Dylan Jovine of Behind the Markets just released a new stock teaser.

In this presentation, Jovine claims "living software" is Ukraine's "secret weapon" against Russia.

Ultimately, this is a teaser that pitches three AI stocks in a special report titled "Search & Destroy: 3 AI Software Stocks Revolutionizing Warfare."

The good news is that Dylan Jovine left enough clues to figure out two of these stocks.

I reveal them below and give you some information on them so you can determine if they're worth investing in.

Let's get started!

Dylan Jovine AI Stocks Summary

Creator: Dylan Jovine

Newsletter: Behind The Markets

Stocks: Palantir and C3.ai

There are enough clues to figure out two of the AI stocks that Jovine is pitching.

One of them is Palantir, which is in data mining and was founded by Peter Thiel, Alex Karp, and Joe Lonsdale.

Their main software is called Palantir Gotham and helps people integrate, visualize, and analyze large amounts of data from disparate sources.

It essentially helps organizations make decisions based on data.

According to the CEO of Palantir, Ukraine is using their software to "target" Russian forces.

In the past, this company has helped the government find Osama bin Laden.

The next stock is C3.ai, which is a pure-play AI stock.

They use AI to help companies interpret data to make decisions as well.

Jovine is pitching them for their ability to help maintain aircraft and is being adopted by the military.

This stock is more risky than Palantir, and its growth is expected to slow down a lot this year.

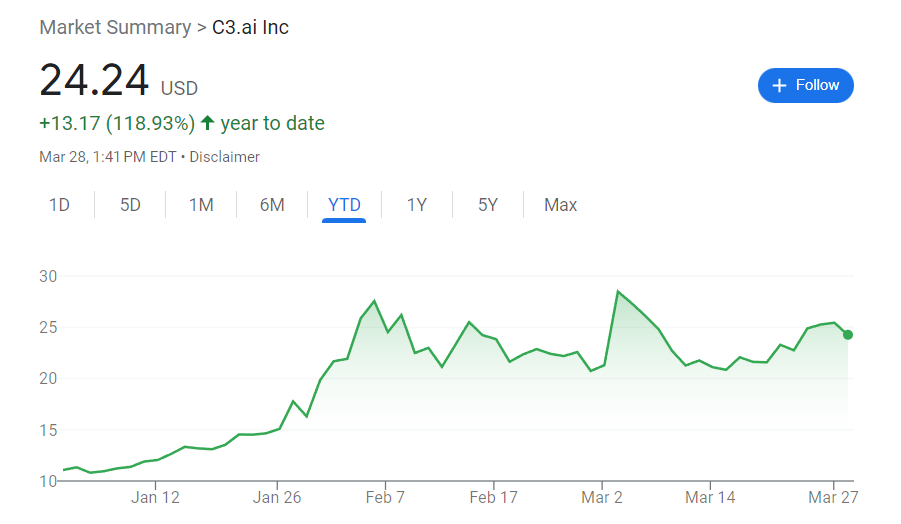

Despite this, the stock is one of the best performers of 2023 so far and is up over 100% year to date.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Jovine Stock Presentation FAQ's

I'm guessing you have some questions about this stock presentation.

Here are some common questions about this pitch and their answers:

1) What Is The Theme Of This Presentation?

Dylan Jovine likes to make stock presentations based on war and conflicts.

In the past, he's recommended stocks based on a possible invasion of Taiwan from China and things like that.

This time, he's focusing on Ukraine and Russia.

He's calling this war the "first AI war."

And early in the presentation, he shares this photo of Zelensky and a mystery CEO:

To prove this idea, Dylan shares several news articles that make the same claim.

This is a battle that will come down to who has the better AI systems directing their operations.

And according to Jovine, "there’s one small software company at the center of this revolution."

And that "its AI software is on the laptops of every Ukrainian decision-maker in uniform."

And Jovine goes so far as to say this company offers you a 5,633% return on investment.

This number is based on gains a different software company called Autodesk accumulated, which Jovine says reminds him of the company he's pitching.

2) What Are Some Clues for This Stock?

Luckily, Dylan leaves behind a lot of clues and article clippings about this company, which makes it pretty easy to figure out what he's pitching.

Besides sharing a photo of the CEO, Jovine leaves behind these clues:

- The US Army signed up to buy their software on October 6, 2022.

- Homeland Security signed up to buy their software on September 26, 2022.

- US Space Command signed up to buy their software on June 2, 2022.

- England bought software on December 21, 2022; Australia bought its software on November 20, 2022; and Japan bought its AI software on January 4, 2021.

- CDC, FDA, Lockheed Martin, and Hyundai all bought the software.

That's a lot of clues!

The company Jovine is talking about is Palantir.

What do they do?

We'll go over that in the next section.

Recommended: After Reviewing 100+ Stock Picking Services, This One Is My Favorite

3) What Does Palantir Do?

Palantir was a private company for many years before going public in late 2020.

What they do and who founded that company created a lot of buzz for them.

In the past, they've helped intelligence agencies with data mining to predict and prevent terrorist attacks.

They apparently helped the government locate Osama bin Laden as well.

Not to mention one of their founders is the famous Peter Theil, who makes headlines whenever he does anything.

4) What Are The Pros And Cons Of Palantir?

Palantir has a lot going for it, but there are still some things to be worried about as well.

Here's a list of pros and cons about Palantir, starting with pros:

Pros:

- Lots of cash, no debt: This company is not fragile and is not in danger of going bankrupt. They have no debt and have $2.5 billion in cash on hand.

- Big market: Andrew Yang called data the new oil when he ran for president, and there's truth to that. All major markets have to analyze more data than ever from government intuitions, financial institutions, and more. There's a big market for Palantir.

- Strong customer base: Many of Palantir's customers are major government agencies and Fortune 500 companies.

- Reasonable stock price: When the stock first went public, it exploded but fell like many tech companies did in the past 18 months. Their stock is around $8, which is much more reasonable than its previous high of $35.

Cons:

Here are some things you should worry about:

- Dependent on Government Contracts: They have strong revenue from the private sector, but much of their revenue relies on government contracts, which can come under pressure from budget cuts.

- Limited operating history: This is still a young company, so it's hard to assess its long-term prospects.

- Reputational risks: The work this company does with law enforcement and government agencies could hurt its overall reputation. Plus, a company like this is at the whims of regulators.

Overall, though, smart investors seem to believe the stock is well priced right now at $8 and worth investing in.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

5) What Are The Other Stocks?

There are two other stocks that Jovine is recommending, but he only gives a few clues about one of them.

The pick he drops hints about is C3.ai, which is a company that a different stock picker just pitched last week.

Palantir isn't really considered an AI company, but C3.ai is a pure-play AI company.

They make software that helps companies and government agencies make decisions based on AI data.

This stock is more of a gamble compared to Palantir.

In the past, this company has shown strong revenue growth but has slowed down a lot this year.

Despite this, C3.ai has been one of the top performing stocks of 2023 and is up over 100% this year in just 3 months.

There are not a lot of pure-play AI stocks to buy.

But with the recent rollout of ChatGPT, people have been looking for AI stocks to invest in, and C3.ai has really benefited from that.

This is the best explanation of why the stock is up so much this year.

People are very enthusiastic about AI at the moment.

But because the stock has gained so much this year, it's definitely valued highly based on its revenue and earnings.

6) Is Behind The Markets Worth Buying?

The last question to deal with is whether Behind the Markets is worth buying.

Now that you know 2 out of the 3 stock pitches Jovine is making, it's not necessary to buy his newsletter.

But you might still be wondering if the stock picks in this newsletter are winners.

I wrote a major, in-depth review of this newsletter earlier this year after buying it.

I don't think Jovine is a bad guy or a scammer like many other stock pickers.

But I don't recommend Behind the Markets.

It's never really been able to beat the market, and it got pounded in 2022.

So if you can't beat the market, you're not worth listening to.

Recommended: The Best Place To Get Market Beating Stock Picks

Wrapping Things Up

So that's the end of my post covering Dylan Jovine's AI stocks.

There's a lot of buzz right now for AI, and usually when a sector catches fire, stock pickers start releasing these kinds of presentations.

This is the second pitch I've come across pitching AI stocks, and I expect many more in the near future.

However, there aren't too many AI companies out there, so I expect to see the same companies pitched by different people.

This is already the second time I've seen C3.ai pitch.

Are you going to invest in AI stocks, or do you think this is just a fad?

Let me know in the comments!

Get High Return Stocks!

Click below to get free expert stock picks: