Innovation Investor is a stock picking service run by Luke Lango.

His goal is to hit 100% returns this year..

Is this all legitimate or one big scam?

We'll get to the bottom of this question in this review.

Additionally, we'll look at what Innovation Investor is offering, look at the portfolio, reveal some stocks and more.

You'll know if Innovation Investor is worth it by the time you're done reading.

Let's get started!

Innovation Investor Summary

Creator: Innovation Investor

Price to join: $49

Do I recommend? Not really

Overall rating: 3/5

Innovation Investor has some things to like about it but I think the bad outweighs the good.

There's way too many stocks in the portfolio (up to 60) and many are WAY too risky to be investing in.

There's some impressive winners but also MASSIVE losers (plenty of 80% and 90% losers).

Additionally, there's stocks that are straight up pump and dumps and other fraudulent companies being recommended.

Innovation Investor comes with a lot of baggage as well and a convicted fraudster runs the publisher distributing the newsletter.

I personally wouldn't recommend buying this service.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

10 Things To Know About Innovation Investor

Before you buy Innovation Investor there's things you need to know.

Here's what you need to consider about this newsletter:

1) I Actually Bought Innovation Investor

There's a few different Innovation Investor reviews out there.

Most aren't very trustworthy, though.

Most of the reviews you'll see at the top of Google make money from Luke for their reviews.

Do you really think you're going to get honest insights from these people?

The second group of reviewers never bought the newsletter to begin with.

I don't get paid by Luke and I actually bought the newsletter.

Additionally, I've reviewed 100+ stock picking services so I know what to look for.

Alright let's jump into the review now!

2) Luke Works Under A Scammer

You can find Innovation Investor over at InvestorPlace.

If you look around the web you'll find glowing reviews of InvestorPlace because it's been around for so long.

However, you shouldn't take these phony reviews seriously.

Why?

Because InvestorPlace is run by Louis Navellier.

On the surface Louis seems like a serious investor.

He has best selling books, he appears on TV and comes off as a guy that makes a lot of money.

However, the SEC just fined Louis over $30 MILLION for defrauding investors!

Louis falsified the track record of an investment opportunity to trick his customers into buying a product.

In other words he committed fraud.

Here's a link the SEC allegations.

Despite this InvestorPlace still proudly sells Navellier's products and you rarely see any reviewers bring this stuff up.

How legitimate can a publisher be if they're run by a guy who knowingly ripped investors off?

Recommended: The Best Place To Get Stock Picks

3) Revealing Some Of Luke's Stock Picks

Like all well known stock pickers, Luke Lango likes to put out teaser presentations where he hypes up stock picks.

He promises to reveal the stock only if you buy his services.

A lot of times, though, these stocks don't work out as advertised.

So instead of you paying to see them, I'm going to show a few Luke has teased in the past.

This way you can judge the picks yourself without spending money.

The Next DNA Sequencing Giant (Oxford Nanopore)

Previously Luke ran a teaser where he hyped up a company that he claimed would be the next DNA sequencing giant.

He was talking about the company Oxford Nanopore.

Luke loves this pick so much because he believes in their patented technology.

Here's a look at the stock price:

This company has only been public for 6 months and the stock was definitely too high before it started to decline.

It currently sits at $3.45 which seems like a much more reasonable price to buy.

This is a long term pick and depends on DNA sequencing growing in the future.

Additionally, Oxford Nanopore is a long term investment, so it's not that big of deal it's declined since Luke recommended it.

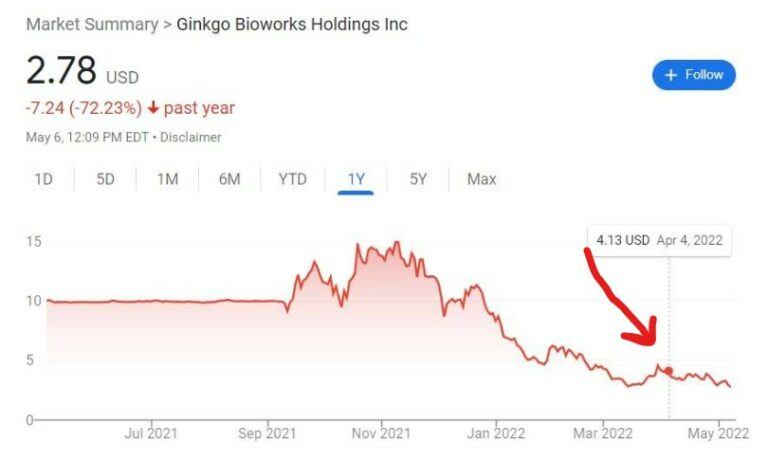

Next Microsoft (Ginkgo Bioworks)

Around the same time as the last teaser presentation, Luke was hyping up another company called Ginkgo Bioworks.

This company creates synthetic cells that are used in pharmaceuticals and food.

The stock price was artificially high during covid, as many of these companies were.

Here's how the stock has performed in the last year:

This stock is very similar to the last one.

It's not going to pay out for years and it immediately lost value after Luke started promoting it.

Small cap stocks are hard to guess on.

So this one could lose all its value.

I'd recommend this one only if you can afford to lose all of your investment.

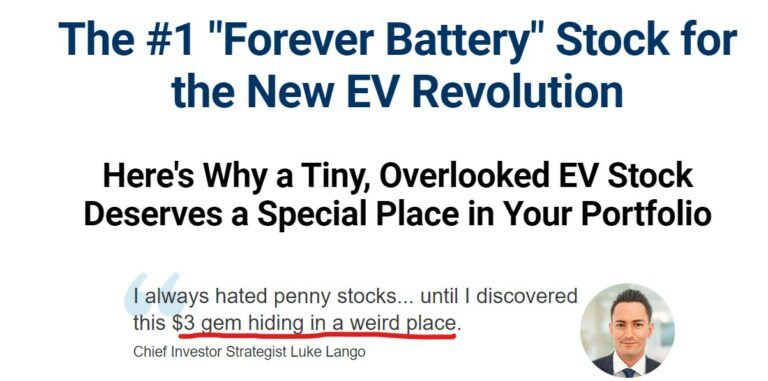

#1 Forever Battery Stock (Ilika)

The #1 Forever Battery stock is a hour long presentation from Luke that actually recommends two stocks.

The first he reveals in the presentation and it's Toyota.

He recommended the stock at around $200 and it's since declined to around $173.

Not a huge loss but it's the third stock in row we've looked at that has lost value instead of gain value.

The stock Luke is withholding is called ilika, which is apparently teaming up with Toyota to create this "forever battery."

Forever batteries is just a hyped up name for solid state batteries.

In the presentation Luke called ilika a $3 stock:

So has the stock gone over $3 since the presentation dropped?

Nope!

It's gone the other direction:

The stock is currently under $1 and has lost most of its value since Luke recommended it.

In December 2022 Luke finally pulled the plug on this stock and stopped recommending it.

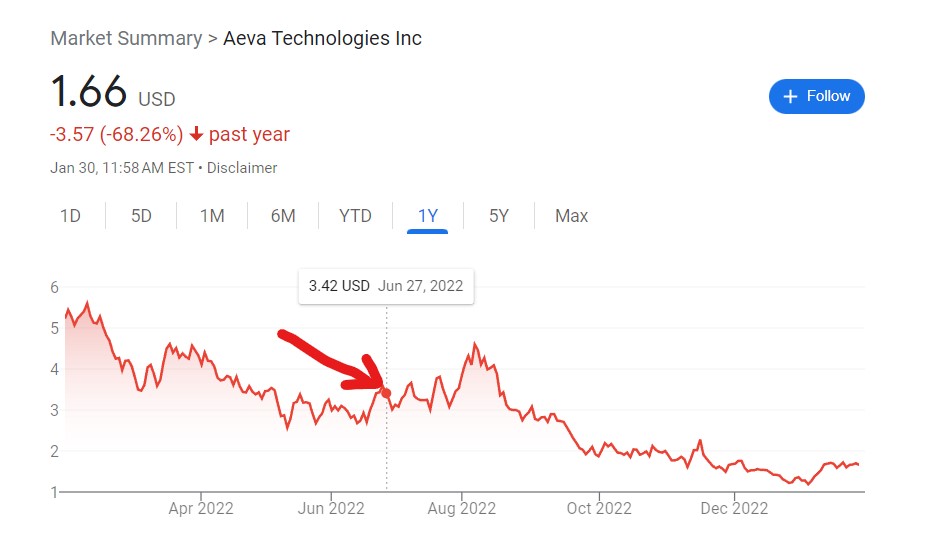

Apple Car Stock (Aeva)

Back in the summer of 2022 Luke was recommending a stock he claimed would help Apple launch their new car.

The stock was Aeva which was a LiDAR company.

LiDAR is the technology that helps self driving cars see the world and drive.

Luke claimed Aeva would be Apple's choice for the mythical "apple car."

However, since being recommended by Luke the company's stock has lost half of its value:

As you can see Luke's stocks are high risk, high reward.

And all of these stocks lost a pretty big amount.

However, not all of Luke's stocks lose money. The portfolio does have winners in it.

4) Here Are Upsells Once You Sign Up

Basically all investing newsletters come with upsells.

Innovation Investor is actually owned by a larger, publicly traded company called MarketWise (they own InvestorPlace).

MarketWise is known for their aggressive upsells.

Most customers hate these kind of things but it makes them a lot of money.

Once you sign up for Innovation Investor there's three upsells.

The first is to become a lifetime member of Innovation Investor:

This will cost you $250 more and you still get the refund policy.

So it's not a bad price for what's being offered.

After you click away from this upsell you're brought to the next one:

This is a service I definitely don't recommend.

Luke will pick a new stock every day for you to invest in and he claims he's aiming for 1000% returns quickly.

These stocks are small caps and are REALLY risky.

The cost is $49 per month.

After this you get the last upsell:

This is another newsletter that focuses on risky, growth stocks.

Early Stage Investor is much more expensive at $1999 per year.

So if you do end up buying Innovation Investor just prepare yourself for the upsells.

Recommended: The Best Place To Get Stock Picks

5) You Get A Monthly Newsletter

The main thing that's being offered at Innovation Report is the monthly newsletters.

This is primarily what you're paying a yearly subscription for.

Once a month you'll get a newsletter that comments on the market, gives updates on the portfolio and gives you new recommendations.

In the newest newsletter Luke explains why 2023 will be a great year for stocks and Innovation Investor:

These newsletters are pretty long winded.

6) Major Changes For 2023

2022 was a BAD year for stocks and a really bad year for tech stocks.

Companies like Tesla, Meta and other tech darlings really plummetted.

These are the kind of stocks Innovation Investor was heavy into.

Because of this 2022 was a bad year for this newsletter.

As a result Luke announced major changes to how this newsletter would function in 2023:

Here's an overview of the changes coming to Innovation Investor:

Simplifying Portfolio Structure

In the past Luke ran this newsletter like an ETF.

He had many stock picks in the portfolios and wanted people to invest the same amount into each stock.

However, there was over 70 stocks in the portfolio at the time and it would be nearly impossible to invest in all of these companies (unless you had millions of dollars).

Additionally, by investing this way you couldn't account for risk for each stock.

So now each stock comes with its own instructions and there's only two portfolios (core portfolio which has larger, well known stock picks and the venture portfolio which is higher risk stocks.).

Capping The Portfolio

Like I mentioned in the last section there was too many stocks being recommended.

There were well over 70 stocks previously which is too much for people to invest in.

Luke blames this on a merger that happened between his newsletter and another newsletter.

As a result of this Luke now caps the portfolio at 60 stocks and by my count there's 52 open positions at the moment.

This is still a lot.

Most newsletters don't go over 25 stocks.

New buy Limits

Luke explains the correlation between stock price and interest rates.

He claims when interest rates are high stock prices go down.

And because of this he's adjusted the buy prices for the stocks in the portfolio.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

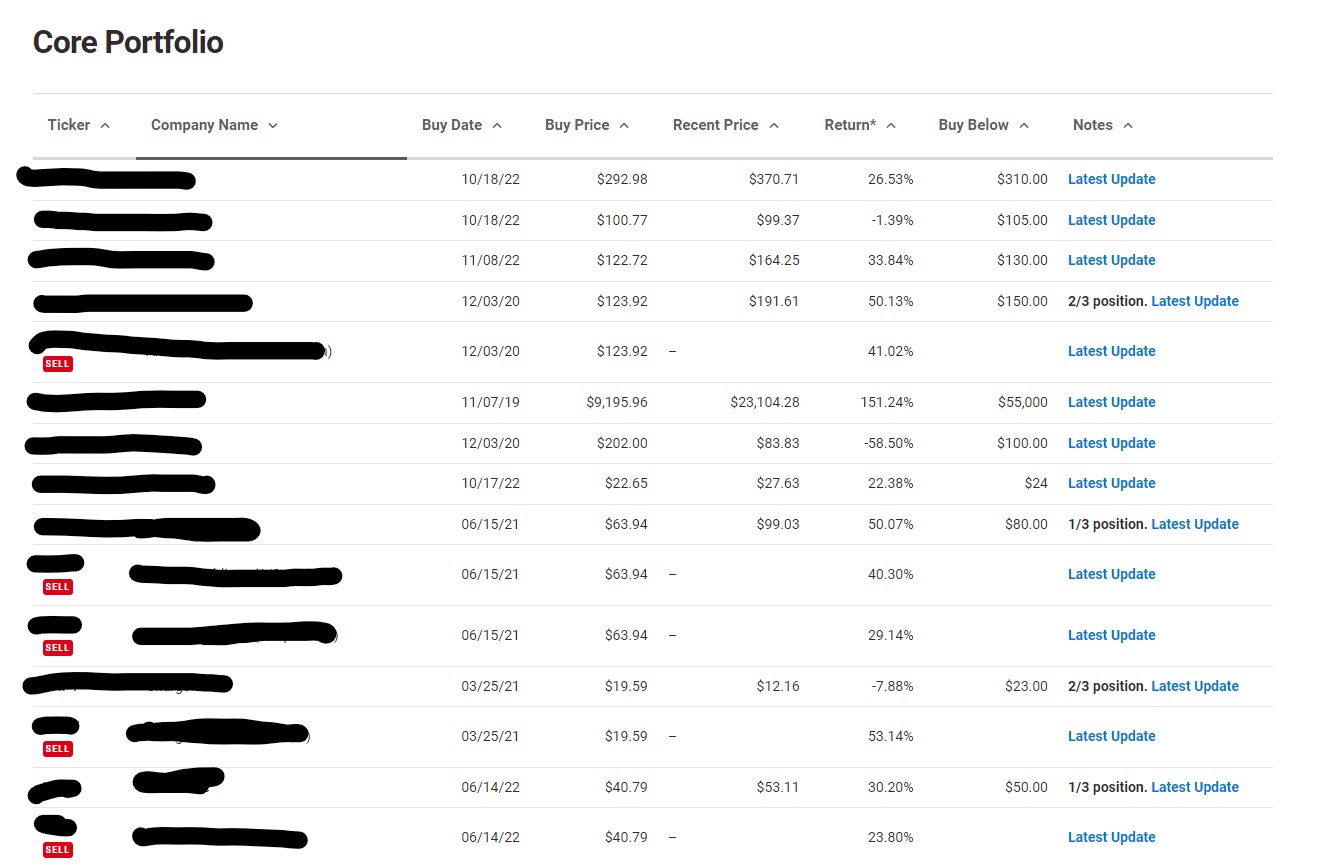

7) There's Two Portfolios

Luke believes the best way to invest is to have two portfolios.

The theme of this newsletter is innovation.

And according to Luke innovation comes in all shapes and sizes.

Because of this there's a different portfolio depending on the size and risk of a stock.

The first portfolio is the Core Portfolio:

These stocks are described as "mid risk, mid reward" and they are the "bread and butter" of your portfolio.

This portfolio is the biggest of the two and has over 35 open positions in it.

It's mainly just tech and growth stocks "with proven business models (or products) and huge revenue bases that are oftentimes either profitable or cash-flow positive. We view these stocks as having a mild risk level with a mild return potential."

Most of these recommendations are companies you've heard of or are large cap stocks.

This is by far the better performing portfolio as well.

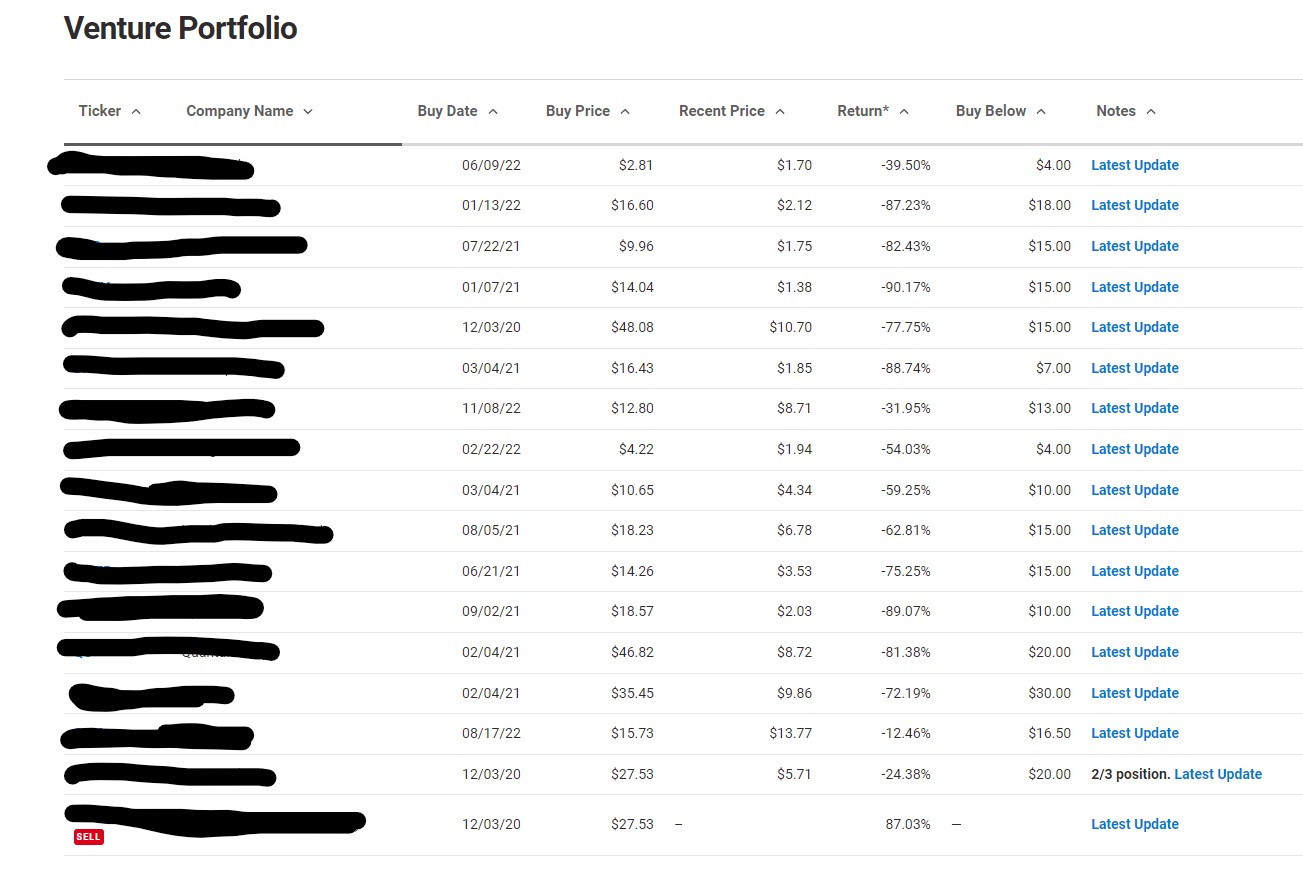

The next portfolio is the Venture Portfolio which is performing absolutely horribly:

This is probably the worst portfolio I have ever seen.

There's such big loses because the market absolutely pounded these stocks in 2022.

Additionally, they're just risky.

Many of these companies are unproven, unprofitable, young, have lots of setbacks and some are straight up fraudulent.

There's a few stocks in this portfolio that are likely just pump and dump schemes.

If Luke really wanted to improve this service for 2023 he'd scrap this portfolio.

It's losing people a lot of money.

8) Calculating Returns Is Impossible

Whether or not I recommend investing in a newsletter comes down to whether I think the picks can beat the market or not.

If you invest in an index fund that mirrors that market you're pretty much guaranteed 10% returns every year over the long term.

It's simple to invest in one of these index funds.

Managing a portfolio with 30 to 60 stocks is more time consuming and stressful.

You have to know when to buy more stocks, sell other stocks, manage risk, etc.

So a bare minimum requirement for a newsletter is to beat the market and most don't.

Does Innovation Investor beat the market?

I'm guessing no but I honestly have no clue what the returns for this newsletter have been.

There's so many different stocks in the portfolio and another newsletter merged with this service back in 2021 (which brought in new stocks).

Additionally, Luke doesn't have a section where you can look at closed positions.

So I have no clue what kind of loses and gains this portfolio had before I bought.

But Luke made major changes to Innovation Investor this year and you'd only do that if things weren't going well.

The small cap portfolio is DEFINITELY NOT beating the market.

The other portfolio is full of tech stocks that were hammered by the market in 2022.

So I doubt that portfolio has beaten the S&P either.

9) Here Are The "Mega Trends" Innovation Investor Follows

Luke and his team target stocks in certain sectors he believes will shape the future.

He describes these trends as "the world’s most innovative and disruptive trends to invest in for the next several years."

The trends are as following:

Green Energy

Luke believes renewables and clean energy is a trend that's going to explode.

Some stock example for this sector Luke will recommend is solar panel installers, inverter/optimizer companies, hydrogen fuel cell makers, energy storage providers.

Electric Vehicles

Another trend being followed is electric vehicles.

Luke believes "the world’s transportation sector is getting electrified at a rapid pace, and we predict that the pace of electric vehicle adoption will only accelerate in the coming years, driven by falling EV costs, increasing EV supply, expanding EV charging infrastructure, and supportive EV adoption legislature."

Some stock examples for EV's is EV makers, charging station operators, battery makes and auto companies.

Autonomous Vehicles

Along with electric cars, Innovation Investor also focuses on self driving cars.

This technology is becoming more prevalent and you're starting to see cars like Tesla roll out this feature.

Some stock examples for self driving cars include LiDAR makers, RADAR makers, autonomous trucking companies, robotaxi operators.

Space

The final frontier is another sector Luke is keeping his eye on and believes space is a "multi-trillion dollar" investment opportunity.

Some stock examples for space includes space tourism firms, rocket makers, eVTOL operators, satellite companies.

Blockchain

Blockchain is another trend that the people at Innovation Investor believe strongly in.

They believe billion dollar companies will be built using blockchain.

Some stocks examples for blockchain includes cryptos, crypto miners, blockchain marketplaces, NFT makers.

Metaverse

The Metaverse is another trend that you see in the headlines a lot.

Basically it's just virtual reality.

Some stocks that you'll find that have to do with the Metaverse includes social media platforms, AR headset makers, VR gaming developers, Metaverse advertising firms.

Automation Economy

This "mega trend" has to do with the implementation of robots and AI.

Some stocks that have to do with autonomation includes software automation developers, 3D printer makers, automated trading platforms, robotics companies.

Cellware

This is probably the creepiest of all the trends Luke is following.

Cellware has to do with gene editing and combining medical and technology companies.

A lot of pump and dumps and fraud is found in this sector, though.

So be careful!

Some stocks include gene editors, synthetic biology technology companies, DNA sequencing firms.

10) You Get Alerts And Daily Updates

The last main features of Innovation Investor are the alerts and daily updates.

The alerts are mainly buy and sell alerts.

When Luke finds a new opportunity that he likes he'll send you an alert on what to do with the stock.

That includes buy prices and why he's recommending it:

You'll also get sell alerts.

Sometimes these sell alerts are to cash in on gains and other times it's to cut loses on a bad stock.

The daily updates are short posts about the market and portfolio from Luke.

You get them every day the market is open.

Recommended: The Best Place To Get Stock Picks

Innovation Investor FAQ's

Still have some questions about this newsletter?

Here's answers to any remaining questions you might have:

1) How Much Is Innovation Investor?

This newsletter costs $49 if you can find the promo for it but if you try to buy directly from InvestorPlace it will cost $199.

That's not a bad price for what you're getting.

But keep in mind every stock picker prices their introductory newsletter at $49.

This is mainly just bait to get you into the sales funnel so you can be marketed more expensive products down the road.

It's important to never buy an upsell until you test the original newsletter first.

The upsells typically don't perform any better.

So if the cheap product is losing you money the upsell will too.

2) Is there A Refund Policy?

Yes, there's a good refund policy.

You get 365 days to get your money back.

However, keep in mind the upsells won't have money back guarantees.

They'll only come with a credit refund which means you can use the money to buy other InvestorPlace products.

Just another reason to stay away from the upsells.

3) Is Luke Lango Legit?

He seems legit enough.

Luke graduated from a very good college called Caltech and has bounced around different investing companies.

He analyzed equities and created financial models at Feinberg Investments, was an equities analyst at Seeking Alpha, investor at L&F management and started working at InvestorPlace n 2017.

However, anyone that works under Louis Navellier has loose morals.

So don't put too much trust into Luke.

4) How Does Innovation Investor Work?

Innovation Investor is described on the Investor Place website as the following:

"Ground-floor opportunities in explosive new megatrends, including blockchain, autonomous vehicles, and even supercomputing."

That's a fancy way to say microcap tech stocks.

This is actually the second microcap investing service I've reviewed this week.

The other one being Future Giants.

I'm going to say the same thing about Innovation Investor as I did with Future Giants..

Microcap stocks are very hard to predict and are VERY risky investments.

The appeal of microcap stocks (otherwise known as penny stocks) is they can blow up and you can make a lot of money.

People pushing penny stocks will talk about Monster Energy or Apple computer as a reason why you should invest in them.

While it's true these stocks were very cheap at one point it's rare to hit on them.

They also are prone to fraud and can be easily manipulated.

Many law enforcement agencies in the government put out warnings about investing in these stocks.

For example, here's the SEC warning about getting involved.

Here's FINRA warning about them.

Idaho Department Of Finance warning about them.

It's hard for me to really believe someone could be an expert at picking these stocks because they're so volatile.

I personally wouldn't recommend investing in microcap stocks as a primary investing strategy.

And I would only invest in them if you can comfortably afford to lose the money.

5) What's The Investment Strategy?

The strategy has been revamped for 2023 and the portfolio has been trimmed a bit.

Innovation Investor recommends two kinds of stocks:

- Large cap tech/growth stocks

- Small cap tech/growth stocks

The idea is to invest in innovation and the companies building the future.

The large cap tech stocks perform WAY better than the small cap tech stocks.

The portfolio for the risky small tech stocks is performing really, really bad.

6) Are There Similar Newsletters?

Yes, there's many newsletters just like this one.

Some include:

- The Distortion Report

- Stansberry Investment Advisory

- TradeStops

- Retirement Watch

- Intelligent Income Investor

- True Wealth

- The Opportunistic Trader

- Jeff Clark Trader

- Behind The Markets

- The Oxford Income Letter

- Power Gauge Report

- Chaikin Analytics

As you can see there's no shortage of investing newsletters out there.

Recommended: The Best Place To Get Stock Picks

Innovation Investor Pros And Cons

InvestorPlace Conclusion

So that's the end of my review of InvestorPlace.

Hope you found everything you're looking for.

I get the appeal of this newsletter.

Luke Lango is a sharp guy and investing in robotics, space and self driving cars is very seductive.

However, these industries are still in their infancy.

It's hard to predict which companies will be the winners with these trends.

Almost all of these companies are unprofitable and years away from making money (and some never will).

Other companies Luke recommends are thought to be fraudulent and pump and dumps.

Either way the portfolio with the stocks targeting emerging trends is doing very badly.

Many of the stocks are down 70%, 80%, 90% and more.

There isn't a single winner in that portfolio currently.

The more well known tech companies Luke recommends are definitely performing better.

Still they're pretty risky at the moment.

When you add this to the baggage of InvestorPlace being owned by a fraudster I'd say pass for now.

Maybe when the economic situation looks better I'll revisit the newsletter.

Here's A Better Opportunity

I'd pass on Innovation Investor.

Luke made some good changes for 2023 but there still needs to be some fine tuning.

The good news is there's better stock picking services out there.

I've personally recommended over 100+ of them..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: