Commodity Supercycles is an investing service from Bill Shaw.

He claims this is the world's best natural resource newsletter.

Is this true or is it another scam?

You'll get an answer to that question in this review - so make sure to read everything below.

Additionally, you'll see insights into this product that you won't find elsewhere including background information, a look at Bill's stock performance and more.

You'll know if Commodity Supercycles is worth it by the time you're done reading.

Let's get started!

Commodity Supercycles Summary

Creator: Bill Shaw

Price to join: $49 to $79 for first year, $199 per year after

Do I recommend? No.

Overall rating: 2.5/5

Commodity Supercycles suffers from the same problem a lot of newsletters suffer from.

The newsletter is affordable but once you sign up you're bombarded with other promotions.

The stock picks are inconsistent as well.

Overall there's just better options out there.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Don't Give Money To These Granny Scammers!

Commodity Supercycles is published by Stansberry Research, which is owned by Agora.

Agora is the single biggest distributor of financial products in the country and they are absolutely MASSIVE.

However, I'd say this is one of the most predatory companies around and I really, really don't like them.

They sell hundreds of investing newsletters and it's very rare for me to recommend any of them.

Here's a couple reasons to steer clear of Agora:

They Sell Legit Scams

You instinctively know that anyone that commits crimes against senior citizens is the lowest of the low.

Anyone that targets vulnerable people is scum of the earth.

But this is exactly what Agora has done in the past and still does to this day.

Just least year they sold phony financial AND health products to elderly people.

This includes lies about making thousands a month from the government and a product promising to cure diabetes in just 28 days.

Just terrible stuff.

As a result they were hit with a $2 million fine last year.

The problem is this is nothing to Agora, who makes HUNDREDS of millions every year.

They'll gladly pay $2 million in fines if they're still allowed to operate.

A report from Truth In Advertising shows they're still up to their old tricks, even after being fined from the FTC:

Again, crime pays for Agora.

This is the kind of stuff you're dealing with when it comes to Agora:

Is this really a company you want to buy from?

Horrible Marketing Practices

Another reason you want to avoid Agora is they have the worst marketing imaginable.

Once you buy one product from them you basically become a target for every other product Agora has.

So while Commodity Supercycles is cheap, the upsells aren't.

And you're going to be promoted all the expensive products every single day - sometimes up to 20 promotions a day.

Agora uses every dirty trick in the book to get you to buy.

You'll be shamed, scared, and manipulated into purchasing products that cost thousands or even tens of thousands a year.

Again, this is why it's not worth getting involved with Agora or Commodity Supercycles.

Recommended: The Best Place To Get Stock Picks

What Is Commodity Supercycles?

Commodity Supercycles is an investing newsletter that's run by Bill Shaw.

There's not a ton out there about Bill.

Usually these editors have Linkedin's where you can research their past work experience but Bill has nothing listed there.

Additionally, on his about me section at Stansberry it's very vague on details and specifics about Bill.

So there's not much I can tell you about him.

I will say this, though: You don't don't owe Bill or Agora your trust.

They need to earn it.

So the fact they're light on details about who Bill Shaw is and his past experience should be a red flag.

As far as Commodity Supercycles goes, according to Stansberry it is a more conservative publication that focuses on commodity stocks (gold, oil, natural resources).

There's plenty of pros and cons of investing in commodities.

The top benefit is natural resources drive the world and we'll always need them.

Additionally, investing in commodities is a good hedge against inflation which is out of control right now.

On the flip side you do become more exposed to geopolitical events.

Covid, Russian vs. Ukraine, wars.. these all are things that effect commodity investments.

Bill's Performance Is Inconsistent

There might not be a lot of information out there about Bill but the main thing that matters is if he can find good investments.

Agora doesn't give track records for their editors but there's still ways to judge Bill's stock picking performance.

He puts out stock presentations every once in a while where he hypes up a company to invest in.

These are supposed to be Bill's best and most researched investment opportunities.

Here's how some of them have performed in the past.

Nova Royalty In August 2021

Last summer Bill ran a pitch where he called one stock "super charged battery royalties" and hints it solves "Elon Musk's big problem."

You'll see stock presentations like this include people like Elon Musk, Bill Gates, Jeff Bezos, etc. all the time.

Usually the stock has nothing to do with them - it's just meant to get your attention.

The company being teased is Nova Royalty and the presentation has been running from almost a year now.

In the presentation he said this "$4 stock was ready to soar."

Here's how the stock has performed from then to now:

Oof.. from $4 to $1.65 in less than a year. That's pretty terrible.

Tudor Gold In September 2020

Tudor Gold is a company pitched by Bill a couple years ago.

He marketed it as a "two billionaires are investing heavily in a small $3 gold mining company."

Here's how it's performed:

As you can see this stock plummeted after Bill recommended it.

It went from $3 to $1.34, losing more than half of its value.

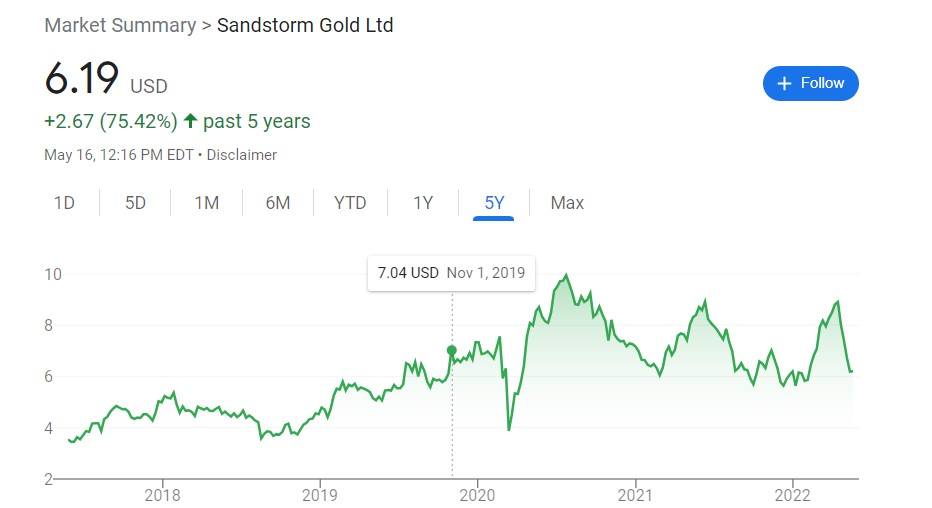

Sandstorm Gold From 2019 To Now

Basically every year Bill calls Sandstorm Gold his #1 gold play. He had a presentation in 2019 claiming this and this year in 2022 he's again calling it his favorite gold play.

In 2019, Bill claims the stock was $7.. here's how the stock has played out:

The stock has gone up and down through the years.

This is a royalty company as well. So beyond the stock price you also get a percentage of the company's revenue.

Recommended: The Best Place To Get Stock Picks

What Is Commodity Supercycles Offering?

Commodity Supercyles is a typical investing newsletter and offers what a lot of other services do.

Here's exactly what you get with it:

Monthly Newsletter

This is the main thing you're paying for.

Once a month you'll get a new Commodity Supercycles newsletter.

In this newsletter you'll get new investment recommendations, market analysis, news effecting the portfolio and more.

You'll get tips on gold, silver and oil here as well.

Model Portfolio

This is the other main part of the offer.

Once you sign up you get access to the model portfolio.

At any time there can be be between 15 to 25 stock recommendations in the portfolio.

This ensures you have plenty to invest in the second you sign up.

Special Reports

The special reports are a lot like the teasers we covered in the last section.

They revolve around a company or stock and give you detailed research into them.

The special reports are always changing.

Currently the special reports are Super Charged Battery Royalty (Nova Royalty), #1 Gold Play Of 2022 (Sandstorm Gold), and The Secret Currency (Gold investment strategy).

By the time you read this review these reports could be different, though.

Education

As part of this offer you get a series of education materials titled How To Find The Best Investments In Commodities.

You'll learn how to invest in gold, commodity dividends and more in these training programs.

Stansberry Digest

The Stansberry Digest is a daily newsletter.

It covers news and the market.. additionally, you'll get updates on all things Stansberry.

This includes things they get right and wrong.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Commodity Supercycles FAQ's

You might still have some questions about Commodity Supercycles.

Here's some answers to any remaining questions you might:

1) How Much Does Commodity Supercycles Cost?

You can find different prices for this newsletter depending on where you buy it.

If you buy it straight from the Stansberry website it costs $199 per year.

However, there's a few promotions going around that cost $49 per year.

If you want to buy and can't find a promotion I'd call Stansberry and try to get the $49 price.

Something to keep in mind is this newsletter basically acts as bait for the more expensive upsells.

Once you buy this newsletter you'll be marketed products that costs thousands per year.

2) Is There A Refund Policy?

Yes but it's not very good - it's only 30 days.

You won't really have time to test out the stock picks in just 30 days.

You also have to deal with Agora's customer service to get your money back.

Their goal is to keep you from doing that.

3) Is Bill Shaw Legit?

I don't really think anyone that works at an Agora company is legit.

What kind of person would work for a company that rips off old people?

Or be involved in the insane marketing this company does?

To be honest there's not too much out there about Bill and his stock picking performance isn't anything that impressive.

4) How Much Will I Need To Invest?

Stansberry believes you need at least $1,000 to start but I personally think it's more.

The only way $1,000 could work is if you're just investing in one stock.

But anyone that wants to participate fully will need much more.

You'll likely need at least $10,000 if you want to buy some of the stocks in the portfolio.

Additionally, you'll need $1,000 for any new stock recommendation you get in the newsletters.

So I'd say $10,000 plus a possible $1,000 each month after.

5) How Long Until I See Results?

These are not short term investments and likely need at least one or two year to pay out.

Additionally, there's some that you essentially buy and never really look to sell.

Any stock that offers dividends or royalties are stocks you hold on forever and try to retire on them.

6) What Is The Investment Strategy?

The strategy here is to invest in natural resources and earn money through royalties.

This is a good conservative approach that works well for retirees or people planning for retirement.

You can earn income to live on when you get older through these investments.

The part I dislike about the strategy is the focus on small cap stocks.

It's incredibly difficult to predict what a $3 stock will do which is why the picks we looked at earlier typically tanked.

Recommended: The Best Place To Get Stocks

Commodity Supercycles Pros And Cons

Commodity Supercycles Conclusion

If you've read my other Agora reviews like:

You'll notice I end in basically the same manner.

I tell the reader the investment newsletter just isn't worth the headache of dealing with Agora.

Is there some stock picks that will make you money?

Yes?

Will you make more than you lose?

That I'm not entirely sure off. The picks I looked at would have lost you more than you would have made.

Because the picks aren't spectacular I'd recommend avoiding this product.

There's better investment services out there where you don't have to deal with Agora.

Here's A Better Opportunity

I'd pass on Commodity Supercycles.

It's just not worth dealing with the headache Agora is going to cause.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: