Technology Profits Confidential is an investing newsletter from Ray Blanco.

It focuses on tech and biotech stocks.

Does this service live up to the hype or is it another investing scam?

We get to the bottom of this question in this review.

Also, we're going to take a look at Ray's stock picking history and we're going to explore any major red flags.

Unfortunately there's plenty..

Let's get started!

Technology Profits Confidential Summary

Creator: Ray Blanco

Price to join: $500

Do I recommend? No.

Overall rating: 2.5/5

Technology Profits Confidential is your typical investing newsletter.

There's a lot of hype involved and sometimes Ray Blanco delivers.

However, from what I've seen there's just too many losing stock picks.

I really, really don't like the company that owns this newsletter too.

I'd avoid.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Ray Blanco's Stock Picking Performance

What's more important?

The credentials of a stock picker or the performance of their stock picks?

The answer should be obvious.

I typically stay away from repeating what stock pickers say about themselves because who knows what's true and what's not.

What matter is the results they get.

Here's a look at some stock picks Ray Blanco, creator of Technology Profits Technology, has made in the past.

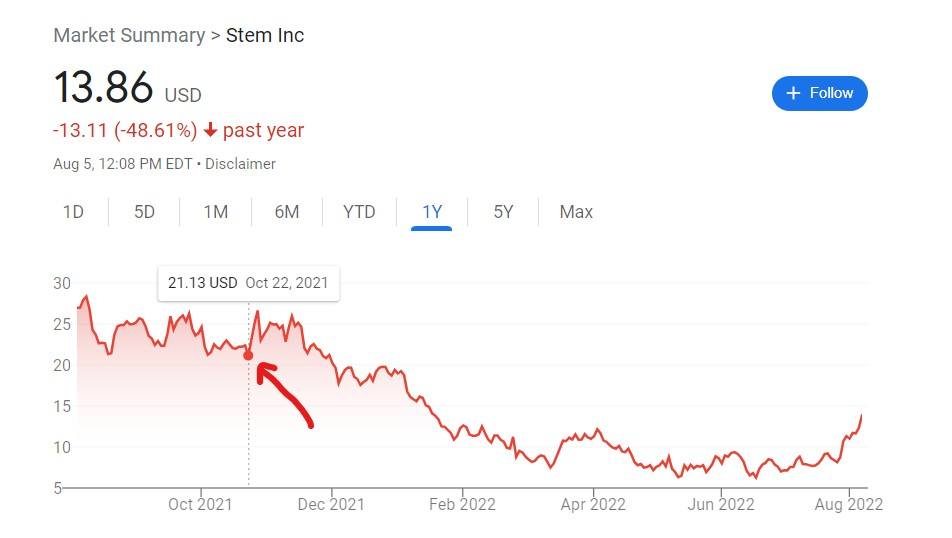

Stem In October 2021

A little less than a year ago Ray ran a teaser talking about "Tesla's Biggest Competitor."

Stock pickers like to use Tesla or Elon in their pitches because it gets attention.

One of the companies Ray was talking about is Stem which sells batteries and software for renewables.

This company came public through a SPAC deal and isn't profitable yet.

SPAC companies usually all follow the same trend. Their stock pops and then it slowly declines because there's no actual revenue.

The gamble is the company will be profitable down the road.

Still.. I don't get why people don't just hold off until the stock comes down like it always does.

Anyway, this is what happened to STEM:

2022 has been a rough year for tech stocks picks too.

It lost 70% of its value at one point but does seem like it's starting to recover.

Satellite Internet Stocks In June 2020

Back in June 2020 Ray ran a teaser hinting at an "Apple-Fi" business.

The jist was internet would be coming from satellite companies in the future and Apple will be providing internet access from satellites.

He actually teased 5 stocks in this presentation and the main one was Aerojet Rocketdyne which creates rocket engines.

The other stocks were:

- Loral Space

- Echostar

- Virgin Galactic

- Maxar

Here's how each stock as performed, starting with the focus of the teaser Aerojet Rocketdyne:

This stock has gone up and down a bit but at the end of the day is pretty much breakeven.

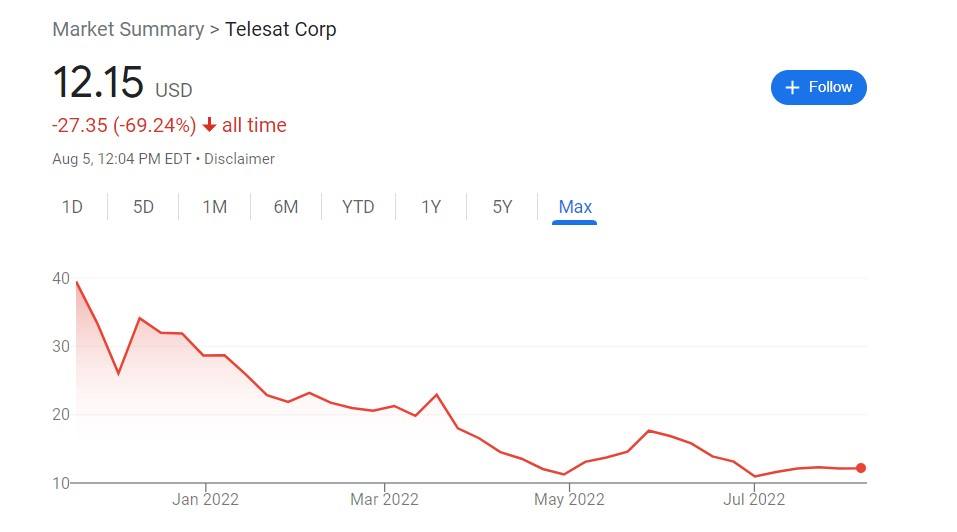

Next up we have Loral Space:

For a while this stock did well and more than doubled in just over a year.

However, the company changed names to Telestat after a merger (the chart up top stops in November 2021) and the stock has tanked since then:

Up next we have Echostar:

This stock hasn't really done well either.

So far there really hasn't been any winners from this group unless you sold Loral Space at the right time.

Let's see if Virgin Galactic has had any success:

Well there definitely was chances for you to cash out with big returns.

The stock went from $15 to $60 briefly.

However, if you held onto it past those peaks you're down over 60%.

Last up we have Maxar:

This stock is a decent winner.

Covid Stocks In April 2020

There was a lot of money to make with stocks during Covidmania.

Ray suggested three stocks in the very beginning and they were:

- Inovio Pharmaceuticals

- Regeneron

- Gilead

Here's how each has performed starting with Inovio:

The stock went from around $7 to near $30 very quickly.

If you sold at the peak you could have made serious money.

If you're still holding you're down big.

Next up we have Regeneron:

This stock hasn't had the dramatic increases like Inovio but it's been steadily going up.

Lastly, we have Gilead:

Gilead was definitely the loser of the group and has been pretty much down since being recommended.

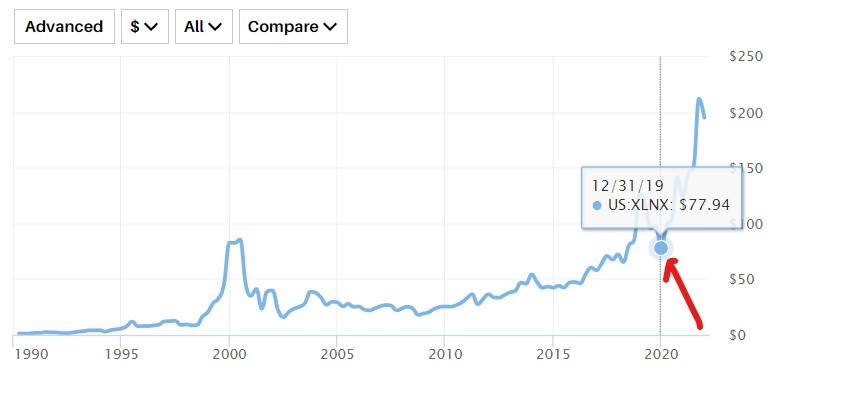

Xilinx In January 2020

Xilinx was a reprogrammable chip maker that made products for 5G, AI and self driving cars.

It was teased in January 2020 and AMD bought it two years later.

However the stock nearly tripled in that time providing big returns for anyone that invested:

Good timing on this recommendation!

Overall I'd say Ray's stocks are mixed with big losers and some winners.

A lot of the recommendations seem pretty volatile in my opinion, though.

Recommended: The Best Place To Get Stock Picks

Technology Profits Confidential Biggest Red Flag

Before we get into what Ray is offering with Technology Profits Confidential, let's talk about one major red flag about this newsletter.

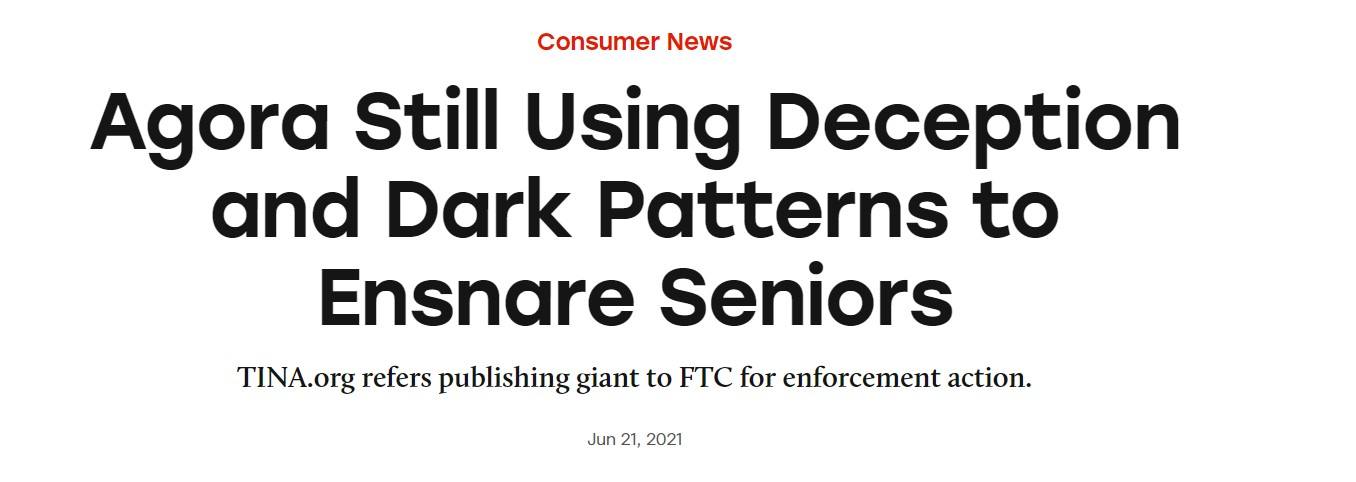

Technology Profits Confidential is owned by a company named Agora (they own the publisher that produces this newsletter).

Agora is the biggest distributor of investing newsletters and they own dozens of popular publishers.

This includes Stansberry, Oxford Club, Brownstone Research, Money Map Press and more.

The problem is they're pretty unethical and frequently step over the boundary of what's acceptable.

For example, just last year they were fined millions of dollars for ripping off senior citizens:

Getting fined for something like this is pretty bad.

However, Agora makes hundreds of millions a year so it's not a big deal to them.

Truth In Advertising has proven they're still targeting senior citizens with deceptive products and marketing:

Is this really a company you want to give your money to?

It gets worst too..

Agora doesn't treat their customer well. Once you buy one product you just become a cow they want to milk dry.

Their marketing is aggressive and relentless.

They won't stop until you upgrade and spend thousands of dollars - and they won't stop then either.

There's always a new product to sell you. Always a new stock being pitched.

Your email will be flooded with these promotions none stop.

I only recommend an Agora newsletter if it's above average because of the headache involved with dealing with them.

I don't think Technology Profits Confidential is worth the headache.

Recommended: The Best Place To Get Stock Picks

What Is Technology Profits Confidential Offering?

This newsletter is basically the same as any other Agora newsletter in what they offer.

Here's a breakdown of what you get:

Monthly Newsletter

This is the main part of the offer and essentially what you're paying for.

Every month you'll get a new edition of Technology Profits Confidential.

In these newsletters you'll get research and new stock picks.

Model Portfolio

This is the other major part that you're paying for.

Once you sign up you'll have access to the full model portfolio which includes dozens of picks.

Each pick will come with additional information on why it's a good pick.

Weekly Updates

Typically waiting for the newsletter for market news will be fine.

However, sometimes you need to hear information about your portfolio faster.

This is where the weekly updates come in.

You'll get portfolio updates every single week in your inbox.

Special Reports

Just like all newsletters this one comes with special reports that focus on a market or a specific stock.

The companies we covered earlier are the kind of companies you can expect in these reports.

Legacy Program

As proven in the last section Agora likes to market to older folks.

The legacy program cements the idea seniors are the target audience.

This feature ensures if you pass away your loved ones will continue to get stock picks.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Technology Profits Confidential FAQ's

Still have some questions about this newsletter?

Here's some answers to any questions you might have.

1) How Much Does Technology Profits Confidential Cost?

This newsletter will cost you $500.

Unlike other services it isn't a monthly or yearly cost, though.

It's a one time cost.

This makes it a pretty good deal in comparison to a lot of other services.

Those yearly costs add up and some cost thousands per year.

2) Is There A Refund Policy?

No.

I guess that's because there's a lifetime subscription instead of a reoccurring costs.

This is disappointing, though.

I typically wouldn't join an investing services that didn't have a refund policy.

3) What's The Investing Strategy?

Like the name suggests this newsletter focuses on tech stocks.

These stocks took a beating in the first half of 2022 and depending how the economy goes could take a further beating.

However, the losses seem to have stabilized.

Many of these stocks are large cap stocks and several cost hundreds of dollars to buy.

This is both good and bad.

You typically won't get huge loses with large cap stocks and there's more stability.

However, the gains usually aren't as big.

4) Is Ray Blanco Legit?

It's hard for me to call anyone that works for Agora legit and he's been under their umbrella for a long time.

In the end I just think he's a typical stock picker which really isn't a compliment.

These guys really over hype and over market in my opinion.

In a lot of instances they're selling false dreams of huge returns.

5) Are There Similar Newsletters?

There's no shortage of these investing newsletters.

Here's a few that remind me of Technology Profits Confidential:

And more.

There's literally hundreds of similar newsletters.

Recommended: The Best Place To Get Stock Picks

Technology Profits Confidential Pros And Cons

Technology Profits Confidential Conclusion

Well.. that's the end of my review of Technology Profits Confidential.

I've reviewed about hundred of these newsletters now and they're all just basically the same.

Some are definitely higher quality than others and some are headed by better stock pickers.

But what's offered is always the same.

The newsletter.. the model portfolio.. the special reports.. the updates..

Every one gives you these features.

The main difference is the returns and performance.

Technology Profits Confidential is just average in terms of performance from what I've seen.

Some picks are decent but there's some major losers as well.

Overall not worth joining in my opinion.

Here's A Better Opportunity

I'd pass on Technology Profits Technology.

There's no need to feed the Agora beast and the stock picks just aren't that good in my opinion.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: