Behind The Markets is a stock-picking service run by Dylan Jovine.

He claims he can help you make money with these recommendations.

Is he telling the truth, or is this all one big scam?

We'll get to the bottom of this question in this review.

Additionally, we'll look at some stock picks and see how the portfolio is doing.

You'll know if it's worth joining by the time you're done reading.

Let's get started!

Behind The Markets Summary

Creator: Dylan Jovine

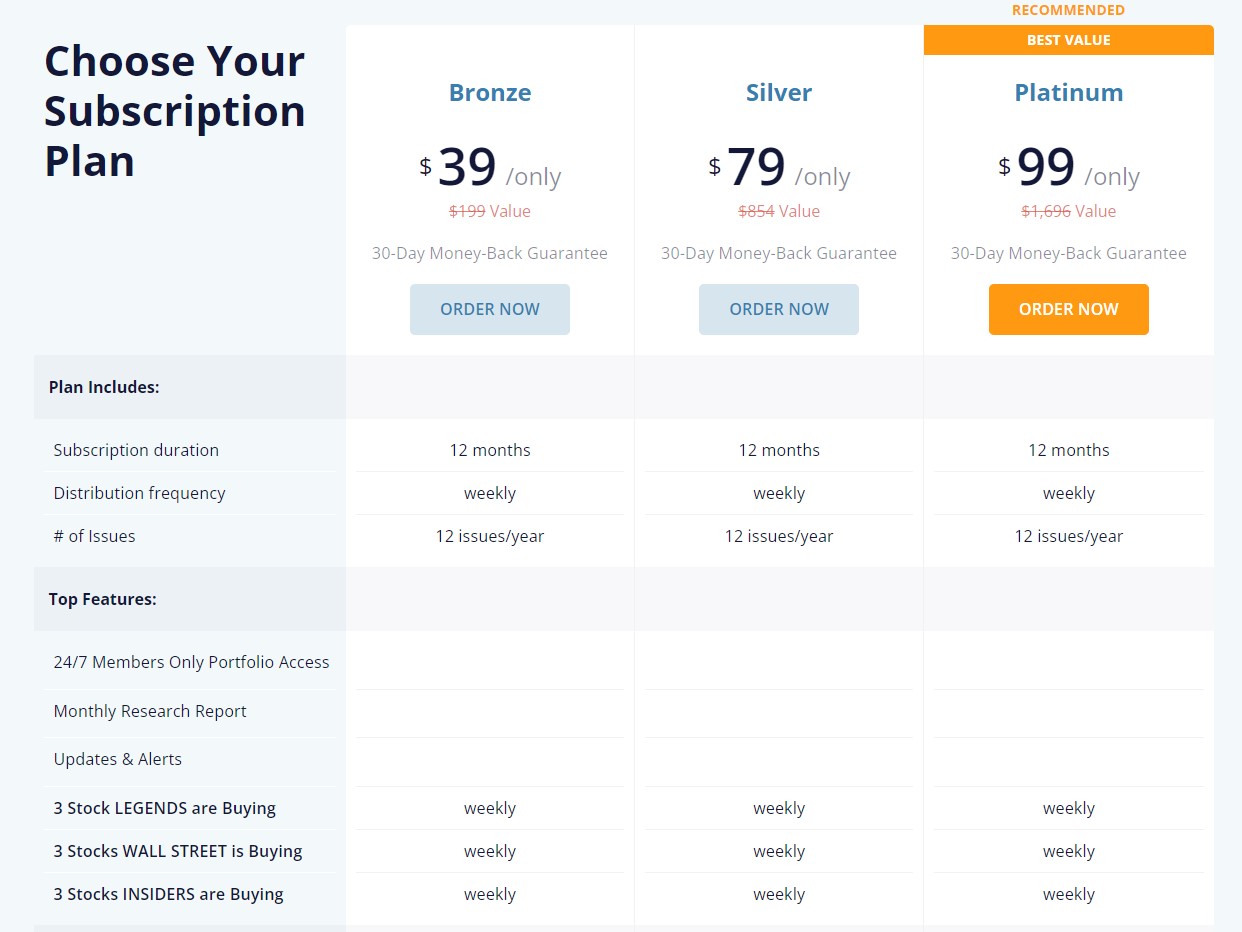

Price to join: $39 to $99

Do I recommend? No.

Overall rating: 2/5

Another year and another update for Behind The Markets.

I've actually spoken to Dylan Jovine on the phone and think he's a nice enough guy.

However, I don't recommend his newsletter.

First off, it doesn't beat the market. Even when the newsletter was gaining, it still trailed the S&P (most investing newsletters don't beat the market, by the way).

It's cheap, but it really only serves as the first step of a marketing funnel.

Once you buy, you'll be aggressively promoted upsells that cost thousands of dollars per year.

And these newsletters don't perform well at all.

So, in the end, I recommend putting your credit card away and not buying from Jovine.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

17 Things To Know About Behind The Markets

Thinking about buying "behind the markets"?

There are some things you need to know before doing so.

Here's everything you need to know about this newsletter:

1) My Conversation With Dylan Jovine

So last year, Dylan Jovine reached out to me to talk about my review.

We had a little chat about his service and his background.

I personally like Dylan Jovine as a person, and he seems like a nice enough guy.

During his conversations, he referred to himself as "one of the good guys" in the stock-picking industry.

and I wouldn't disagree with that.

There are things that other stock pickers do that are so unethical that it's pretty easy to be a good guy, comparatively speaking.

However, being "good" doesn't get you anywhere; being right does.

And Jovine admitted on the phone that most of his positions were currently down.

And things have gotten worse since this conversation.

As I'm writing this, 11 out of 13 open positions are losing, some by 40% to 70%.

The market is doing badly at the moment, but not this badly.

So Jovine might not use the underhanded tactics some stock pickers use, but he's also not picking winners at the moment.

2) Did Jovine Work In A Boiler Room?

Before Jovine started selling stock picks to retail investors, he worked as a broker at many different companies.

Some of these companies include:

- Firs Hanover Securities

- LCP Capital

- Gilford Securities

- Northeast Securities

Most of these brokers are now defunct, but the last name, Northeast Securities, caught my eye.

In the past, I wrote a review about a stock scammer named Teeka Tiwari who worked at Northeast Securities.

Teeka is a really bad guy who's literally banned from Wall Street.

Northeast Securities is pretty infamous for the scams and fraud it committed.

Many people associated with the company have been arrested and fined millions.

Apparently, the movie Boiler Room was based on Northeast Securities.

This is what actually prompted Jovine to call me.

He claims Northeast Securities works like McDonalds, and that you can essentially franchise the name.

So Jovine said the Northeast Securities company he worked for is completely different.

I have no idea if this is true or not.

Northeast Securities doesn't exist anymore, and Jovine worked there in the 1990s.

Maybe Jovine is telling the truth, but it's just something to consider.

3) A Brief Stint at Awful Agora

Another reason Jovine wanted to call me was to talk about his time at Agora.

Agora was at one point the largest distributor of stock-picking newsletters, and they bought Dylan's original newsletter, Tycoon Publishing.

After Jovine worked for Agora for two years, she headed the Institute of Individual Investors.

The problem with this is that Agora is an absolutely horrible company—truly one of the worst to exist.

Don't you believe me?

Just two years ago, Agora was fined $2 million for defrauding senior citizens.

Jovine was adamant he knew nothing about this kind of stuff.

It is true that at the time, Agora owned dozens of publishers and health companies.

So perhaps his publisher wasn't engaged in any of this stuff.

But all Agora publishers act unethically in one way or another.

Either by using manipulative sales tactics, unrealistic return promises, or insane upselling.

You can't be involved with Agora and claim innocence.

Jovine was only there for two years and didn't explain why he left.

Recommended: The Best Place to Get Stock Picks

4) Why I Still Consider Jovine "Good"

Thinking someone is "good" isn't the same as recommending their services.

I'm not currently recommending Behind the Markets, but I still think Dylan Jovine should be considered a good guy in the industry.

The reason isn't so much about him but more about the other characters selling stock picks.

There are a lot of horrible people with newsletters. Many are straight-up criminals.

Jovine doesn't seem to have the worst business practices in the industry.

For example, yesterday I did a review of the popular newsletter The Distortion Report.

After you buy this newsletter, you have to sit through seven upsells just to access what you bought.

I could feel my blood pressure rising going through them.

So I appreciate Jovine not doing stuff like this.

5) Revealing Some Of The Market's Stocks

Later in this review, we're going to look at the portfolio and how it's performing.

But I can't just give you the stock picks in the portfolio—that's proprietary information.

However, Jovine has done some stock presentations in the last few years to sell his newsletter.

This means he hypes up a stock but doesn't reveal it; he only reveals it if you buy it through Behind The Markets.

The good news is that Dylan left enough clues in the presentations to figure out the stocks.

So I can reveal these.

Jovine's most recent stock picks are Viking Therapeutics, Eli Lilly, and Novo Nordisk.

These were all in a stock teaser promising the best picks to capatilize on weight loss drugs:

The first stock, Viking Therapeutics, was around $14 when Jovine recommended it in August 2023.

Now it's at $19, so it's up around 33%, which is good.

Eli Lilly is up 27% since being recommended as well:

The last stock, Novo Nordisk, is up around 30% in the last 5 months:

So hats off to Jovine with this teaser - the stocks got good results.

The next stock pick we're going to look at is Editas. This is a gene editing company in the biotech sector.

Here's how the stock has performed since being recommended:

Jovine doesn't have a buy or sell price for this stock; he just recommends continuously buying it.

So how well it's done for you depends on when you bought it.

If you bought when he first recommended it, there was a chance to get 400% returns in early 2021.

If you bought in early 2021, you're down about 90%.

The next stock Dylan recommended is Leidos.

Jovine hyped this company up as a "new 5G weapon" that could help build the first "5G arrow."

Leidos won a contract for a hypersonic glide missile, but the development of the missile is only a small part of Leidos (which does contract work for the government in defense, health, and IT).

Here's how the stock has done since October 2020:

This is another stock without a buy or sell price.

So if you bought when Jovine recommended it, you'd be up about 10%.

That's about even with the market.

The last stock Dylan Jovine teases is Denali Therapeutics; he did so in September 2021.

He was hyping up their potential to create Alzheimer's drugs.

Here's how the stock has performed:

Not good!

It's down about 50% at the moment.

Recommended: The Best Place To Get Stock Picks

6) Signing Up For Behind The Markets Is Easy

Like I mentioned earlier, I bought a newsletter yesterday that made me want to pull my hair out.

Jovine doesn't make you sit through any upsells before accessing your product.

You put in your credit details, buy, and you're immediately sent Behind The Markets.

You're first brought to a welcome video:

And that's it.

You have access to the bonus reports, recent alerts, and model portfolio.

However, you are sent an email with an expensive upsell shortly after joining:

The upsell in this case is Takeover Targets and it costs $1500 a year to join.

I'll talk about all the upsells later in this review but when talking on the phone with Dylan this is the product he's most excited about.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

7) You Get A Monthly Newsletter

This is mainly what you're paying every year for.

Every month, you'll get a new copy of Behind the Markets.

In this new copy, you'll receive a new stock or asset to invest in as well as Jovine's reasoning for investing in it.

These newsletters are much, much shorter than what I've seen from competitors.

But I don't think that's necessarily a bad thing.

Some people really overload readers with information, and I find it to be superficial sometimes.

Additionally, you may get a video on how to invest in certain assets.

This is mainly the case if the recommendation isn't a traditional stock.

Lastly, you get updates on some of the positions in the lineup.

You'll get a brief explanation of what's happening with the stock and the moves that Jovine believes you should take.

8) The Portfolio Is Hurting

This year has been tough for stock pickers, and I'm guessing most of these newsletters are down right now.

My favorite stock-picking service is up, but that's an exceptional product.

But behind the markets, open positions are not doing well.

Here's a look at the current open positions:

As you can see, things aren't going well for Behind The Markets currently.

There are eleven open positions, but only two are filled right now.

The two highest are 11% and 15%.

But if you look at the losers, some are down 68%, 37%, 44%, 71%, etc.

Many of these positions were added from 2021 to now.

So if you bought this product within the last 18 months, I'm betting you're not too happy.

Additionally, there are four stock picks that Dylan recommends buying continually:

I didn't blank out three of the stocks because I revealed them earlier.

Of the three one is up, one is about even and the other is down big time.

You can be up or down on the fourth stock but it depends when you bought.

Here's how the blanked out stock has performed over the last five years:

9) Behind The Markets Has Never Beaten The Market

Behind The Markets is ironically a good name for this newsletter..

Want to know why?

It's always trailed behind the market LOL!

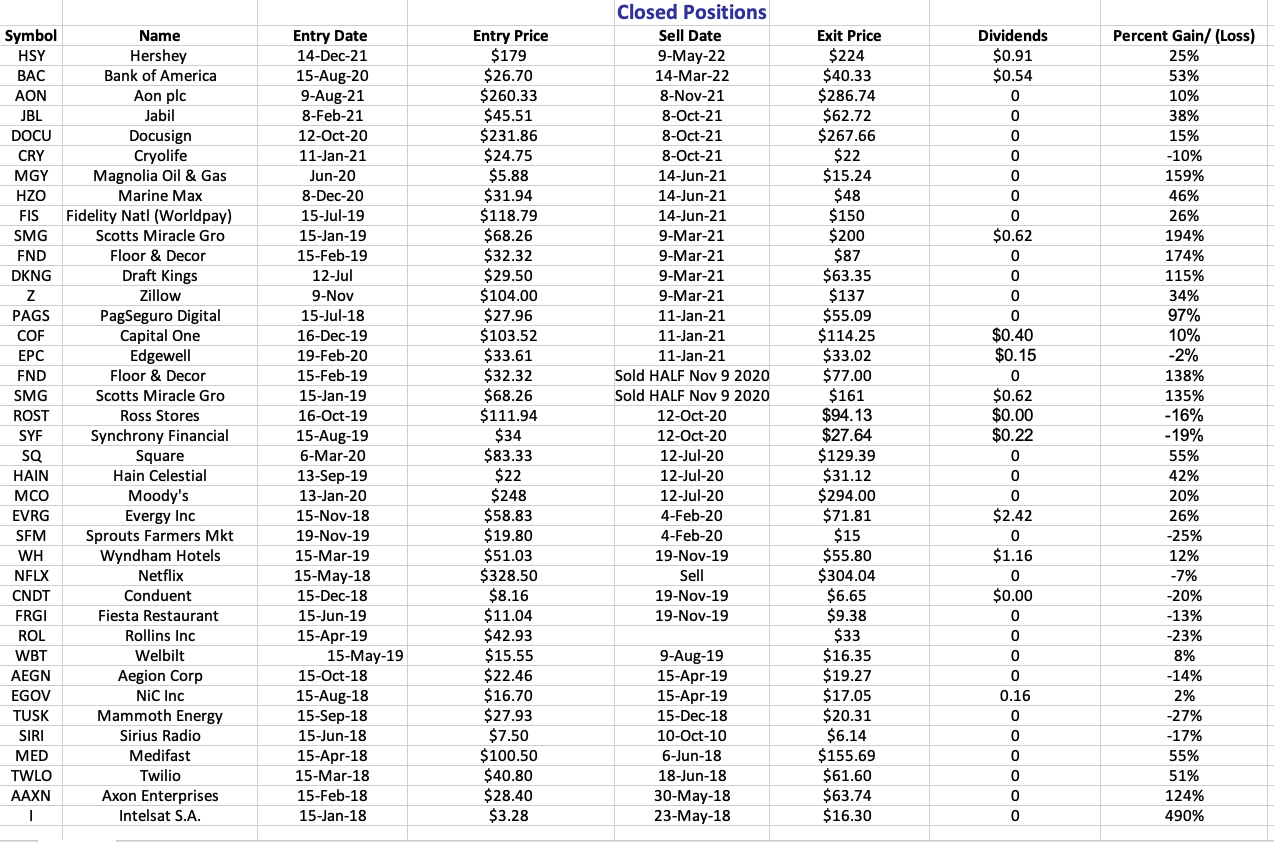

When I talked with Jovine he sent me over a table of the closed positions at Behind The Market:

looks pretty good at first glance.

There are some losers, but everyone is going to have that.

Most of the positions ended positively.

Nice!

BUT if you go to the closed positions section, you'll see the closed positions on average are up 39%.

Most of these positions were recommended from early 2018 to mid-2020 and were closed by the end of 2021.

At this time, the market was up over 50%.

So if you had just put your money into an index fund that mirrored the S&P 500, you would have made more money.

You'd also be down less now.

Out of the 39 positions, nine beat the market (23%).

Four of the positions are about even with the market (10%).

The rest of the positions are losing ground to the market (67%).

So unless you decide which stocks will beat the market from "behind the markets," there's no reason to buy.

You're better off just putting your money into an index.

Recommended: The Best Place to Get Stock Picks

10) You Get Trade Alerts and Updates

You might be thinking to yourself that waiting every month for portfolio updates isn't going to work.

What happens if something crazy happens in the market or to one of the open positions?

Jovine remedies this by giving out alerts about the open positions when needed.

These alerts can deal with investment ideas and tutorials.

For example, back in September, Dylan released a video update on how to profit in the current bear market.

However, there are not too many alerts.

In the last six months, there have only been two.

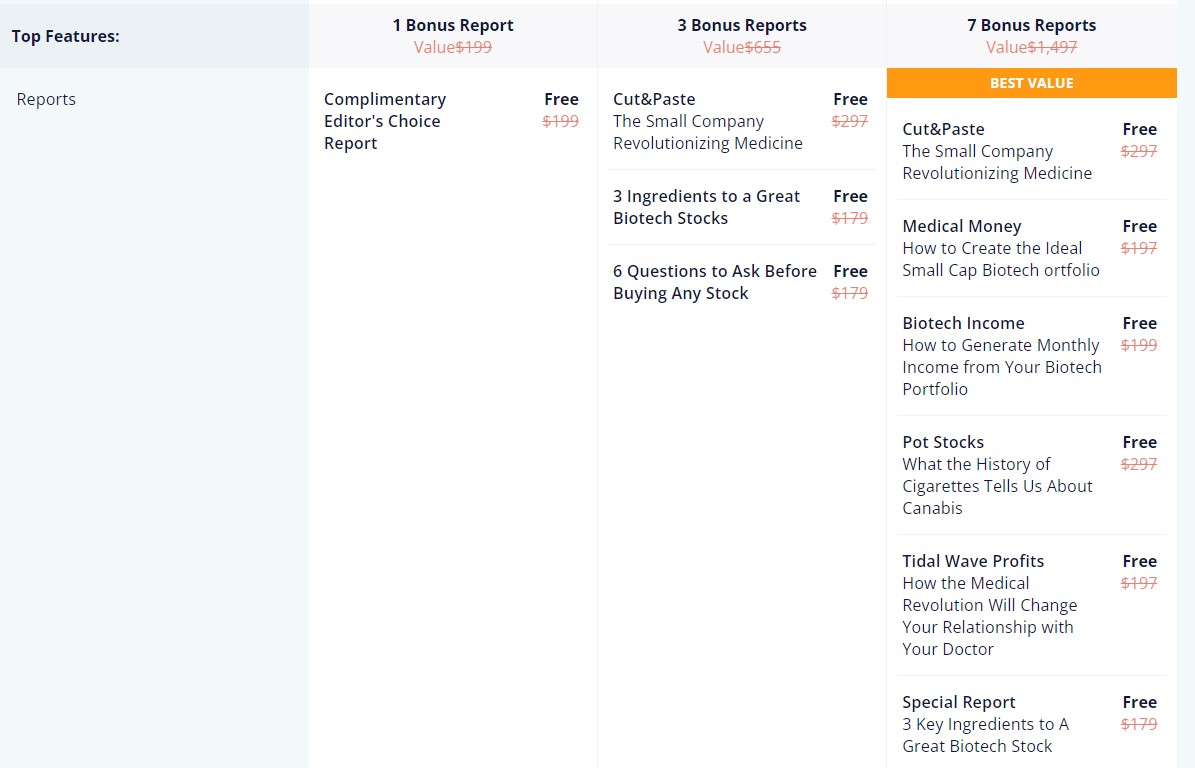

11) You Get A Bunch Of Special Reports

Another thing you get with your subscription is access to special reports.

Some of these special reports we covered earlier (the three stocks I named before).

These act as sweeteners to get you to buy.

Typically, Jovine puts on a big show about a stock and then promises to give you a full report on the stock.

For example, we talked about a stock called Editas that Jovine recommended in 2019.

Here's a look at the report you get detailing this stock:

The report is 19 pages but most of the pages are just graphs and figures.

There's only about 6 pages of commentary.

Another report we revealed earlier is Leidos who has a contract with the government to make 5G weapons.

This report is 50 pages:

Again, most of the pages are graphs and pictures.

Most of the pages just have five to six sentences on them.

In total, you get access to 12 of these special reports.

12) Jovine Looks For "Beaten Up" Value Stocks

You get access to a few different strategies if you sign up for the Behind the Markets subscription.

The main strategy is to find midsized companies with market capitalizations ranging from $1 billion to $10 billion.

Additionally, they're looking for undervalued midcap companies that are suffering from a temporary setback.

Stocks can be fragile, and any bad news can send the stock price tumbling.

The goal here is to find stocks that have recently tumbled, but what sent them tumbling isn't a really big deal.

Besides that, the strategy considers:

- High returns on equity

- Low debt

- durable competitive advantage

This is definitely a strategy that can work.

The only downside I could see is that you'll have to time these picks to make any money.

The drop in stock price is only temporary, and it is likely to go back up soon.

If you're a month late, you might lose your chance to make money.

So you should have a bit to spend on stocks if you decide on this newsletter:

Recommended: The Best Place To Get Stock Picks

13) Behind The Markets Is Very Cheap

One thing to like about Behind the Markets is that it's very cheap.

However, this newsletter is the introductory product that Jovine offers.

Basically, all stock pickers offer a product in this price range.

The main goal is to get you into a sales funnel so they can upsell you later.

In fact, the second you buy Behind The Markets, you're sent an upsell for a product that costs $1,500 a year.

On the sales page, Jovine claims you get more special reports if you pay more:

However, this isn't true.

I paid for the $39 subscription and got all the special reports you get with the $99 subscription.

So there is no need to buy the expensive membership; it literally gives you nothing extra.

14) There's A 30 Day Refund

There's a 30-day refund for Behind the Markets, which isn't that big of a deal because it's so cheap.

However, Dylan Jovine does something that I like and that most other stock pickers don't do.

He offers a refund on his more expensive products.

For example, with his upsell Takeover Targets, he gives you 30 days to get your money back.

Basically, no one does this.

Typically, stock pickers offer refunds on their cheap products but not on their expensive ones.

It's pretty cool that Dylan allows you to get your money back.

15) The Website Is A Little Slow

One thing that was a little frustrating is that the website is very slow.

Dylan definitely needs to upgrade his hosting provider because sometimes it would take 10 seconds for a page to load.

You typically want your website to load in under 3 seconds every time.

16) Takeover Targets Are Jovine's Favorite Upsell

Just like every other publisher, Behind the Markets offers upsells.

This is mainly how these guys make their money.

No one is becoming a millionaire by offering a $39 newsletter; the money is in the $3000 or $5000 upsell.

Typically, I tell people to avoid upsells because they tend to perform poorly.

The reason is that they are mostly obscure investing strategies.

No one wants to pay $5,000 to be told to buy Facebook and Apple.

You have to offer something unique for people to pay that kind of money.

But uniqueness rarely pays with stocks.

The upsells include:

- Biotech Insider

- Takeover Targets

- Breakthrough Wealth

- Hidden Market Profits

All of these newsletters have their own unique angle.

But when talking on the phone with Dylan, you could tell Takeover Targets was his favorite.

This service allows you to make money on potential mergers.

Basically, a company's stock will pop during a takeover.

Jovine targets companies that seem likely to be bought and claims you can earn 10% to 20% a year doing this.

On the phone, he said he had a 100% success rate here, but one deal was down at the moment (wasn't closed yet).

(17) Here Are Similar Newsletters

I've reviewed a lot of investing services over the years.

Here are some newsletters that remind me of Behind the Markets:

- The Distortion Report

- The Oxford Income Letter

- Extreme Value

- The Ferris Report

- The Near Future Report

- True Wealth

- Strategic Intelligence

- Growth Investor

- Innovation Investor

- Strategic Investor

- Green Zone Fortunes

- The Dividend Hunter

And many more—as you can see, there's no shortage of investing newsletters.

Recommended: The Best Place To Get Stock Picks

Behind The Markets Pros And Cons

Behind The Markets Conclusion

When I looked at Behind the Markets last year, I was a little more enthusiastic about it.

The positions were doing better, and there were better returns.

It was trailing the market, but not by much.

Right now, things are really bad, though.

Almost every stock recommendation is down, and some are down a lot.

It wouldn't be a good time to invest in the stocks that Jovine is recommending.

Honestly, even if the market were in good shape, you'd make more just investing in a market index.

It's more boring, but more profitable.

That's really all that matters in the end, right?

Here's A Better Opportunity

I'd pass on Behind the Markets.

The portfolio just doesn't perform well enough (now or in the past).

The good news is that there are better alternatives.

I've personally reviewed over 100 stock picking services.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Can confirm… I got fooled into subscribing to Behind the Markets, realized it was a marketing funnel… not only did I not get my money back, I also tried unsubscribing. Six months later I am still getting spammed by the affiliates that Behind the Markets sold my email address to. Join at your own risk.

Sorry to hear that!

I just watched a compelling video with Dylan Joline selling a subscription to Behind the Market for $39. The main selling point is his 40 page report on China vs Taiwan War, which I was interested in reading. But because you never know I decided to look for reviews which lead me here.. 1st know this I did push the button to pay the $39 US funds for everything offered, and thankfully my card sends me alerts because the charge was going to be $106.39 Canadian funds when it should have only been about $50.68 based on todays exchange rate. Don’t know what kind of calculator BTM uses but is broken.

There’s different prices for BTM.. maybe you accidently picked the more expensive one.

That’s odd.. there’s different levels for Behind The Markets.. maybe you accidently clicked the premium version.

Hello, my name is Barbara Kershner. I can’t help but think you are a scammer. In June, I called to say NO, I don’t ! want to be billed for a 2nd year since I never received a newsletter for the first year. I spoke to Rosemary. She said NO, we cannot refund your money even though I was billed in June and called in June. I was going to forget it but you are a skam. I never requested last year and can’t get rid of you this year. This is my note to you stating I am canceling all my future dealing with you and DON’T BILL ME AGAIN. I am 85 years old and I suppose this is your normal way of making money. SKAM. SKAM. SKAM!!!!

‘

I’m not associated with the Behind The Markets!