Altucher's Investment Network is the flagship product of James Altucher.

He claims he can help you achieve true financial security and independence.

Is James telling the truth, or is this one big scam?

We'll get to the bottom of this, and we'll also explore any red flags that I find about James.

And there definitely are some.

By the time you're done reading, you'll know if Altucher's Investment Network is right for you or not.

Let's get started!

The Complete Investor Summary

Creator: James Altucher

Price to join: $299

Do I recommend? No.

Overall rating: 1/5

Altucher's Investment Network is not a product that you want to buy.

I looked at past stock picks, and most of them are losers.

Plus, I'm not a fan of Altucher and think he's just an entertainer.

He's always doing very goofy marketing gimmicks, and it's hard to take him seriously.

On top of all this, the newsletter is owned by a predatory company that's known to defraud customers.

There's nothing really good about this newsletter besides the refund policy.

I'd stay away.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

The Biggest Red Flag

There are a few red flags with James, but let's address the biggest one first.

The publisher that sells Altucher's Investment Network is called Three Founders Publishing, and that's owned by a bigger company called Agora.

Agora is a massive company, and they make over $500 million per year.

However, their reputation has taken a hit over the last couple of years.

Typically, I don't recommend anyone getting involved with an Agora publisher because it's such a headache.

Here are a few reasons why you should avoid buying anything from Agora.

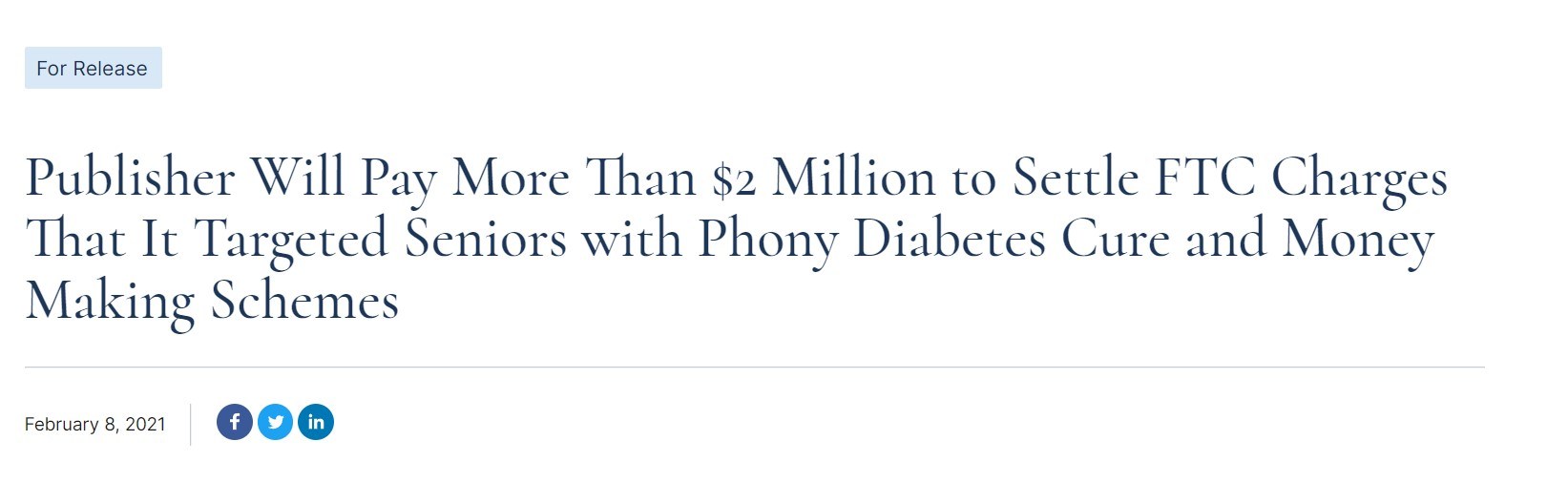

They Scammed the Elderly

I think we all agree that people who commit crimes against venerable people are the absolute worst.

There's something especially bad about committing a crime against kids, immigrants, handicapped people, and elderly people.

But that's exactly what Agora has been doing for many years.

Just last year, they had to pay millions in fines for targeting senior citizens with finance and health scams.

Agora promised to cure diabetes in elderly people without them changing their diet or having to exercise, and they promised them thousands of dollars a month from the government if they bought their newsletter.

Both were outright lies.

You might think $2 million in fines is enough to deter a company, but it's not.

Remember, Agora makes over $500 million a year.

So $2 million is nothing to them; they'll gladly pay that if they can continue to scam old people.

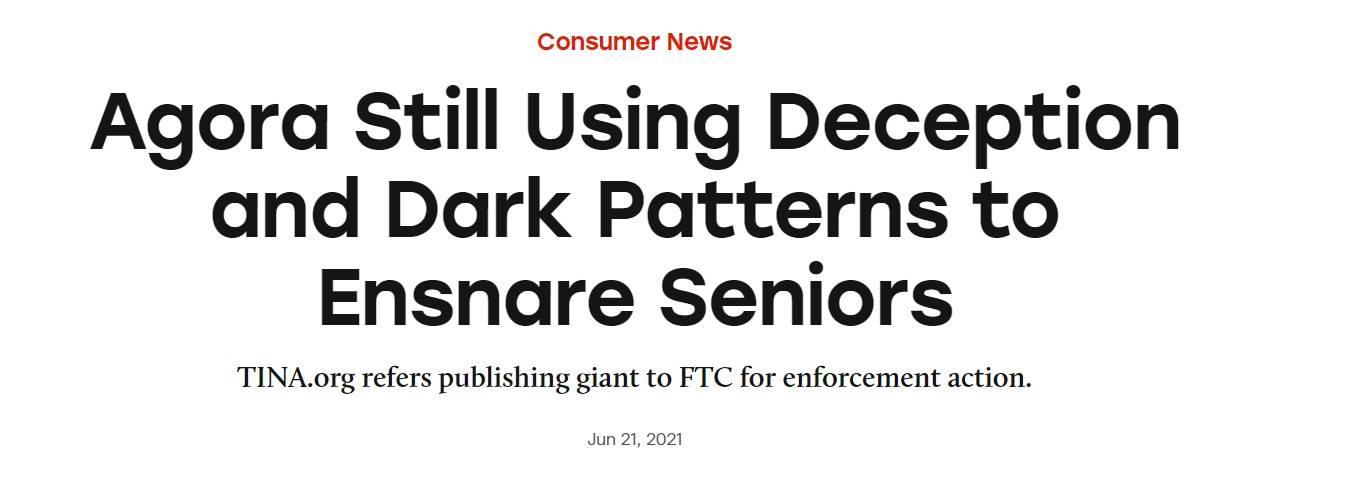

Truth in Advertising has proven exactly what is happening:

My question is pretty simple:

Is this who you want to be giving your money to?

I personally wouldn't, which is why I rarely recommend an Agora newsletter.

Many scammers work for Agora.

You have to have very flexible morals to do what Agora does.

They market in unethical ways and really take advantage of people with promises of high returns.

Many people just lose money.

Naturally, unethical people flock to work for Agora.

For example, in the past, they hired a guy named Teeka Tiwari who sold a newsletter called Palm Beach Letter.

Teeka is a lifelong fraudster who was banned from working on Wall Street.

Andrew Keene is another guy at Agora, and I just reviewed his services last week.

For the second time, I've caught him posting fake testimonials!

Other editors have poor track records and lose people money.

If you buy Altucher's Investment Network, you'll be marketed products from these guys.

Which brings me to the last point.

Too many upsells

Altucher's Investment Network isn't that expensive and costs $299. They also run promo offers where you can get it much cheaper.

However, Agora doesn't make hundreds of millions a year by selling $299 subscriptions.

They try to milk their customers for every penny that they can.

Once your credit card details are entered into the Agora system, you are treated like a target.

You'll be sent promotions multiple times a day, and many of these products will cost thousands and thousands of dollars.

This is where the real money is for Agora.

They're very aggressive with their promotions, and your email will be flooded with them.

It's really annoying to deal with.

Recommended: The Best Place To Get Stock Picks

James Altucher Is Clown Like

James Altucher doesn't really have the best reputation in the stock-picking world.

A large number of people consider him to be a clown.

For instance, in 2013, he was calling Bitcoin a scam, and then a few years later, he started heavily running a promotion on Youtube, calling himself a "crypto genius."

Can you call yourself a crypto genius if you claim Bitcoin was a scam?

Many people were mocking the ad as cringe-inducing.

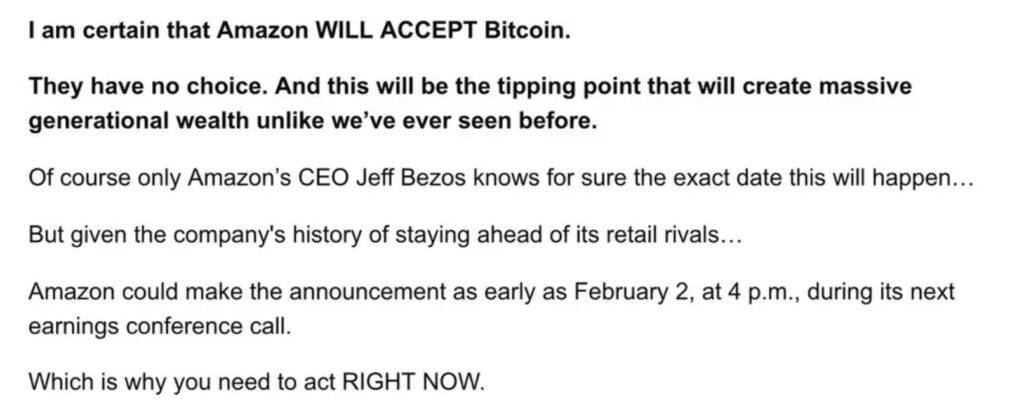

He's done other clown-like things, like telling his subscribers that Amazon was going to start accepting Bitcoin.

He even gave a date for when it was going to happen.

This was a completely made-up rumor James was pushing, but it caught on, and other people started reporting it as fact.

After it didn't happen, James sent out another email saying it would happen.

Amazon even addressed the rumors, saying there were no plans to accept Bitcoin.

In the end, James isn't a guy I would trust with my investments.

Earlier in his life, he lost all his money and, in another instance, sold all of his possessions and lived out of a suitcase.

I personally like getting my investment advice from someone more stable.

James Altucher's Stock Picking Performance

James markets his newsletter the same way every other Agora stock picker does—with stock presentations.

Basically, these are long presentations hyping up a stock and only revealing the name of the company if you buy the newsletter.

He's done a number of these through the years, and you can judge his stock-picking performance by looking at the performance of his recommendations.

Maxar Technologies in May 2021

Back in May 2021, James ran a teaser presentation titled "Bezo's Big Bet."

In the presentation, James hinted at space stocks that would benefit from Jeff Bezo's push to go into space.

The main stock being hinted at was Maxar Technologies.

Maxar Technologies is a satellite service company.

At the time, they had plans for managing orbits and space debris.

Here's how the stock has performed since the recommendation:

It's down pretty big and has lost about 40% of its value since being recommended.

Another company hinted at in this presentation is Microchip Technology.

This is a semiconductor company.

Here's how the stock has done:

This stock is down as well, but not as much.

Auxly Cannabis in September 2019

Many people were pushing "pot stocks" a few years ago.

However, most of these investments stunk and ended up crashing.

This is the case for one of James's picks in the weed industry.

He recommended Auxly Cannabis in September 2019, calling it "the only marijuana stock you'll ever need."

Well, since being recommended, it's basically lost 100% of its value.

There were definitely red flags about this company, and James chose to ignore them.

Altria in June 2019

Altria is another stock that James hyped up as a winner in the pot industry.

Altria is a massive tobacco company and owns brands like Marlboro.

They've been diversifying away from Marlboro for the last decades and have been spending money on marijuana.

Altria is one of the best-performing stocks of all time but has been stagnant for years now.

Since James recommended the stock, it hasn't grown.

This stock does offer a solid dividend, and James recommended reinvesting the dividend back into the stock for retirement.

This is a good long-term plan.

Turtle Beach in February 2019

Back in 2019, James was hyping up Turtle Beach as a "social media killer."

Turtle Beach is popular in the video game world and makes gaming headsets so people can talk to each other.

At the time of this presentation, they were earning a lot of money because of the popularity of Fortnite.

As a result, the stock did pretty well.

The stock struggled for about a year, but anyone who was patient could have more than doubled their money.

ShotSpotter in November 2018

ShotSpotter is a company that Altucher hyped up as "electronic police" back in November 2018.

The main product is an electronic system that pins where gunfire comes from and sends cops the location.

It's an interesting product, and I have friends who have personally seen it in action.

However, the stock has been pretty stagnant over the years and hasn't grown too much.

Overall, it's down pretty big at the moment.

After looking at these picks, it's clear that James picks a lot of losers, and some of them lose really big.

Recommended: The Best Place To Get Stock Picks

AI Crown Jewel

The most recent teaser put out by Altucher pushes what he calls "The A.I. Crown Jewel."

This teaser is getting a lot of attention, and the theme of the teaser is chip producers that make chips for A.I.

A.I. requires specialized and powerful chips, and many stockpickers are recommending semiconductor stocks as a result.

James left enough clues in the presentation to figure out the stock he's pitching, and it's Taiwain Semiconductor.

This is an absolutely massive company that makes semiconductors.

If you want a full breakdown of this presentation and more information about Taiwain Seminconducotr, click here.

What Is Altucher's Investment Network Offering?

Altucher Investment Network works in the same way that basically all Agora newsletters do.

Here's a breakdown of what you get:

Monthly Newsletters

This is the main part that you're paying for.

Every month, you'll get a new edition of Altucher's Investment Network.

In each copy, you'll get new stock picks, market news, and updates on the portfolio.

Model Portfolio

This is the other main part that you're paying for.

Once you sign up, you'll get access to all the current positions in the portfolio.

With this, you'll get additional information on the stocks and why they should be bought.

Special Reports

The special reports are similar to the stocks we looked at in the last section.

Basically, they look at a company or market and explain why you should be investing in it.

The reports are constantly changing.

Alerts and Daily Letters

Sometimes action needs to be taken immediately, and you can't wait for the monthly newsletter.

This is where the alerts come in.

If you need to buy, sell, or hold a position in the portfolio, you'll be alerted to do so.

Additionally, you get three daily letters.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Altucher's Investment Network FAQ's

Still have some questions about this service?

Here are the answers to any questions you might have left.

1) How Much Does This Newsletter Cost?

If you go to the Three Founders website, this newsletter will cost $299 per year.

However, there are promotions out there that are usually running for less for the first year.

This is what you should expect to pay for an introductory newsletter like this one.

Just remember, though, that this is a bait product.

The main goal is to get you into the sales funnel to sell more to you down the road.

2) Is there a Refund policy?

Yes, there's a pretty good one.

You get 3 months to decide if the newsletter is worth it, and if you want your money back, you can get it back.

However, with the more expensive upsells, Agora doesn't typically have money-back guarantees.

So keep that in mind before spending thousands.

3) What is the investment style?

The investment style seems to be all over the place.

In some instances James is recommending space stocks and in others he's recommending weed stocks.

One thing I don't like is that James recommends penny stocks, which are a really bad idea to invest in.

Overall, I'd describe James' investment style as high risk/high reward.

4) Is James Altucher Legit?

I really don't think so.

Maybe he's made some money in life off of investments and business ventures.

But he's not someone I would want to get my stock picks from.

In the end, he's really just a stock entertainer.

Someone that likes to put on a show and get attention - much like Jim Cramer.

I wouldn't take stock advice from either of these guys.

5) Are there similar newsletters?

Yes, there are plenty of Agora newsletters out there.

Some include:

And more. I've probably reviewed 100+ of these newsletters in the last year.

Recommended: The Best Place To Get Stock Picks

Altucher's Investment Network Pros And Cons

Altucher's Investment Network Conclusion

So that's the end of my Altucher's Investment Network review.

I feel like this is a review I've written 100 times because it is basically the same review I've written 100 times.

Agora pumps out newsletters like this, and they're all the same.

The language is the same, the marketing is the same, the style is the same, what's being offered is the same, etc.

All that changes are the faces and the themes of the newsletter.

But there's all the red flags you'd expect to come from Agora.

You have bad stock picks, aggressive upsells, an unethical editor, and more.

I would advise you to stay away from this newsletter.

Here's A Better Opportunity

I'd pass on Altucher's Investment Network.

The good news is that there are plenty of good alternatives.

My favorite place to get stock picks is very affordable to try and delivers high-quality stock picks.

To learn more, click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: