Matt McCall recently launched a stock presentation teasing a company in the V-Toll market.

Apparently this company will help revolutionize flying taxis..

Sounds pretty interesting!

But there's one major downside to this presentation.. Matt won't reveal the name of the company unless you buy his new newsletter called The McCall Report.

No worries, though..

I took a look at the teaser and was able to figure out the name of the company he's alluding to.

Below you'll see the name of the company, whether it's a smart investment or not and if Matt McCall is legit.

Every question you have will be answered here.

Let's get started!

Matt McCall V-Toll Stock Summary

Creator: Matt McCall

Stock: EVE

Stock Symbol: EVEX

Matt McCall is pitching a company called Eve, which just went public after a SPAC Merger.

The stock has been volatile in the short time it's been public and is currently surging after crashing.

It's definitely still early to be investing in these kind of stocks and there is a lot of competition.

Ultimately this presentation is trying to get you to buy The McCall Report, which I don't recommend.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

What Is Matt McCall's V-Toll Stock?

Recommended: Best Place To Get Stock Picks

Matt McCall is pitching a new company to invest in and it's in the V-Toll market.

V-Toll stands for Vertical Take Off and Landing Planes.

The idea is you'll have taxi's and transportation in urban areas that can fly.

The designs of these products are definitely cool:

Matt is trying to pitch a company that is going to make products like this.

He's calling it the "biggest money making trend of the next decade"

And believes it's a "new way to travel in 2022."

While this technology maybe the future one day it's still pretty far off from being practical.

There's a lot of laws and regulations that need to pass for this to "take off."

Also, the technology just isn't quite yet there.

But soon perhaps.

Next, Matt claims this technology will help people "get you from Baltimore to Philadelphia in 15 minutes."

Right now it's about a 2 hour drive.

Further in the pitch Matt claims he recommended an air taxi stock in 2020 that went from $10.28 a share to $129.80.

This company is EHang Holdings and is a Chinese stock.

Here's how the stock did:

So the stock really did go from $10 to $129.80.

If you sold at the right time you had a chance to 10 to 13 times your money.

Even after the peak the stock was up around 3 to 4 times the $10 stock price.

It's down now but you would have had a lot of time to cash out with the stock.

So kudos to Matt for getting this one right.

I guess the question is whether or not Matt can recreate this magic with his new V-Toll stock.

At first Matt talks about a company called Embracer, which is a Brazilian aircraft manufacturer.

However, this isn't the company he's pitching.

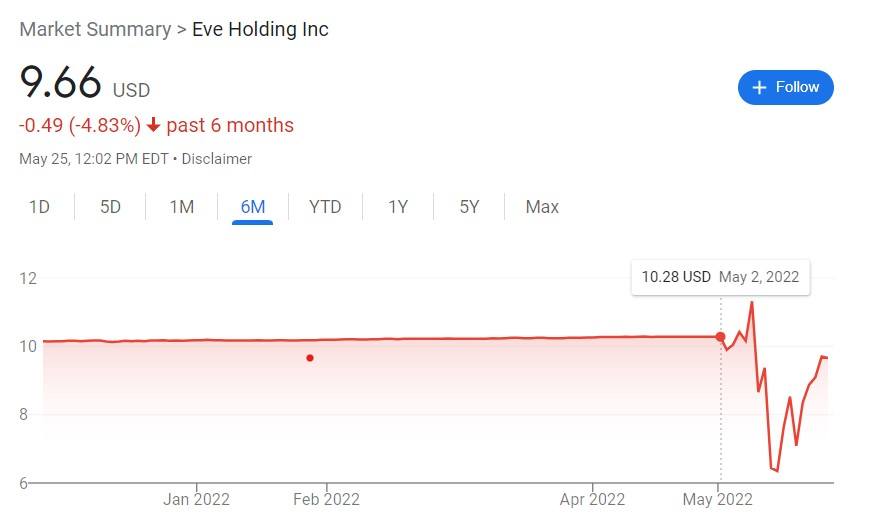

He's pitching a subsidiary of Embracer called Eve (EVEX) that just went public two weeks ago.

The stock has been on quite a rollercoaster in this time:

I'm not going to tell you whether or not you should invest in this stock.

That's up to you to decide.

There is a lot of competition, though and many more of these companies will be going public soon.

But that's not all there is in this pitch..

Besides this stock Matt is selling his newsletter The McCall Report.

The next question you need to ask yourself is if this newsletter is worth it or not.

Let's start by looking at Matt's past and whether or not he's legit.

Matt Worked With A Scammer

Matt McCall has been in the stock picking business for a long time.

He likes to talk about his work on Wall Street with Charles Schwab but he was only there for a year.

After that he transitioned pretty quickly into the stock entertainment world.

Right after he left Schwab he started hosting a stock radio show and launched a bunch of investing newsletters.

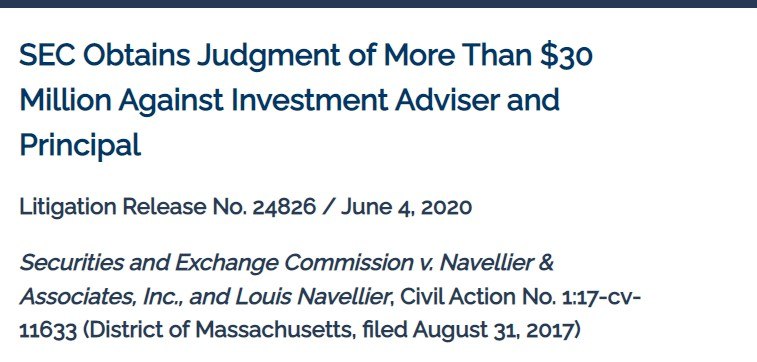

A major red flag, though, is Matt worked with a HUGE scammer named Louis Navellier.

Louis is the face of InvestorPlace (where Matt worked previously) and he sells a ton of newsletters there.

Just last year Louis and Matt ran a newsletter together.

The problem?

Louis was fined $30 MILLION for defrauding investors in 2020:

Basically Louis made up a bunch of details about stocks and purposely made investors lose money.

That right there should have ended Louis' career in the stock picking industry.

But it didn't and Matt continued to work with him.

Matt's New Employer Is Even Worst

There's not many places worst than InvestorPlace.. but there is one that's definitely worst.. it's called Agora.

Can you guess who Matt works for now and who is now selling his investing service The McCall Report?

That's right - Agora.

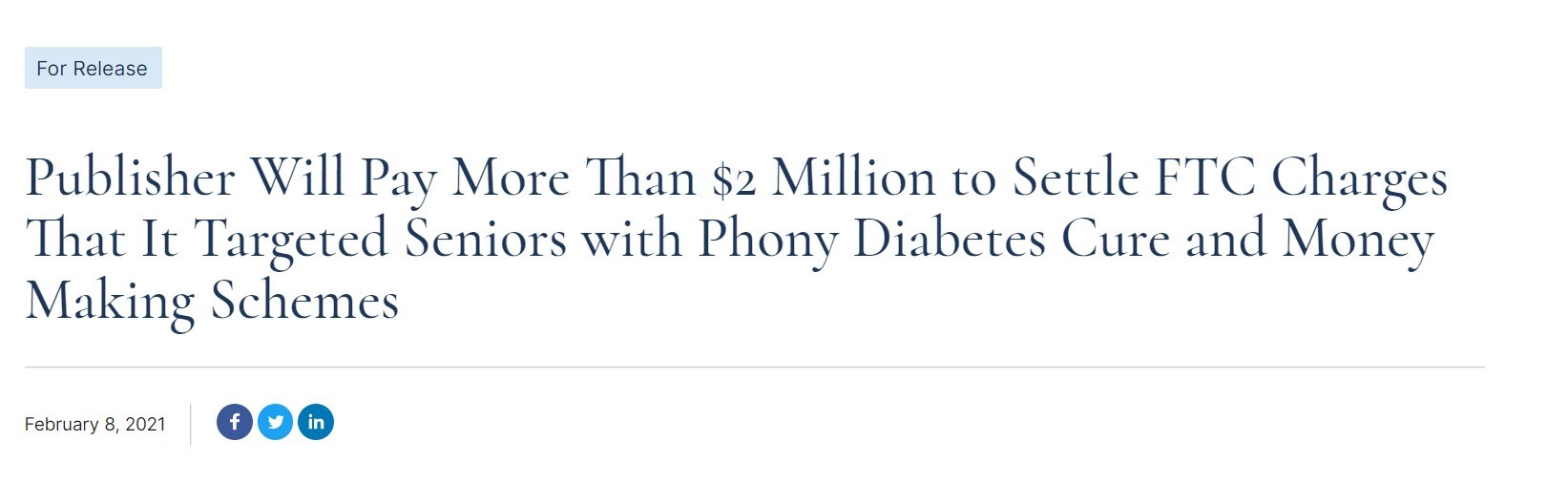

So why is Agora the worst place to buy investing newsletter?

They get caught defrauding people all the time.

For example, just last year Agora was fined $2 million for defrauding senior citizens:

This is pretty bad..

I mean would you trust your credit card with someone in your neighborhood that is constantly stealing from old people?

I don't think so.

The problem is Agora is so big that $2 million is nothing to them.

They make HUNDREDS of millions a year.

According to Truth In Advertising they still target senior citizens with scams and deceptive marketing:

It's hard to say Matt is legit when he works at these places.

Additionally, it's very rare for me to recommend an Agora product.

Once you get in their marketing funnel you're bombarded with promotions every day.

Some of the products cost thousands and will make you lose thousands.

Something to keep in mind.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Matt's Stock Picking Performance

Because Matt has been selling stock picks for so long, he's done a ton of these teaser presentations.

We can look at his past stock picks to see how good he is and how seriously we should take him.

Here's a few I've come across in the last few years:

Silvergate Capital Corp In 2020

In February 2020 Matt pitched Silvergate Capital Corp.

He claimed it was a crypto bank that was going to take off.

In the presentation he claimed the stock would go over $75 a share (it was trading at $15 at the time).

It turns out he was right:

The stock even went over $200.

Overall this was an excellent stock pick from Matt.

Kudos to him on this one.

BeiGene Pharma And Asceletis Pharma In November 2019

In this presenattion Matt was teasing a bunch of Chinese Biotech companies.

There was a good pick and a bad one.

First the good one:

This stock doubled pretty quickly and there was plenty of time to sell at the high.

The other stock didn't do as well, though:

This one was definitely a bad one.

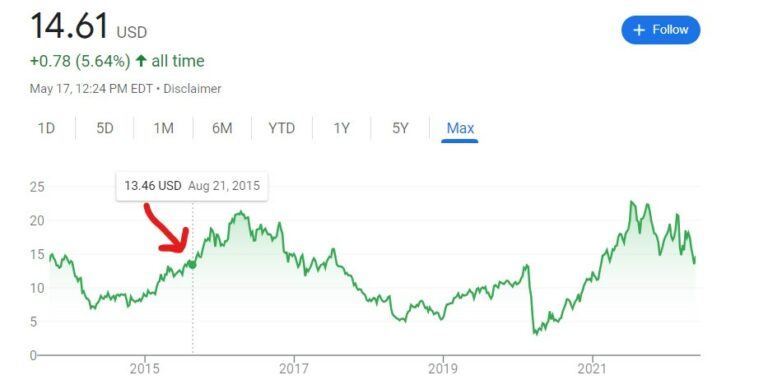

Valeris and Ophthotech In August 2015

In 2015 Matt was pitching two stocks he said were under the radar.

The first one, Valeris, has been up and down:

Most people probably lost money with this stock pick.

The second stock pick was absolutely horrible:

Pretty much everyone lost their money unless you sold at the very brief high the stock had.

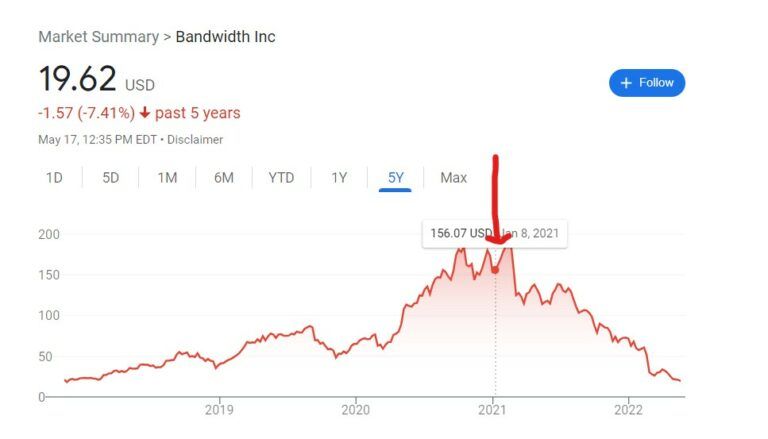

Bandwidth And Five9 In January 2021

The last two stock picks we're going to look at were from Matt and Louis Navellier.

These come from the newsletter that they ran together.

Both stock picks did really bad.

Here's bandwidth:

It was recommended at its peak and shortly after crashed.

It's lost basically all of its value.

Here's Five9:

This is another one that was recommended at the top and basically lost all of its value.

Overall, Matt's stock picking ability is spotty at best.

There's some good ones but there's some really bad ones too.

I'm not sure I would want to get my stock picks from him.

Recommended: The Best Place To Get Stock Picks

The McCall Report Is Very Typical

Like I mentioned before Agora owns The McCall Report and Stansberry Research.

Additionally, they own dozens of other publications and sell hundreds of investing newsletters.

I've reviewed many of them including:

- Strategic Investor

- Commodity Supercycles

- Strategic Fortunes

- Alpha Investor

- Wall Street's Proving Ground

- Technology And Opportunity

So I'm very familiar with what Agora offers with their newsletters.

The McCall Report is exactly the same as the ones I just listed.

You get a monthly newsletter, model portfolio, alerts and special reports.

You can find a hundred other newsletters that offer the same thing.

In the end the stock picks are the only thing that matters.. and Matt's history is spotty.

There's some big winners but there's also massive losers.

Wrapping Things Up

Welp that's the end of this review..

You now know the stock being teased by Matt, you've seen Matt's work history and stock picking history and you now know the product being pitched to you.

You have all the information you need to decide if Eve is right to invest in and whether or not The McCall Report is worth buying.

The first option is up to you but I'd urge against buying The McCall Report.

There's nothing special about it and the company that owns it is extremely predatory.

They're not someone you want to have your credit card information.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: