Strategic Fortunes is an investing newsletter from Ian King.

He's promises if you join you'll learn how to make money with the stock market.

Is he being honest or is he a scam artist?

You'll get an answer to that questions in this review.

Additionally, you'll get a lot more information to help you decide if this product is right for you.

This includes background information, a look into his stock picking performance and more.

All your questions will be answered here!

Let's get started!

Strategic Fortunes Summary

Creator: Ian King

Price to join: $97 per year

Do I recommend? No.

Overall rating: 2/5

There's just way too man red flags with this newsletter to ignore.

From the publisher, to not being able to verify anything in Ian's past, to the bad recommendations...

I don't think you should buy this product.. if you do I think you're going to lose money.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Agora Scams Seniors!

Before we get into Strategic Fortunes and Ian King, I want to talk about the owners of this newsletter - Agora.

Agora is the largest distributor of financial newsletters in the country and they own the publisher that sells Strategic Fortunes (Banyan Hill).

Agora is an EXTREMELY unethical and predatory company.

The only time I recommend a product from them is if it's phenomenal, which Agora products rarely are (and Strategic Fortune isn't).

Here's why I think you should avoid Agora products:

They Sell Legitimate Scams

Would you trust a person that was known to steal from the elderly people in your neighborhood?

Of course you wouldn't.

If you saw this person walking down the street you'd likely lock your doors and hide your credit card.

This is actually the advice I would give you when it comes to Agora!

Whenever you see one of their sales pitches put your credit card away and exit out of the website.

A big reason for this is Agora has a history of scamming elderly people.

Just last year they had to pay $2 million in fines for doing just that.

They tried selling seniors both financial and health scams.

The financial product promised thousands a month from the government and the health product promised to reverse diabetes in 28 days!

Just the scummiest stuff imaginable.

No Signs Of Slowing Down

The sad thing is $2 million is nothing to a company like Agora - they make HUNDREDS of millions every year.

They welcome these fines as a cost of doing business.

As Truth In Advertising details Agora is still marketing fraudulent products to senior citizens.

Crime literally pays in this instance.

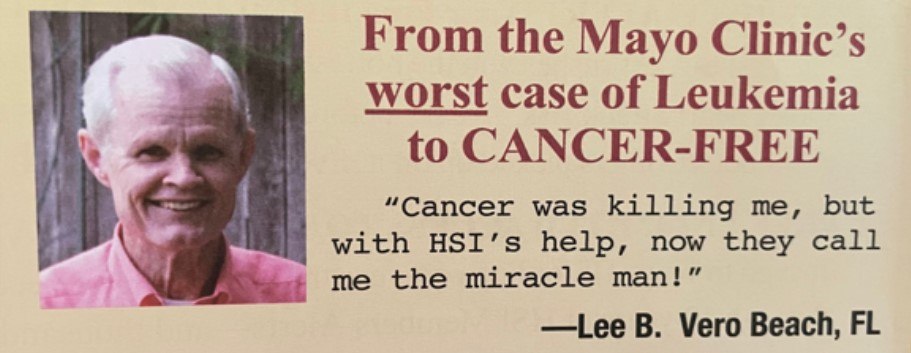

Here's an example of some of the ads they're targeting seniors with:

Again, if someone in your neighborhood was selling old people fake cancer cures would you not be appalled?

Would you still buy other products from them?

Of course not.

The Art Of The Upsell

Another reason to avoid Agora is they are going to try and milk you of every dollar they can.

Strategic Fortunes is a cheap product but it's only bait.

Once your credit card details enter Agora's payment database you're going to be targeted with upsells non stop.

Sometimes up to 20 a day.

A lot of these products are going to cost thousands a year and some can cost up to $25,000.

Agora will use every dirty trick in the book to get you bite at these upsells too.

It's annoying. It's predatory. And it's just not worth buying from them because of this.

Recommended: The Best Place To Get High Return Stocks

Nothing Can Be Verified About Ian King

I've reviewed close to 100 investing newsletters and many are from Agora.

One thing that always jumps out to me is how these people lie about themselves or completely overhype their ability.

I mean people that couldn't pick a stock to save their life claim they're 10 times better than Warren Buffet.

There's one thing I've learned from reviewing all of these products - NEVER trust what these guys (and girls) say about themselves!

None of these people deserve the benefit of the doubt and more often than not they're lying about their abilities.

Is Ian King lying about his resume?

Well I can't verify a single thing he says about himself.

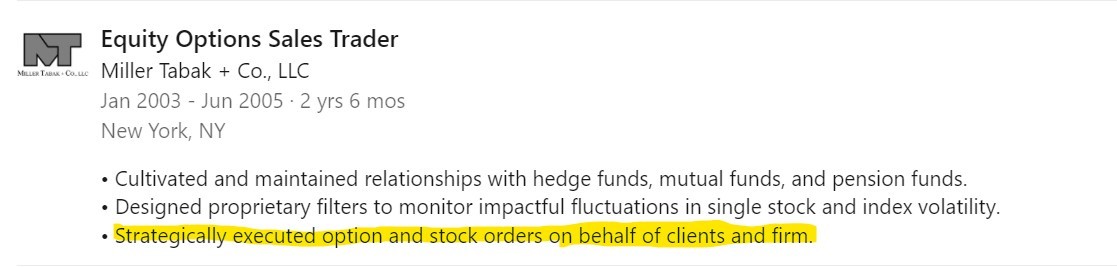

For example, on Ian King's Linkedin he claims he "strategically executed option and stock orders on behalf of clients and firm:"

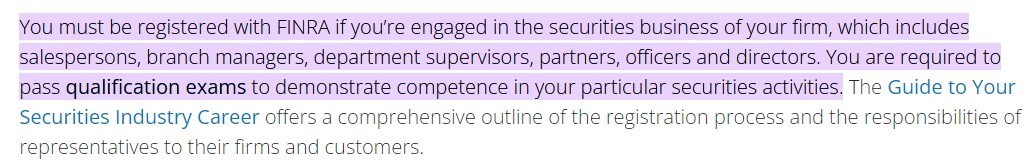

In order to buy securities on behalf of clients you need to be registered with Finra.

Finra enforces brokerage laws in America and has the power to fine people and ban people from selling securities.

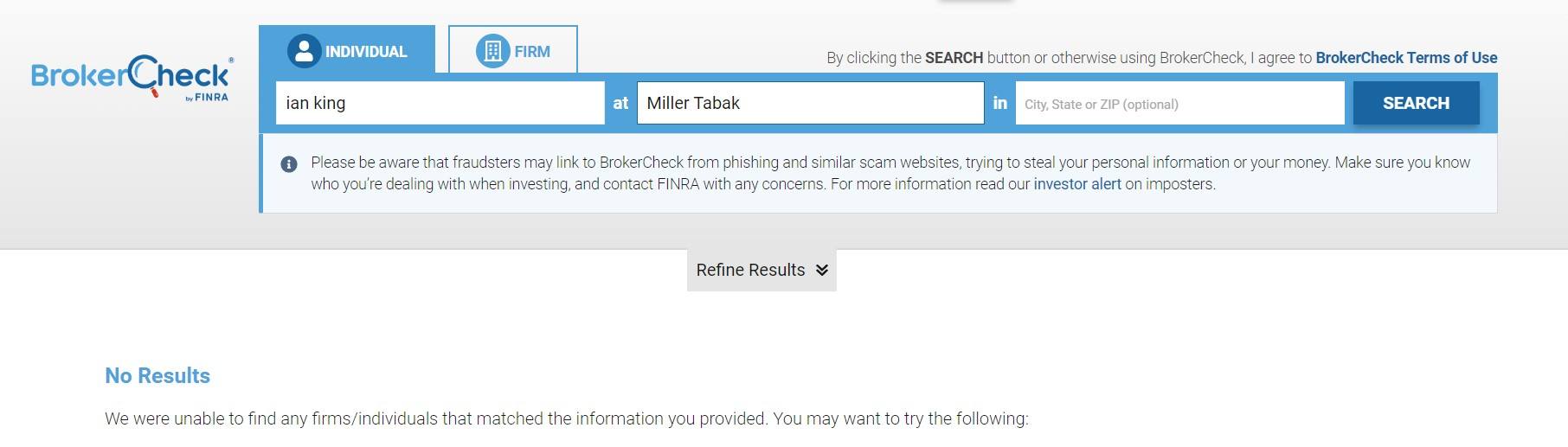

You can search Finra's records and there's zero proof of an Ian King matching Ian's "resume."

In fact, there's only one Ian King in Finra's system and it's a former cop who was charged with rape.

So I really hope this isn't the same Ian King (I don't think it is).

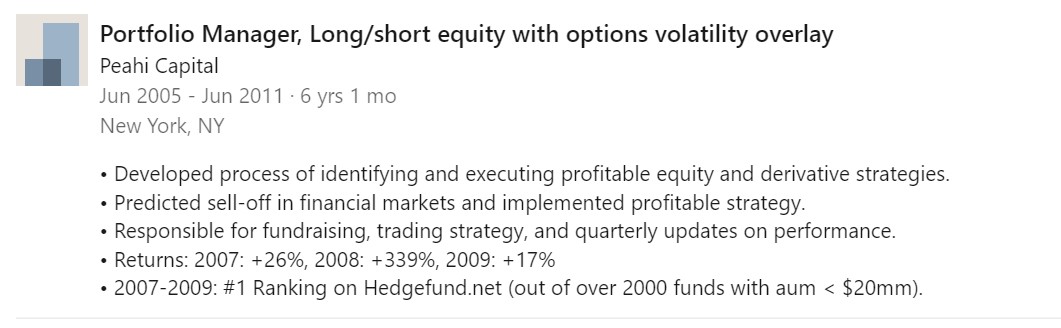

In another instance Ian claims he was a portfolio manager for Peahi Capital:

Again, there's not record of Ian working at Peahi Capital.

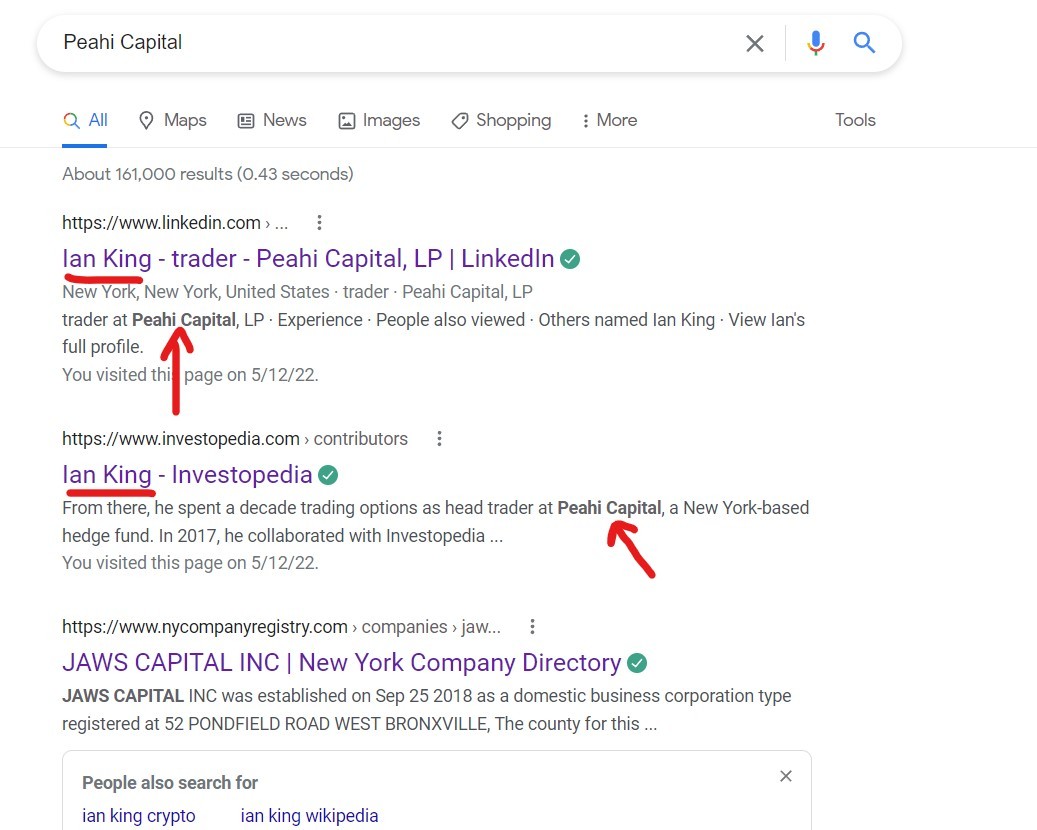

I can't even find any record of Peahi Capital!

If you Google Peahi Capital the only thing comes up is a reference to it in Ian's Linkedin:

If Ian is completely making up his resume and background he wouldn't be the first person to do it.

Again, you don't have to give Ian or anyone selling you financial services the benefit of the doubt.

It's up to them to prove they're trustworthy.

And I'm just not seeing that with Ian because there's zero proof of anything he claims.

I emailed Banyan Hill for an explanation but I doubt they respond (they never do).

Ian King's Stock & Crypto Performance

Ian doesn't provide a real track record for his stock and crypto performance so I can't say with certainty what is returns are.

However, he does a ton of teaser presentations where he hypes up stocks and crypto.

You can get a good idea about his performance by looking at these assets.

Here's a look at various stocks and cryptos Ian has promoted heavily in the past:

Luna (Crypto)

In one of the main presentations Ian has running right now he references Luna as a major success story.

He claims ordinary Americans saw gains of 18,325% with this new crypto coin and his own words "wants the same for you."

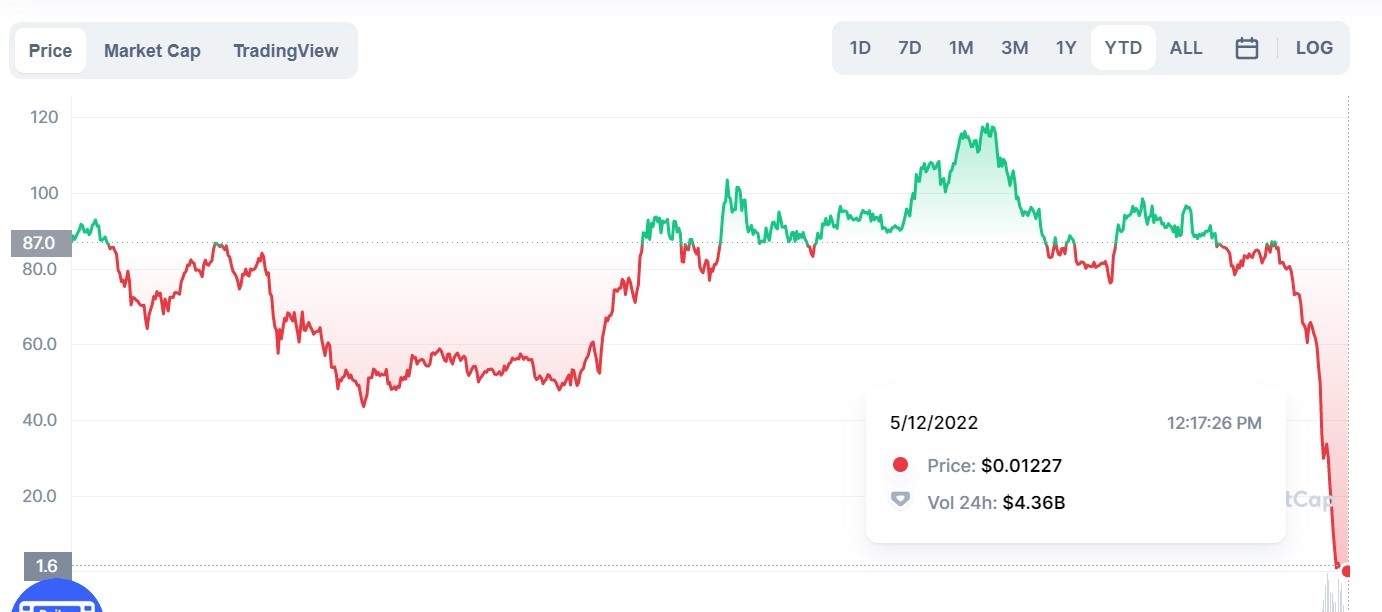

Well let's check in on Luna and see if this is something you would have wanted to get involved in:

In just 7 days it dropped from over $100 a coin to $0.012.

This means in a week it lost 99.9% of value and is completely bankrupted anyone that invested.

This is a huge blow to crypto because Luna was a newer coin that supposedly fixed a lot of issues previous cryptos had.

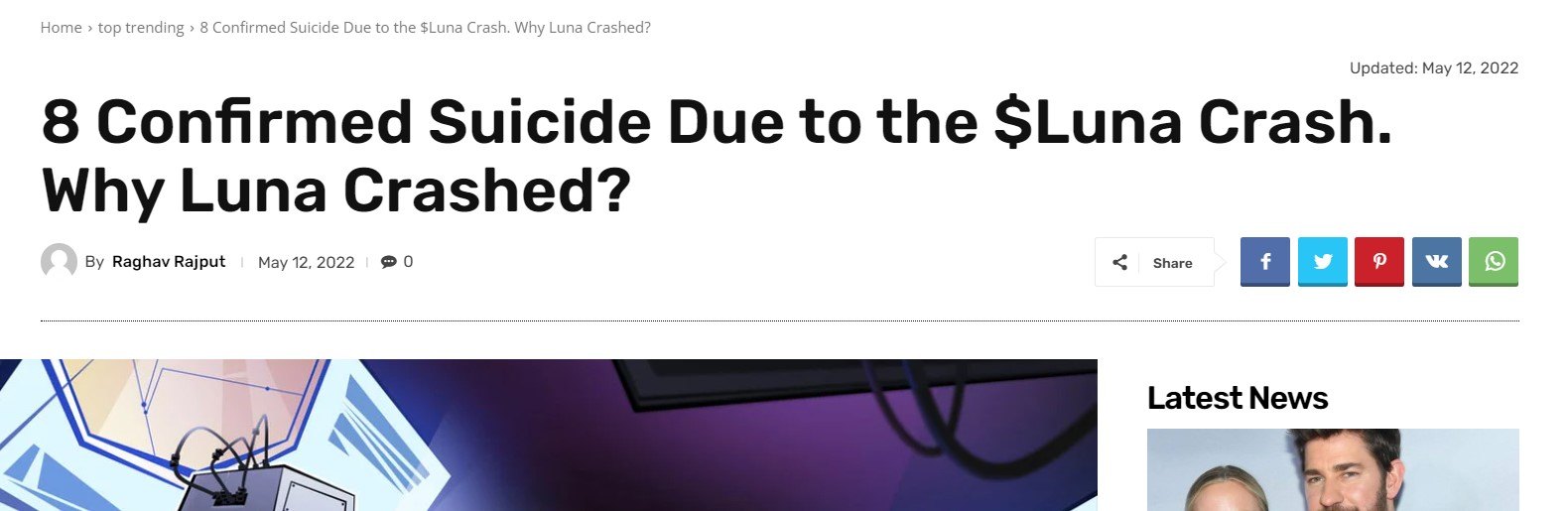

In this week there's already been confirmed suicides from the crash:

Ian King wants this for you!

Cryptos are extremely volatile and in my opinion you can't really be an expert in them.

Luna was supposed to be the next big one.

Be very skeptical of anyone claiming to be a crypto expert.

Ethereum (The Next Gen Coin)

Ethereum is the big crypto Ian is pitching and the coin he's referring to in his Next Gen Coin presentation.

Ethereum is a very well known crypto and is the second biggest in the world, next to Bitcoin.

Ethereum hasn't been spared in the recent crash.

Because of its brand and size it hasn't been that bad but it's down since Ian started this campaign:

Velodyne Lidar In March 2021

Velodyne Lidar is a stock that Ian was hyping up last year.

At the time "LiDAR" stocks were hot. These are sensors that will be used in autonomous cars.

Everyone and their mother had a LiDAR stock to pitch then.

Velodyne Lidar was Ian's.

Here's how the stock performed after the recommendation:

It completely crashed and has lost about 90% of its value.

Not good!

Square In January 2021

Every January you'll see stock predictors launch their big predictions.

This one stock was predicted by Ian to be the "#1 Tech Stock For 2021."

The stock was Square which is a well known payment processor.

In the sales pitch Ian confidently declared "The massive tech boom is just starting."

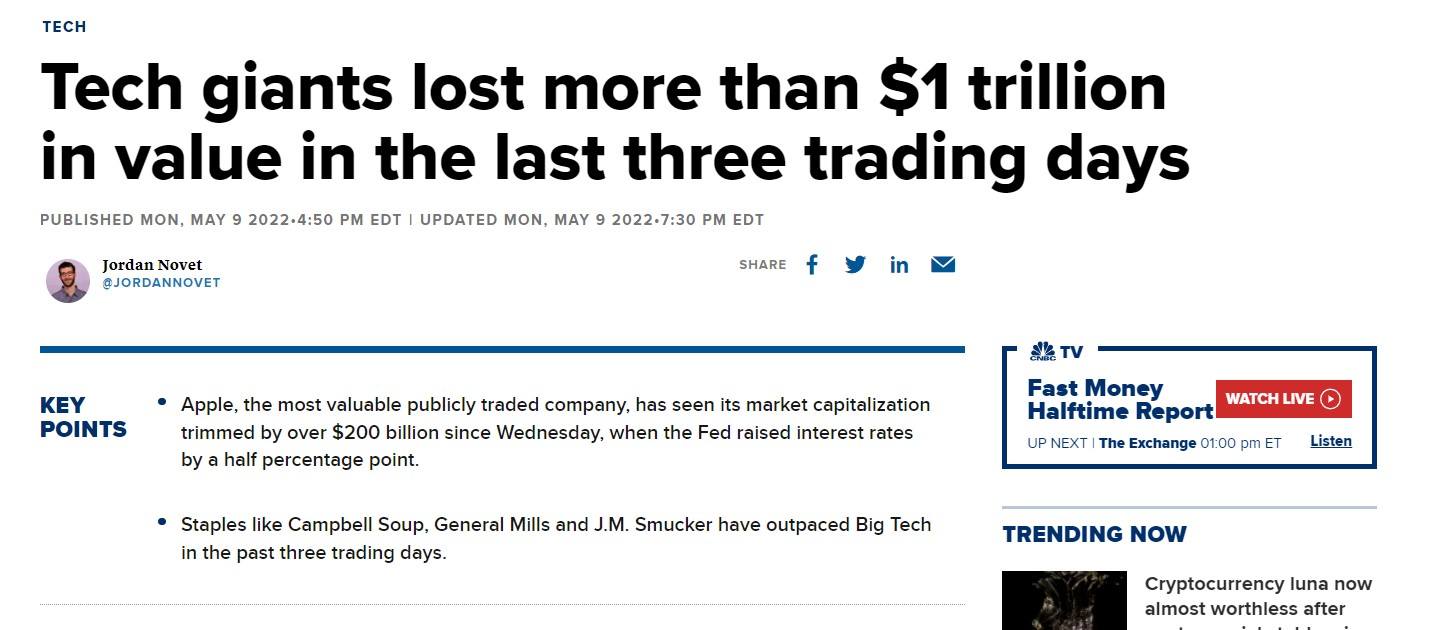

Let's check in on tech stocks:

Uh Oh.

How has Square done since Ian's recommendation about 15 months ago?

It's tanked..

It's lost about 75% of its value and anyone that invested when Ian made his recommendation must be panicking at the moment.

Inseego In August 2020

This stock is the first winner (sort of) that I've seen from Ian so far.

5G stocks are another kind of stock you'll see teased and hyped up.

Inseego apparently struck a deal with Verizon to sell wireless access points that would bring 5G wireless into people's homes.

A little after the stock was recommended it popped about 40%:

So if you were able to sell when the price went up you could have made money.

However, if you held on to it after it peaked you're down big.

It's lost about 80% of its value since being recommended.

Splunk In September 2019

In September of 2019 Ian predicted Splunk would be the "most important tech stock of 2020."

The previous year he predicted it would be the biggest tech stock of 2019.

It did well from 2019 to 2021 and more than doubled in that time period:

I'm guessing most people sold at the peak but if you didn't you'd be down right now.

Aptiv In July 2019

The last stock we're going to look at is Aptiv in 2019 which is another 5G stock.

In this pitch he also recommended Inseego which we covered earlier.

Aptiv had a pretty good run for a couple of years and most people most likely made money from it:

Recommended: The Best Place To Get High Return Stocks

What Is Strategic Fortunes Offering?

Strategic Fortunes is a very standard offer and is exactly like a million other Agora stock picking services.

Here's everything that you get:

Monthly Reports

Every month you'll get an 8 page report that covers Ian's next stock pick.

These reports come with all the research that Ian and his team have found about the company.

Model Portfolio

Besides the monthly reports, this is the most important part of the offer.

The second you sign up you'll get access to the entire portfolio and dozens of stocks to invest in.

Each stock will come with a price to buy at and a selling price.

Trade Alerts

Big things can happen in the market at any time.

As we speak the market is getting hammered and tech stocks are losing value.

Sometimes you can't wait until a month to get a recommendation on what to do.

This is where the trade alerts come in.

If you need to sell something or buy something quick you'll get an alert to do so.

Weekly Updates

Every week Ian hosts a webinar where you can ask questions and he updates you on the positions in the portfolio.

With crypto crashing at the moment I'm sure the next webinar should be spicey!

Special Reports

You also get a bunch of special reports when you sign up.

These reports look at specific stocks or markets - they're always changing too.

If you buy from the Banyan Hill website the reports are different than if you buy it through a promotion.

Here's some of the reports you can expect:

- How To Make A Fintech Fortune

- The Company Leading The $12 Trillion 5G Revolution

- Buy This Millennial App Now

- The Driverless Car Race Is Here

- The 20 Minute Retirement Solution

Another set of reports include:

- The Next Gen Coin

- 100X Coins

- Banking 2.0

- Crypto 101 Video

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Strategic Fortunes FAQ's

Still have some questions about this product?

Here's some answers to any questions you might have:

1) How Much Is Strategic Fortunes?

Strategic Fortunes has a few different prices and it costs different depending on where you buy it.

For example, I saw a promo that gives you a lifetime subscription for $199.

Another option allows you buy it for $49 for the first year and then $79 per year after.

The third option is to buy it for $97 for the first year and then $79 per year after.

Again, different options depending on where you buy it.

This is exatly what you should expect for an introductory newsletter.

Keep in mind this is mostly just bait to get you to sign up for the more expensive products.

Ian has services that are so expensive you can't buy them online and have to call to get them.

These will be marketed towards you.

2) Is There A Refund Policy?

Yes, it seems there's an open ended refund policy, which means you can get your money back anytime you want, no questions asked.

However, if you're getting your money back it's probably because you lost thousands of dollars.

Getting $97 back after losing that much isn't going to make a difference.

Additionally, the expensive products typically only have a credit refund, meaning you can only get money back to buy another Banyan Hill product.

3) Is Ian King Legit?

I personally have a hard time calling anyone that works for Agora legit.

It's such a scummy business that only a certain type of person could work for them.

Additionally, I can't verify Ian's past or anything he says on his resume.

There's no records of him being a trader anywhere and many of the hedge funds he lists on his resume have no record of existing.

Furthermore his picks in the past have been pretty bad in some cases, with many completely crashing.

Ian is more of an entertainer in my opinion. This is how I feel about most Agora personalities.

They're like WWE wrestlers.

4) What Does Strategic Fortunes Focus On?

The main focus of Strategic Fortunes is tech stocks and crypto.

These two assets had a really good run for years.

But it looks like the ride is over for tech stocks and crypto.

Both are literally cratering as I'm writing this and many cryptos are about to disappear.

So now may not be the best time to join this newsletter

5) Are There Similar Newsletters?

There's many newsletters just like this one.

Some include:

Most of these come from Agora as well.

Recommended: The Best Place To Get High Return Stocks

Strategic Fortunes Pros And Cons

Strategic Fortunes Conclusion

Strategic Fortunes is just like every other Agora product I've come across.

They hype of stocks and put out slick stock presentations to reel in customers.

The problem is these presentations often flounder.

This seems to be the case with a lot of Ian's big picks.

A lot of the cryptos he's been pitching are down and a lot of the tech stocks he's been pitching are down too.

Some have lost basically 100% of value.

I personally would stay away from tech stocks and cryptos right now.

It's just way too volatile.

I'd also stay away from Strategic Fortunes and basically all other Agora products.

Here's A Better Opportunity

I'd pass on Strategic Fortunes.

There's just too much baggage with this newsletter and too many red flags with Ian.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

I would to join the Strategic Fortunes at the $47.00 for the $20.00 investment in The Gen Coin. Is this investment still available?

im sure if you called them you could get it for $47