Stansberry Innovations Report is an investing service run by John Engel.

He claims him and his team can help you make money with stocks focusing on "the most pioneering and disruptive technologies around the world today."

Is Engel being honest or is this another investing scam?

We'll get to the bottom of this question in this review.

Additionally, you'll get insights into this service you won't find anywhere else including red flags and performance record.

You'll know if Stansberry Innovations Report is worth it by the time you're done.

Let's get started!

Stansberry Innovations Report Summary

Creator: John Engel

Price to join: $59 for first year, $199 per year after

Do I recommend? Not really

Overall rating: 3/5

Stansberry Innovations Report is a decent investing newsletter.

There's good stock picks here and some losers as well.

Nothing special but it comes with some serious baggage that makes me reluctant to recommend.

This includes massive upsells, manipulative marketing and more.

There's better options out there.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

ANOTHER MarketWise Newsletter

The investing newsletter industry can be difficult to navigate if you're a beginner.

There's a lot of big promises, slick marketing and unsavory characters in this world.

Think of me as your guide to investing newsletters.

As your trusted guide it's important for me to inform you Stansberry Innovations Report is owned by a much larger company called MarketWise (they own Stansberry Research).

Here's what you need to know when dealing with MarketWise:

Agora Influenced

Agora used to be the king of the investing newsletter world.

But after major hits to their reputation, like getting fined millions for defrauding seniors, they've shrunk a lot:

At its peak Agora was making more than $500 million in revenue and owned a lot of the most popular investing publishers.

However, last summer many of Agora's top publishers moved on to create their owned publicly traded company called MarketWise.

If you look at the "experts" at MarketWise and the publishers they own you'll see they basically all come from Agora including Nomi Prins, Teeka Tiwari, Jeff Brown and everyone at Stansberry.

Massive Upsells And Aggressive Marketing

Stansberry Innovations Report is known as a bait product.

Basically it's priced so cheap because Stansberry just wants to get you in to the sales funnel.

Once in the sales funnel you'll be bombarded with promotions every single day to upgrade.

Many of these promotions will cost thousands of dollars and this is how Stansberry/MarketWise make the majority of their money.

MarketWise is actually on track to make well over $500 million in revenue this year and they're not hitting those numbers by selling $59 newsletters.

They're masters at squeezing as much money out of you as possible.

So if you buy Stansberry Innovations Report just beware you're going to be put in a very sophisticated and persuasive sales funnel.

Scammers Get Promoted To You

The last thing you need to understand about MarketWise is they hire legit scammers and pass them off as experts.

Once in a MarketWise sales funnel you'll be marketed products from Stansberry AND their other publishers.

One of the publishers, InvestorPlace, is headed by a guy names Louis Navellier.

Louis Navellier was fined $30 million just two years ago for misleading his customers about his stock picking abilities:

No reputable company would want to associate with Louis but MarketWise will happily market his products to you - some of which cost over $10,000.

Someone like Teeka Tiwari, head of Palm Beach Research Group, was thrown out of Wall Street and can't works as a stock broker ever again.

There's other characters who have bad reputations at MarketWise as well.

The last place you want to be in is a MarketWise sales funnel and getting these promotions to your inbox every day.

Recommended: The Best Place To Get Stock Picks

John Engel's Stock Picking Performance

At the end of the day what a stock picker says about themselves is irrevelant.

They all call themselves the best stock pickers on earth.

What truly matters is the results the stock picker gets.

Here's a look at some of the bigger stock picks John Engel has made in the past and how they've done.

Bitcoin, Amazon, Alphabet, DocuSign In January 2021

In a stock presentation where John Engel asked "are you prepared to opt out of America" Jon pitched a few different assets.

They were Bitcoin, Amazon, Alphabet (Google) and DocuSign.

Here's how each has performed starting with Bitcoin:

Crypto was booming for a while and Bitcoin did almost double after being recommended by John.

But things have gone south for crypto in general and now Bitcoin is worth about half of what it was in January 2021.

Next up we have Amazon:

Amazon is down pretty big since January 2021 as well going from $160 to $94.

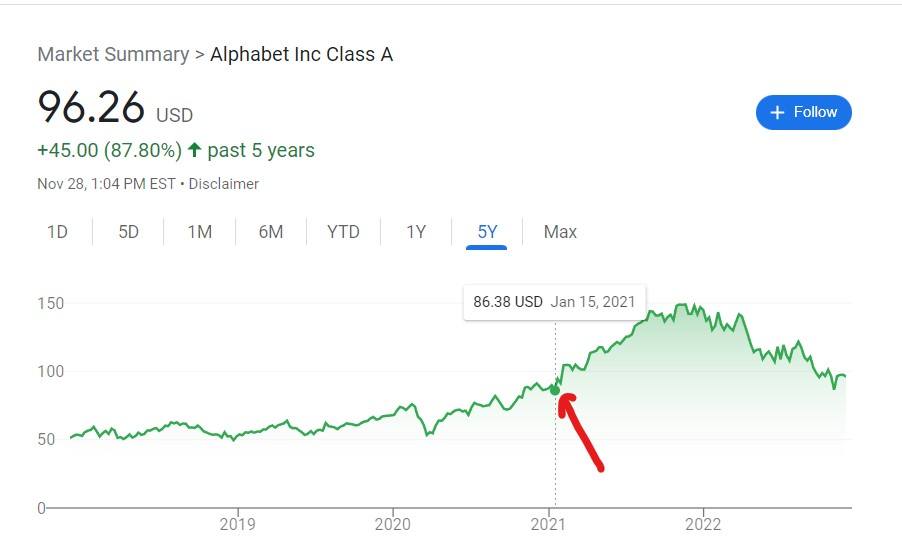

Next we have Alphabet:

Alphabet has done better than most tech companies in today's climate and has held on pretty well.

It's down from its peak but it's up slightly since being recommended by John.

Lastly we have DocuSign:

The DocuSign stock pick has been really bad and has lost about 80% of its value.

Not good!

Microsoft and Intuitive Surgical In October 2019

Back in October 2019 John ran a stock teaser claiming there would be an "image mapping rollout" to cure "3rd leading cause of death."

John is making the claim medical error is the 3rd leading cause of death in America and augmented reality will hep bring these numbers down.

The two companies being pitched here are Microsoft and Intuitive Surgical.

First we'll start with Microsoft:

Microsoft has been a strong stock over the years and more than doubled since being recommended.

Even with the current state of the market it's not down overall and is still up a good amount since being recommended.

Here's how Intuitive Surgical has done:

This is another stock that has performed well and has doubled since being recommended.

Overall this was a strong stock presentation.

Fortinet In February 2019

In early 2019 John claimed there was a "new arms race to save the internet."

The pitch revolved around cybersecurity companies and the main company being teased was Fortinet - they focus mainly on firewalls.

Here's how this stock has performed:

An excellent stock pick!

This one has about tripled since being recommended.

Overall you can see there are some losers and winners with this newsletter.

If you can be discerning about which to invest in and which to avoid you can definitely find some winners here.

Recommended: The Best Place To Get Stock Picks

What Does Stansberry Innovations Report Offer?

Stansberry Innovations Report works like every other investing newsletter out there.

Here's an overview of what you get:

Monthly Issues Of Newsletter

This is mainly what you're paying for.

Once a month you'll get a new copy of Stansberry Innovations Report.

In this newsletter you will get new stock ideas and detailed write ups about why John likes the stock.

Model Portfolio

This is the other part that you're paying for.

The model portfolio contains around 20 open stock positions and you'll get access to them when you sign up.

Additionally, you'll get updates on the stocks and if immediate action needs to happen on the positions you'll be told what to do.

Special Reports

Additionally, you get access to special reports which are just sweeteners to get you to buy.

These special reports are the stock teasers that we looked at in the last section.

They're always changing and will focus on some sort of tech trend or stock.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Stansberry Innovations Report FAQ's

Still have some questions about this newsletter?

Here are some answers to any remaining questions you might have:

1) How Much Does Stansberry Innovations Report Cost?

This newsletter is pretty affordable and is only $59 for the first year - after the initial year it's $199 per year.

This is a good price for what you're getting.

But remember this is a bait product to get you into the sales funnel.

After you're in the sales funnel you'll be pressured to buy products that cost several thousands per year.

2) Is There A Refund Policy?

Yes, you get 30 days to get your money back.

This won't give you time to test the stock picks but will give you time to see the model portfolio and read the research.

Typically the more expensive products that get marketed to you after won't have a money back guarantee, though.

So keep that in mind if you decide on one of the expensive upgrades.

3) Is John Engel Legit?

I only really judge a stock picker based on their track record.

John seems to be able to pick some winners - there's a good amount of losers in his portfolio as well but all stock pickers will have those.

Overall I'd say he's pretty average.

4) What Kind Of Investing Is Stansberry Innovations Report?

The main focus of this newsletter will be tech stocks.

Additionally, this is a very conservative newsletter and most of the stock picks are large cap companies.

If you look at the stocks we covered earlier you'll see Amazon, Microsoft, Google, Bitcoin, etc.

The good thing with large cap stocks is they are less risky but the the massive returns you can get from smaller companies won't be there.

Recommended: The Best Place To Get Stock Picks

Stansberry Innovations Report Pros And Cons

Stansberry Innovations Report Conclusion

Stansberry Innovations Report is a pretty decent newsletter overall.

The biggest problems is the stock picks are ones you can find literally everywhere and it's a MarketWise newsletter.

I mean do you really think you should be paying to be told to invest in Amazon and Google?

These are companies that everyone knows.

Plus there's a lot of baggage with this newsletter being from MarketWise.

You'll have to deal with manipulative marketing and big upsells.

You'll even be marketed products from legitimate criminals.

I guess if you can resist the urge to buy the upsells this newsletter could be worth it.

But I can understand someone wanting to pass.

Here's A Better Opportunity

Stansberry Innovations Report isn't a bad newsletter but there's better out there.

I've personally reviewed hundreds of stock picking services..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: