Matt McCall is out with a new product called The McCall Report.

He claims he can help you find stocks that are ready for crazy growth..

Is this legit or just a scam?

You'll get an answer to that in this review.

Additionally, you'll get insights into his service you won't find anywhere else.

This includes a look in McCall's past and stock picking performance, important background information and more.

You'll know if this newsletter is right for you by the time you're done.

Let's get started!

The McCall Report Summary

Creator: Matt McCall

Price to join: $49 to $79 per year

Do I recommend? No.

Overall rating: 2.5/5

The McCall Report is a new investing letter from an old face.

Honestly there's no reason for this newsletter to exist.

There's already a million services that do exactly what this one does.

Matt McCall's history doesn't make me believe this will be any better than already existing newsletters.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

I Rarely Recommend Agora Products

The McCall Report is published by Stansberry Research, which is owned by Agora.

Agora is the biggest distributor of financial investing newsletters and they own dozens of publications - they sell hundreds of financial products.

The problem with Agora is they are an extremely predatory company and have proven they're most concerned with making money for themselves.

I only recommend an Agora product if it's exceptional and I just don't think The McCall Report is that.

Here's a couple reasons why you shouldn't get involved with Agora:

They Sell Scams To Senior Citizens

Agora sells health products along with their financial products.

Just last year they were fined $2 million for selling fraudulent health and financial products to senior citizens.

The health product was a diabetes cure they claimed could reverse diabetes in 28 days without exercise or diet change.

The financial product lied about getting thousands a month from the government.

Both were obvious scams and only a soulless company could target the elderly with these products.

The thing is Agora makes so much money from doing this stuff they haven't changed their marketing style at all.

In 2021 they made $168 million.. a $2 million fine is nothing.

In fact they'll gladly pay that if they're allowed to continue to operate.

Many investigations into Agora since the $2 million fine show they're continue to target seniors:

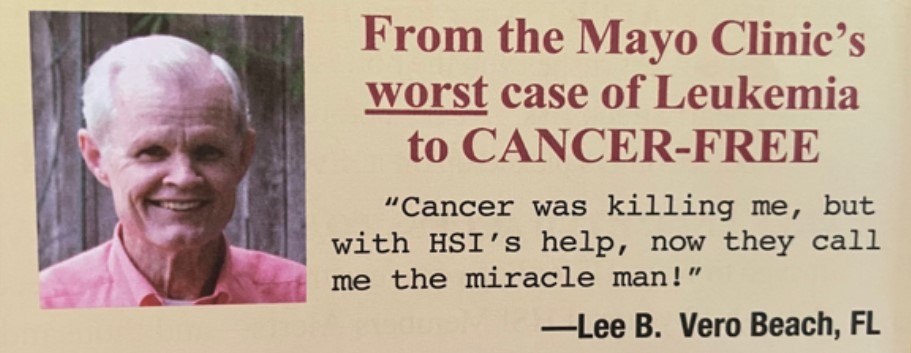

Until the FTC does more than small fines Agora will continue to publish ads like this one:

Does this seem like a company you want to give you money to?

Do you feel like they're being completely honest when they sell products?

Massive Upsells

The McCall Report is inexpensive like many other Agora products are.

However, when you see an investing newsletter from Agora that's only $49 per year, know this - you're going to be promoted more expensive products HEAVILY after you buy.

This means getting up to 20 promotional offers a day in your email.

Again, Agora only cares about making money for themselves.

They'll use all the most dirty marketing tricks to get you to spend thousands to tens of thousands on upsells.

This means using fear, shame and promises of riches to get you to enter your credit card details.

It's not worth the headache most of the time.

Recommended: The Best Place To Get Stock Picks

Who Is Matt McCall?

Matt McCall is the creator of The McCall Report.

If I had to describe Matt McCall in a single sentence it would be investing entertainer.

Before Matt entered the investing world he apparently was caught with some marijuana with the intent to sell.

Later the charges were dropped (I'm guessing he had a good lawyer because these were felony charges).

After this Matt briefly worked as a stock broker for Charles Schwab - he was only there for a year.

This is when McCall made the transition to investing entertainment.

He left Charles Schwab to join Wall Street Radio where he'd host a daily show called Winning on Wall Street.

You'll see Matt on TV a lot and according to him he has made over 1,000 TV appearances.

Before launching The McCall Report he had newsletters at InvestorPlace. Here Matt ran a newsletter with a guy that defrauded investors and was fined $30 million for doing so.

Now Matt is at Stansberry.

So can Matt pick good stocks?

We'll look at that in the next section.

Matt McCall's Stock Performance Is Inconsistent

Because Matt has been in the newsletter business for a while he's done a lot of stock teasers.

These are long form sales pitches where he hypes up a stock or company.

The goal is to get you to buy his newsletter and then he gives you the stock.

These presentations can be over a hour long and are supposed to be the best stocks Matt has to offer.

Here's how they've performed in the past:

Silvergate Capital In February 2020

Back in February 2020 Matt ran a teaser for his investing newsletter Early Stage Investor.

In the presentation he talked about a company that he claimed was a "crypto bank about to take off."

He was talking about Silvergate Capital.

In the teaser Matt claimed the stock was at $16 and could pop to $75 a share in under 24 months.

Was he right?

Yes!

In fact, the stock reached as high as $219 at one point and $160 just one year after the recommendation.

This is an absolutely fantastic stock pick and anyone who took Matt's advice on this one is very happy.

BeiGene Pharma & Asceletis Pharma In November 2019

In 2019 Matt ran a teaser with the headline "300X Your Money" and was alluding to a Chinese Biotech company called BeiGene.

In the pitch Matt called this one of his "safest and most lucrative opportunities" he's ever uncovered.

Here's how it's performed:

This is another good stock selection.

It basically doubled in less than a year.

Hopefully people sold at the high point because it's down now.

Another stock in this teaser was Ascletis Pharma.

This one hasn't done as well:

This one was down for a number of years.

It's had a bit of a resurgence this year but nothing crazy.

Valeris and Ophthotech In August 2015

Next up we have two stock picks and they were made for Matt's newsletter called FUTR Stocks.

In this pitch he claimed Valeris and Ophthotech were "under the radar stocks."

First up we have Valeris:

This one was definitely a loser unless you were able to sell before its drop off.

I don't know if going from $14 to $20 would be enough to sell, though.

Next up we have Ophthotech:

This has done absolutely terribly and basically lost all of its value.

Anyone who invested in this stock definitely lost big.

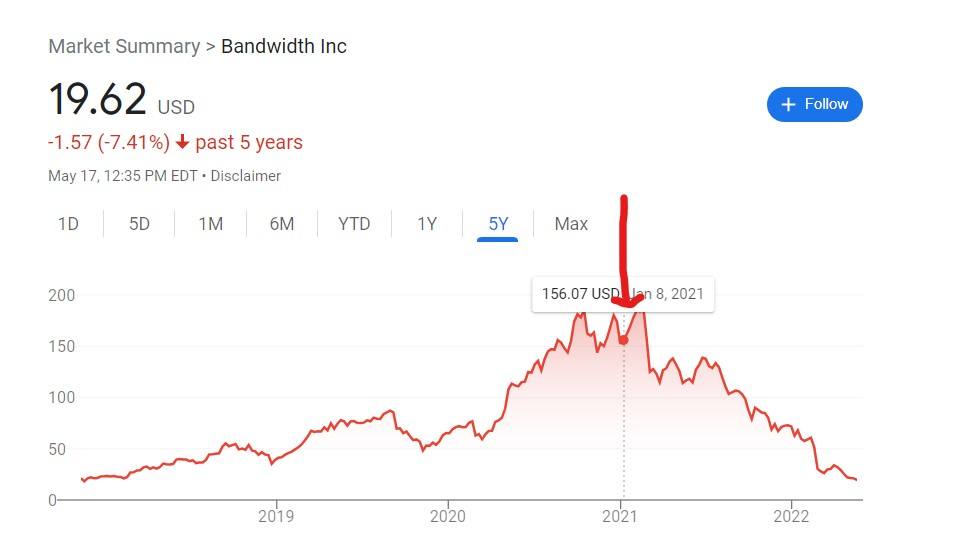

Bandwidth And Five9 In January 2021

These are the last two stocks we're going to look at.

Bandwidth and Five9 were stocks hyped as Matt's "favorite hypergrowth stocks of 2021" for a newsletter called Power Portfolio.

This is the newsletter Matt ran with Louis Navellier, who was fined for defrauding investors.

Here's how Bandwidth has performed since being recommended:

This stock absolutely tanked and it tanked FAST.

It's essentially lost all of its value since being recommended and plummeted from $156 to $19.

Ouch.

Next up we have Five9:

This has been another bad pick so far.

It was consistent for a year but has dropped around 40%.

Recommended: The Best Place To Get Stock Picks

What Is The McCall Report Offering?

The McCall Report is very similar to other investing newsletters and the newsletters Matt has run in the past.

Here's a look at everything that you get:

V-Toll Stock Pitch

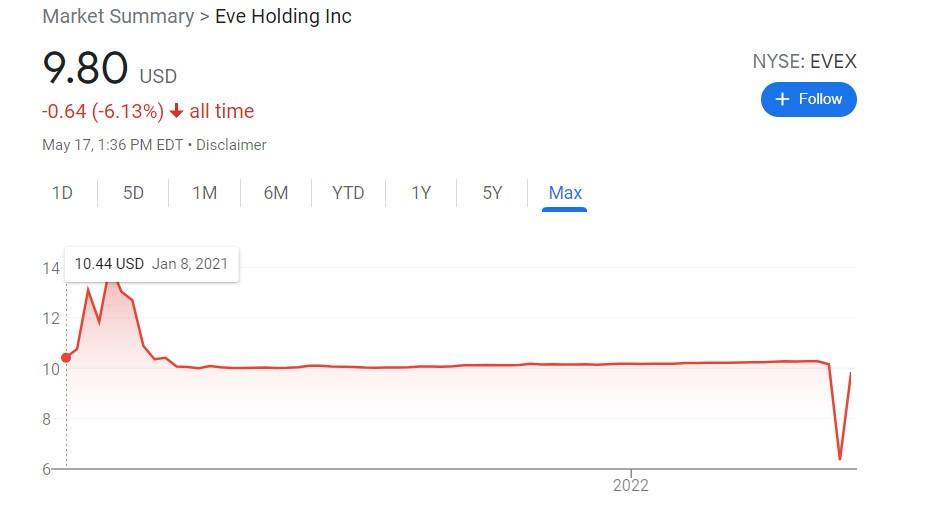

The main teaser going around for The McCall Report is what Matt calls V-Toll.

V-Toll stands for vertical take off and landing planes.

These are vehicles that take off and land without a runway and essentially would work like taxis in urban areas.

The company that Matt is teasing here is Eve.

Eve recently went public after a SPAC merger.

This is definitely a long term investment if you're interested.

Here's how the stock looks right now:

Most people I know believe it's too early to start investing in this technology - there's a lot of competitors at the moment.

However, if knowing the name of this stock is all you wanted, you don't have to buy this newsletter anymore!

Monthly Issue Of The McCall Report

This is basically the main part of what you're paying for,

Once a month you'll get a new issue of The McCall Report which details new investment ideas and gives updates on previous stock picks.

You'll also get the latest news affecting stocks that you own.

Model Portfolio

This is other main part that you're paying for.

When you sign up you'll get access to the model portfolio.

This is a new service so the model portfolio is still a work in progress and isn't complete yet.

Once the portfolio is built out I'm guessing there will be around 15 to 25 stocks in it at all times.

Additionally, there will be buy prices and sell prices on these stocks.

Special Reports

The special reports re similar to the stock teasers we covered in the last section.

They're entire reports that cover a specific stock or company.

As you also saw in the previous section these special report picks don't always work out.

The current special reports are:

- How Auto Industry Disruption Can Lean To Triple Digit Gains

- How To Profit From The Rapid Changes In Health Care

These special reports tend to change a lot.. so it could be different by the time you read this review.

Quarterly Updates With Matt

Every 3 months you get a hour update on your portfolio.

Additionally, he claims he'll answer the most frequent questions he gets as well as news on the current open positions.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

The McCall Report FAQ's

Still have some questions about The McCall Report?

Here's some answers to any remaining questions you might have:

1) What Does The McCall Report Cost?

There's a few different prices depending on where you buy it.

At the Stansberry website I believe it's $199.

If you find the promotional offer for it you can get it for either $49 for the first year and $199 per year after or $79 for the first year and $199 per year after.

The second option comes with a few extra special reports and a year to another Stansberry product called True Wealth.

The McCall Report is just an entry level newsletter so this price makes sense.

Matt and Stanberry have much more expensive products for sale, though, and they will be heavily promoted to you.

2) Is There A Refund Policy?

Yes but it's not very good.

You get 30 days to get your money back.

That's not nearly enough time to see if the stocks are worth it or not.

You'd need at least 6 months to determine that.

3) Is Matt McCall Legit?

Matt has some good stock picks but I have a hard time calling anyone at Agora or InvestorPlace (his previous employer) legit.

These guys are all mostly entertainers.

Just look at the headlines of some of their pitches if you don't believe me.

Every promo they cut is like a professional wrestler.

I'm sure there's some legitimate research going on but the marketing is so over the top (which includes what Matt is doing).

4) How Much Do I Need To Invest?

On the sales page it's recommended that you have at least $3,000 to invest which is a decent number.

If you truly want to participate in this newsletter you'll need more, though.

I'd say around $10,000.

You'll also need money for new investment ideas.

A lot of these stock picks will be growth stocks in emerging industries so they're going to be cheap.

I'd probably want $500 for every new stock pick.

5) Is The Investing Strategy Legit?

A lot of the stocks Matt focuses on are tech and growth stocks - both are performing horrible right now.

A couple years ago these were good investments but not at the moment.

Additionally, there's a lot of small cap stocks being recommended.

These stocks are hard to predict and pretty volatile.

You can lose your investment pretty quickly as I demonstrated earlier with Matt's teaser picks.

I'd only invest in these stocks if you're ok with risk and have extra money to gamble.

6) Are There Similar Products?

I've reviewed a ton of similar newsletters.

Some of them include:

And more.. there's no shortage of investing newsletters out there.

Recommended: The Best Place To Get Stock Picks

The McCall Report Pros And Cons

The McCall Report Conclusion

The last thing the world needs is another Agora newsletter.

There's already hundreds of them available across various publishers.

But Agora didn't make $170 million last year by not launching new products.

I only like a couple of Agora's newsletters.

For example, Oxford Income Letter is a good one.

But even when I recommend a product like that I have to put a million warnings about dealing with Agora.

The McCall Report is new but doesn't seem worth the Agora headache to me.

Unless the results end up a lot better than McCall's previous newsletters I'd just skip over this one.

Here's A Better Opportunity

The McCall Report is another typical Agora newsletter.

There's no need to fall for they hype and buy it.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Surely yes. That’s the way it is. He was advising mostly failed losing stocks.

At most, you could make a speculative profit on them. That’s why he was summarily fired from Investorplace.

Well the same company that owns InvestorPlace, owns Stansberry. He wasn’t fired, he was just moved to another newsletter.