Mark Minervini runs a trading service called Minervini Private Access.

Mark calls this program the premier choice for serious trades for education, research and market monitoring.

Is this true or just another investing scam?

You'll get an answer to that in this review.

Additionally, you'll see some background information on Mark, any red flags I find and more.

You'll know if Minervini Private Access is worth it or not by the time you're done reading.

Let's get started!

Minervini Press Access Summary

Creator: Mack Mills

Price to join: $999 per month, $5988 per year

Do I recommend? Not really

Overall rating: 2.5/5

There's a lot to like about Mark Minervini - he's an investing champ and has written popular books.

However, a lot of people think his success is due to pump and dumping his audience.

No clue if this is true but he claims big returns while his customers lose money.

Additionally, the service is very expensive and there's no refunds.

Add this all up and I say pass.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Mark Minervini - Investing Champ Or Pump And Dumper?

Mark Minervini is the guy we're reviewing today and he's a well known trader.

Here's everything you should know about him:

1) 37 Years Wall Street Experience

Mark claims to have over 37 years Wall Street experience and this line is repeated by a lot of different people.

Oddly enough Mark and most people repeating this don't say where this experience comes from.

From what I gather Mark doesn't have a high schooldiploma and is completely self taught.

According to his book Trade Like A Stock Market Wizard he started trading in the 1980's with only a couple thousand.

This Yahoo article states he advised traders at well known firms like Soros Management.

But from everything I've read Mark is completely self taught and according to him he has 4000 books in his library and he's read them all.

2) Certified Investing Champ

One of the main selling points from Mark is he's a certified investing champ.

This is true and was done through the US Investing Championship.

Mark has won this tournament several times and won the most recent tournament in 2021.

He even set the record this year for the $1 million dollar bracket with 334% returns, which is almost triple the previous record of 119%.

This competition verifies all results and previous contestants includes legends like Paul Tudor Jones.

3) Does Mark Pump And Dump?

So with all of these massive returns Mark gets you're pretty much guaranteed to succeed right?

I mean the whole service is you getting access to Mark's buy and sell alerts..

However, that doesn't seem to be the case for a lot of people.

In fact, most customer reviews I've read are very negative about Mark.

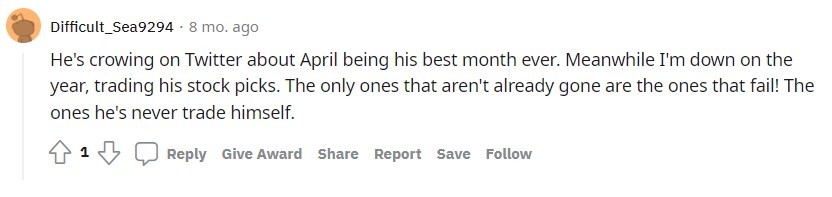

For example, here's one customer claiming he lost money following Mark's trades while Mark was claiming to have his best month ever:

What's going on here?

How is possible for a guy getting gains as high as 300% to possibly have customers losing money?

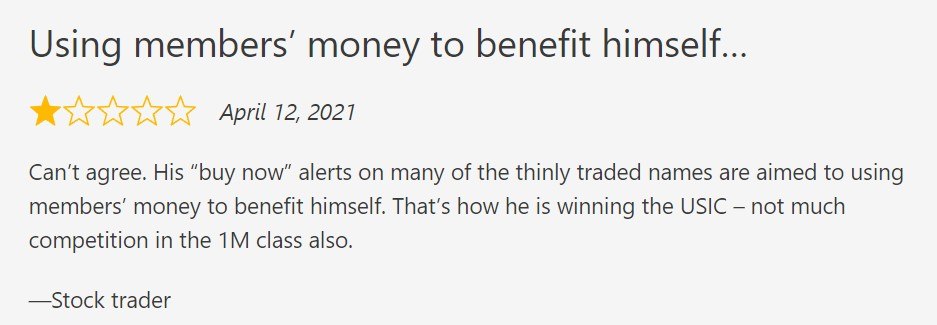

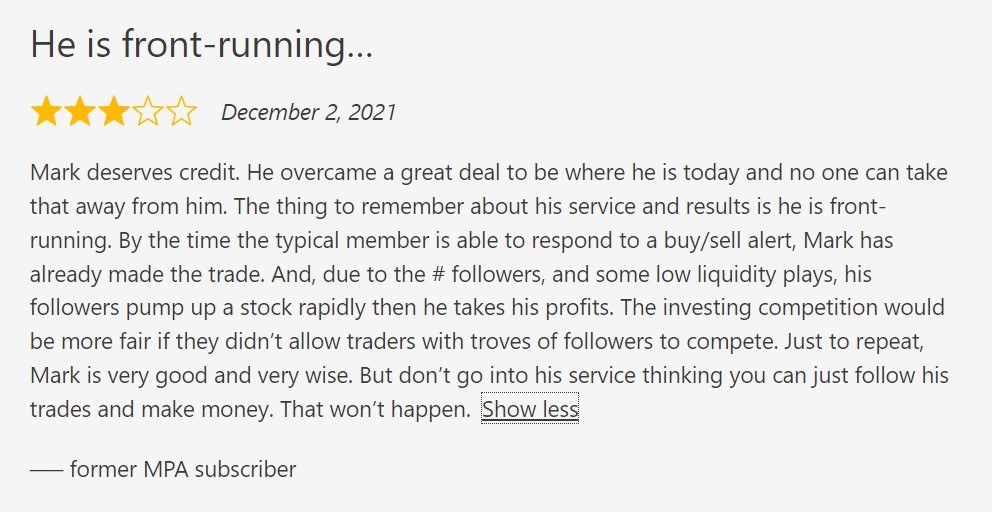

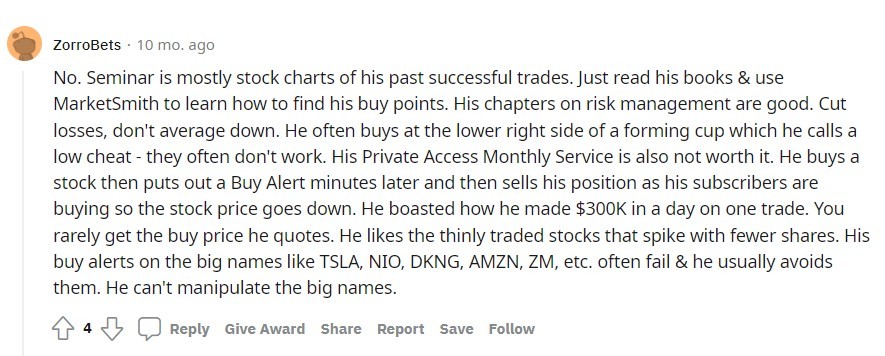

Well many people claim he's pump and dumping thinly trading stocks.

This means he buys a stock that's not traded a lot, sends a buy alert out to his large audience, they buy and cause the price to go up and Mark sells while the price peaks.

The problem with this is most people will lose money because the price artificially goes up and will crash when Mark sells it.

I personally don't know if this is true but a lot of people make this accusation.

Here's just a few comments I found stating this:

So this is four people making this claim and there's honestly a lot more out there.

The last comment catches my eye the most.

Stocks that Mark can seemingly manipulate he profits from and stocks he can't manipulate like Tesla and Amazon he doesn't profit from (and rarely recommends).

Additionally, you apparently never see the price Mark buys at.

Mark doesn't have a verified track account where you can look back on all the trades he's made.

Furthermore, his assistant claims he makes trades the members of Minervini don't get to see as well.

Again, I'm not personally saying this is happening but it certainly would answer why he's getting massive returns while his customers are losing money.

4) The Numbers Don't Add Up

Another thing that's very confusing is the returns Mark claims he's been getting.

Mark claims to make 200% returns basically every year and one article claims his worst year was 128% in a 5 year stretch.

For comparison, Warren Buffet has gotten an average return of 20% in his investing career.

He even claims he has a hard time beating the average returns of the market.

Warren Buffet is one of the richest people in the world and has over $100 billion.

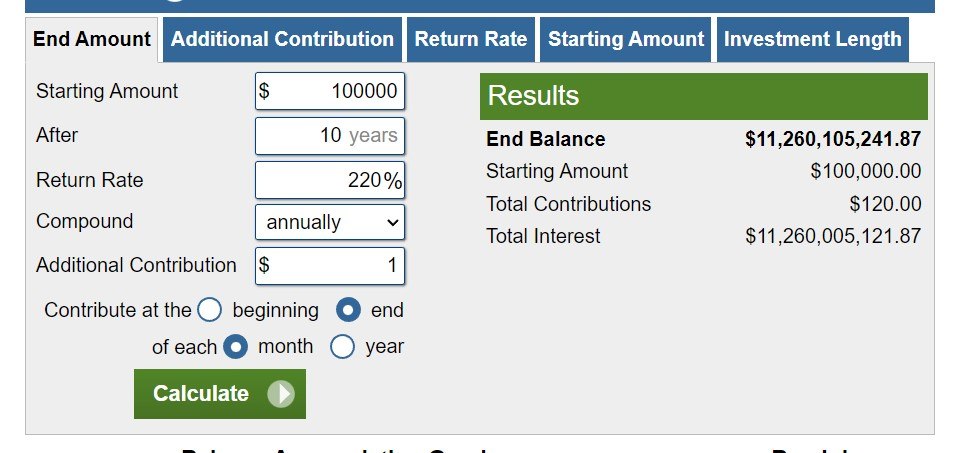

So if Mark were to invest $100,000 and get annual returns of 200% and only added $1 to the account every month, that $100,000 would be worth over $11 billion in just 10 years:

I'm not the only person confused about these numbers.

Here's another person stating how the numbers don't make sense:

An explanation for this could be Mark has many trading accounts and just shows you the winning ones.

He might take huge loses in the ones he's not showing.

This is just speculation, however.

Recommended: The Best Place To Get Stock Picks

I Don't Recommend Day Trading/Swing Trading

Mark describes himself as a intermediate swing trader that will hold a stock from a few hours to several months.

This is a trading strategy that I definitely don't recommend for most people.

Here's a few reasons why this won't work for most people.

Extremely Time Consuming

Mark's trading style is only for people that can treat trading like a full time job.

You will likely have to work on this every single day and put in hours of work on the weekends too.

Mark himself talks about how he puts 80 hour work weeks in.

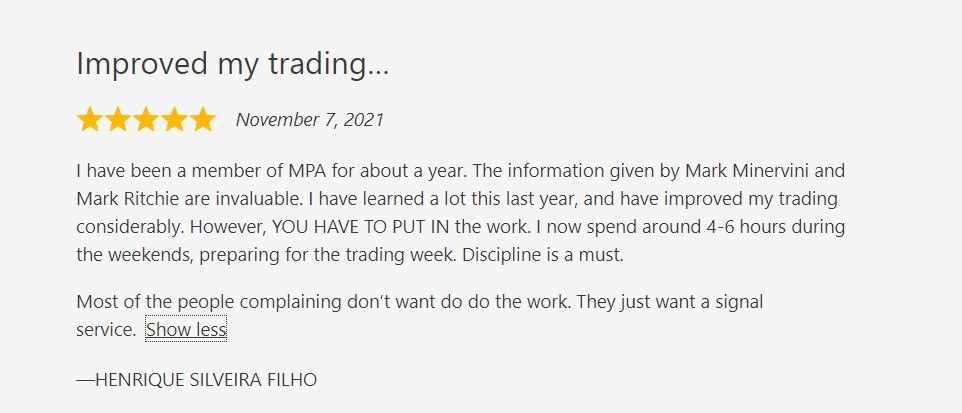

A customer confirms this and claims he has to prepare on the weekends for up to 6 hours for the trading week:

And that's just the weekend.

It takes incredible discipline and time to be a day/swing trader.

If you have a job or have any kind of busy life this won't work for you.

Success Rate Is Less Than 1%

One of the things that's so confusing about Mark's returns is day trading's success rate is laughably low - it's less than 1%.

Some people claim the success rate is high as 10% but I disagree.

The people claiming 10% are looking at the people who make anything from trading.

But since day trading is so time consuming you have to look at it differently.

Success should be measured by more than minimum wage.

Studies that have tracked hundreds of thousands of day traders prove that less than 1% of day traders make more than minimum wage.

The More You Do It, The More You Lose

Another incredible statistic is the more people day trade and the longer they do it, the more they lose.

This makes sense when you look at day trading as gambling.

If you went to the casino 5 times compared to 100 times you'd expect to lose less right?

The same with day trading.

It's basically impossible to guess where a stock will be a in few days.

So it's just a coin flip.

Except with day trading there's high fees involved so it's like paying to flip a coin.

Every trade you make can cost up to $100 and every time you buy and sell an asset under a year you need to pay 28% taxes on it.

Combine this with the monthly cost of $999 to access Marks trades and you're starting DEEP in the hole.

This is why I suggest buying and holding stocks long term.

It takes way less time and there's way less fees involved.

If this sounds better to you then click below:

Recommended: The Best Place To Get Stock Picks

What Is Mark Minervini Offer?

Besides Mark's books he's only offering Minervini Private Access.

Here's a breakdown of everything you get with this service:

Real Time Delivery Platform

The Real Time Delivery Platform is where you'll be getting all your trading information.

Here you'll get the following:

- Buy and sell alerts

- Watch list

- Updates

- Long and short ideas

- Market memos

This all can be accessed from your phone, computer and tablet.

However, you'll probably want to be on a computer if you're trading.

Training Room

Additionally, you'll get access to the interactive training room.

You will be learning Mark's SEPA trading strategy.

Plus you'll get:

- Weekly study sessions with Mark

- Post trade analysis

- Stock reviews

- Market Analysis

- Tutorials

- Live Q&A

A lot of people don't actually like the training and it's not because of what's being taught.

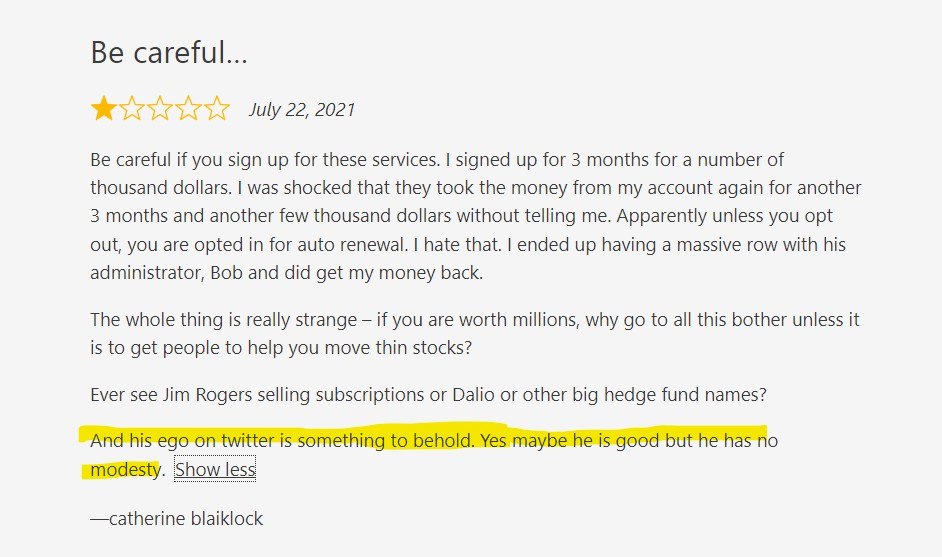

Many customers just seem to not like Mark and think he's too arrogant.

Here's a couple people complaining about this:

So he might not be the best to deal with on a personal level.

TradingLogger Analytics Suite

The last feature of this program is the TradingLogger Analytics Suite.

This gives you the following:

- Ability to track your trading performance

- Monitor key trading stats

- Monthly trade analysis

- Risk calculation

These programs are usually pretty expensive and is included in the membership.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Minervini Press Access FAQ's

Still have some questions about this service?

Here's answers to any questions you might have:

1) How Much Does It Cost?

Minervini Press Access is very expensive and costs $999 per month or $5988 per year.

I guess when you're the investing champ you can charge this much.

Still it's a lot.

Remember, day trading has a very low success rate and most people lose money.

So to start nearly $6000 in the red is not good and is going to make profiting that much harder.

2) Is There A Refund Policy?

No.

This is a pretty big red flag in my opinion and rarely do I recommend joining an alert service unless there's a refund policy.

Why join a program like this if you can't get your money back for ad results?

And it's not like Mark is hurting for money.

He apparently became a million in the early 90's and if his returns are even close to true he's make serious money trading.

So it's not like he's hurting for money or relying on this service as his main source of income.

Unless he actually is..

3) Is Mark Minervini Legit

If you just look at Mark's accolades you'd have to come to the conclusion he is.

He's set investing records in competitions, made millions in his thirties, worked on Wall Street for nearly 40 years, has gotten massive returns, written popular books, etc.

But there's some issues that are out there.

The front loading is the biggest issue of them all.

Plenty of people seem to think he's using his audience to make himself money (at the expense of his audience).

It would explain a lot of things.

I honestly don't have an answer if Mark is pump and dumping, though.

4) What Is Mark's Trading Style?

Mark is a day and swing trader and call his trading strategy SEPA (Specific Entry Point Analysis).

Basically this combines technical and fundamental analysis to determine when to buy and sell a stock.

The 5 elements that make up SEPA are:

- Trend

- Fundamentals

- Catalyst

- Entry points

- Exit points

Then mark looks at things like earnings, revenue, profit margins, market position, liquidity risk, etc.

Mark also makes trades based on "superperforming" stocks which all have the following:

- Decent earnings

- Coming out of a bear market or correction

- Less than 10 years on the stock market

- Usually a small or medium firm

5) Are There Similar Programs?

There's plenty of similar alerts services.

Some include:

There's plenty more too.. no shortage of places you can get alerts from.

Recommended: The Best Place To Get Stock Picks

Minervini Press Access Pros And Cons

Minervini Press Access Conclusion

On the surface Mark Minervini looks like one of the best traders of all time.

He's gotten returns as high as 200% over multiple years and has won many investing championships.

He also has books that are popular and long Wall Street history.

But I have my concerns.

Mark doesn't have a track record that you can look back on inside his trading group.

You can't look at the prices he bought stocks at or look at his losers.

Which is concerning because many customers complain they lose money following Mark's alerts.

How is this possible if he's making 300% in trading competitions?

Well the obvious answer would be he's front loading the picks and dumping them when his audience buys them.

That could explain the huge discrepancy between Mark and his customers.

I don't have proof this is happening because I don' have access to Mark's trading account.

If it were true, though, he wouldn't be the first to do this.

All Mark has to do is post his positions after he closes them and all these questions could be answered.

Until then I'd say pass.

Here's A Better Opportunity

I'd pass on Minervini Press Access - there's just too many red flags and it's expensive without a refund policy.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

I was a member of Minervini Private Access for several years and attended his Master Trader Program. Minervini is very knowledgeable, and at times, Minervini posted sound stocks and excellent trades, and I would recommend his books. However, it seemed to me that he also used his knowledge and skill to exploit the hope and greed of his clients.

First, I think his service is overpriced at $6000 a year, and his Master Trader Program is overpriced at $5000. Also, I think Minervini is a terrible teacher. In the question-and-answer session, Minervini would commonly get irritated at his client’s questions and criticize their questions. I think that you can find better services and programs at a lower cost with more effective teachers.

Second, Minervini focuses on volatility contraction in stocks because when the stock moves to either the upside or downside, it can be explosive especially if the stock is thinly traded. However, the stock can also be manipulated especially if the stock has weak fundamentals. Each week, Minervini would post the stocks he was watching at the market open, so you did not have time to research them, and the stocks would commonly change from week to week. Thus, it would be a challenge to get a strong understanding of the stock’s fundamentals.

During market hours, Minervini would put out a “breakout alert” or “buy now” alerts on the stocks he was watching as the stocks were breaking out. At times, the breakout was a legitimate market induced breakout because the stock was heavily traded. However, commonly the stock was thinly traded with weak fundamentals, and the stock would surge in value, and then come crashing down. At times, I saw the service would put out a breakout or buy now alert on a stock. I looked at the stock on Market Smith, and it was not breaking out, but moments later, it broke out. It could have been a lag in my internet, but it happened several times, so it seemed as if Minervini or the service was creating the breakout, pumping it to their clients, and then selling into the manipulated demand. Also, Minervini would add stocks to the watch list during the trading session. At times, just after adding the stock, the stock would breakout and at times, eventually crash down. Minervini even admitted to “popping” stocks at times because his account size was so large.

Minervini said one of his tactics was to enter the trade with large size, sell a portion into strength, and then free roll the rest, which is a sound strategy, if the stock is breakout on fundamental reasons and not manipulation. Thus, it seemed his service was alerting their clients to a combination of both legitimate and manipulated stock breakouts.

Minervini also talked a lot about the compounding effect of small profits turned over frequently enough to accomplish your goal. This is a sound strategy, but the hard part is consistently doing it. Unless, let say you hypothetically pumped up a thinly traded stocks with weak fundamentals to your clients after you purchased large amount of the stock to create a breakout. Then, you sold your shares after your clients drove up the price. If you do that frequently enough, you might be able to win something like the US Investment Championship.

I lost a lot of respect for IBD because they give this guy a lot of airtime.