Jeff Brown is running a teaser hyping up what he calls The Apple Car.

He claims a certain company could lead a $10 trillion revolution and could be a Tesla killer..

Jeff even headlines the presentation as R.I.P. Tesla.

There's one problem, though.. he won't reveal the company unless you buy his newsletter.

Well I have good news - I was able to figure out the stock and will be revealing it below.

Additionally, I'll show you some information on whether it's a good investment or not.

Plus you'll get some insights into Jeff Brown.

Let's get started!

Jeff Brown Apple Car Summary

Company: Most likely NXP Semiconductors (maybe Taiwan Semiconductor or Foxconn).

Stock symbols: NXPI

Current price: $158

The stock Jeff is talking about in this presentation is most likely NXP Semiconductors.

They make chips for Apple and are the second largest manufacturer of car chips.

The idea is they'll supply Apple with their chips when they launch their car.

Who knows if that will actually happen, though.

Overall a good company that many investors like for reasons that have nothing to do with Apple.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Figuring Out Apple Car's Stock

Recommended: The Best Place To Get Stock Picks

Everyone has the next big electric car stock and Jeff Brown claims he does too.. and this one has the chance to be the king of this $10 trillion market.

This presentation starts by building skepticism around Musk.. claiming he's shifting focus from Tesla to Twitter and is dumping Tesla stock.

Jeff Brown then shifts attention to the long rumored Apple Car and how it's going to compete against Tesla in the Near Future.

After this Jeff goes on to hype what an Apple Car would mean.

He claims it would be 60 times bigger than the iPhone.

Next, Jeff starts dropping evidence that Apple is indeed working towards building cars.

He mentions Project Titan as his primary source of evidence.

Jeff even claims Elon Musk has confirmed rumors of the Apple Car.

Eventually we start getting into information about the mystery company Jeff is teasing and what it has to do with Apple.

Apple teams up with companies with their products and when they do stock in those companies tend to explode.

Jeff drops more hints about the company and claims it makes computer chips and already has deals with Apple.

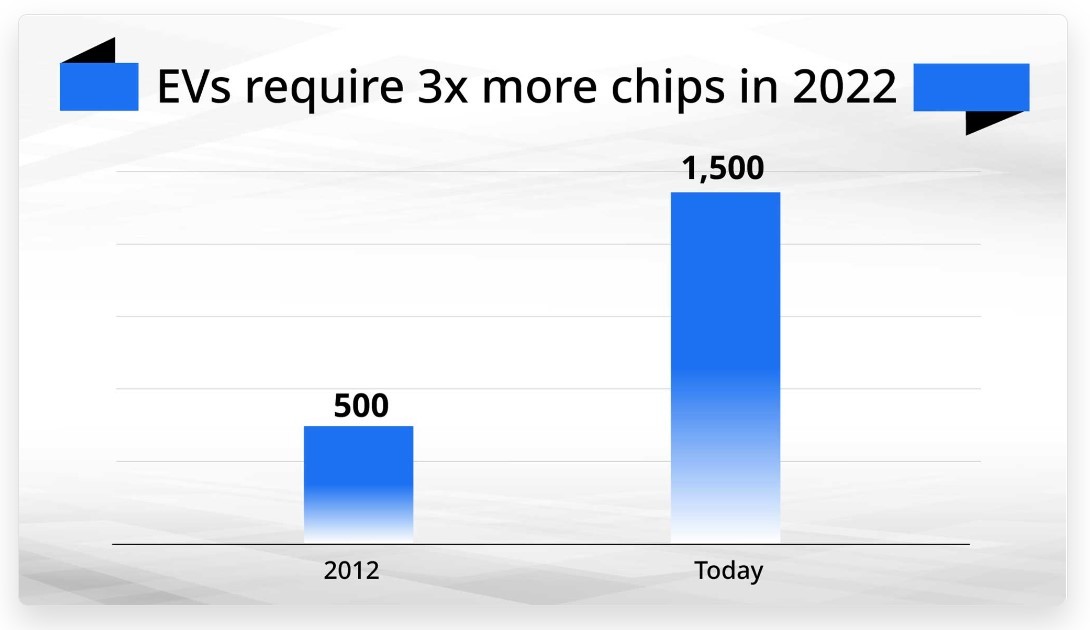

The idea is electric cars use 3 times the amount of computer chips than regular cars and Apple will rely more on this company for chips:

There's really only three companies that would fit this description. Taiwan Semiconductor, Foxconn and NXP Semiconductors.

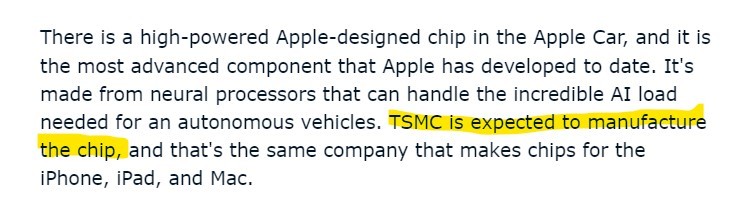

Taiwan Semiconductor makes chips for Apple already and is a stock Jeff has pitched many times before.

In another article it's rumored Taiwan Semicondoctor will be making the chips for the Apple Car:

However, Jeff claims the company in question is 50 times smaller than Apple and Taiwan Semindoctor is only about 5 or 6 times smaller.

The next company is Foxconn.

Foxconn recently bought a chip factory that specializes in car chips:

Foxconn is a manufacturer for Apple and is around 50 times smaller as well.

Additionally, Foxconn unveiled three different electric vehicles last year.

Their stated goal is to build electric cars for other brands instead of selling them under their own brand.

However, Jeff claims the company being teased has a "stranglehold" on producing EV chips.

That doesn't sound like Foxconn.

This leads me to believe the company being teased is NXP Semiconductors.

NXP Semiconductors makes chips for Apple, is around 50 times smaller than Apple and is heavy into car chips (they're the second biggest car chip manufacturer in the world):

NXP Semiconductors seems like the best match.

So the question now is if you should invest in them..

Recommended: The Best Place To Get Stock Picks

Is NXP Semiconductors A Smart Investment?

If you're going to invest in NXP Semiconductors don't do it because of the idea of an "Apple Car."

These rumors about Apple making a car have been around for nearly a decade and nothing ever seems to happen.

From what I've seen Apple is more likely just to make the hardware and software for driverless cars instead of actually making Apple cars.

Who knows though..

Additionally, this isn't the first time Jeff has run a stock presentation hyping up a potential Apple Car stock.

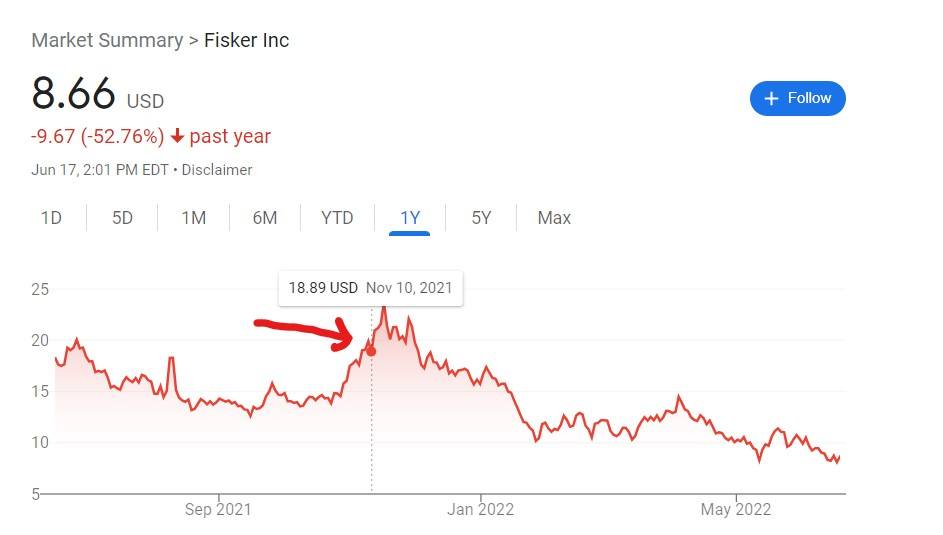

In the past Jeff claimed a company called Fisker could potentially be a manufacturer for Apple Cars.. he even used the same title "R.I.P. Tesla"

Here's an article that covers it

This company crashed after Jeff recommended it, though:

Fisker was run by a guy that wasn't very trustworthy and the stock hasn't done well.

This hasn't deterred Jeff from sticking with the idea of an Apple car.

NXP does seem like a strong stock, though, for reasons that have nothing to do with Apple.

Their revenue is growing and they have plenty of cash to invest in new research.

Motley Fool claims this stock will likely "play a prominent role in the EV movement."

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Jeff Brown's Many Red Flags

Jeff Brown has made some good stock picks in the past.

For example, he was pretty early on predicting NVIDIA and AMD which are excellent stock picks.

Does this mean I think you should buy his newsletter The Near Future Report?

I don't think right now is the best time.

As I detailed in this article Jeff's picks of late haven't been great.

This is due to growth stocks and tech stocks going down, which he primarily focuses on.

There's some other red flags you should know about as well:

Red Flag #1: Agora Owned

Agora owns Brownstone Research which is the publisher for The Near Future Report.

The problem with this is Agora is a horrible company and extremely predatory.

Just last year they were fined $2 million for defrauding senior citizens:

Agora is massive, though, and makes HUNDREDS of millions a year.

They'll gladly pay this fine if it means they can continue to do business.

As Truth In Advertising proves they continue to rip off the elderly:

Is this really a company that you want to give your money to?

Additionally, all Agora companies market in the same way.

Once you buy The Near Future Report you'll be bombarded with promotions for products that cost thousands of dollars.

The marketing is unethical in my opinion and they'll try anything to get you to buy.

I usually recommend people to stay away from Agora.

Red Flag #2: Jeff's People Lied About Me

This is kind of a personal beef I have with Jeff Brown and Brownstone Research.

They tried to get my Youtube channel taken down because I made a video about them.

The video in question is here:

This video follows the same format as this post does.

Jeff did a presentation hyping up a stock and I figure it out and revealed it.

However, his lawyers tried to claim I infringed on their copyright by giving away paid information, which is a lie.

I just covered the free presentation.

Also, the video is one my lesser viewed video's and only had like 50 views at the time.

They still felt the need to lie about the video and try to get it taken down.

There was a long back and forth between them and Youtube and to Youtube's credit they understood what was going on.

Youtube told Brownstone my video wasn't violating copyright law and kept the video up:

If they're willing to lie about something so small like this.. that likely didn't really effect them at all.. what else are they willing to lie about?

Just makes me not trust them very much.

Recommended: The Best Place To Get Stock Picks

Wrapping Things Up

So there you have it..

We've narrowed down the stock to three companies and I'm pretty NXP Semiconductors is the company in question.

It matches up perfectly!

Many people think it's a good stock as well.. but for reasons that have nothing to do with Apple.

So if you're thinking about investing do so without the idea of the Apple Car thing happening.

Lastly, I'd probably pass on The Near Future Report.

I personally don't trust the people at Brownstone and Agora.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: