Stansberry Credit Opportunities is an investing newsletters run by Mike DiBiase.

It focuses on corporate bonds and Stansberry claims it can help you earn 100% gains.

Is this the truth or another investing scam?

We'll get to the bottom of this question in this review.

We'll look at what's being offered, typical results and any red flags that I find (and there's plenty).

So make sure to read everything below..

Let's get started!

Stansberry Credit Opportunties Summary

Creator: Mike DiBiase

Price to join: $3000 per year

Do I recommend? No

Overall rating: 1/5

I'm not a fan of Stansberry Credit Opportunities at all.

I've read a lot of customer insights about this service and most people have lost money.

The process is much riskier and complciated thatn Stansberry lets on.

Lastly, the price is $3000 per year and there's not way to get your money back if your unsatisfied.

I simply can't recommend a product like this.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Everything You Need To Know About Stansberry

Before we get into what Stansberry Credit Opportunities is offering let's take a look at the publisher Stansberry Research first.

There's some things you need to understand about them before buying.

Here's what you should know about Stansberry Research.

Used To Be Owned By Agora

Agora used to be the big dog in the investing newsletter world.

They had an impressive empire of a dozen or so publishers and made $500 million every year in revenue.

Stansberry Research was one of their most well known publishers (run by Porter Stansberry who retired a few years ago).

But Agora has gotten into a lot of trouble recently and their reputation took a beating.

For example, a couple years ago they were fined millions for defrauding senior citizens:

Things like this really hurt Agora.

As a result many of the publishers fled including Stansberry.

Stansberry Is Now Owned By MarketWise (Agora 2.0)

So the good news is Stansberry left Agora.

Agora is a terrible company that does extremely unethical things and have the most manipulative marketing you can imagine.

Plus they treat their customers terribly.

The problem?

All the former Agora publishers came together again under a publicly traded company called MarketWise.

It's pretty much Agora 2.0.

They use the same manipulative sales tactics to get people to buy.

It's actually run in the exact same fashion which isn't a good thing.

Expect Massive Upsells

MarketWise actually makes more money than Agora did.

This is pretty crazy since it only launched 18 months ago.

They make so much money by upselling to their current customers.

Their main goal is to squeeze the most money out of you as possible.

There's a good chance that you learned about Stansberry Credit Opportunities because you already own a product from Stansberry.

The sales funnel Stansberry uses is very aggressive and annoying to deal with.

Their sales presentations are extremely annoying and they'll send dozens to you every day.

They're experts at getting you to spend a lot of money.

You'll Be Dealing With Legit Scammers

You need to understand your email will be shared with the other publishers at MarketWise too.

So you're going to be getting promotions from many different publishers all pushing expensive products.

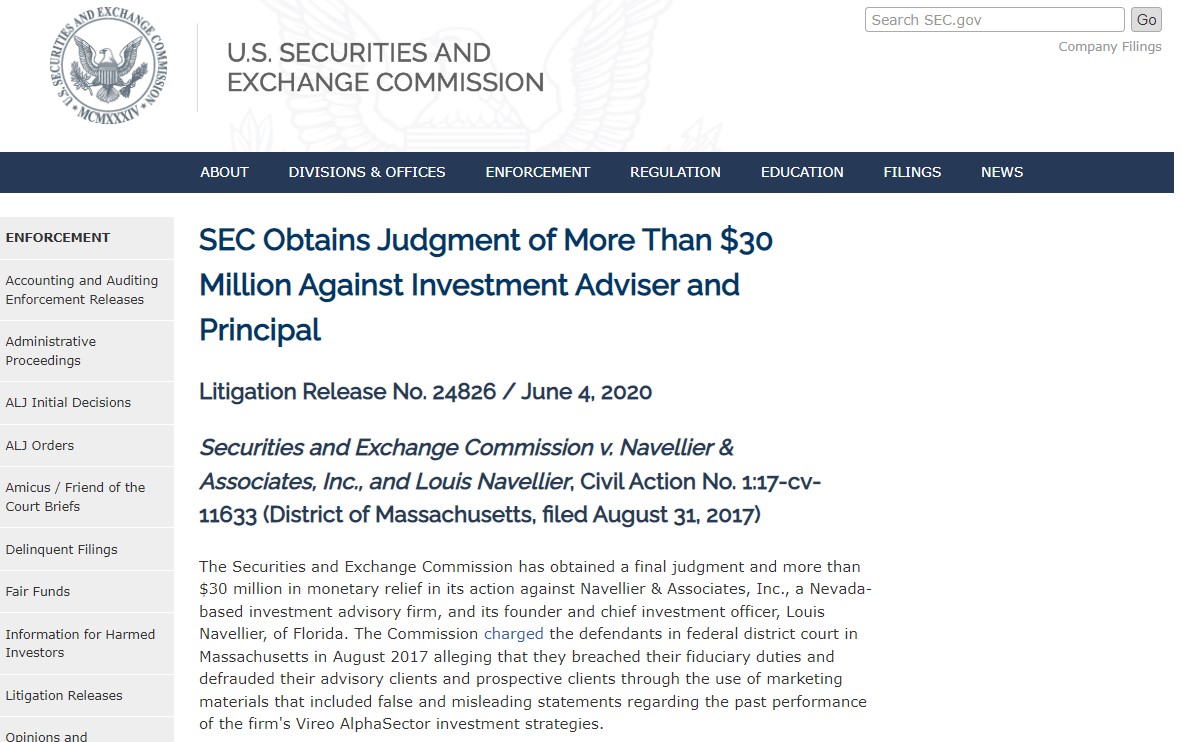

The problem is MarketWise hires legitimate scam artists and criminals and passes them off as experts.

For example. Louis Navellier was just fined $30 million for defrauding customers:

You'll get emails telling you he's this great expert and that you should give him thousands of dollars.

Other people at MarketWise are banned from Wall Street while others are just really bad stock pickers.

I personally wouldn't want to be in a MarketWise/Stansberry Research sales funnel.

Recommended: The Best Place To Get Stock Picks

What Is Stansberry Credit Opportunities?

Stansberry Credit Opportunities is an investing service from from Stansberry Research.

Instead of focusing on stocks like most research newsletters do this one focuses on buying corporate bonds.

Here's what you should know about corporate bonds:

Corporate Bonds Give Corporations Access To Cash

Corporate bonds are issued by companies and this gives them access to cash.

It's an alternative to issuing more stocks that will dilute ownership and it's an alternative to going to a bank for a loan.

Typically this is done if a company wants to expand and grow.

So if a business wants to develop new products, buy new assets or fund stock buybacks they can issue bonds.

You Get Paid Back With Interest

The incentive for you to buy a corporate bond is you get paid back with interest.

You're loaning money to a corporation the same way a bank would.

There's various ratings for bonds that range from A all the way to D.

A ratings are companies that are deemed safe and have the lowest level of credit risk.

D is companies that are already default and bankrupt.

If a bond gets a rating of BBB or Baa it's considered "investment grade" and is suitable for most investors.

Anything lower than those grades and the bonds are considered more risky.

Corporate Bonds Pay Better Than Government Bonds

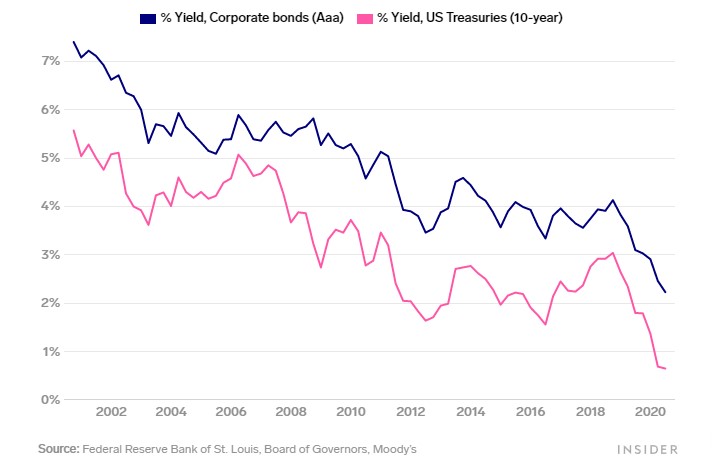

One of the main benefits of investing in corporate bonds over government bonds is they pay higher interest.

If you're looking to earn money from your bonds a higher interest equals more money:

As you can see both move the same way and both are decreasing but corporate bonds pay out higher.

There's Risk With Corporate Bonds

However, corporate bonds do have their risk.

A company could default on their payments if they don't have the money to pay lenders back.

If a business goes under there's a chance you lose money.

Additionally, a company has the ability to "call" a bond at value before maturity.

This means a business can buyback the bonds at face value and you lose interest form the bond.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

There's Really Bad Customer Reviews

One of the most concerning things about Stansberry Credit Opportunities is the customer reviews.

The problem seems to be that this this service is constantly recommending junk bonds.

Junk bonds are companies with high risk and many seem to go bankrupt before paying back bond holders.

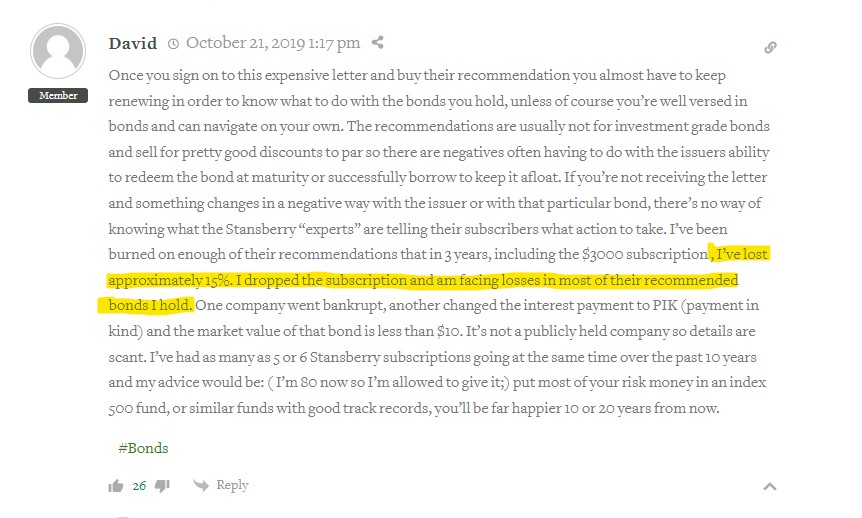

Here's an example of one investor being down 15%:

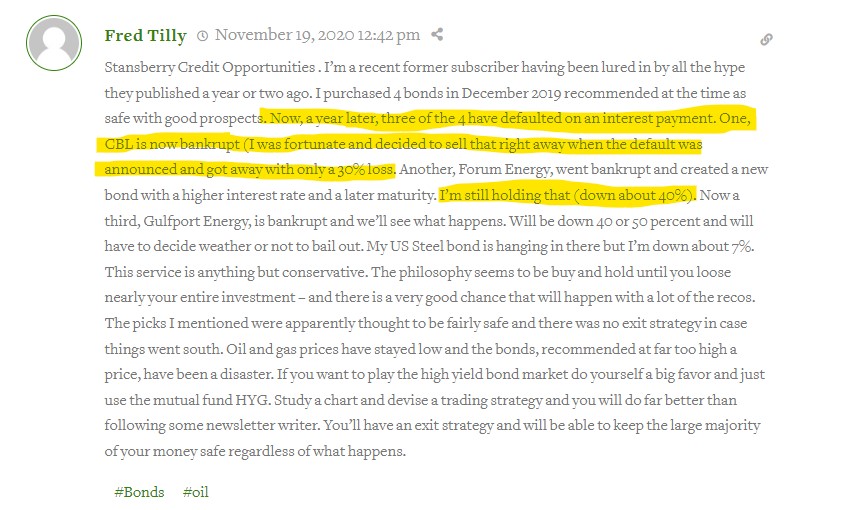

Here's another claiming most of the bonds he bought have defaulted on their payments or gone bankrupt:

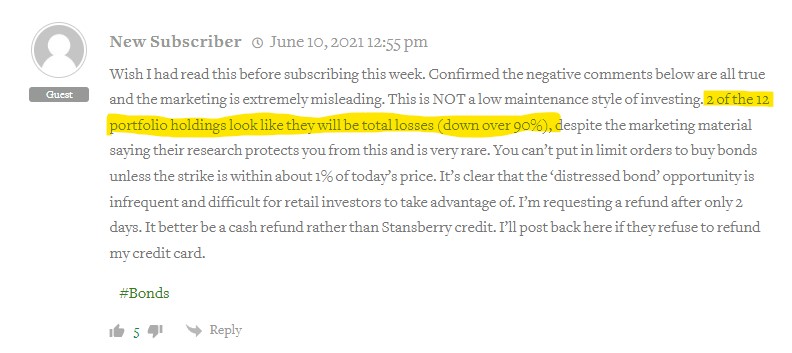

Another person is claiming that two of the recommendations are going to be complete loses:

So as you can see there's a lot of people losing money with this newsletter.

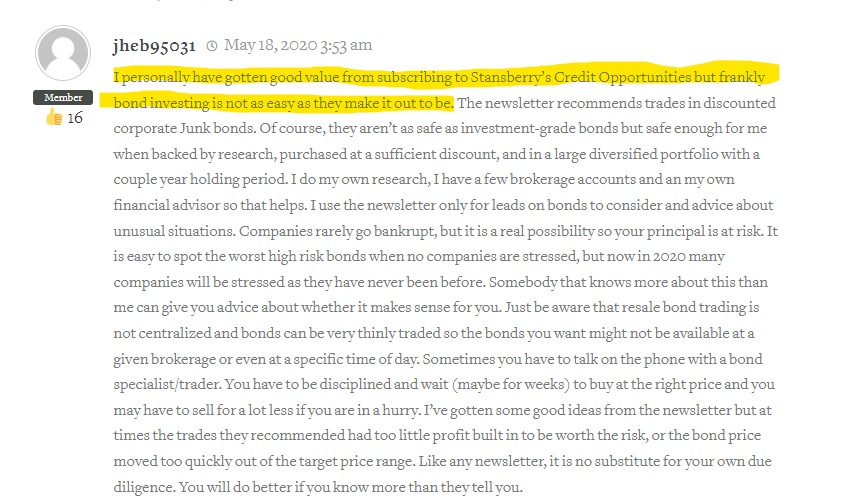

I could only find one positive review and it's still not that positive

This customer says there's things he likes about Stansberry Credit Opportunities but that's it's a very difficult way to invest:

I personally just don't think it's worth the risk to invest in junk bonds and these customer reviews validate that.

You Can't Get Your Money Back

One thing that Stansberry Research and all MarketWise publishers do is they only offer money back guarantees on their cheap products.

But they don't on their expensive ones.

It's very sneaky because they typically lure people in with the cheap products and then upsell them the expensive ones.

Many customers just assume because the cheap products have a refund the expensive ones do.

Stansberry Credit Opportunity does NOT offer a money back guarantee.

Instead they offer a CREDIT refund.

This just means you can use the money to buy another Stansberry product.

I'd never recommend an investing service this expensive if there's no way to get your money back.

Especially with customer reviews so bad.

Recommended: The Best Place To Get Stock Picks

Stansberry Credit Opportunities Pros And Cons

Conclusion

There's some Stansberry newsletters that might be worth buying.

I like Stansberry Investment Advisory.

That's an inexpensive newsletter and they offer regular stocks.

But I really don't like Stansberry Credit Opportunities.

The results don't seem good, it's way too expensive and there's no way to get your money back.

Add in the fact this product already comes with a lot of baggage because it's owned by Stansberry/MarketWise?

You just don't have a product worth buying.

Here's A Better Opportunity

I'd pass on Stansberry Credit Opportunities.

The good news is there's plenty of high qualtiy investment services.

I've personally reviewed over 100+ of them..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: