Nathan Slaughter runs an investing service called High Yield Investing and today we're going to be reviewing it.

This is going to be the most in depth review of this newsletter out there.

Not only are we going to dig into Nathan's past but we're also goign to look at how his stock picks have performed over the years.

You'll see any red flags that I find too.

You'll know if High Yield Investing is worth it by the time you're done reading.

Let's get started!

High Yield Investing Summary

Creator: Nathan Slaughter

Price to join: $39 per year

Do I recommend? Sort of

Overall rating: 3/5

High Yield Investing is a decent newsletter that gives you high yield dividend stock picks.

This is a good investing strategy and a great way to build passive income.

However, some of Nathan's stock picks have done very poorly and lost almost all of their value.

There's definitely a lot of volatility with these recommendations.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Nathan Slaughter Is A Typical Stock Picker

Nathan Slaughter is a typical stock picker and I don't really mean that as an insult.

He just has a very similar background to other people in this business.

Here's a few things you need to know about Nathan Slaughter:

Has The Credentials You Look For

Nathan went to college for finance at the University of Arkansas (WOOO Pig).

Many people get degrees in unrelated fields and then move over to finance but this is what Nathan has always wanted to do.

Along with that he has all the certificates a trusted financial advisor should have.

He has the following certificates:

- Series 6

- Series 7

- Series 63

- Series 65

These show that Nathan is legit and has knowledge in finance.

Worked At Well Known Companies

The idea of a self made stock picker is a romantic notion and maybe there are some average joes out there that can actually make it happen.

However, usually these stories aren't very legit.

If you're paying for stock picks it's good to get them from someone that spent a lot of time at reputable companies.

This is the case for Nathan.

He worked for Morgan Keegan which has over 300 offices and thousands of employees.

Additionally, Nathan worked for AXA/Equitable which manages around $300 billion in assets.

These are good companies that have given Nathan a solid foundation.

Started Retail Investing In 2004

Having a financial planning job is a good career but it can be stressful.

Many people in the field move to writing for retail investors to get a more flexible schedule.

Additionally, if you start selling stock picks you can make serious money.

There's many publishers that make hundreds of millions a year.

Nathan claims he wanted to reach more investors and turned to writing as a way to do this.

Now this is what all stock picks say lol.

I'm guessing the prospects of making serious money was the main driver of the career switch.

Recommended: The Best Place To Get Stock Picks

Nathan Slaughter Stock Performance

The most important thing about a stock picker is if they can pick a good stock.

The credentials and resume are nice but a track record is better.

Here's a look at some stock picks Nathan has made over the years and how they've performed:

Centennial Resource Development In December 2021

Centennial Resource Development is an oil company that formed out of a SPAC merger.

This company is based in West Texas where there is believed to be untapped oil in the underground shale fields out there.

Nathan teased this stock pick as a way to make "Rockefeller riches."

Is that what happened?

Nope.

The stock was recommended at around $8 and eventually the company was bought by Cohen Development Gas And Oil - the stock was under $8 at the time.

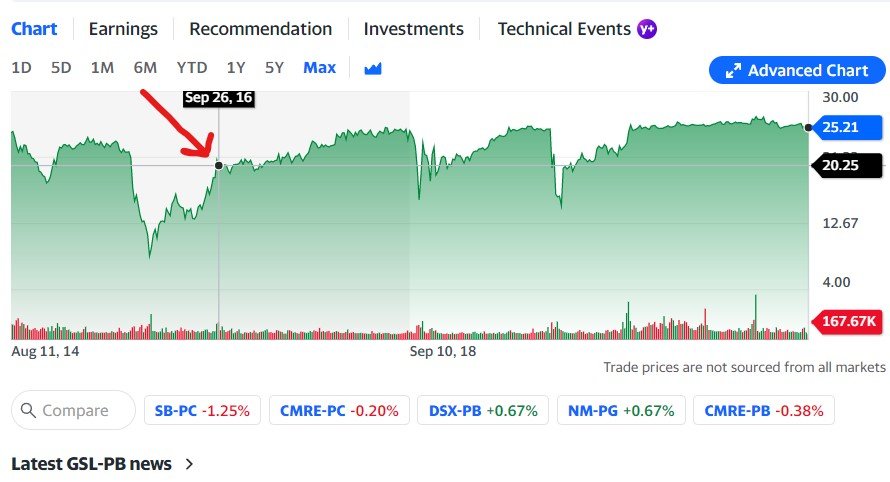

5 "Social Security" Stocks In September 2016

Back in September 2016 Nathan ran a teaser hyping up 5 stocks he claimed were social security insurance plays.

The 5 companies were Global Ship Lease Preferred, Government Properties Income Trust, Senior Housing Properties Trust, Prospect Capital and OneOK Partners.

Here's how each stock performed starting with Global Ship Lease Preferred:

The Yield is currently 8% which is good.

So it's not a big deal the stock hasn't really gone up over the years because of the dividend payment.

Next up we have Government Properties Income Trust:

This company is a REIT which means real estate investment trust.

They own buildings that are leased by the government.

Something must have went horribly wrong because the stock has tanked BIG TIME since being recommended.

It was known as a volatile stock at the time of recommendation but this is worst case scenario.

Next we have Senior Housing Properties Trust.

This company is another REIT and most of their properties at the time were assisted living facilities.

Here's how the stock has performed:

They changed their name to Diversified Healthcare Trust in 2020.

I'm guessing this is because the stock price and company were struggling BIG TIME.

This is another huge loser.

Now let's look at Prospect Capital:

This stock has been a loser as well.

The stock is down and the dividend payments have been cut over the years as well.

Last up we have OneOK Partners, which is a company that owns natural gas pipelines:

The stock took a major beating during covid but has recovered and was going up after Nathan recommended it.

The dividend has gone up a lot since being recommended as well.

So a good stock pick.

Recommended: The Best Place To Get Stock Picks

What Do You Get?

At the end of the day High Yield Investing is a pretty typical investing service.

Here's an overview of what you get:

Monthly Issues Of High Yield Investing

Every month you get the High Yield Investing newsletter - this is basically what you're paying for.

In these newsletters you'll get new investment ideas that have high yields.

The goal is to build your dividend payments until you have enough to retire on.

Updates And Alerts

You can't always wait a month to get an update on the portfolio or market.

This is where the updates and alerts come in.

There's a mid month update that covers the portfolio and let's you know if there's any changes that you need to make to your portfolio.

Additionally, if something surprising happens in the markets you'll get a special alert dealing with that.

Special Reports

The special reports cover a specific company or investing idea.

For example, the stocks we looked at in the last section came from special reports.

Most of the reports have to do with different high yield investments and markets.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

High Yield Investing FAQ's

Still have some questions about this newsletter?

Here's answers to any remaining questions you might have.

1) How Much Does High Yield Investing Cost?

Right now there's promotions where you can get this newsletter for either $39 per month or $78 for two years.

After the product renews for whatever the price is at the time so it'll probably be much higher (most likely $99 to $199 per year).

This is exactly what you'd expect to pay for an introductory newsletter like this one.

2) Is There A Refund Policy?

Yes, there's a very good one.

You get 90 days to get your money back.

After the 90 days you still can get a prorated refund.

This means whatever time is left on your subscription you'll get refunded.

3) What Is The Investing Strategy?

Like the name suggests you'll be targeting dividend stocks.

Stocks with dividends, also known as yield, payout a portion of their revenue to shareholders.

There's many different kinds of yield stocks and they range from well known corporations like Coca Cola to smaller banks to real estate companies and to commodity companies.

The main benefit for these kind of stocks is you can generate passive income.

With enough money you can retire on this passive income and get payments without having to work.

4) How Much Do I Need To Invest?

It depends on your goals and how far from retirement you are.

If you're young you can start with $10,000 and just reinvest the dividend payments back into the stocks.

This way you build your portfolio up and can retire on these residual payments.

If you're older and want enough passive income to live on right away you'll probably need $500,000 to $1,000,000.

5) Is Nathan Slaughter Legit?

Yes, I believe he is.

He has all the credentials you look for in a stock picker.

Nathan is certified in every way he needs to be and he worked for some well known financial companies.

He's been writing and giving advice to retail investors for nearly 20 years now.

6) Are There Similar Newsletters?

Yes, there's many newsletters that focus on dividend stocks.

Some I've reviewed include:

- The Dividend Hunter

- The 20% Letter

- The Dividend Machine

- Monthly Dividend Multiplier

- Lifetime Income Report

There's plenty more out there as well.

Recommended: The Best Place To Get Stock Picks

Nathan Slaughter's High Yield Investing Conclusion

Nathan's newsletter definitely has some value and some of the picks are excellent.

The customer reviews for this newsletter are pretty positive as well.

However, there are some big losers too and I mean REALLY big losers.

I don't think this is an investing newsletters for beginners.

The reason is you'll need to do your own research on some of the companies Nathan recommends.

The big losers could have been avoided if you know how to properly evaluate a company and market.

So if you're just looking for a newsletter to give you picks without having to do extra research I'd pass on High Yield Investing.

Here's A Better Opportunity

High Yield Investing isn't a bad newsletter but there's better out there.

I've reviewed HUNDREDS of these investing services..

To see my favorite (which is affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: