True Wealth is an investing newsletter from Dr. Steve Sjuggerud.

He claims he can help you find discount stocks that you can sell for a big profit later.

Is Steve telling the truth or is this a big scam?

You'll get an answer to that in this review.

Additionally, you'll see some background information like stock picking performance, who Steve is, what you get and more.

You'll know if True Wealth is worth it by the time you're done reading.

Let's get started!

True Wealth Summary

Creator: Steve Sjuggerud

Price to join: $49

Do I recommend? Sort of

Overall rating: 3.5/5

True Wealth is a solid newsletter from Stansberry Research.

The recommendations you'll find from Steve Sjuggerud are common sense ones like gold, oil and different funds.

There's no risky small tech stocks or anything like that.

However, some of the assets you'll be investing in are extremely expensive (4 of them are over $1000).

The upside might be limited but these investments are much safer, which is good right now.

Another downside is a predatory company owns this newsletter and they don't treat customers well.

Expect massive upsells and manipulative sales tactics.

If you can resist these expensive upsells True Wealth might be worth it.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

11 Things To Know About True Wealth

Before you buy True Wealth there's things you must know about it.

Here's everything you should consider before buying this newsletter:

1) I'm An Actual Member Of True Wealth

There's a lot of different True Wealth reviews out there (it's a pretty popular newsletter).

However, there's not many you can actually trust.

Most of the reviews are affiliates for True Wealth and are paid by Stansberry for their reviews.

Do you think you can get honest insights this way?

The other group never actually bought the newsletter.

I am NOT an affiliate for True Wealth and actually own this newsletter.

Additionally, I've reviewed 100+ stock picking services so I know what to look for.

I have your best intentions in mind!

2) A Predatory Company Owns True Wealth

The biggest red flag for True Wealth is it's owned by a very predatory company.

Stansberry is the publisher and Stansberry is owned by MarketWise.

MarketWise doesn't treat their customers well and uses underhanded sales tactics to squeeze every dime they can from their customers.

You have to understand this if you're planning on buying True Wealth.

If you do buy you'll be put into an aggressive sales funnel.

You'll be offered upsells right after you buy and everyday in your inbox.

Some of the products MarketWise offers cost thousands of dollars and get poor results.

They're typically sold with the promise of massive returns.

So beware of this and don't fall for the upsells.

3) Scammers Will Have Your Email Address

Another thing to keep in mind is MarketWise owns over a dozen investing publishers and they all sell stock picking services.

They cross promote newsletters from different publishers.

So if you buy True Wealth you'll get promotions from publishers outside of Stansberry.

The problem with this is legitimate scam artists work at MarketWise and will have access to your email.

For example, Louis Navellier runs InvestorPlace and MarketWise will tell you he is a trusted investing expert.

However, just a few years ago he was fined $30 million for defrauding customers:

Louis has products that cost more than $10,000!

I personally wouldn't want his products marketed to me.

There's many other personalities like this at MarketWise.

It makes buying from them a headache and it's hard for me to recommend their services because of this.

Recommended: The Best Place To Get Stock Picks

4) Steve Sjuggerud Is A Solid Stock Picker

On the plus side True Wealth is a solid newsletter and the lead editor, Steve Sjuggerud, has a good track record.

He's done a ton of stock teasers in the past.

We can look at those teasers to see how well his stock picks have done and what kind of assets he likes to recommend:

Gold Standard Ventures In October 2019

In 2019 Steve ran a stock presentation promising to help people leverage themselves against rising gold prices.

The company he's talking about is Gold Standard Ventures, who at the time had very large land packages.

The stock didn't do well and definitely wasn't a leverage against rising gold prices, though:

As you can see this stock has lost more than 50% of its value.

MercadoLibre In February 2018

In 2018 Steve was calling MercadoLibre the next Tencent, which is an internet company.

MercadoLibre is a very big e-commerce platform that dominates Latin America.

He absolutely nailed this stock pick:

The price peaked at around $1800 which means it more than quadrupled.

It's currently sitting at $785 which is double.

This was an excellent stock pick.

Tencent, PureFunds ISE Mobile Payments, Euronet Worldwide In 2017

Steve ran a stock presentation in May 2017 and recommended three different stocks.

He claimed these stocks could "make up to 5 times your money from the mobile payment revolution."

Here's how each stock has performed, starting with Tencent:

This stock has done well and at one point more than doubled.

It's down like most tech stocks are down but most people already sold and profited from the recommendation.

Next we have PureFunds:

This is another stock that more than doubled.

So far 2/2.

Next we have Euronet Worldwide:

This is another stock that doubled after being recommended.

Overall this was an excellent stock presentation and anyone who invested in these companies is pretty happy right now.

Sprott Gold Miners ETF In January 2015

In 2015 a gold mine ETF was launched that focused on the best gold miners.

It has around 25 stocks in it.

The ETF has been up and down since 2015:

Sea Ltd, Telkom Indonesia, ICICI Bank In October 2020

Steve runs a newsletter that focuses on Chinese and Asian stocks.

In 2020 he teased "three easy to buy 'next China' opportunities that could rise by hundreds of percent or more."

First up is Sea Ltd:

If you profited from this depends on if you sold.

You could have more than doubled your money or you could have lost half your money.

Next is Telkom:

This stock was recommended at the right time and has done well since 2020.

Lastly, we have ICICI Bank:

Another good stock pick!

Overall it's clear that Steve is a very competent stock pickers and knows what he's talking about.

Recommended: The Best Place To Get Stock Picks

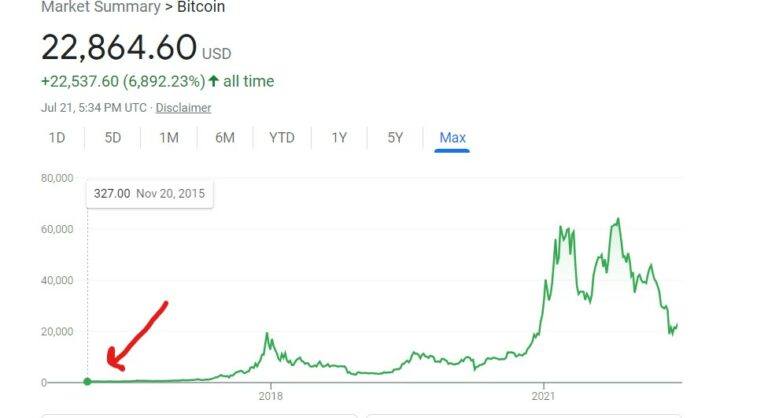

5) Steve Told His Subscribers NOT To Buy Bitcoin

Form 2013 to 2015 Steve and Stanberry told their subscribers specifically NOT to buy Bitcoin.

They claimed it was doomed for failure and would end up like a lot of dot com stocks in the early 2000's.

Instead they said you should invest in a "secret currency."

They were talking about collectable gold coins.

This is painful to look at to be honest.

How many people wish they invested in Bitcoin in 2013 or 2015?

Let's look at the price of Bitcoin in 2015:

Bitcoin reached over $60,000 since 2015 which means it's gone up over 18,000%..

If you had invested $10,000 in Bitcoin in 2015 you would have had $1.8 MILLION at one point.

Even with Bitcoin at $22,000 you'd still have over $670,000.

I like Steve's stock picks a lot but unfortunately many people missed out on being a millionaire listening to him.

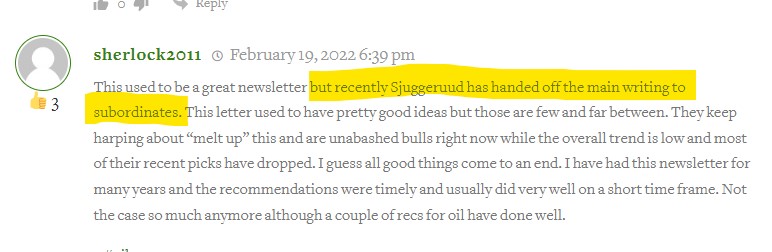

6) Steve Might Be Less Involved Now

Quick point before moving on to what you get with your subscription.

Steve might not be as involved with True Wealth now as he used to be in the past.

If so that would definitely be a bad thing.

I noticed many customers complain he no longer does the writing for the True Wealth newsletter:

Steve was recently named interim CEO of MarketWise.

I'm guessing running a publicly traded company that makes hundreds of million in revenue like MarketWise does takes up a lot time.

So I could definitely see Steve neglecting True Wealth.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

7) You Get A Monthly Newsletter

The monthly newsletter is basically the main thing that you're paying for at True Wealth.

These newsletters are no longer written by Steve and instead are written by his team.

Like I said in the last section I have no clue if Steve is still really involved in the newsletter or not.

These newsletters are pretty long and about 20 pages.

There's some graphs and images but these newsletters are wordy and packed with a lot of information.

In every issue you get a new stock recommendation along with information why the stock is being recommended.

For example, in the latest edition a biotech fund was recommended:

Along with these new stock picks you get analysis of the market.

To be honest this is mainly what the newsletter is.

The stock recommendation doesn't even happen until around page 13 or 14.

Before that is insights into the economy and things like that.

Lastly, you get updates on previous stock recommendations.

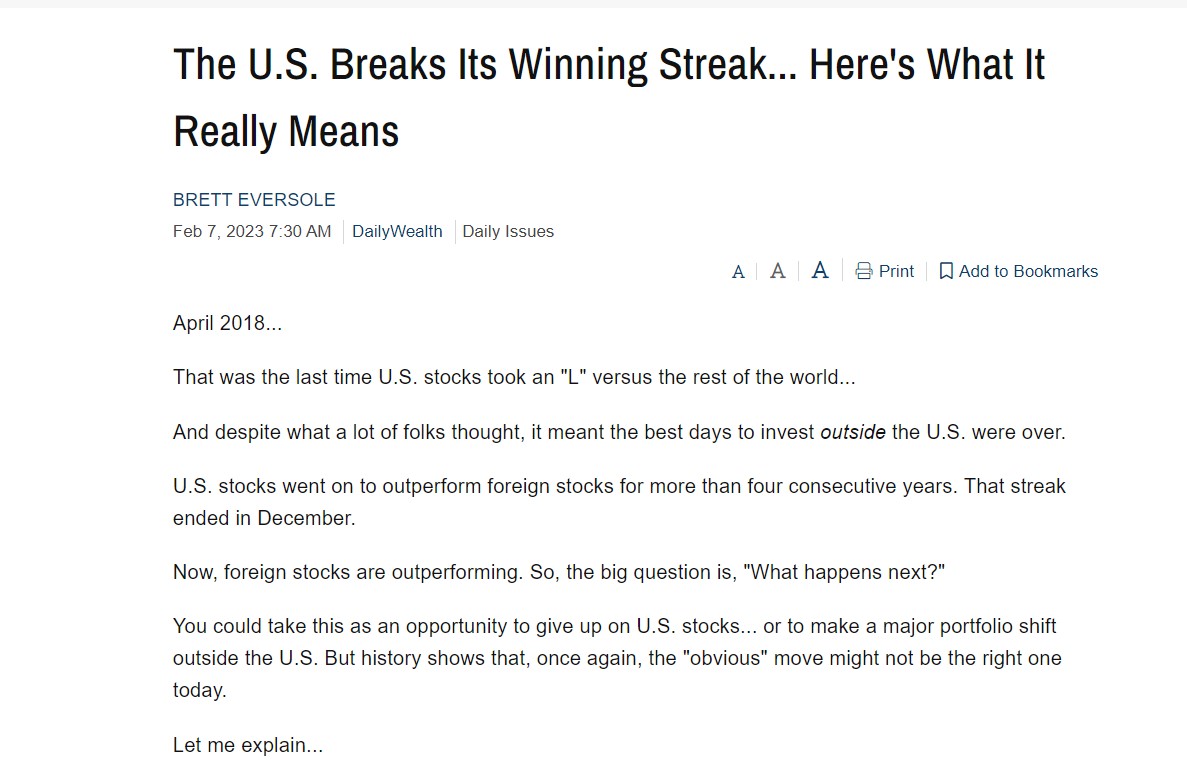

8) You Get A Daily Newsletter

Another nice feature of True Wealth is the daily newsletter you get.

These seem to be a member favorite and I've seen many subscribers talk about how they like the daily updates.

Basically these are just overviews of the market and you get insights about the markets.

These are much shorter than the newsletters that go out once a month.

The monthly newsletter will take a half hour to read.

The daily newsletter can be read in five minutes.

Recommended: The Best Place To Get Stock Picks

9) There's 15 Assets In The Portfolio

There's two portfolios and there's 15 assets in total being recommended.

The first portfolio is "Real Assets" and is mostly collectable coins made of silver, gold and other previous metals.

There's five recommendations in total:

As you can see these are pretty expensive coins in some cases.

Additionally, in almost every instance the returns on these coins have trailed the market.

So you would have made more just investing in an index fund that mirrors the market.

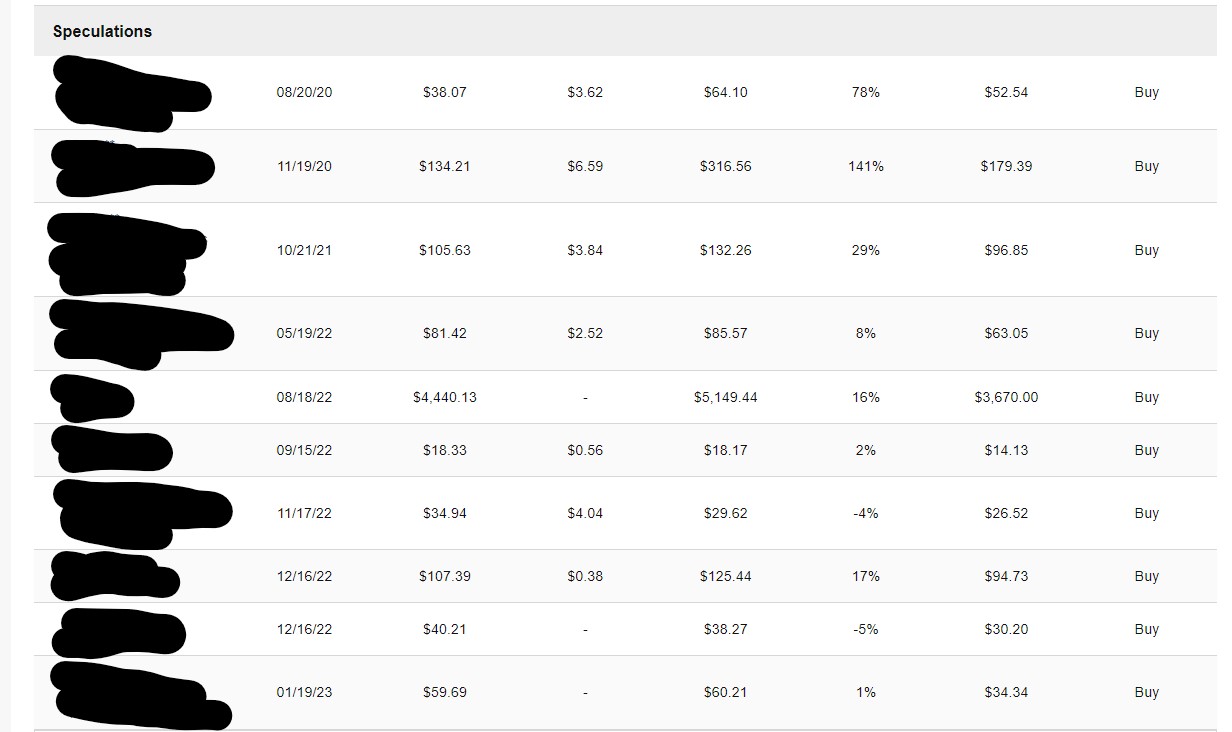

The second portfolio is made up of speculative assets:

This portfolio is mostly made up of different funds in different sectors.

For example, there's a fund focused on oil, banking, pharmaceuticals and more.

These picks are beating the market for the most part.

Many of them were made in 2022 when the market lost around 19% for the year.

And many of them are positive.

10) There's No Way To See Closed Positions

True Wealth uses a 25% trail loss rule for all of their picks.

So if they recommend an asset and it goes 25% under their recommended buy price they sell automatically and the asset is removed from the portfolio.

Many other newsletters will have a list of closed positions that you can look at but you can't find them at True Wealth.

This makes it hard to judge the performance of the recommendations.

There's supposed to be 25 picks in the portfolio:

However, there's only 15 right now.

There's two ways an asset gets removed from the portfolio.. the first is if it hits 25% loses and the second is if it reaches the max gains Steve believes it will hit and you sell for profit.

2022 was a rough year for stocks so I have a hard time believing there were 10 gainers so high they needed to be sold.

But I can't tell for sure.

It's definitely a red flag there's so few recommendations in the portfolio right now.

11) Many Special Reports

Lastly you get access to a bunch of special reports.

These special reports are the stock teasers we looked at earlier in the review.

They're long term reports that focus on a particular asset, theme or sector.

The special reports are typically used to sell the newsletter.

They'll market the report as "free" as long as you buy the newsletter.

It seems 3 or 4 of these reports get released a year.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

True Wealth FAQ's

Still have questions about True Wealth?

Here's some answers to any remaining questions you might have:

1) How Much Does True Wealth Cost?

It really depends on where you buy it from.

If you try to buy it from the Stansberry website it will cost you $199 per year.

However, if you buy through one of the promotions that are going around you can get it for $49 per year.

So if you're interested in buying and can't find a promotion I'd call up Stansberry's customer service and try to get it at the discount price.

Overall I think this price is excellent and definitely worth it.

Just remember you're dealing with an Agora product.

This mean True Wealth is just bait - the real money is getting you to upgrade to a product that costs thousands of dollars a year.

Typically these expensive products underperform the bait products.

So be aware you're going to get heavily promoted to once you buy.

2) Is There A Refund Policy?

Yes, you get 30 days to get your money back.

This isn't really enough time for you to determine if the stocks are good, though.

It's basically just enough time to see if you like how the service is run.

Additionally, if you do fall for one of the upsells you likely won't get a refund.

The more expensive products typically just come with a credit refund - meaning you don't get your money back and can just use the money to buy another newsletter.

3) Is Steve Sjuggerud Legit?

I personally don't like calling anyone that works at an Agora owned publisher legit.

You have to be pretty unethical to engage in the marketing that they do.

However, Steve is definitely legit at picking stocks.

I looked at a number of stock picks through the years and most of them have done really well.

So I won't use the word legit - I'll use the word competent.

4) How Much Do I Need To Invest?

Stansberry recommends that you have $1,000 for this newsletter.

That's not nearly enough, though.

There's four assets being recommended that cost over $1,000 and two that are over $4,000!

There's one coin that's over $6,000.

I think a better starting number would be $25,000 to $50,000.

You can invest in everything if you have that to start.

5) What Is The Investing Style?

True Wealth is described by Stansberry as a service that looks for assets that are currently being undervalued by the market.

So Steve Sjuggerud is a value investor.

This means he stays away from small cap stocks and growth stocks.

You'll be investing in things that are definitely safe and less prone to huge loses.

However, the huge returns you'd get from growth stocks aren't going to be there.

6) Are There Similar Newsletters?

Yes, there's many similar newsletters out there.

Some include:

- The Distortion Report

- Stansberry Investment Advisory

- TradeStops

- Retirement Watch

- Intelligent Income Investor

- The Opportunistic Trader

- Jeff Clark Trader

- Behind The Markets

- The Oxford Income Letter

- Power Gauge Report

- Chaikin Analytics

- The Ferris Report

- Extreme Value

Most of these newsletters are under the MarketWise umbrella.

Recommended: The Best Place To Get Stocks

True Wealth Pros And Cons

True Wealth Conclusion

So that's the end of my review of True Wealth.. I hope you found it helpful!

In the end I like True Wealth and there's a lot of good, safe investments in the portfolio.

Stansberry describes this service as "conservative" and I'd agree with that.

It has a history of doing pretty well and many of the recommendations do end up beating the market.

However, there's some drawbacks.

MarketWise is not a company I like buying from and they really like to nickel and dime their customers.

The upsells are exhausting to deal with and it's obvious they care most about getting you to spend a lot of money.

Additionally, it's not really clear how involved Steve Sjuggerud is with True Wealth now.

He's acting CEO of MarketWise and I can't imagine he can do both at the same time.

So my guess is he's not too involved anymore.

He doesn't do any of the writing for the newsletters.

Overall I wouldn't talk you out of buying this newsletter.

I'd just recommend creating a separate email account from your main one.

This way you're not bombarded with promotions every day.

And DON'T pay for any upsell until you're fully satisfied with True Wealth.

This is one of Stanberry's best newsletters and the upsells are likely to disappoint.

Here's A Better Opportunity

True Wealth is a good investing newsletter but there's better out there.

I've personally reviewed over 100+ stock picking services..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: