Crowdability is an investing publisher that sells a few different products.

They all involve private investments.

Before buying their products I'm sure you want to know if they're legit or a scam..

We'll get to the bottom of this in this review.

Below you'll find everything you need to know about this company.

You'll know if Crowdability it worth it by the time you're done reading.

Let's get started!

Crowdability Summary

Creator: Matt Milner and Wayne Mulligan

Price to join: Depends on service

Do I recommend? No.

Overall rating: 2/5

Crowdability is an investing brand that sells products related to private investments.

There's a lot of reasons to steer clear of this company.

Private investing is unregulated and extremally risky.

The odds of losing your money is much greater than hitting it big.

Additionally, the recommendations from Crowdability are investments you could find on your own.

Most seem to come from Startengine which is completely free to sign up for.

Lastly, there's many upsells that cost thousands of dollars.

I'd avoid.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

What Is Crowdability?

In the past private investments were reserved for accredited investors.

An accredited investor is someone that makes more than $200,000 per year in annual income or a couple with a joint income of $300,000 or more.

Additionally, a person can be an accredited investor if their net worth is more than $1 million.

The reason for these rules is private investments are unregulated securities and they're much, much more risky than stocks.

However, there were recent changes to laws regulating private investing and now non-accredited investors can get in on the action.

Now non-accredited investors can invest up to 10% of their annual income or net worth.

If you're investing through a crowdfunding website and make less than $107,000 per year you can only invest 5% of your income or net worth.

If you make more than $107,000 you can invest 10%.

This is where Crowdability comes in.

They are a company that focuses on private investments and helping people understand them.

Additionally, Crowdability has services that give private investing recommendations.

Another MarketWise Company

One of the big red flags about Crowdability is it's owned by a larger company called MarketWise.

When I started this review I actually didn't know Crowdability is owned by MarketWise because I didn't see it on MarketWise's website.

However, Matt Milner, creator of Crowdability, has it listed on his Linkedin that MarketWise acquired Crowdability in August:

There's a few reasons why this isn't a good thing.

Here's exactly why:

Expect Massive Upsells

All MarketWise publishers act in the exact same way.

They lure customers in with splashy stock presentations (where they withhold the stock name until you buy a product).

Typically there's some cheap newsletter being sold.

This is just a bait product that's meant to get you into the sales funnel.

Once in the sales funnel you'll be hit with aggressive upsells and manipulative sales presentation for expensive services - some will cost thousands per year.

Customers hate it and it makes one thing clear - MarketWise is most concerned with milking you for the most they possibly can.

Scammers Will Have Access To Your Email

There's another huge downside to buying a MarketWise service and that downside is who MarketWise employs.

MarketWise owns over a dozen publishers and they'll be sending you promotions from all of them.

The problem with this is there's legitimate scammers at MarketWise who will have access to your email address.

For example, Louis Navellier is one of their main guys and he was just fined $30 million for defrauding customers.

If you buy from Crowdability expect to be marketed Louis' products that can cost more than $10,000.

Another scammer is Teeka Tiwari.

He runs Palm Beach Research Group and that's owned by MarketWise.

Teeka is such an unsavory character he's banned from Wall Street.

Is this really people you want to have access to your email?

Do you trust a company that employs people like this? With your credit card details?

Just something to think about.

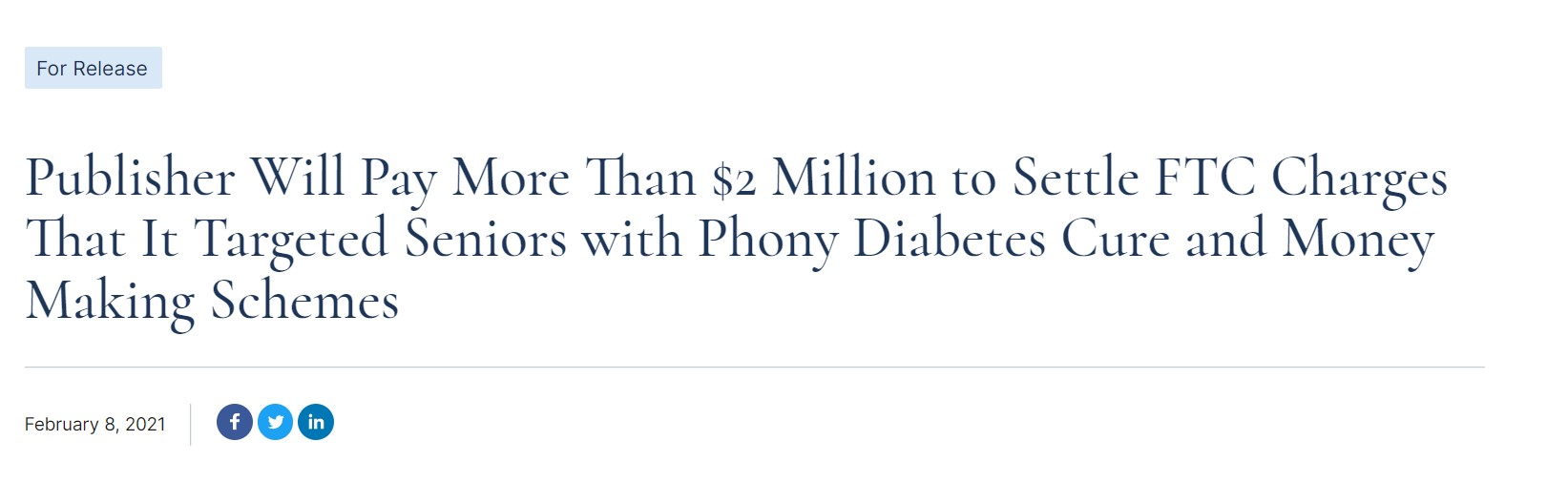

Agora 2.0

Agora used to be the biggest independent distributor of investing newsletters.

They were a behemoth that brought in $500 million in revenue every year.

But after getting fined millions for defrauding senior citizens they've lost a lot of business:

So where did all the Agora publisher's go?

They went to MarketWise.

I don't believe Crowdability was a part of Agora but basically every other publisher at MarketWise was.

It's almost the exact same faces.

The problem is they're continuing the bad business practices of Agora at MarketWise.

I've seen them even use the exact same marketing materials.

Again.. this is just all going to create a frustrating and annoying customer experience.

Another thing to consider before spending your money on Crowdability's products.

Recommended: The Best Place To Get Stock Picks

"Neural Vision" Company Revealed

Crowdability markets their products the same way as every other MarketWise publisher.. by doing presentations that hype up an investment idea.

The investment idea isn't reveled in the presentation and you have to buy the service to get it.

There's always enough clues in these presentation to figure out the stock being hyped, though.

The main presentation going around right now for Crowdability is hyping an investment called "Neural Vision:"

I actually wrote an entire post revealing the company in this presentation.

The investment opportunity here that is supposedly the "missing piece" for Tesla and Google's driverless car ambitions is Epilog.

Epilog's main product is called Sidecar and can be installed in non-driverless cars to help them become driverless (the car needs to have lane assist already installed).

Additionally, their technology produces a clearer camera for self driving cars.

Matt Milner claims this will make self driving cars safer.

If you wanted to invest in this company you would create an account on Startengine.

The company is listed there and the shares are under $200 each.

Companies like this are very risky, though.

Sidecar is just a prototype and Epilog is a LONG way from being profitable.

The only way for you to ultimately make money is if a bigger company like Tesla purchases them or if they go public.

Neither are guaranteed.

But if you want to buy from Crowdability to learn what "Neural Vision" company Milner was talking about, you no longer have to do that.

What Is Crowdability Offering?

I think the Crowdability website is being re-worked or something.

All the services currently have a waiting list or the links just aren't working.

Perhaps MarketWise is in the middle of a relaunch or something like that.

But because I can't access the products I can't tell you too much about their products.

I'll make sure to update this section as Crowdability opens up again.

But here's what I can gather so far about the products at Crowdability:

Early Stage Playbook

This is the flagship product at Crowdability and has been around for years.

Early Stage Playbook is a 12 part training course that teaches you how to invest in private companies.

Along with the training series there is a portfolio of companies to invest in.

These will be pre-IPO investments like Epilog.

In the past it was $79 and came with a 30 day refund.

We'll have to see if the price is the same.

CrowdabilityIQ

CrowdabilityIQ is a "stock screener" for early stage private companies.

This tool supposedly helps you avoid riskier private investments.

It does this by giving you information like which private investments are backed by prominent venture capital money.

Other information you get is:

- Founder's education level

- Valuation

- Sector

- Risk

and more.

CrowdabilityIQ is $99 per month.

Private Market Profits

This is the upsell to Early Stage Playbook and costs $3000 per year.

Private Market Profits is also the service being marketed with the "Neural Vision" investment presentation.

This works like a typical investing newsletter and every month you'll get a new investment idea from Milner and company.

Income Unlimited

Income Unlimited is the last product being offered at Crowdability and is another upsell.

This product costs $2000 per year.

Income Unlimited focuses on private investments with high yields.

This includes private real estate deals, energy deals and federally insured savings accounts with high interest.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Crowdability FAQ's

Still have some questions about Crowdability?

Here's answers to any remaining questions you might have:

1) Is Crowdability Legit?

I guess.. they promise to give you private investment ideas and you'll get that.

But they are a MarketWise company which isn't good.

MarketWise is pumping out products right now at an alarming pace.

I feel like they're just seeing what sticks.

So Crowdability is legit in a sense but comes with a ton of baggage being owned by MarketWise.

2) Is Investing In Private Companies A Good Idea?

Not really.

There's a reason these investments were only for people with a lot of money.

They're very risky and you can lose all your money in the wrong deal.

You'll see promises of big returns and hypotheticals involving other private deals but you typically won't get in on those investments.

A lot of the picks seem to be from Startengine which is a free to join.

You can research these companies on your own.

The biggest problem with investing in private companies is they're unregulated securities.

This means these companies don't have to file paperwork with the SEC an it can be hard to find accurate financial information about them.

You find a lot of fraud and scams in this world because of this.

Additionally, many legitimate private companies just end up turning out to be duds.

Many of these investments are startups and aren't profitable.

When you invest you're hoping a larger company buys them out or they go public.

It's a long road to that.

Investing in regulated securities is just so much safer.

3) Who Is Matt Milner And Wayne Mulligan?

Matt Milner and Wayne Mulligan are the creators of Crowdability and founded it in 2013.

Milner is an entrepreneur that has been involved in a lot of different companies.

He started in the investment world back in the 80's with Bear Stearns and worked at other well known investing banks like Citi and Lehman Brothers.

Milner has founded various media companies as well.

Wayne Mulligan is much younger and graduated from Columbia in 2007.

Immediately after graduating Wayne founded Ticker Hound which was a Q&A platform about investing.

This company was eventually bought by Tycoon Publishing (owned by Dylan Jovine).

From there Wayne started Crowdability with Milner.

4) Do You Recommend Crowdability?

Not really.

I mean the idea of investing in startups is definitely exciting.

And it is true that some people do get rich from these kinds of investments.

But it's soooo risky.

The odds of losing your entire investment is much more likely than getting rich.

I just wouldn't recommend normal people get involved in these kinds of companies.

Investing in publicly traded stocks is much better for most people.

Add on the fact Crowdability is owned by MarketWise which means a ton of baggage.

I just would avoid.

Recommended: The Best Place To Get Stock Picks

Crowdability Pros And Cons

Crowdability Conclusion

Crowdability is the latest edition to MarketWise's empire.

MarketWise is growing rapidly and is already making over $500 million in revenue a year.

There's really not too many services I recommend from them.

I've bought a bunch of their products and none of the services perform all that well.

Plus they nickel and dime you with their upsells.

If a service from MarketWise is excellent I'll recommend it.

Is Crowdability excellent?

No I don't think so.

I can't imagine it being smart for average people to invest in unregistered securities.

There's a reason these kind of investments were off limits to most people previously.

And it wasn't some conspiracy to keep your poor.

It was because these investments are incredibly risky and only very knowledgeable people should be putting money into them.

If you're really that interested in private companies just create a Startengine and start browsing yourself.

No need to pay to access public information.

Here's A Better Opportunity

I'd pass on anything Crowdability is offering.

The good news is there's better investing services out there.

I've personally reviewed over 100+ investing services..

To see my favorite (that's very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Thanks, the article was interesting & I’ll try to get my $3,000 refunded.

Thanks!