Personal Finance is an investing service run by Jim Pearce.

He claims this product is "unlike any investing service you've ever seen."

Is this true or another stock picking scam?

We'll get to the bottom of this question in this review.

Additionally, we'll look for any red flags and you'll get an overview of what you get.

You'll know if Personal finance is worth it by the time you're done reading.

Let's get started!

Personal Finance Summary

Creator: Jim Pearce

Price to join: $39.95 for one year

Do I recommend? No.

Overall rating: 2/5

I personally don't recommend Jim Pearce's Personal Finance.

Jim has some pretty serious red flags in his past including regulatory discipline for unethical behavior as a money manger.

Additionally, he's worked for legit scam companies that have been shut down by the government.

The customer reviews for this service are pretty bad too.

I'd stay away because of this.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Jim Pearce Has Some Red Flags

Personal Finance has seen a bunch of editors in the past and the current lead is a guy named Jim Pearce.

The publisher of Personal Finance, Investing Daily, claims Jim is a trusted expert but my research has found otherwise.

There's some serious red flags in Jim's past.

Here's what I was able to find:

Faced Regulatory Discipline In 2003

The group that oversees and regulates stock brokers is Finra.

This group has the power to fine and ban people/brokers.

Back in 2003 they fined and punished Jim for "purchasing large positions of mutual funds in the account of customers. The recommendations were made without a reasonable basis for believing them to be suitable for the customers."

So Jim likely wanted to get himself some nice commissions and bought securities that weren't benefiting his customers.

He put himself over the welfare of people that trusted him to mange their accounts.

That's not a good sign for a stock picker.

As a result Jim was fined $10,000, suspended for 30 days and had to retake all of his finance exams.

Worked For Horrible Companies

The crazy thing about Finra is they're not overly aggressive and most people think they need to do MORE.

For example, Senators on opposite side of the political aisle have come together to demand Finra do more to protect consumers.

So it's not like this group is out of control with their disciplinary actions.

If you look at Finra records of Jim Pearce you'll see he worked for one sketchy company after another.. these companies were constantly getting fined by by Finra.

In fact, in a 20 year period as a broker Jim worked for 12 different companies!

This is not a good sign for a broker. It usually mean they're hopping around from one sketchy company to the next.

And records into these companies confirm that.

For example, in 1994 Jim worked for U.S. Securities Corporations Of Washington D.C.

This broker was BANNED from operating because of fraud.

You might be thinking that's too long ago to hold against Jim but every company he's worked for wasn't good.

The last broker he was employed under was Suntrust Investment Services.

If you look at their full broker report they've been fined 12 different times - some times for hundreds of thousands of dollars.

Unfortunately many stock pickers have this kind of background.

The industry attracts these unethical people.

Recommended: The Best Place To Get Stock Picks

Stocking Picking Track Record

Personal Finance doesn't give out a track record for their stock picks.

The good new is they do big stock teasers where they hype up a stock to get people to buy their service.

These are supposed to be their best picks.

They've done a lot of these over the years and we can get a good idea of how well they pick stocks if we look at their performance.

Office Properties Income Trust In June 2020

Back in 2020 Jim ran a teaser ad claiming you could collect benefits of thousands of dollars a month due to a "secret loophole."

In reality he was just pitching a dividend paying REIT stock called Office Properties Income Trust.

These kind of teasers promising free money has landed stock pickers in trouble before and resulted in millions in fines.

Jim is lucky he didn't get fined for this..

Anyway, here's how the stock has performed:

The stock has lost 50% of its value in the last two years and has steadily been going down.

So this was a pretty bad stock pick.

Innovative Industrial Properties In December 2018

This is another REIT stock.

If you don't know REIT is just a company that owns lands and buildings and leases them out.

REIT stocks also pay dividends.

Innovative Industrial Properties leases out land and buildings to medical marijuana growers.

Now usually you should stay away from marijuana stocks but this was a smart play on the industry.

The stock has performed really well over the years:

The stock was recommended at $50 and climbed almost to $300 in a pretty short time.

Overall this is a homerun for a stock pick and one I wish I invested in.

Digital Realty Trust In February 2020

In early 2020 Jim made another recommendations for a REIT stock.

This time he was hyping up Digital Realty Trust which is the second larges data center REIT.

This company was a play on streaming according to Jim.

Here's how it's performed:

The stock was up for a bit but has had a tough 2022.

I'm guessing many tech stocks being down hurt this stock and the need for data centers has gone down as well.

So this is has been a slightly disappointing stock.

MobilEYE In May 2016

Back in 2016 Jim recommended a stock called MobilEye.

This is a camera technology company that helps cars avoid collisions and helps with a bunch of other safety features.

This company had a wild ride on the stock market and was up and down a lot.

Eventually Intel bought at a premium for $63 a share at $15 billion so the stock ended up being a winner.

Recommended: The Best Place To Get Stock Picks

What Is Personal Finance Offering?

This is your standard investing newsletter and offers what hundreds of other services are offering.

Here's an overview of what you get:

Monthly Newsletter

This is essentially what you're paying for and is the same thing you get with every other similar product.

Once a month you'll get a new newsletter that covers the market and you'll get new stock idea.

The stock ideas focus on income, growth, investments for retirees, funds and options.

Flash Alerts

Obviously something big can happen with the market between the 30 days you get your newsletter.

If something big happens that effects one of the open positions in the portfolio you'll get an alert on what to do.

Model Portfolio

This is another big part of the offer.

Besides getting new investment ideas every month you also get a model portfolio.

This means you'll have a bunch of stocks to invest in right away.

Stock Talk Message Boards

The last feature you get is the stock talk message board.

This allows you to ask questions to the team at Personal Finance and get answers.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Personal Finance FAQ's

Still have some questions about Personal Finance?

Here's answers to any remaining questions you might have:

1) How Much Does It Cost?

This newsletter is very cheap and costs $39.95 per year - this is basically what all introductory newsletters cost.

It's priced this way to get you into the sales funnel.

Once in the sales funnel you'll be aggressively sold on upgrading to a product that costs thousands of dollars.

2) Is There A Refund Policy?

Yes, you get 90 days to get your money back.

That's a pretty big deal but is only $39 we're talking about.

If you're getting your money back it's likely you lost pretty big on a stock recommendation.

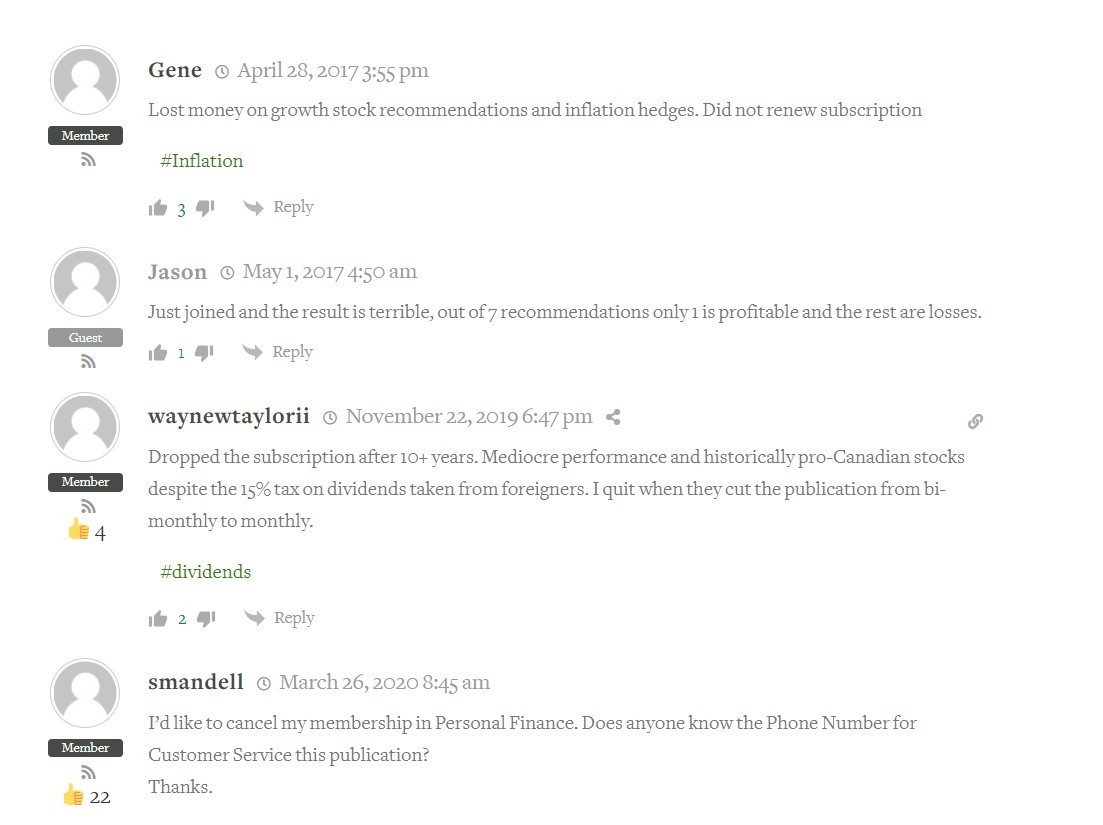

3) What Are Customer Reviews Like?

Customer reviews aren't great to be honest.

Stock Gumshoe is a great place to find customer insights on stock picking services.

If you look at how customers feel you'll see customers don't like this newsletter:

As you can see these reviews span multiple years.

So it's not like this product has had just a short period of bad luck.

4) Are There Similar Newsletter?

There's a lot of similar newsletters.

Some include:

- Porter and Company

- Retirement Watch

- Black Box Stocks

- Weiss Crypto Investor

- Intelligent Income Investor

- Extreme Value

- Lifetime Income Report

- Altucher Investment Network

There's a lot of stock picking services just like this one...

Recommended: The Best Place To Get Stock Picks

Personal Finance Pros And Cons

Personal Finance Conclusion

So that's the end of my review of Jim Pearce's Personal Finance.

I personally don't like this newsletter much.

Some of the stocks are going to be winners but anyone can pick some winners.

The problem is there's too many losers it seems.

I couldn't find a single good customer review from the last 5 years and almost everyone said they lost money following the picks.

On top of this Jim just doesn't seem like a trustworthy character to me.

Just too much sketchiness in his past.

Here's A Better Opportunity

I'd pass on Personal Finance.

The good news is there's much better options out there.

I've reviewed over 100+ stock picking services..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: