Owns Energy Investor

The first thing you need to know about Energy Investor is it's owned by Angel Publishing which is owned by Agora.

Agora is one of the worst companies in existence and I mean that literally.

For example, just two years ago they were fined $2 million dollars for defrauding senior citizens.

It doesn't get much lower than this.

I mean if someone in your neighborhood was caught stealing from the elderly would you still trust them?

Of course you wouldn't.

But it gets worst..

This $2 million fine hasn't done much to deter Agora (who at one point was making $500 million).

Truth In Advertising has proven Agora is still targeting senior citizens with manipulative marketing:

As long as Agora can make money doing this stuff they'll happily pay the fines.

Angel Publishing uses some of these "deceptive and dark patterns" too.

We'll go over that now.

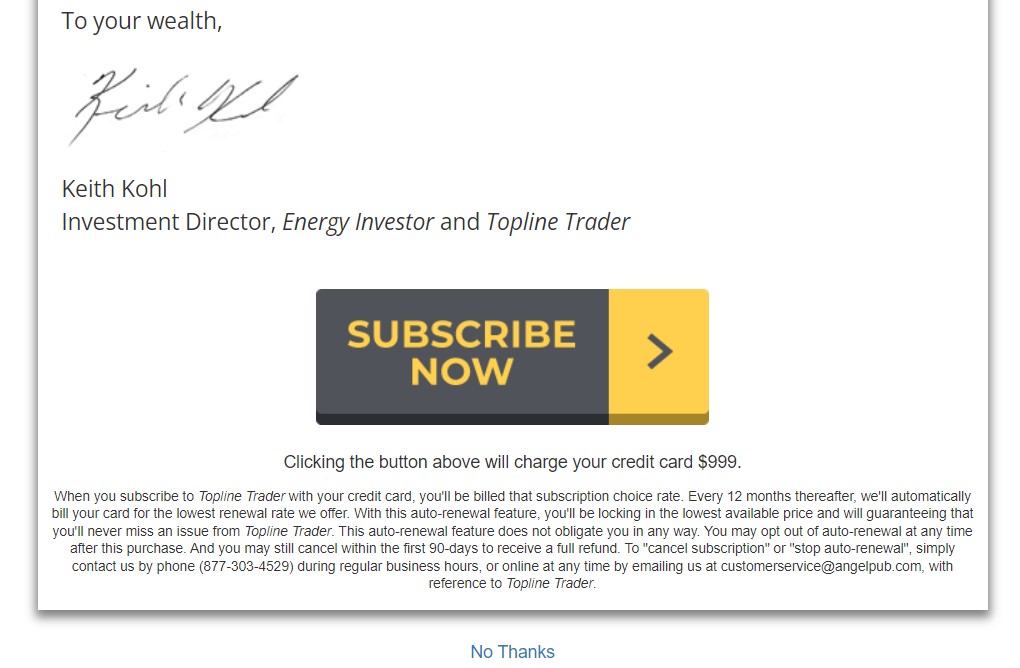

3) Energy Investor Tries To Trick You Into Upsells

Truth In Advertising lists a bunch of things they consider "deceptive and dark patterns" and Energy Investors uses a couple of them.

For example, they use these over the top stock presentations that promise massive returns.

One of Keith's most popular teasers is called "TriFuel" where he hints at returns over 46,000%:

That's an absolutely absurd amount to hint at LOL!

I've seen the Energy Investor portfolio and I can promise you there's nothing even remotely close to those returns.

Another thing they do is offer expensive upsells the second you buy Energy Investor.

Now there's nothing wrong with an upsell as long as it's done ethically.

Keith and his team don't do it unethically, though.

There's three upsells after you and they range from a couple hundred to $1000.

What makes them unethical is they make it hard to leave the page without buying the upsell.

Here's the button at the bottom of each upsell:

To get to your product you either click that massive "subscribe now" button and you're charged $999 or you have to see that tiny "no thanks" button to proceed.

You have to remember most people buying this newsletter are older people.

They might now be tech savvy and might not have the best eye sight.

It took me a little bit to actually find the no thanks button.

I can't imagine how many people hit the "subscribe button" out of frustration or simply not even realizing that they're going to be charged $999.

Just a scummy tactic from a scummy company.

Recommended: The Best Place To Get Stock Picks

4) Revealing Some Stock Picks

We're going to look at the entire portfolio later in this review.

But I have to censor the stocks in the portfolio because it's proprietary information.

The good news is Keith does stock presentations to sell his newsletter.

He typically leaves enough clues in the presentations to figure out the stock.

So I can reveal those stocks.

The first one we're going to look at is Phillips 66.

This is a stock that Keith recommended back in June of 2022:

This is a big oil refiner and is a play on diesel fuel shortages.

It's up a little since being recommended but it's still too early to tell if this company will work out in the long run.

Next we have a stock Keith recommended back in June of 2021.

This stock was called Li-Cycle holdings.

Li-Cycle was teased an "infinite lithium" stock that "could solve America's lithium supply crisis."

Ultimately Li-Cycle recycled old batteries back into component metals.

The stock has struggled mightily, though:

The stock fell 46% in the last 18 months.

Remember in the last section when I said claiming 46,000% return possibility is absurd.

Well the stock Keith was talking about there was Lightbridge.

He marketed Lightbridge as "TriFuel-238."

They make a safer fuel for nuclear reactors that uses less uranium.

Did the stock get 46,000% returns since being recommended in May of 2021?

Nope:

It's actually own 14% since Keith told subscribers to buy it.

The last stock we're going to look at was teased as a way to turn $1,500 into $120,135 and to "retire rich on the power grid's upgrade of the century.

The company in question is Akoustis and they make RF filters.

Apparently these products help improve communications by filtering out external signals.

Unfortunately every $1,500 investment didn't turn into $120,135.

Instead it lost over 50%:

There's was a brief window to triple your money but Keith still has the stock in the portfolio.

Which means he didn't recommend selling it.

If you held you're down around 56%

5) Keith Kohl Is An Agora Lifer

There's not really too much to Keith's resume.

He graduted from Millersville University in 2003 with a history and English language degree.

Then in 2006 he was hired at Angel Publishing and he's been there ever since.

So that's over 16 years with Agora.

You can probably tell that I'm not a fan of Agora in any way, shape or form.

The good news is Agora's reputation has taken a beating over the years and they're starting to crumble.

Companies just as bad have taken their place but I'm glad Agora is shrinking.

As far as Keith, it's not a good sign that all he's ever known is Agora.

You have to have loose morals to work a at company like this for so long.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

6) You Get A Monthly Newsletter

As part of your membership you get a monthly newsletter and this is the main part of what you're paying for.

The last report I received was over 30 pages long but most of that was just updates on the portfolio.

The newsletter portion was about 5 pages long.

Additionally, it doesn't seem like you get a new stock pick every edition like some newsletters.

I don't think that's necessarily a bad thing either.

You don't want a stock picker forcing stock picks to meet some arbitrary demand.

The updates cover the following topics:

- Market capitalization

- Outstanding shares

- 52 week range for the stock price

- Overview of the company

- Recent news about the company

- Buy, sell or hold rating and what price to buy up to

Almost every stock in the updates is a "buy" position.

7) The Portfolio Is Hurting Recently

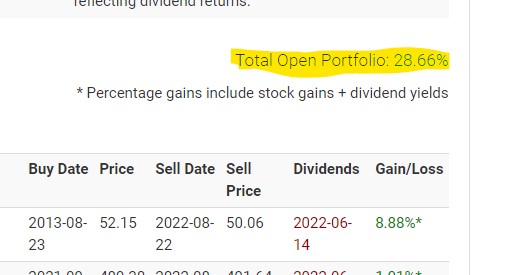

So if you go to the portfolio you'll see the open portfolio is up 28.66%:

You might be considering this is pretty good since the market is doing bad right now.

However, if you're a new customer the open portfolio performance is useless to you because there's stocks recommendations from 2011 that are currently open.

What matters more is how the stock picks from the last two years have been doing.

That'll give you a more accurate idea of what you can expect if you sign up.

Well I have bad news about Energy Investor..

The average returns of the stock picks from 2021 to now is -43%.

Here's the numbers of those stock picks:

- -60.07%

- -46.15%

- -59.36%

- +13.47%

- +42.17%

- -15.62%

- +7.08

- -12.54%

- +13.84%

- +16.80%

- -10.37%

- +9.88%

- +4.34%

- -.071%

- -35.34%

- +12.32%

- -16.61%

As you can see there's more losing trades in the last two years than winning ones.

And not only are there more losers, the losing picks are way more dramatic than the winning ones.

Some of the gains are a paltry 4%, 9%, 13%.

While some of the losers are 35%, 60%, 45%.

So the portfolio and new picks are struggling very hard right now.

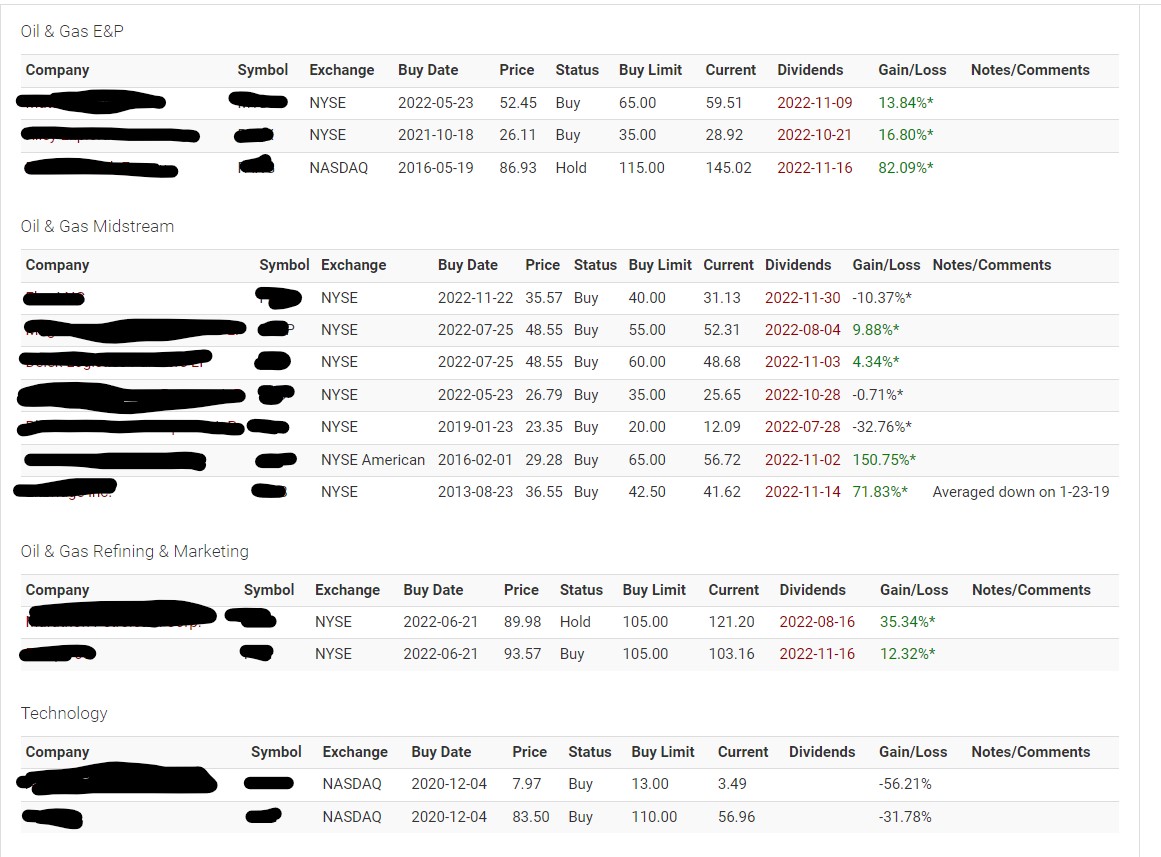

8) The Portfolio Hasn't Beaten The Market

You always want to compare an investing newsletter to the the S&P 500.

The reason is there's many indexes out there that mirror the movement of the market and S&P 500.

They're very easy to invest in and over time you're pretty much guaranteed to gain 10% yearly on average.

If a newsletter can't beat the market it's not worth investing in.

It's pretty much as simple as that.

According to Keith the average return across all trades for the life of this newsletter is 23%:

So if you did exactly what Energy Investors recommended from the start you'd be up 23% right now.

This is pretty bad when you consider the newsletter has been around since 2005.

Inflation is up 53% since 2005 so you'd actually have 30% less purchasing power now than what you started with back in 2005.

The market is up 350% since 2005!

So had you invested $10,000 into Energy Investor's picks from 2005 to now you'd have 12,300.

If you invested $10,000 into a market index from 2005 to now you'd have $30,500.

This newsletter isn't worth it now and has never been worth it.

Recommended: The Best Place To Get Stock Picks

7) Here Are The Different Categories Of Energy Positions

Overall there's 11 different energy sectors in the model portfolio for Energy Investor.

Here's a look at each sector and how many stocks are in them.

I had to blank out the names because the stocks are proprietary information:

So those are all the open positions in the portfolio!

As you can see most of the biggest gains are from stocks recommended back in 2015 or 2016.

Most of the recent stocks are struggling bad.

8) You Get A Bunch Of Special Report

We covered a bunch of the special reports earlier.

These are the reports that come from the big stock presentations Keith uses to sell this newsletter.

For example, here's a look at the special report hyping up "TriFuel:"

This report covers Lightbridge which is the stock that makes cleaner nuclear reactor fuel.

Additionally, it was hinted this company could bring 46,000% returns but instead is own 50%.

Another example of the special reports is "Infinite Lithium."

This report details Li-Cycle Holdings and was hyped as good investment opportunity.

But it's down 46% since being recommended.

In total there's 14 special reports which are:

- Imperial Profits

- TriFuel-238

- Infinite Lithium

- The Fab Four Of The Energy Sector

- The Permian Playbook

- The Apex Charger

- How Invest In Water

- The Billionaire's Battle

- 5G-Volta

- The Hidden Grid Giant

- Investing 101

- The Energy Cloud's Financial Plumbing

- The Most Important Natural Resource

- 3 LNG Stocks Set To Soar

Again, all of these stocks can be found in the portfolio.

And you've now seen the portfolio is struggling.

So you're not missing out on anything by not owning these reports.

9) You Get Trade Alerts/Updates

Another benefit of being a member of Energy Investor is you get trade alerts.

For example, here's the most recent alert from November 2022 recommending that you buy two LNG stocks:

These alerts act like quasi-newsletters.

They're not overly long.

Basically Keith will sum up something in the market briefly and then give you some stock recommendations.

He'll tell you why he likes the company and what price to buy at.

However, there's not too many of these alerts and updates.

In 2022 there were only two and both came towards the end of the year.

Recommended: The Best Place To Get Stock Picks

10) How Much Does Energy Investor Cost?

If you go to the Angel Publishing website you'll see this newsletter cost $249 per year.

There's a lot of promotions floating around and I'm sure if you know about this newsletter it's from one of the promotions.

If you go to buy through them the cost is $49 for the first year or $79 for two years.

This is how Agora prices all their introductory newsletters which Energy Investor is.

The goal is to get you into the sales funnel where they can upsell you more expensive products.

The second you sign up you're offered three upsells.

One is for Topline Trader that costs $999 per year.

You'll be hammered with upsells every single day if you buy.

11) 6 Month Refund Policy

There's a good refund policy for this newsletter.

You get 6 months to get your money back if you're not satisfied.

And what makes this refund policy even better is Keith actually offers a refund on his upsell, Topline Trader.

Most stock pickers give you a refund for the cheap products but not the expensive ones.

So kudos to Keith for doing that.

12) Here Are Some Similar Newsletters

I've reviewed a lot of newsletters that are very similar to Energy Investor.

Here's some that remind me of this newsletter:

- The Distortion Report

- The Oxford Income Letter

- Extreme Value

- The Ferris Report

- The Near Future Report

- True Wealth

- Strategic Intelligence

- Growth Investor

- Innovation Investor

- Strategic Investor

- Green Zone Fortunes

- The Dividend Hunter

- Behind The Markets

A lot of these newsletters are owned by Agora or at one point were owned by Agora.

Recommended: The Best Place To Get Stock Picks

Energy Investor Pros And Cons

Energy Investor Conclusion

Any person that has gone through this offer wouldn't recommend this newsletter.

So be wary of anyone that is recommending it.

There's simply nothing to like about it.

No matter how you spin it this newsletter is bad.

First off, it's owned by a company that's known to treat their customers horrible.

They see you as a cow to be milked of all your money.

Agora will try all the most rotten tricks to get you to spend thousands of dollars.

Including creating confusing upsells that may trick people into spending money they didn't want to.

Moving beyond that the stock picks just aren't good.

Over an 18 year period the portfolio is up 23% which means you lost money to inflation.

The market has crushed this newsletter in that period.

Then you have the most recent picks which are struggling very hard and down over 40%.

Your goal is to make money right?

I don't think that's going to happen in any significant way here.

And if you bought Keith's picks from 2021 to now you'd be down a lot.

Here's A Better Opportunity

I'd pass on Energy Investor.

The portfolio is struggling right now and I don't see that changing any time soon.

The good news is there are high performing stock picking services out there.

I've personally reviewed over 100+ of them.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Thank you for being honest