Hey, what's going on?

Today we're going to look at The Complete Investor by Stephen Leeb.

He claims if you join you'll "enjoy market trouncing returns from the ultimate straight shooter."

Is he telling the truth or is this all one big scam?

We'll get to the bottom of this in this review.

Additionally, you'll look at Stephen's stock picking performance and you'll see any red flags that I find.

You'll know if The Complete Investor is worth it by the time you're done reading.

Let's get started!

The Complete Investor Summary

Creator: Stephen Leeb

Price to join: $199

Do I recommend? Sort of

Overall rating: 3/5

The Complete Investor is a pretty solid stock picking service.

I like that there's diverse investment ideas ranging from different sectors.

The price isn't bad either.

There's some stinkers in the portfolio so if you buy do your own research as well.

Overall not my favorite investing newsletter but a pretty good one.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Who Is Stephen Leeb?

I've reviewed over 100 investing newsletters and stock picking services at this point.

Many of the people that lead these products aren't fit to give out stock picks.

Some are life long scammers and others push horrible investing strategies that lose money.

I try to be hard on these guys because you can lose money if you follow the wrong investing guru.

However, Stephen Leeb is definitely someone that's capable of giving out winning stock picks and has an impressive resume.

He got his economics degree from Wharton Business School which is one of the best schools in the world.

Stephen also has a Masters in mathematics and a PH.D. in psychology.

Impressive stuff.

But education accomplishments don't really count for much in the real world..

Stephen has plenty of real world success too.

In my opinion his most impressive ability is to accurately predict market trends.

For example, he accurately predicted:

- $100 a barrel oil

- Dow's rise over 4000

- Dot Com Bubble

- Bull market in precious metals

- China's global rise

And more.

Stephen has many best selling books and customer reviews for his products are pretty positive.

I can't really find any red flags or controversies in Stephen's past or anything like that.

He calls himself a straight shooter and that seems to be the truth.

Recommended: The Best Place To Get Stock Picks

Stephen Leeb's Stock Performance

Stephen doesn't have a public record of every stock he's ever picked.. so I can't tell you his exact returns.

However, he does a lot of stock teasers where he hypes up a company to try and get you to buy his newsletter.

It's basically how all stock pickers sell their newsletters.

These are supposed to be his best and most researched investment ideas.

Here's how a number of them have performed over the years:

NovaGold For Over 15 Years

NovaGold is a mining company that Stephen has been pitching for over 15 years now.

He most recently pitched it in April 2022.

At the time the stock was around $9 and it's down pretty significantly since then:

There is a lot of potential with this mine, however, and the price seems to rise and fall pretty consistently.

Additionally, for the price to rise gold prices would have to go up and the cost of building their mines would have to come down.

Nokia In September 2019 & 2020

Nokia is a stock that Stephen has recommended a couple times in the past.

He last ran a stock presentation claiming this company was a "5G fix" for a "devastating 5G flaw."

He hyped this stock up a lot and claimed it could get gains as high as 2,247%.

So did it reach those numbers?

Nope!

Apparently Nokia has had a hard time keeping costs down and didn't get the orders they expected.

The stock dropped a pretty good amount and has recovered since the dip.

Overall it's down, though.

iQiyi In December 2018

iQiyi is known as the "Netflix of China" and Stephen called this the "perfect retirement stock."

This stock has performed horribly, though, and has essentially crashed completely:

There's some big competition for streaming in China.

Alibaba offers streaming and does Tencent - both are bigger.

I really hope no one actually put their retirement into this stock.

Eli Lilly, Merck, Pfizer, Bristol Myers Squibb And Roche In November 2012

In 2012 Stephen Leeb recommended 5 different medical stocks.

He claimed these were "MCR" stocks which means medical capital returns.

Here's how each has done over the years:

Eli Lilly is a very old company that founded all the way back in 1870's.

It's gotten awesome returns since 2012 and anyone that's held on to the stock this long must very happy.

Next up we have Merck:

This stock hasn't done as well as Eli Lilly but it's still gone up for 10 years now.

So this is another good stock pick.

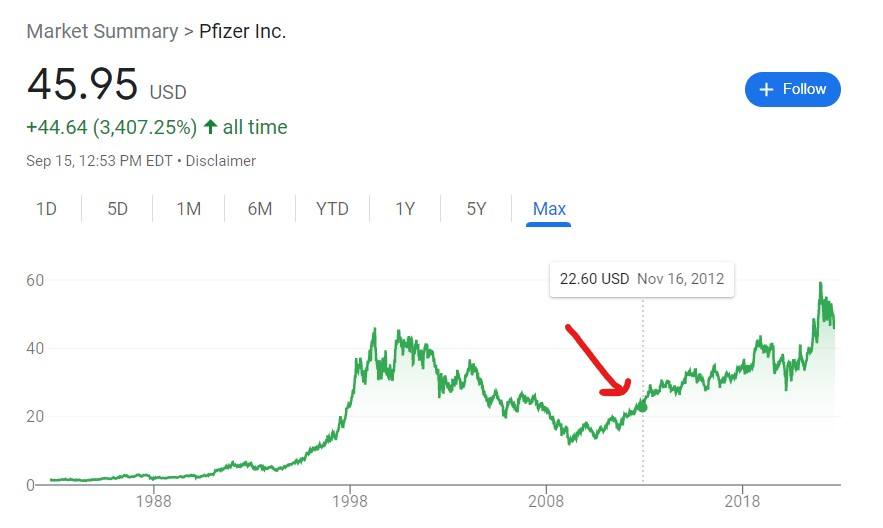

Stephen then recommended Pfizer:

Pfizer is very famous because of the Covid 19 vaccine but they've actually been around since the 1850's.

This stock has doubled and consistently gone up in the last 10 years.

Next up we have Bristol Myers Squibb:

Another stock that's doubled over the last decade.

Lastly we have Roche which was recommended at $24 and the stock is currently $42.

So it's basically doubled as well.

Overall this was a VERY profitable stock presentation from Stephen and anyone that listened would have made a good amount of money.

Recommended: The Best Place To Get Stock Picks

What Is The Complete Investor Offering?

The Complete Investor functions almost exactly like every other investing newsletter.

Here's a breakdown of everything that you get:

Monthly Issue Of Newsletter

This is the main part of the offer and what you're paying for.

Every month you'll get a new issue of The Complete Investor.

In each new edition you'll get new stock recommendations and you'll get updates on the open positions in the model portfolio.

You'll be given instructions to buy, sell or hold these positions.

Access To 5 Different Portfolios

Usually you only get 1 portfolio when you sign up to a stock picking service.

It's nice to see you get 5 with The Complete Investor.

They all have a theme and recommend different stocks based on risk and strategy.

The 5 portfolios are:

- Growth

- Income

- Fund portfolio

- Core ETFs

- Small caps

You can put all your money into one of the portfolios or you can mix and match to build a diverse portfolio.

Weekly Updates And Flash Alerts

Sometimes action needs to be taken before you get the monthly newsletter.

This is where the weekly updates come in.

Every Monday you'll get a breakdown of the market so you can stay on top of your portfolio.

If a position needs to be sold or bought you'll get an alert when to do so as well.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

The Complete Investor FAQ's

Still have some questions about this service?

Here's answers to any remaining questions you might have about The Complete Investor:

1) How Much Does The Complete Investor Cost?

The Complete Investor only costs $199 per year which is a good price.

There's many alternative services that cost way more than this.

Plus you get print editions of the newsletter along with your digital copies.

I definitely think this newsletter is worth checking out at this price.

2) Is There A Refund Policy?

Yes, there's a pretty good one.

You get 90 days to get your money back.

It's prorated so you'll be charged for the time you were a member but you'll get most of your money back.

3) Is Stephen Leeb Legit?

Definitely.

Usually I look for any excuse not to call a stock picker legit but Stephen is.

If you like credentials Stephen has those.

He went to Wharton Business school and earned an economics degree.. he later got a masters and PH.D. in mathematics and psychology.

Stephen also has real life success.

He's written many best selling books and has made some very accurate predictions about the market.

4) What Is Invest Daily?

Invest Daily is the publisher that sells The Complete Investor.

This publisher works like a lot of other investing publishers do HOWEVER I think it's better quality than alternative publishers.

I've reviewed another newsletter from Invest Daily called Utility Forecaster and that got a good review out of me too.

There's probably less then 10 investing newsletters I would recommend and now two come from Invest Daily.

There's a lot of products there I haven't looked at yet too.

Invest Daily can be annoying to deal with though despite their quality.

They're going to send your email non stop promotions and this gets pretty annoying.

Plus they do the over-hyped stock presentations that are often misleading.

My advice is if you're going to get The Complete Investor use a burner email account.

This way your email doesn't get flooded with promotions.

5) What's The Investing Strategy?

Stephen writes about natural resources a lot and these are going to be a big theme of his investments.

This includes mining, drilling and stuff like that.

He does seem to recommend growth/tech and medical stocks as well.

For example, he recommended Nokia, the Chinese streaming service and all of those medical companies we looked a earlier.

He does have 5 different portfolios for you to choose from.

So the investment strategy is pretty diverse and covers many different markets.

6) Are There Similar Newsletters?

Yes there's plenty of similar newsletters.

Some include:

- True Wealth

- Strategic Intelligence

- Strategic Investor

- Jeff Clark Trader

- Insider Newsletter

- Hidden Alpha

- Forecasts And Strategies

- Katusa Research

There's no shortage of these kind of investment newsletters.

Recommended: The Best Place To Get Stock Picks

The Complete Investor Pros And Cons

The Complete Investor Conclusion

It's always good to find a newsletter that's worth recommending.

I don't think The Complete Investor is the best investing service out there but it's good enough to consider buying.

The stock picks seem to be pretty solid even though there's some big losers and Stephen isn't always right.

But no stock picker is always right.

The customer reviews for this newsletter are solid too.

Most complaints are about the constant upselling and not the stock picks themselves.

I've found people that have been with the newsletter for many years now which is a good sign the picks are profitable.

So if you wanted to buy The Complete Investor I really wouldn't talk you out of it.

Here's A Better Opportunity

The Complete Investor is pretty good but not my favorite stock picking service.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: