Luke Lango is running a presentation titled "The #1 Electric Vehicle Stock Of The Decade."

He believes this company will help make solid state batteries more mainstream and pure rocket fuel on the electric car industry.

Sounds pretty interesting.

However, there's one big problem..

Luke won't reveal the name of the stock unless you buy his investing newsletter.

Well I have good news for you.. I know what the stock is and I'm going to reveal the name of it below.

Additionally, I'm going to give you information on this stock so you can determine if it's a good investment.

Let's get started!

#1 EV Stock Of The Decade Summary

The stock being pitched as the best EV stock of the decade is ilika.

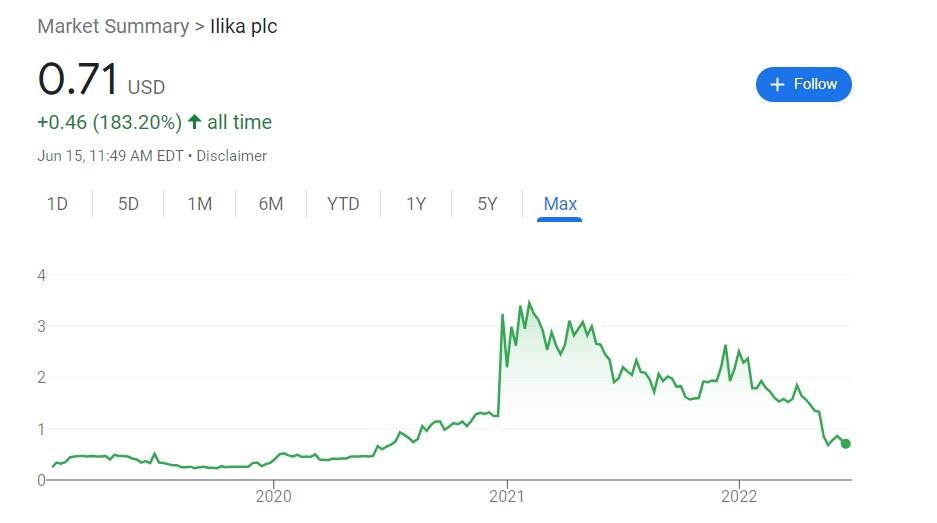

When the presentation first started running Luke called it a $3 stock.. now he's referring it to it as a $2 stock.. in reality it's trading at $0.72.

It just keeps going lower and lower.

I guess if you believe Luke this just means the stock is at a discount.. but it's very early in the company's history and who knows if they'll ever be profitable.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Figuring Out The #1 Electric Vehicle Stock Of The Decade

Luke has been running this teaser presentation for quite some time and I've covered it a couple times before.

In the past this stock was referred to as a "forever battery stock" that cost $3:

However things have changed since then and now he's calling this presentation his "#1 Electric Car Stock Of The Decade."

Oh and he's now referring to it as a $2 stock you need to buy:

It's honestly just getting worst for this stock too.. it's currently sitting at $0.72.

Guess he's going to have to start calling this the $0.70 stock leading the way.

To Luke's credit he does say in the presentation this is a speculative investment and carries more risk than usual stocks.

So what's going on here?

This entire pitch is hinting at a new type of battery that will make electric cars more mainstream.

Luke is hinting at solid state batteries.

Apparently solid state batteries hold a charge longer than lithium ion batteries (which are the batteries being used now).

The science doesn't quite seem there yet, though, and there's still time before these batteries come into production.

Luke believes there's one company that's going to lead the way in this industry.

He even shows a picture of their battery:

He then goes on to to claim the company being teased has a deal in place with Toyota.

The company he's talking about here is ilika.

ilika is a solid state battery company that has a program called Goliath, where they make solid state batteries for electric cars.

So question now is ilika worth investing in?

Let's explore that.

Recommended: The Best Place To Get Stock Picks

Is ilika Worth Investing In?

ilika makes various solid state battery products.

They don't just make products for cars.. they make batteries for different technologies (mainly batteries for harsh environments) and batteries for medical devices.

Recently they began manufacturing their own batteries.. making them the first solid state battery manufacturer in the UK.

Here's a video they recently released explaining what they do and the current state of their business:

Seems like an interesting company.

But a company needs to be more than interesting if you want to invest in it.

The stock has been up and down since 2019:

As you can see it's been falling since about 2021.

If you're interested in this stock you're basically gambling on solid state batteries actually becoming a thing.

It doesn't seem like the technology is that close to a breakthrough and could be 10 years before you start seeing mass produced solid state battery EV's.

There's more and more competition in this market every year as well.

You likely won't see results from this stock for years and you might never see results.

Like Luke says - this is a speculative investment and comes with more risk.

Whether or not you want to take a gamble on ilika being the leader of solid state batteries is up to you.. if you do throw some money into it just realize it's not a guaranteed and you'll have to be patient.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Luke Lango Is On A Losing Streak

Luke is the guy pitching ilika at the moment (in the past this presentation was run by Matt McCall).

The problem is Luke is an investor in tech stocks, biotech stocks and cryptos.. all of which are STRUGGLNG right now.

His investment strategy may have been good a few years ago but I don't think he's someone you want to listen to right now.

Here's a look at some of his recent losing picks:

Oxford Nanopore

Oxford Nanopore is a gene editing company.

Every stock picker is putting out their favorite gene editing company and basically all are doing bad.

Oxford Nanopore is no different and in just a few month has lost a good amount of value:

To be fair this is a long term investment but still.. losing 40% of your investment in two months is not a good feeling.

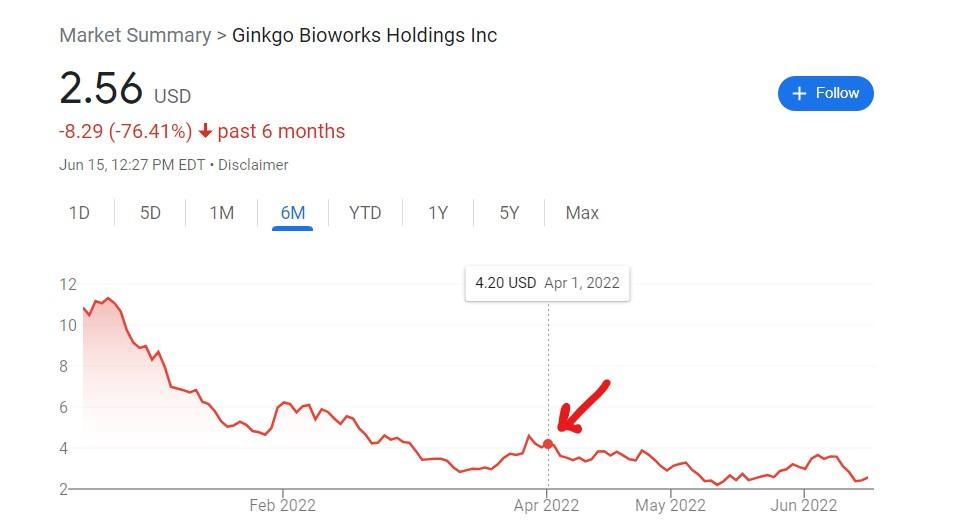

Ginkgo Bioworks

Ginkgo Bioworks is a company that many stock pickers are recommending.. Whitney Tilson calls it his $4 inflation stock.

This is another biotech company and this one specializes in synthetic cells that'll be used pharmaceuticals and food.

However, it's down since being recommended by Luke (and Whitney):

This is another one that lost 40% pretty quickly.

Chiliz

Chiliz is a crypto that makes Fan Tokens.

This coin was suggested in Luke's other newsletter called Crypto Investor Network.

The entire pitch surrounding this coin is Luke claims he has a special tool that can predict when cryptos are about to explode.

Let's check in on that claim:

He recommended it at $.21 cents and it has crashed to around $0.09.

That's over 50% in just a few months.

Cosmos

Cosmos is the same deal as Chiliz.

Luke's tool predicts it'll go up.

Here's how it's performed:

As you can see it crashed after he recommended it and it's lost basically all of its value.

ilika has been a big loser so far for him too.

Factor in all of these picks and I just can't see how you can trust Luke's analysis right now.

Recommended: The Best Place To Get Stock Picks

What Is Innovation Investor Offering?

The whole point of the "#1 Electric Vehicle Stock Of The Decade" presentation is to sell you Luke's newsletter Innovation Investor.

I've done a full review of this service already which you can read here.

In my review I gave this newsletter a 2/5 based on the investing strategy and Luke's poor track record of late.

Overall I believe investors who have money to lose and want to speculate in highly risky and volatile assets should consider.

But for most people I wouldn't recommend.

The offer is pretty standard as well.

If you sign up you get the following:

- Monthly newsletter

- Model portfolio

- Bonus reports

It is cheap and only costs $49 per year.

Usually when a publisher does this, though, they're using the product as bait.

They get you to sign up for $49 and then throw a bunch of promotions at you.

Some of the products being promoted to you will costs thousands of dollars.

A Warning About InvestorPlace

One last thing before we wrap up this post..

Another reason I don't recommend that you buy Innovation Investor is because I'm not a fan of the publisher, InvestorPlace.

InvestorPlace operates a lot like other publishers.

They offer cheap newsletters, do upsells for expensive products and do these long form stock presentations to get you to buy.

That's just how the game works.

However, the reason I don't like InvestorPlace is because the face of the company is Louis Navellier.

Louis has by far the most newsletters at InvestorPlace and when you buy anything from this publisher you will be promoted his products.

The problem with this is Louis is a convicted fraudster that's duped investors in the past:

Louis made up information about a company to get people to buy a stock.

That's something that should get you thrown out of the stock picking industry for life and make you a pariah.

Nothing has changed at InvestorPlace, though.

Louis is still promoted as a trusted expert and has products that cost tens of thousands a year.

Recommended: The Best Place To Get Stock Picks

Wrapping Things Up

Alright!

So you no longer have to buy Innovation Investor to learn what Luke's favorite electric car stock is.

The company is ilika and you have all the information you need to know if it's a good investment.

It's definitely high risk, high reward and it might take some time to see good returns.

Additionally, you've seen Luke's recent stock performance which hasn't been good.

Lastly, you know the product he's pitching you and my big warning about InvestorPlace.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: