Nomi Prins is the editor of Rogue Economics' investing service, The Distortion Report.

This newsletter claims there's a huge crisis coming, and they can help you navigate it (and make you rich).

Is this an honest statement, or is this just one big scam?

You'll get an answer to that in this review.

Additionally, you'll get more information about The Distortion Report, including background information, an overview of what you get, a price quote, and more.

You'll know if it's right for you by the time you're done reading.

Let's get started!

The Distortion Report Summary

Creator: Nomi Prins

Price to join: $49 to $199

Do I recommend? No.

Overall rating: 1/5

I've been a member of the Distortion Report for quite some time now and can't recommend it.

This product launched in 2022 and has not had much success since then.

It's never even come close to beating the market, and many of the stock picks have lost a shocking amount.

In some cases, the stocks have lost 100% of their value and no longer exist.

Other recommendations have lost 70% to 80%.

On top of all this, once you buy, you're thrown into an aggressive sales funnel, and your inbox is bombarded with upsells that cost thousands.

There's nothing good about this offer.

So in 2024, just like in 2023 and 2022, I don't recommend the Distortion Report.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

The Distortion Report Video Review

Recommended: The Best Place To Get Stock Picks

17 Things To Know About The Distortion Report

Before you think about buying The Distortion Report, there are things you need to know about this newsletter.

There are also things you need to know about the lead editor, Nomi Prins.

The following insights will help you determine if this service is right for you.

1) Nomi Used To Work For Agora (Gross)

The stock-picking industry has a pretty bad reputation, and it's earned that bad reputation.

Some of the biggest scam artists and nefarious characters make money selling stock picks.

The worst of all the stock-picking brands is Agora, though.

Agora was once the biggest distributor of investing newsletters and would bring in $500 million every year.

This is where Nomi originally sold her newsletters.

The problem is that Agora is truly a horrible company that treats its customers terribly.

and I have very little respect for anyone who works there.

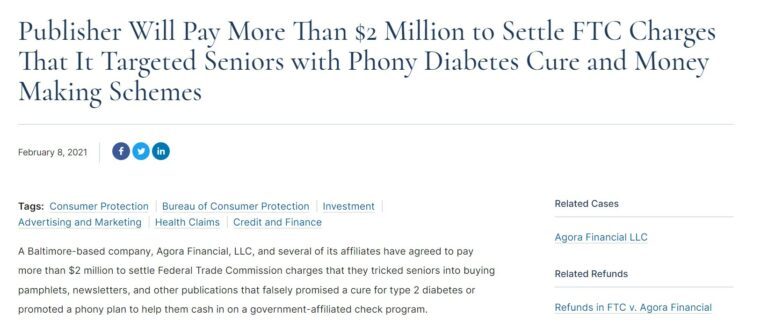

How bad is Agora?

Well, just two years ago, they were fined $2 million for defrauding senior citizens.

Scamming elderly people is as low as it gets.

I personally wouldn't want my money to go to someone who's participated in stuff like this.

Fortunately, Agora is starting to crumble.

The bad news is that a new company has taken its place.

2) Nomi Now Works for MarketWise (Agora 2.0)

Stock picking is a lucrative business.

There aren't many people who are good at it, but you can make a lot of money selling stock picks.

So when Agora started to fall apart, it was a safe bet that someone would take their place.

And the company that took its place is called MarketWise.

This is now Rogue Economics, the publisher of The Distortion Report.

MarketWise launched in the summer of 2021 and is a publicly traded company.

Basically, MarketWise now owns all of the publishers that Agora previously owned.

It's all the same faces and the same brands.

The problem is that nothing has really changed.

MarketWise markets their products in the exact same way as Agora.

This means using deceptive marketing, outrageous claims of returns, expensive upsells, and little regard for customers.

The entire goal of MarketWise is to squeeze every last dime they can out of you.

Later in this review, I'll show you how they do this.

3) Scammers Will Have Access To Your Email

Here's the thing about MarketWise: They make even more money than Agora did.

This is only their second year, and they're going to make well over $500 million in revenue.

They don't make this kind of money selling $49 subscriptions, which is what The Distortion Report costs.

They perfected the art of upselling.

You see, The Distortion Report is really only a bait product that puts you into a manipulative sales funnel.

Once you're in the sales funnel, you'll start receiving promotions from ALL of MarketWise's publishers, not just Rogue Economics.

This is an issue because MarketWise employs legitimate criminals and scam artists.

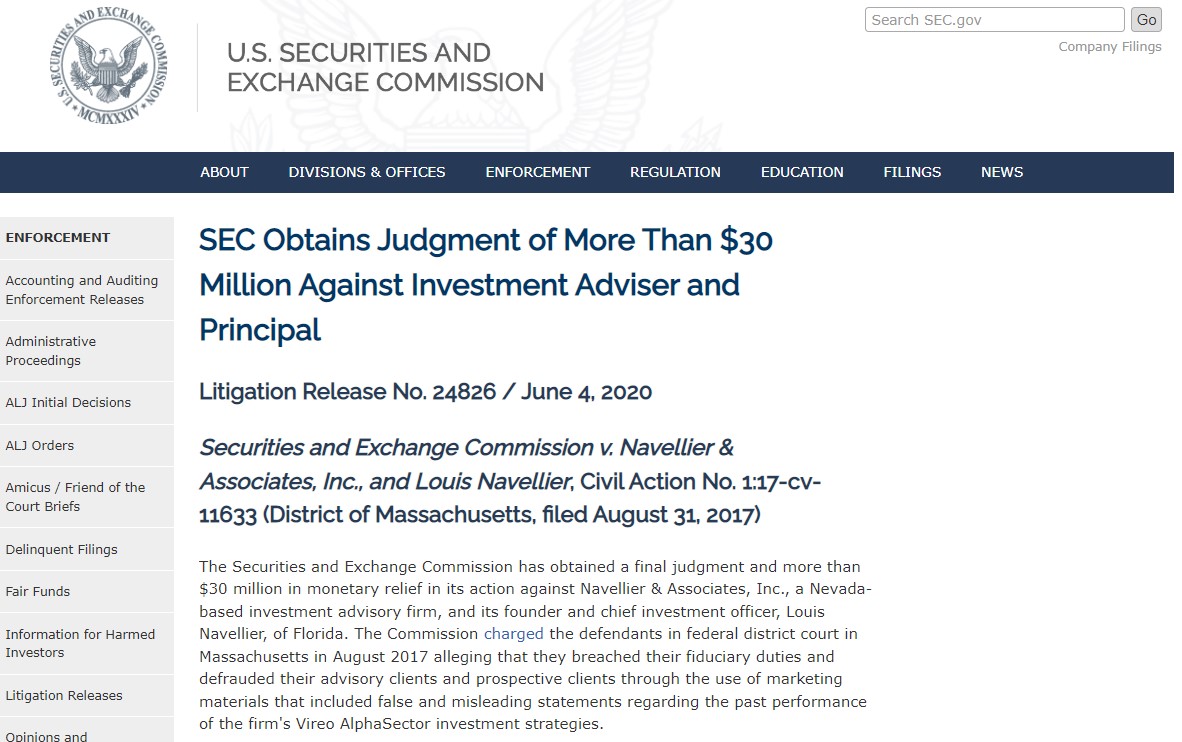

For example. Louis Navellier runs InvestorPlace, and MarketWise calls him a trusted expert.

In reality, Louis Navellier was just fined $30 million for defrauding customers.

Louis will have your email address and promote products that cost up to $10,000.

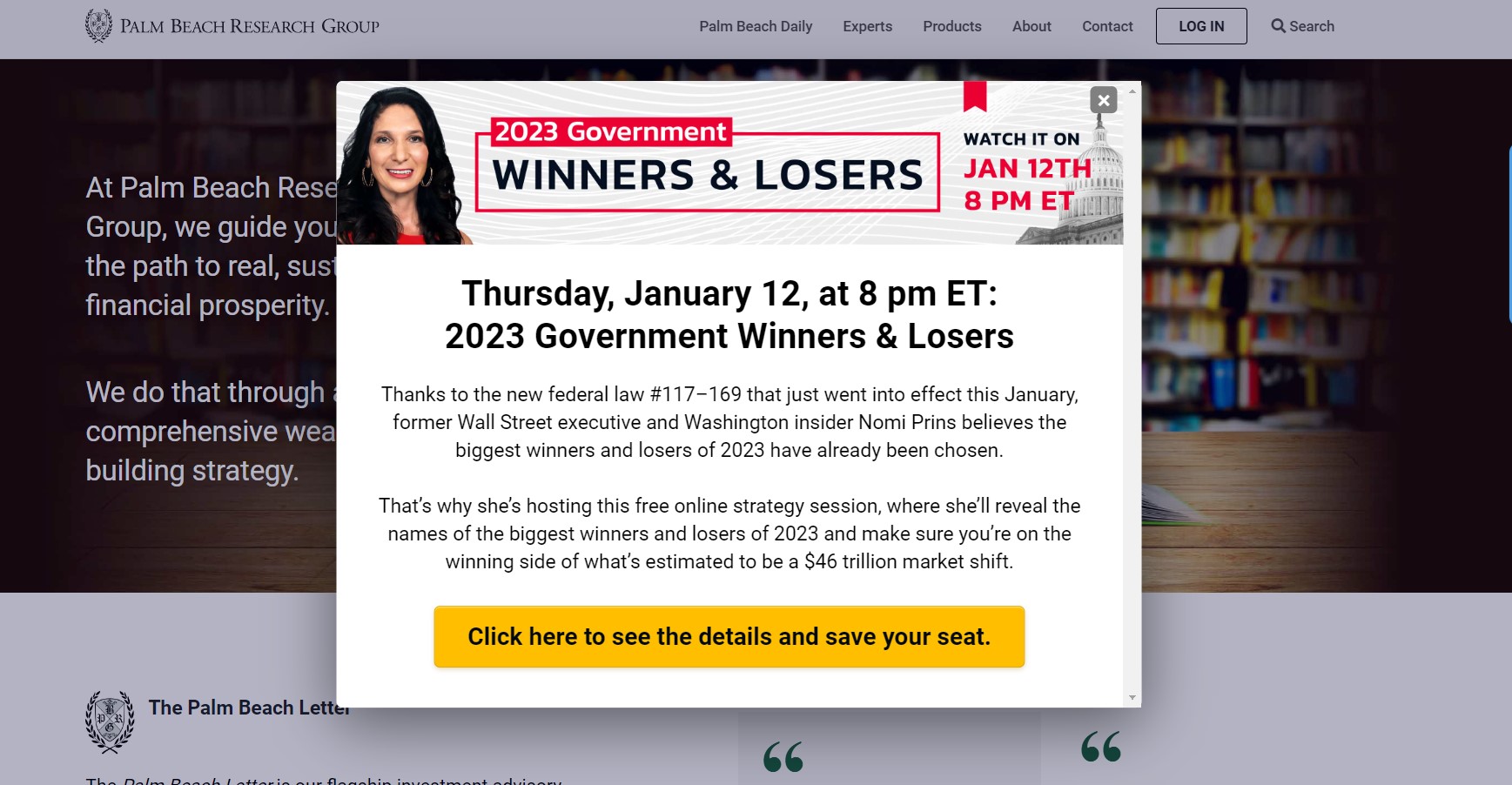

MarketWise also owns Palm Beach Research Group, which Teeka Tiwari is in charge of.

What's the problem with Teeka?

He's literally banned from working on Wall Street. He can never work for a company that manages customers' money.

That's how bad of a character he is.

Again, like Louis Navellier, Teeka will have your email and promote his low-quality products to you.

When you're on Teeka Tiwari's website, you even get a pop-up from Nomi:

I don't think Nomi is as bad as Louis or Teeka.

But you know what they say.

You are the company you keep.

And Nomi doesn't keep good company.

Recommended: The Best Place to Get Stock Picks

4) Nomi's Bad Customer Reviews

Like I mentioned earlier, Nomi used to have an investing service with Agora.

This isn't Nomi's first time selling stock picks.

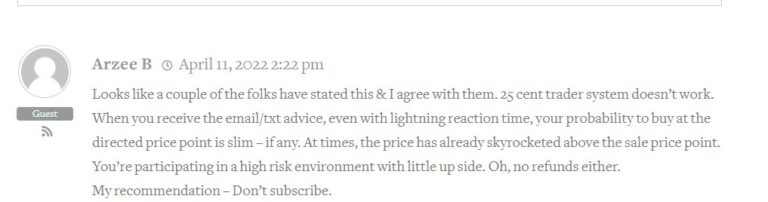

Her old newsletter was called 25 Cent Trader.

This service sent alerts out to people for option trades.

25 Cent Trader was poorly reviewed, though, and after hundreds of people rated it, the product earned a score of 2.6/5.

Overall this service didn't deliver results.

Here's what one customer had to say:

5) There's Things I Like About Nomi

I'm not a big fan of Nomi as a stock picker, but there are things I like about her.

Nomi is a journalist of sorts and has written some very good books.

She has a book called All the President's Bankers that takes a look at Wall Street's influence over the presidency for the last 100 years.

This is a topic that not enough people write about, and she did a good job with it.

This is the kind of stuff I think Nomi is good at.

Stock picking doesn't seem to be working out.

6) Signing Up For The Distortion Report Is A Nightmare

Earlier, I said MarketWise doesn't care about their customers.

The sign-up process for The Distortion Report proves this.

When you put your credit card details into The Distortion Report, you don't get access right away.

Instead, they make you go through a series of upsells before you can get your product.

This experience literally made my blood pressure rise and is enough for me to not recommend The Distortion Report.

It felt like a bunch of pickpockets trying to grab my wallet!

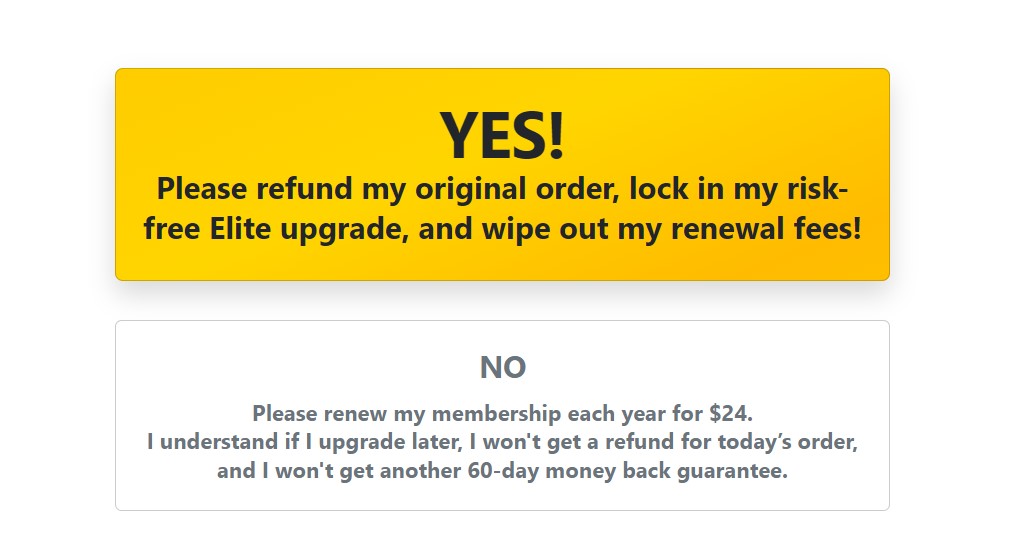

After you buy The Distortion Report, you're brought to your first upsell:

This is a video where Nomi tries to convince you to become a lifetime member of The Distortion Report.

I think the price is $299.

I'm guessing most people only become members of The Distortion Report for the first year and then cancel.

So it pays for them to offer a lifetime membership.

Below is the button you're presented with, which is very confusing.

I wasn't actually sure which button to hit!

This is done on purpose.

Many of the customers These buttons will be simple to confuse because the Distortion Report targets are old.

I'm sure many people upgraded without even knowing they did.

But it doesn't end there.

They send you through 7 very confusing upsells before you can access the Distortion Report.

Some of the offers cost several thousand dollars, while others are under $100.

What a horrible experience!

After finally getting through the upsells, you're sent an email with access to your membership.

In this email, you'll get a link to the membership area of The Distortion Report and the special reports.

7) Here Are Some Of The Stock Picks

I can't just give you all the stocks in the model portfolio.

It's proprietary information (we'll look at the performance later on, though).

But I can give you some of the stock picks.

Nomi markets The Distortion Report with Special Reports

She left enough clues in these special report presentations to figure out the stocks.

The first stock is marketed as Nomi's "#1 Stock for America's Great Distortion."

This is the presentation Nomi launched the Distortion Report with, which I wrote about in detail here.

The stocks recommended here are ChargePoint and Silvergate Capital.

Both stocks have performed badly.

First we have ChargePoint:

Chargepoint makes electric car chargers and Nomi recommended them at their absolute peak (around $20).

The stock has lost more than 50% of its value in just 9 months.

But that's not as bad as Silvergate Capital.

Silvergate Capital is a crypto bank and they've absolutely TANKED:

Nomi recommended it at around $140, and it's worth just $11 today.

That's a 95% loss; it doesn't get worse than that!

Just last month, she finally told her subscribers to sell the stock.

Next, Nomi ran a presentation called the "#1 Stock for America's New Era."

This presentation wasn't as big as her previous one, and in it she recommends Block (SQ).

Block is a payment processor, and the idea was that digital payment processors were going to become more popular.

The stock has gone up slightly since being recommended, but nothing major.

The last major stock teaser Nomi has done is where she hints at a "$4 energy stock."

This is another presentation that I wrote about in depth.

The stock is ESS Tech and they're a company that makes iron flow batteries.

Apparently they're a cheaper alternative to lithium ion batteries.

Maybe one day this company will deliver results but it's had a rough 4 months so far:

It's down about 50% since being recommended.

You'll see in a little some of Nomi's picks are doing alright but the majority are losers like these.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

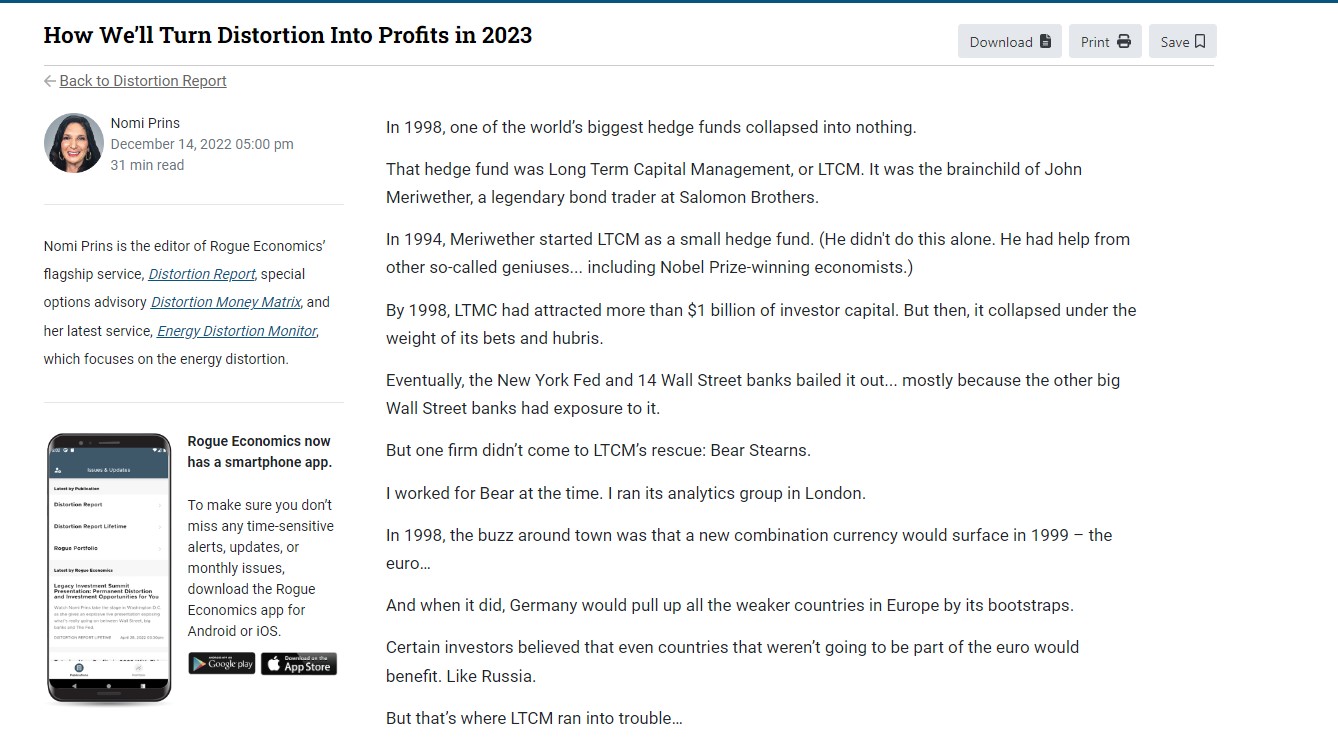

8) You Get A Monthly Newsletter

This is mainly what you're paying a year's subscription for.

Once a month, you'll receive a new copy of The Distortion Report Newsletter.

These are pretty long and take about half an hour to read.

Mainly, the newsletter will cover the market and what Nomi thinks is happening.

You'll get insights about different sectors and more.

Additionally, you'll get updates on some of the positions in the model portfolio.

For example, in the latest newsletter, Nomi claims she's sticking with her thesis on ChargePoint and believes it will be a winner in the end.

Also, in the latest newsletter, she talked about Silvergate Capital, which ended up being a horrible stock pick.

She blames the crypto market at large for her sell recommendation.

Nomi claims she still likes the company but can't trust it in the current market conditions.

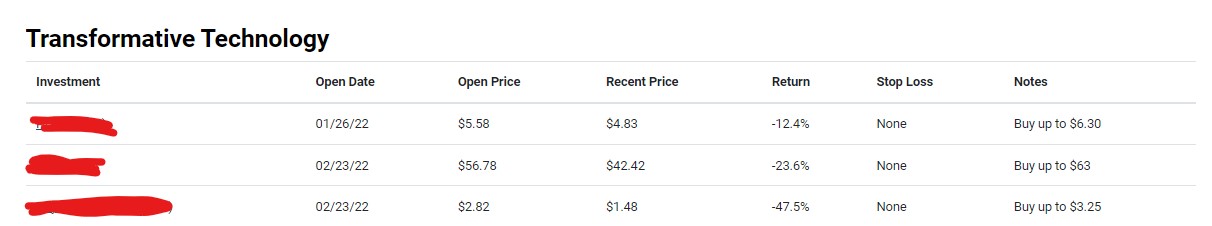

9) You Get A Model Portfolio (Not Doing Good)

This is the other main thing that you're paying for.

Once you sign up, you get access to the entire model portfolio with all the current open recommendations.

The portfolio is broken up into the following categories:

- Transformative Technology

- Infrastructure

- New Energy

- New Money.

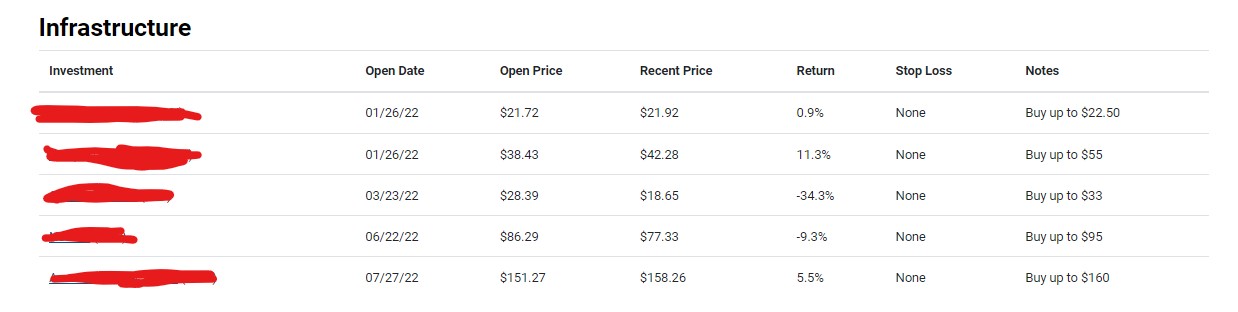

Here's a look at how each section has performed:

I have to scribble out the names because that information is proprietary information.

As you can see there's three stocks in the "Transformative Technology" section.

All are down currently with one being down 47%.

Next we have "Infrastructure:"

There's 5 stocks in this section and two are losing money. The biggest gainer is up 11% but the biggest loser is down 34%.

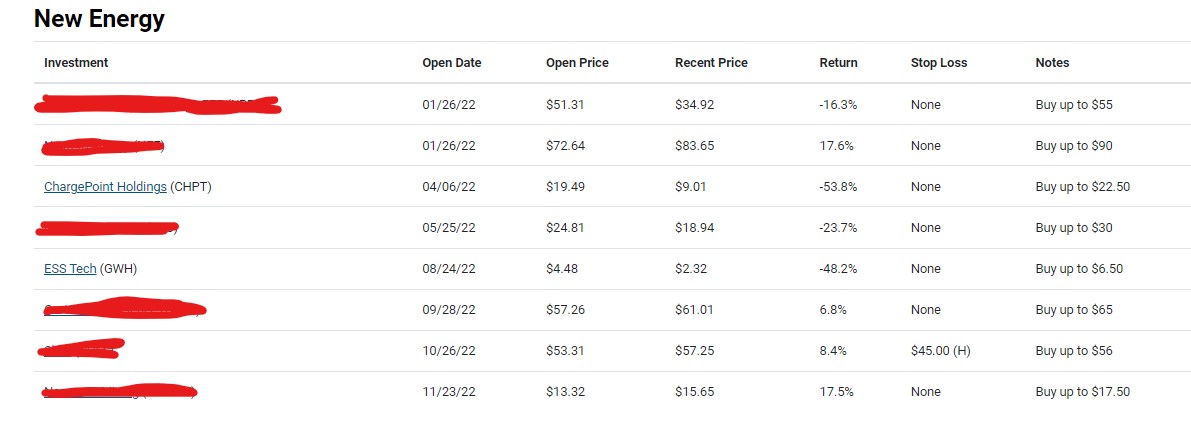

After that we have "New Energy:"

This is the section with the most stocks in it.

Since we already revealed two of these stocks I decided not to scribble them out.

There's some winners here but the losers far outweigh the winners.

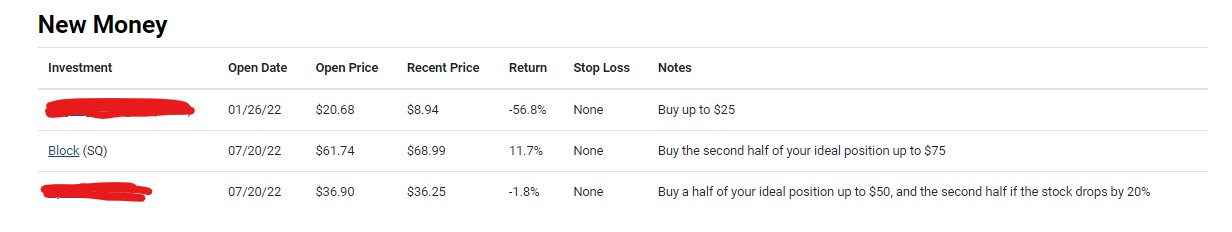

Last up we have New Money:

There's three stocks here and one is down big time (56%).

Block is the only stock up.

10) Special Report: The #1 Stock For America's Great Distortion

This is the main special report that goes along with this newsletter.

It went super viral earlier this year, and I bet the presentation has been seen over a million times.

I revealed the stock earlier: it's Chargepoint,

Chargepoint went public through a SPAC deal and has some things to like about it.

It's definitely leading the industry, but the financials aren't good.

They're spending way more money than they're making.

Their latest financial reports weren't great either, causing the stock to fall even further.

11) Special Report: The Electric Car Myth

The next special report is called "The "Electric Car Myth."

Nomi hasn't released this presentation publicly as far as I know, so I can't reveal the stock in it.

The gist of the special report is that there's no real way to make a massive amount of electric cars.

The infrastructure simply isn't there.

So instead of investing in electric cars, you'll be investing in a different kind of EV investment.

12) Special Report: Bank of the Future

This presentation used to go by the title "The #1 Stock for America's New Era."

I revealed it earlier, which is Block.

Block is a digital payment processor that owns the Cash App.

Nomi claims this stock will "connect the legacy banking system to a new one."

and that it could "modernize banking and usher in mainstream digital money for the global financial system."

13) Updates and Alerts

Another feature you get are the updates and alerts.

The market has been crazy lately, and Nomi recommends stocks that are greatly affected by the craziness.

Many are tech stocks and new energy companies.

The market has not been friendly to these assets.

Sometimes you're going to need updates before the newsletter goes out.

That's where the updates and alerts come in.

So if you need to sell a stock (like Silvergate Capital), this is where you'll be told to do so.

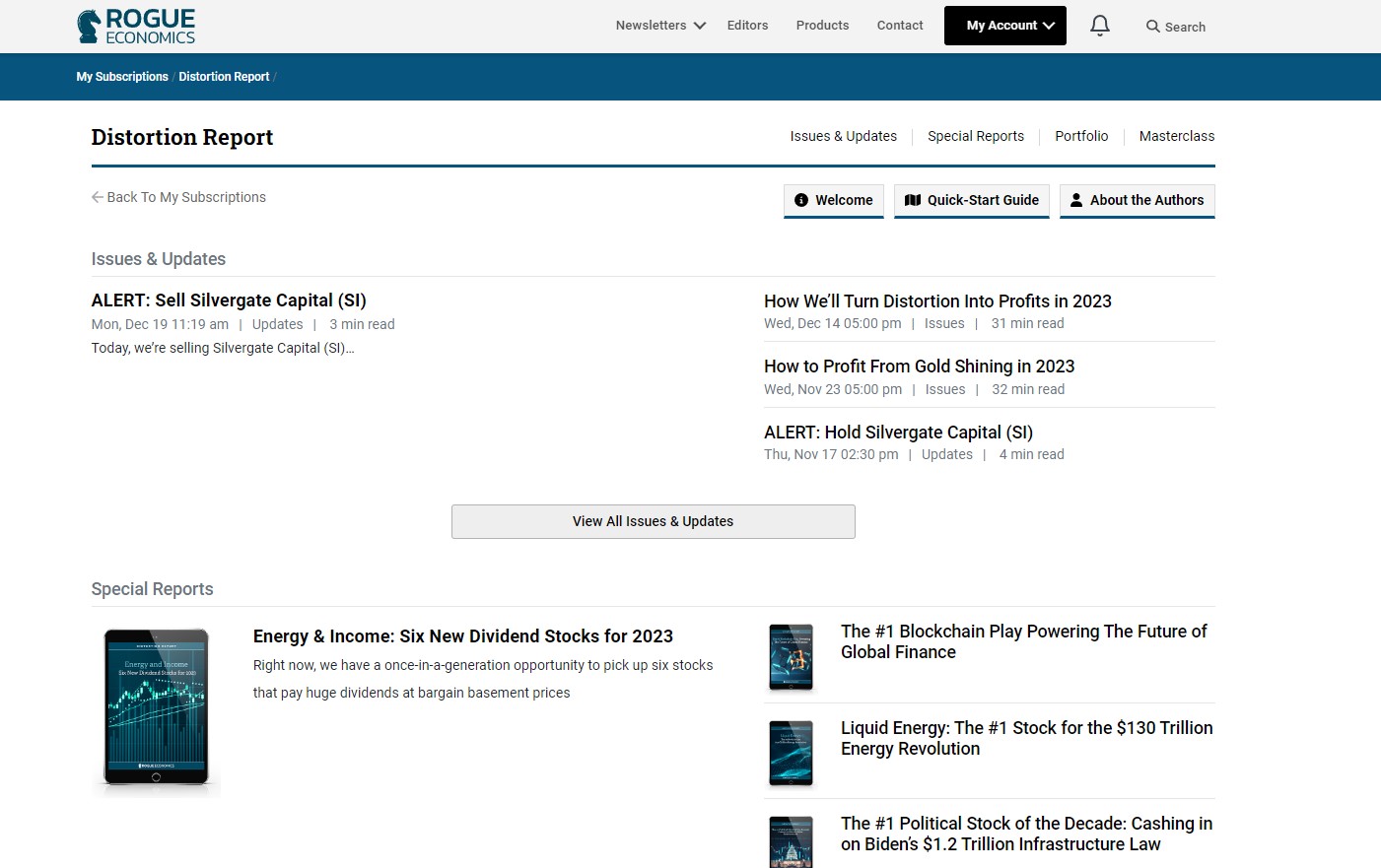

14) You Get A Membership Website

So one thing I do like about The Distortion Report is that the membership website is very easy to navigate.

There's not a lot of clutter on the page, and everything is easy to access.

I didn't need to spend hours on the site to figure out where everything was.

The portfolio is clearly marked, along with the updates, reports, and newsletters.

Getting here is a hassle because you have to go through a hundred upsells.

But once you're there, it's fine to use.

15) The Distortion Report Costs $49

The price listed for The Distortion Report is $199 on the Rogue Economics website.

But there are plenty of promotions that offer it for $49 for the first year.

Additionally, right after you buy, you'll be asked if you want to be a lifetime member for $297.

This is how every MarketWise publisher prices their introductory newsletter.

The goal is to get you into the sales funnel and then hit you with the upsells.

And boy do they hit you with upsells!

Immediately, you're sent seven upsells that range from a few bucks to a few thousand.

Your email is flooded with promotions.

It's very annoying.

16) There's A 60-Day Refund Policy

The Distortion Report comes with a 60-day money-back guarantee.

This is pretty good.

HOWEVER, you need to understand that the expensive upsells won't come with a money-back guarantee.

So if you buy The Distortion Report and then buy one of the upsells for thousands of dollars, you can't get your money back.

The expensive newsletters only come with a credit refund.

Another sneaky trick from MarketWise

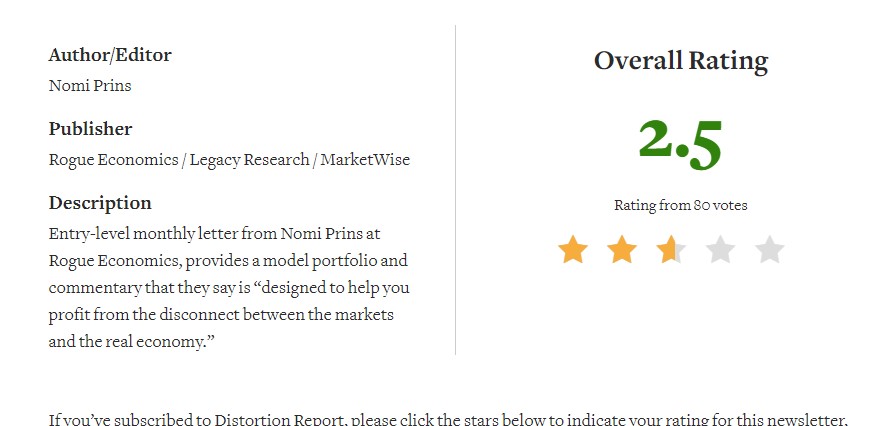

17) Customer Reviews For The Distortion Report Are Bad

The Distortion Report doesn't get good customer reviews.

So it's not like I'm just a hater or something.

Over 80 people voted on it, but it only has a 2.5/5 rating:

This is what you'd expect when a portfolio has so many losers.

The Distortion Report is less than a year old, but it's off to a rough start.

I will revisit next year to see if it's any better!

Edit: I'm updating this review in 2024, and things have not gotten better in terms of customer reviews.

In fact, things have just gotten worse for Nomi.

Now the average score for her newsletter is down to 2.3/5:

There have been some shakeups at MarketWise over the last couple years, and many of the big names have been let go because of their poor performances.

I think Nomi must be on the hot seat at this point.

She was one of the big personalities hyped up by MarketWise as an investing genius, and she has not delivered.

I wouldn't be shocked if she ends up on the chopping block very soon.

18) Here Are Some Similar Newsletters

There are a lot of newsletters that are similar to The Distortion Report, and a lot of them are struggling too.

Some include:

- Behind the Markets

- The Dividend Hunter

- Extreme Value

- The Ferris Report

- Stansberry Research

- Strategic Intelligence

MarketWise owns the majority of these.

Recommended: The Best Place to Get Stock Picks

The Distortion Report Pros And Cons

The Distortion Report Conclusion

Alright, that was a long one!

I came across The Distortion Report about nine months ago.

I'm familiar with these investing newsletters, so I'm not shocked that they're performing poorly.

I know the sales presentations are slick, and Nomi makes it seem like these investments are all home runs.

But it's simply not true.

You have to look past the marketing and manipulative sales techniques.

I've given you a bunch of stocks to look at, and some of them are down seriously huge.

Like 95%.

There are only a few moderate winners, but nothing too crazy.

The losers here far outweigh the winners.

And to top everything off, there's just so much baggage with The Distortion Report.

The people running the show only want to squeeze every penny they can out of you.

The sign-up process proves this.

You have to see 7 upsells before you can access the product you paid for!

It's a horrible experience, and I wouldn't recommend that you join.

Here's A Better Opportunity

I'd pass on The Distortion Report.

The results just aren't good, and they're a pain to deal with.

The good news is that there are much better investing services out there.

I've personally reviewed over 100 stock-picking newsletters.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Thank you. Bang on review – I was a perfect target. I did not sign up but was puzzled enough by her progressive history and spent 40 minutes watching the endless pitch. I will block this company as well as I can on Youtube, because they will send me a lot more seeing how long I watched it.

No problem! Yeah I found her progressive history interesting too!

FINRA removes a person from their registry after ten years of leaving the industry. My own was just removed.

I see people in Finra that have been out of the industry for more than 10 years all time. For example, I did a review of Dylan Jovine and he’s still in Finra despite not working as a broker for over 20 years.

what do you think of Jeff Brown of Brownstone Research and his recommendations I understand he’s with the same company and who is Chris Hurt who interviews them both I’ve been trying to research them both I was all for their recommendations but I decided to wait to say what transpired. I’m wondering why your not following the most successful for example Warren Buffett. Seems the most logical person to follow he certainly knows his stuff.

I think Jeff Brown is alright.. he’s going to have the same issues as Distortion Report because he’s also owned by Agora. Just try not to get suckered into the upsells.

Hi Dylan,

I really like what you do, you have my respect. What actually always puzzles me is that people like “Nomi Prins” (whoever she is) are so easy to see through just by looking at all the material they produce: isn’t this obvious? Why even waste time? Only because “what if”?

You know, I mean things like “we’ll tell you something Wall Street|Government|IRS|fill-in-blanks does not want you to know”, the staging itself of the “interviews” (third-grade acting both by the “interviewer” and the “guru”), impossibility to find out who these people really are.. etc. In the end it always turns out – they just want your money.

It’s like asking yourself, why are there so many guys writing so many books about how to get rich, how to make money in stocks, online, from home etc. when all of them are supposedly rich already? Why bother with the rest of us, the dummies? Because if you really knew how to get rich why would you tell anyone, right? Why to have more parties competing for the same wealth?

So, it’s basically all about multilevel marketing schemes: pay me and I will show you how to make money. But I make money from showing it you, not by doing it myself.

Anyway, all the best.

Pietro

Thanks for commenting Pietro – Appreciate it!

So what is the $4 stock that Naomi Prinz was touting? That reveal was promised. Thanks Emac

ESS Tech

Yes it’s a scam. BS waist of time

This news letter is a scam, every day she comes in with a reason to try and up sale you with some new line of BS

Yeah that’s a big problem

I enjoy reading some of Jeff Brown’s Bleeding Edge commentaries. Once bitten, twice shy with Prins and Tiwari. They’re just full of hot air and bottom feeders. Excellent job you do Dylan exposing this stuff.

Roger.

Thanks!