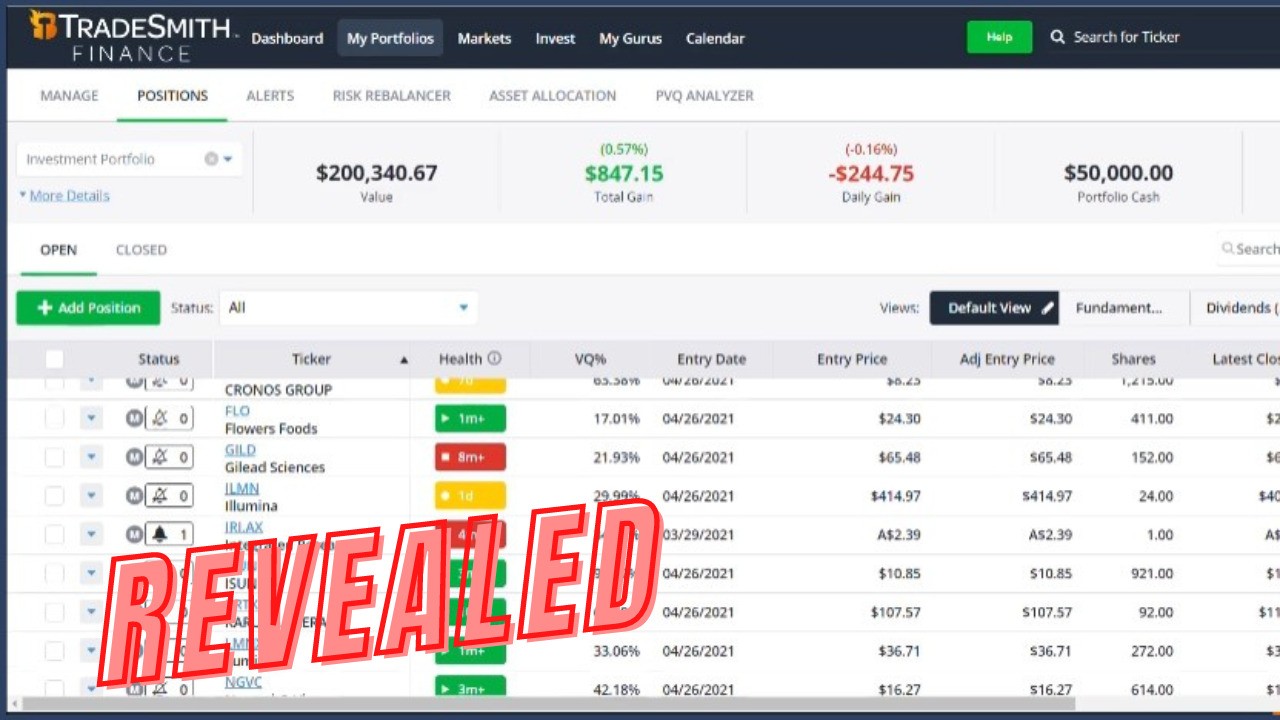

TradeStops is a portfolio management service that helps you manage risk.

Before buying I'm sure you want to know if it's a scam or not.

That's what this review will answer.

Below you'll find everything you need to know about this product including what to like and the red flags.

You'll know if TradeStops is worth it by the time you're done reading.

Let's get started!

TradeStops Summary

Creator: Richard Smith (owned by MarketWise now)

Price to join: $228 to $3000

Do I recommend? Not really

Overall rating: 3/5

Tradestops isn't really a tool that will help you too much.

Basically it tracks volatility in your portfolio and gives you recommendations on what to sell and when to buy.

Personally I wouldn't stress over price movements of a stock on a day to day basis.

You should only be buying stocks that you think will do well over a few year period.

Because of this I don't really see much use for TradeStops.

Plus it comes with a lot of baggage including big upsells and manipulative marketing.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

What To Know When Dealing With MarketWise

Before we get into what exactly is TradeStops you need to know about the company that owns this tool.

TradeSmith is the company that sells this service and TradeSmith is owned by MarketWise.

All MarketWise companies function in the exact same manner and you need to know how they work - you might lose thousands if you don't.

So here's everything you need to know about MarketWise.

The Stench Of Agora

MarketWise is a public company that was launched in the summer of 2021.

Mainly it's made up of investing publishers that used to be under the control of Agora.

Agora was the biggest distributor of investing newsletters and at its height was making over $500 million a year.

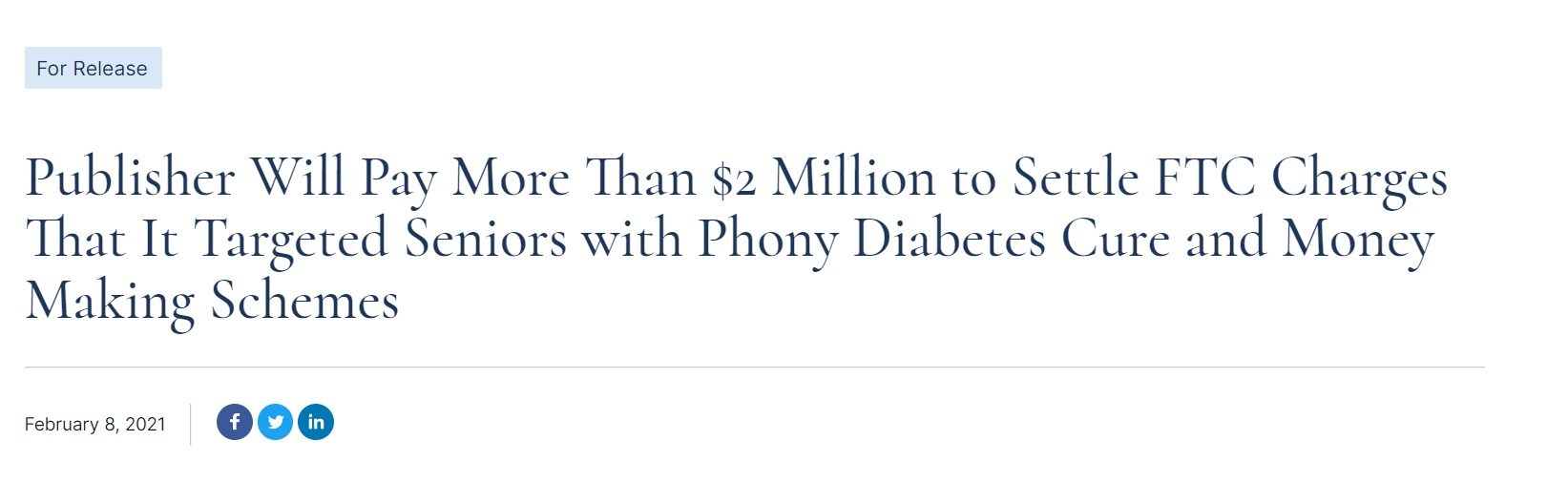

But their reputation started taking a beating over the last few years.

They were fined millions for defrauding seniors citizens and many of the publishers seemed to flee after this:

The problem is MarketWise hasn't really changed anything and functions almost exactly in the same manner as Agora.

This is not a good thing.

Prepare For Massive Upsells

One thing you'll notice is there's four different prices for TradeStops.

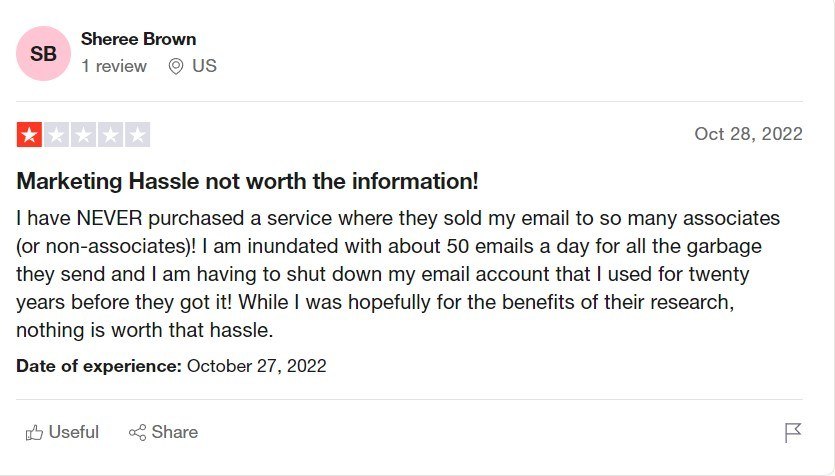

Once you sign up for TradeStops you'll be pressured to keep upgrading until you reach the $3000 subscription.

But it doesn't stop there.

You will keep getting upsells from all other TradeSmith products too.

As one customer points out you'll get up to 50 emails a day trying to get you to spend thousands:

MarketWise is already making more than Agora did and is on track to make around $700 million in revenue this year.

They don't get numbers like that from just selling one subscription - they're experts at milking you for all your money.

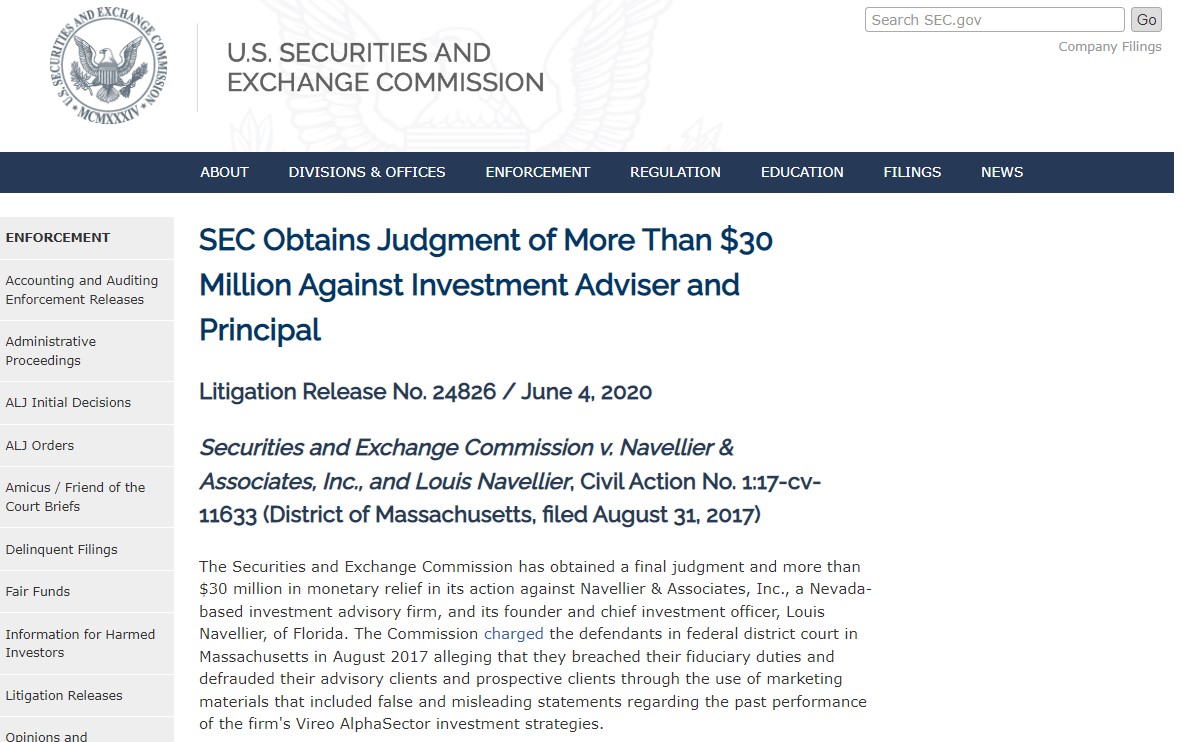

Legit Scammers Work At MarketWise

Another massive red flag with MarketWise is they hire legit scammers and pass them off as experts.

Louis Navellier is the main face at InvestorPlace (owned by MarketWise) and he was fined $30 million for defrauding customers:

Other "experts" at MarketWise like Teeka Tiwari have been literally kicked out of Wall Street for their unethical behavior.

You'll be marketed their services and some cost over $10,000.

Being in a MarketWise sales funnel is brutal and some people will spend thousands on low quality products.

Don't let this happen to you.

Recommended: The Best Place To Get Stock Picks

How Does TradeStops Work?

TradeStop is a tool that helps you manage your portfolio and mange risk.

This is NOT a tool to find new stocks (Ideas by TradeSmith is the tool that finds new stocks).

There's three different services TradeStops does for you:

- Portfolio Management

- Risk Management

- Research

Here's an overview of how TradeStops claims they help you with each service.

Portfolio Management

Here's how Portfolio Management works:

- You sync up your portfolio from your online brokerage firm or create your own portfolio.

- TradeStops uses its volatility quotient to to analyze how volatile each position in your portfolio is.

- You will get an indicator showing which positions are more volatile.

Risk Management

Next, TradeStops helps you management risk in your portfolio.

This s done using the Portfolio Volatility Quotient.

The PVQ Analyzer looks at your portfolio as a whole and shows you how you're invested in low, medium and high risk stocks.

After this you'll get insights into asset locations.

This graph will show you how your portfolio is diversified across multiple markets and industries.

You can manage your investments to mitigate risk with this information.

Lastly, you'll get Risk Rebalancer insights.

This gives you tips to help reallocate money amongst your investments away from volatile stocks and towards less volatile stocks.

Research

Lastly, TradeStops will help you research how to diversify your portfolio.

Again, this doesn't mean finding new stocks - it means researching how to balance your portfolio better to reduce risk.

This includes a Position Size Calculator that helps you determine the risk you have in each position.

There's also the Billionaire's Portfolio feature that allows you to track high profile people's investments and portfolios.

Lastly, there's the Pure Quant feature which balances your portfolio based on risk.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

TradeStops FAQ's

Still have some questions about this services?

Here's answers to any remaining questions you might have:

1) How Much Does TradeStops Cost?

There's four different price points.

The first is $228 and that gets you the Volatility Quotient, Position Size Calculator, along with some other minor features.

The second is $588 and that adds Health Status Indicators and Health Status Alerts.

The third option is $999 and with it you get the Portfolio Volatility Analyzer, Risk Rebalancer, Position Risk Equalizer and Asset Allocation Calculator.

The last option is $3000 and you get The Billionaire Club (track billionaire investments) and the Pure Quant Portfolio.

In my opinion the $3000 subscription doesn't offer nearly enough to pay that much compared to the other subscriptions.

2) Is There A Refund Policy?

Yes, there's a pretty good refund policy.

You get 60 days to get your money back if you're not happy with the service.

This is plenty of time to test out the tool to see if you like it.

3) Is TradeStops Useful?

To an extent.

Sometimes I think people get too analytic about their investments and stress too much about day to day price movements.

TradeStops might give you some good insights into risk management but will also probably stress you out.

You're going to get alerts about constantly reallocating money and rebalancing your portfolio.

I personally would focus on stocks that are going to pay out in a few years.

So the idea of micromanaging my portfolio on day by day or week by week basis seems unappealing.

4) Do You Recommend TradeStops?

Maybe one of the lower subscriptions.

I don't think you need to spend thousands to be able to track the investments of Bill Gates or anything like that.

You can follow Warren Buffett's portfolio for free online.

I don't think anything TradeStops is offering is really grand breaking or anything like that, though.

Recommended: The Best Place To Get Stock Picks

TradeStops Pros And Cons

TradeStops Conclusion

In the end TradeStops makes it seem like it's an essential tool for investing but I don't think it really is.

You can get some useful insights from the tool but I don't think it's make or break for an investor.

Allocating the right amount between your stocks is important but you don't really need this tool to do that.

And constantly getting updates about every price movement and volatility change can be counter productive.

Your portfolio should be filled with stocks you want to hold for years.

There's going to be volatility along the way.

As long as you use some common sense you should be able to balance your portfolio on your own.

Plus being a MarketWise product means TradeStops is going to come with a lot of baggage like upsells and manipulative marketing.

Here's A Better Opportunity

I personally don't think a tool like TradeStops is essential.

There are some investing services that I do think are, though..

For example you need a good investing newsletter that will help you fnd new stock picks.

I've reviewed hundreds of these services.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: