Brownstone Research is an investing newsletter publisher run by Jeff Brown.

They claim they can help you find the most disruptive tech investments..

Is this true or is this a scam?

I'll help you answer this question in this review.

Plus you'll see some of my personal interactions with Brownstone Research.

You'll know if they're worth buying from by the time you're done reading.

Let's get started!

Brownstone Research Summary

Creator: Jeff Brown

Price to join: $49 to $10,000

Do I recommend? Not really

Overall rating: 2.5/5

Browstone Research is a decent publisher.. their products are average and nothing special.

However, there's red flags about Brownstone that makes me not recommend them.

The biggest red flag is they're owned by a horrible company that targets senior citizens with scams.

Because of this I'd avoid.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Brownstone Research And Awful Agora

Here's a little secret..

One company owns most of the investing newsletters out there and they own a majority of the publishers as well.

The company's name? Agora.

Agora owns Brownstone and many other popular publishers like Stansberry, Oxford Club, Angel Publishing and more.

This company is an absolute behemoth and they're also extremely predatory.

Agora is constantly ripping customers off and selling fraudulent products.

Their main targets are senior citizens.. they were just fined $2 million for targeting older people with financial AND health scams:

The problem is $2 million is nothing to them.. they make HUNDREDS of millions every year.

So these fines aren't enough to deter them.

As Truth in Advertising proves, they're still targeting elderly people with scams:

I've caught them running basically the same scam that got them fined $2 million as well.

All Agora publishers and newsletters operate in the exact same manner.

They put out long stock presentations where they hype a company and try to get you to buy their newsletter.

Typically they sell a cheap newsletter as bait and then HEAVILY promote you more expensive products after.

This is what Brownstone does.

The Near Future Report is only $49 to try but Brownstone offers products that cost $10,000.

You will marketed these pricey products in the most deceptive and unethical ways imaginable.

This means trying to scare you, shame you, excite you with promises of easy money, etc.

I almost never recommend Agora newsletters because of this.

It's just too much of a headache to deal with them.

Recommended: The Best Place To Get Stock Picks

Bronwstone Lied About Me..

I actually have personal experience with Brownstone and they lied about me to try and get my Youtube channel deleted.

I did a video about a stock presentation Jeff Brown did and revealed the name of the company Jeff was teasing:

In this video I also covered the manipulative techniques Jeff Brown was using in his presentation and the fact that Agora owned them.

Well the people at Brownstone took exception to this..

They filed a copyright claim against the video and tried to get it taken down.

They claimed I was showing copyrighted material from paid reports that weren't available to the public:

This is 100% a lie.

In the video I just covered the FREE presentation Jeff sent out and figured out the company he was teasing through the clues in the presentation.

I did it live on video.

They knew they were lying but were hoping Youtube wouldn't be able to figure it out.

To Youtube's credit they didn't fall for it and kept the video up:

This is just such a scummy move from Brownstone.

I think the video had only 50 views at the time - it just shows how petty they can be and how they'll try to bully anyone who calls them out.

How can you trust a company that lies like this?

You don't think they tell other lies to benefit themselves at the expense of their customers?

Recommended: The Best Place To Get Stock Picks

Jeff Brown's Stock Picking Performance

Often times stock pickers make up their past or at least over hype their resume.

It's not even worth repeating what Jeff says about himself because you have no real way of knowing if it's true or not.

However, a stock picker's resume isn't the most important thing.. their ability to pick a good stock is.

Here's a look at how some of the bigger stock picks Jeff has made in the past have turned out:

CRISPR Therapeutics In April 2022

CRISP Therapeutics is the stock I revealed in the video that Brownstone tried to punish me over.

This company is in the gene editing market and many stock pickers are recommending these kind of gene editing companies.

It's only been a couple months since the recommendation and here's how it's done so far:

Basically the stock has stayed even.

However, it's too early to declare this a winner or loser.

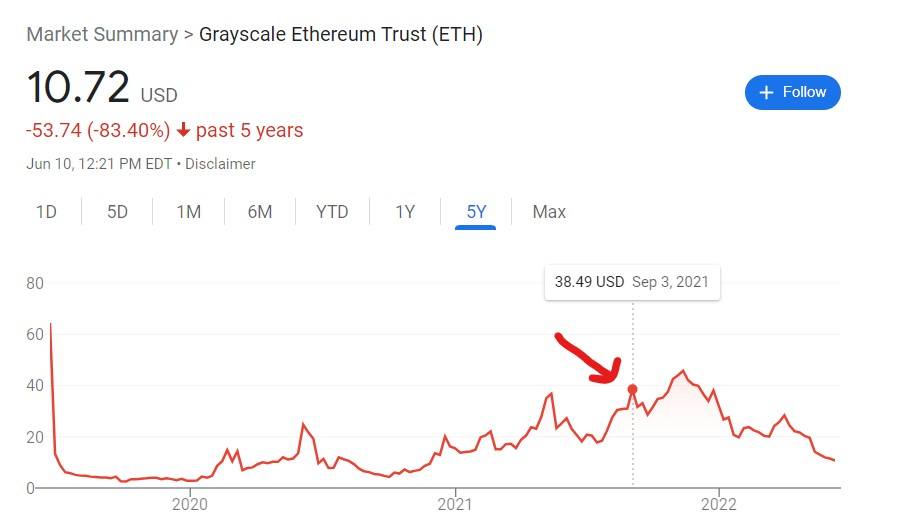

Grayscale Ethereum Trust In September 2021

Grayscale Ethereum Trust is similar to a close end fund that only owns Ether tokens.

I'm not really an expert in blockchain or Ethereum so I couldn't really explain to you what this does or anything like that.

However, it's gone down quite a bit since Jeff Brown recommended it:

It's lost close to 75% of its value in just 8 months.

Not good!

NVIDIA And Cognex In September 2020

In 2020 Jeff Brown teased NVIDIA and Cognex as "Project Xi."

The idea is America will bring back it's manufacturing and start a new cold war against China and President Xi.

NVIDIA makes chips that are used in computers and AI.

Here's how NVIDIA has performed in the mean time:

This stock has done well over the years and peaked at around $350.

To Jeff's credit he's pitched NVIDIA for years and before this presentation.

Definitely a stock everyone wish they bought.

Cognex is the leader in factory automation and barcode scanning products.

Here's how the stock has done:

This stock hasn't done as well.

It was up a little bit for a while but has recently crashed pretty hard.

There was definitely a chance to make money here if you sold at the peak but I don't think Jeff was recommending that.

Amazon, NVIDIA And AMD In August 2020

This presentation teased these three companies as leaders in 6G.

6G is not a real thing and it's just something Jeff made up to get people interested in the service.

What's he's talking about is cloud processing power for machine learning and AI.. he's just calling it 6G.

Amazon is the first stock he recommends and here's how it's done:

It was pretty much stagnant in the last two years but has dropped recently (along with most stocks).

Next up we have NVIDIA and this one is obviously a winner:

Lastly, we have AMD which makes computer processors.

Here's how the stock has done:

This stock has done decent.

Despite going down for about 6 months it's still higher than it was when Jeff recommended it.

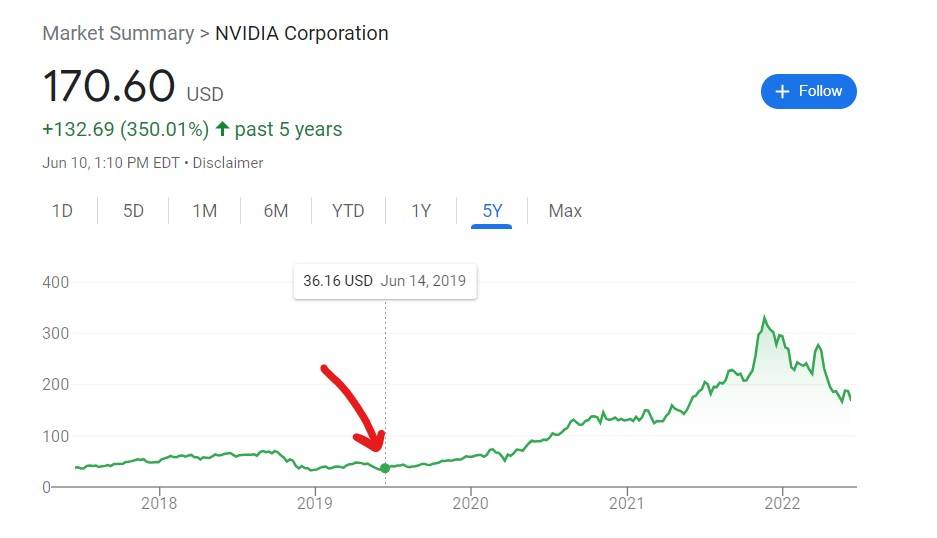

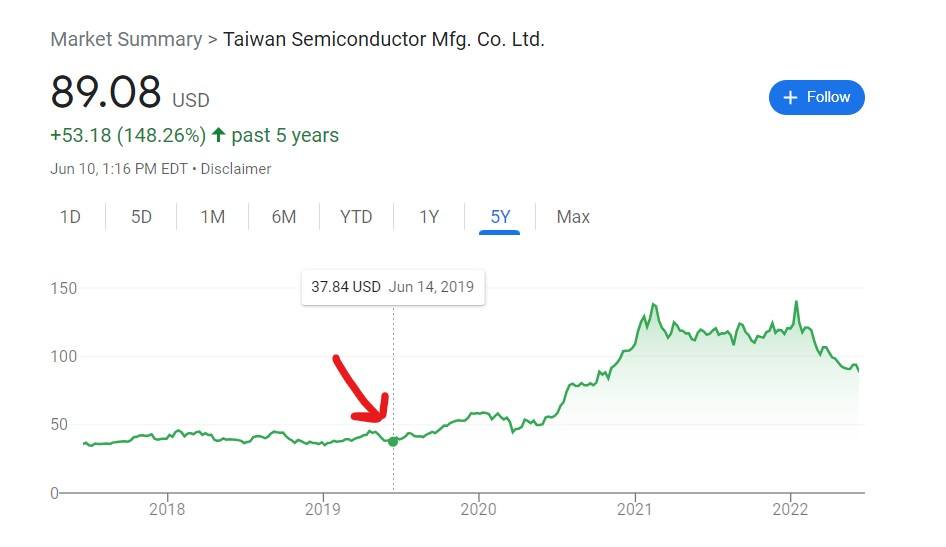

NVIDIA, AMD And Taiwan Semiconductor In June 2019

You're starting to see a theme with Jeff.. he likes to recommend NVIDIA and AMD.

The earlier you listened, the better your results would be, though.

For example here's how NVIDIA has done since June 2019:

Here's AMD since 2019:

Taiwan Semiconductor makes chips for NVIDIA and AMD and others.

Here's how the stock has done:

This is was definitely a winning presentation from Jeff.

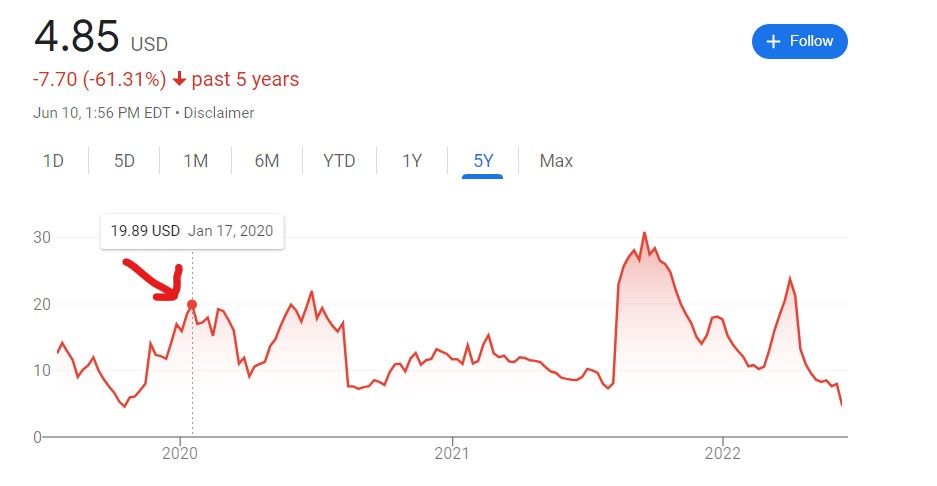

Fulcrum Therapeutics In January 2020

Fulcrum Therapeutics is a company that Jeff Brown called his "#1 Timed Stock."

This is a biotech stock that had important trial results being released at the time of this presentation.

However, the stock has floundered for years and is down significantly overall:

So definitely not a winner!

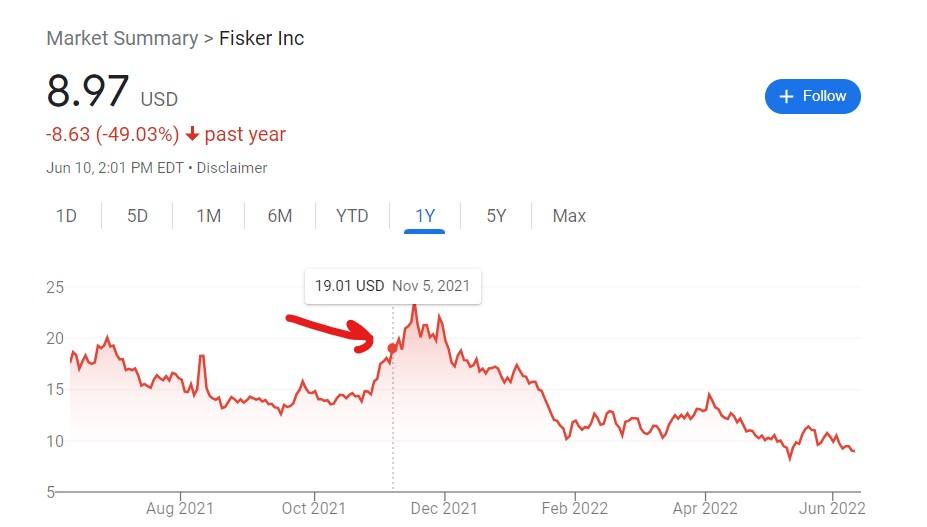

Fisker In November 2021

Fisker is an EV company that came public through a SPAC.

A lot of people love investing in SPAC's but they always seem to do poorly.. at least that's what I've always seen.

You can see this with Fisker as well:

This stock has lost more than half of its value in less than a year and shows no signs of recovering.

Schrodinger In September 2021

Schrodinger is a biotech company which is another market stock pickers like to hype up.

Jeff called this company a "convergence company taking over biotech."

Small cap biotech stocks are extremely hard to predict..

Here's how this one turned out:

This was a horrible stock pick and has lost 70% of its value pretty fast.

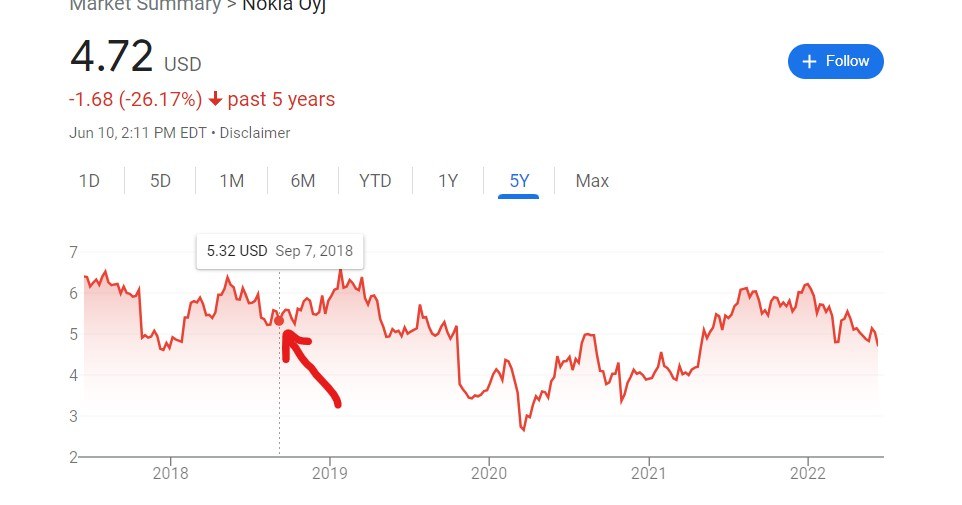

Nokia In September 2018

Nokia has been a stock Jeff has recommended a few different times and he's always presenting it in different ways.

However, it doesn't really matter what he's pitching it as.. it really hasn't done well in the last few years:

This one is definitely a loser.

Overall I think Jeff is a mediocre and average stock picker. He gets credit for recommending NVIDIA and a few others but that's it. Some have lost pretty big as well. You'd probably be around breakeven if you invested an equal amount into all of these stocks.

What Products Is Brownstone Research Selling?

Brownstone is sells various newsletters and investing services.

It pretty much works like all other Agora sales funnels.

There's a cheap newsletter to get you into the funnel and then they try to convince you to buy the more expensive products after.

To be honest cheapest product, The Near Future Report, probably gets the best results.

So if you do buy that newsletter don't feel pressured to upgrade - you'll likely just get worst results.

Here's an overview of each service:

The Near Future Report

This is the flagship product run by Jeff.. like I just said it's also the best product Brownstone offers.

It's also the cheapest and you can find it as low as $49 for the first year and $79 for every year after.

The main focus of this newsletter is large cap tech stocks and Jeff looks to capitalize on upcoming trends.

The reason this newsletter does better is the investing style is much safer than the other newsletters.

Large caps are less volatile.

This service is pretty standard and gives you the following:

- Monthly newsletter with stock picks

- Model portfolio

- Alerts

- Special reports

I wrote a review for this service a while ago which you can read here.

Exponential Tech Investor

A lot of the bad stock picks you saw in the last section came from this newsletter.

That's because the strategy is different than The Near Future Report.

Exponential Tech Investor focuses on small and micro-cap investments.

These are extremely high risk, high reward stocks.

You can make 10 times your money or you can lose 100% of your investment.

These small stocks are extremely volatile and their price can change drastically in a short period of time.

This is only for people that can comfortably afford to lose money and can handle ups and downs.

To be honest even if you have the money to lose I wouldn't recommend this service.. the picks I looked at just weren't good.

Plus it's pricey at $4,000 per year.

Early Stage Trader

This is another expensive upgrade at Brownstone and will cost $5,000 per year.

Early Stage Trader is basically a swing trading service where you look to profit in weeks not years.

Again, this is much higher risk and is only for people that can handle losing money.

The goal is to invest in small tech stocks and profit as quickly as possible.

This requires precise timing so you have to be able to execute trades quickly.

Blank Check Speculator

This newsletter focuses on SPACs.

For whatever reason SPACs are popular to invest in but they don't perform well.

They underperform the market and typically the stocks don't end up doing well.

So I definitely don't recommend this product.. that and the price is $4,000 per year.

Unchained Profits

Unchained Profits focuses on the blockchain and crypto.

Crypto has been taking a beating as of late so not sure this is the time to jump in.

I also don't think you need to pay $5,000 to get blockchain and crypto tips.

There's many cheaper alternatives.

Neural Net Profits

This is definitely a service I don't recommend.

The jist here is Jeff claims he uses AI to spot crypto trades.

These AI trading bots never work out and I've only seen people lose money from them.

It reminds me of The Crypto Cash Calendar - these guys claim to have the same thing and are constantly recommending losing trades as a result.

Again, this is wildly overpriced and costs $5,000 per year.

Outlier Investor

The last newsletter covers growth stocks.

Growth stocks seem overpriced based on their financial details but are expected to gain revenue quickly.

Cathie Wood is big into these stocks.. she's also down big time right now.

Again, $4,000 per year for these stock picks just isn't worth it.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Brownstone Research FAQ's

Still have some questions about this publisher?

Here's some answers to any remaining questions you might have:

1) Is Jeff Brown Legit?

I think there's a ceiling to how legit you can be if you work for Agora.

Agora is so terrible that only a certain kind of person can work for them.. and engage in the marketing that they do.

I do think Jeff can pick stocks when he just focuses on large cap tech stocks.. like with The Near Future Report.

But I wouldn't trust his other services.

I'm skeptical anyone can be an expert in swing trading small cap tech stocks.

2) Is There A Refund Policy?

Brownstone does what other Agora publishers do.. which is offer a refund policy on the cheap newsletters and not on the expensive ones.

Basically you'll just get a credit if you're unhappy with the services that cost thousands or a free year.

But typically you won't be able to get your money back.

3) Are The Prices Fair?

Only The Near Future Report is priced fairly and that's because it's just bait.

They use cheap newsletters to get you into the marketing funnel.

The other products are way overpriced and won't likely perform as well as The Near Future Report.

4) What's The Biggest Red Flag?

The biggest red flag is Brownstone is an Agora owned publisher.

All Agora publishers act int he same exact manner.

They market in manipulative ways, they constantly try to upsell you into buying expensive products and often times don't perform well.

Additionally, there's some investing strategies I don't like at Brownstone.

Specifically swing trading small tech stocks and investing in microcap stocks.

Those are just too volatile for me.

Brownstone Research Conclusion

Brownstone is the same as any other Agora Publisher.. I've reviewed many Agora products, including:

And many more.. they're all basically the same.

You get a monthly newsletter with some stock picks, model portfolio, alerts and very manipulative stock presentations.

I think The Near Future Report is decent but I'd steer clear of anything else sold at Brownstone.

Just ignore the aggressive promotions.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Wish I’d seen this a while back…Jeff Brown also highly recommended Akoustis (AKTS)…I bought at $6 it’s now…wait for it…. $0.57