Hidden Alpha is an investing newsletter headed by Joel Litman.

He claims he can help you find stocks through his forensic accounting system.

Is this true or all one big scam?

You'll get an answer to this question in this review.

Additionally, you'll see any other information I can find about Joel and this service.

You'll know if Hidden Alpha is worth it by the time you're done reading.

Let's get started!

Hidden Alpha Summary

Creator: Joel Litman

Price to join: $49

Do I recommend? Not really

Overall rating: 2.5/5

Hidden Alpha is an average investing newsletter.

The stock picks are ones you can find in a 100 other places and there's nothing really special about this service.

I looked at a bunch of stocks that Joel Litman recommended and most were down as well.

I'd pass.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

3 Things To Know About Hidden Alpha

There's a few things you should know about Hidden Alpha before you buy.

Here's what I think is most important to know:

1) Not Independently Operated

The first thing you need to know about Hidden Alpha is the publisher that distributes this newsletter, Altimetry, is not independent.

Altimetry is owned by Marketwise which is a MASSIVE company.

They're actually a public company you can invest in and they own around a dozen other investing publishers.

Some popular ones they own are Stansberry, InvestorPlace, Brownstone, Palm Beach Group, etc.

Marketwise just released their earnings for Q2 and revenue was over $100 million!

So why does this matter?

Well once you buy one product from a Marketwise publisher you'll be marketed other products from other Marketwise publishers.

Many of these products are expensive and very low quality.

For example, Palm Beach Group is headed by a snake oil salesman called Teeka Tiwari who's literally banned from Wall Street.

If you buy Hidden Alpha expect to see his promotions in your inbox.

Getting Paid To Promote Stocks?

I review investing products for a living and I de-tease stock presentations.

A stock presentation is when a stock picker puts out a long pitch for a company to invest in.

Usually they hype the stock up but don't reveal then name unless you buy the newsletter.

Right now the main teaser for Hidden Alpha is about "Synbio" investments:

SynBio just means biotech - the merger of technology and medical products.

There's three stocks being teased here and they are Illumina, Thermo Fischer Scientific and Ginkgo Bioworks.

The first two stocks are well known but the last one caught my eye.

Ginkgo Bioworks is a small biotech company that makes synthetic cells for medical products and food.

However, I've seen many stock pickers pushing this stock recently.

For example, Whitney Tilson pitches it as a $4 hedge against inflation and Luke Lango claims it will be the "the next Microsoft."

It turns out both of these people work for Marketwise as well.

This is concerning to me because a hedge fund put out a 175 page report calling Ginkgo Bioworks a complete scam.

Here's there summary of the company:

The report goes on further to say this:

The allegation is the company has basically no revenue.

This hedge fund believes Ginkgo Bioworks buys third party companies and then sells their products to them after.

So no revenue is coming from companies they don't own.

The report goes on to say this company is a complete scam destined to collapse.

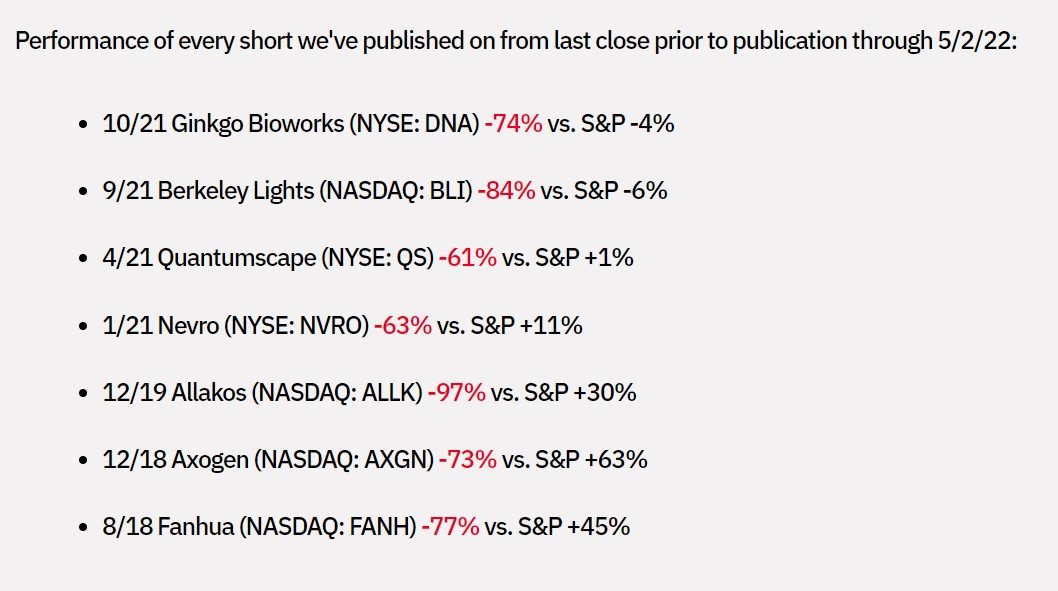

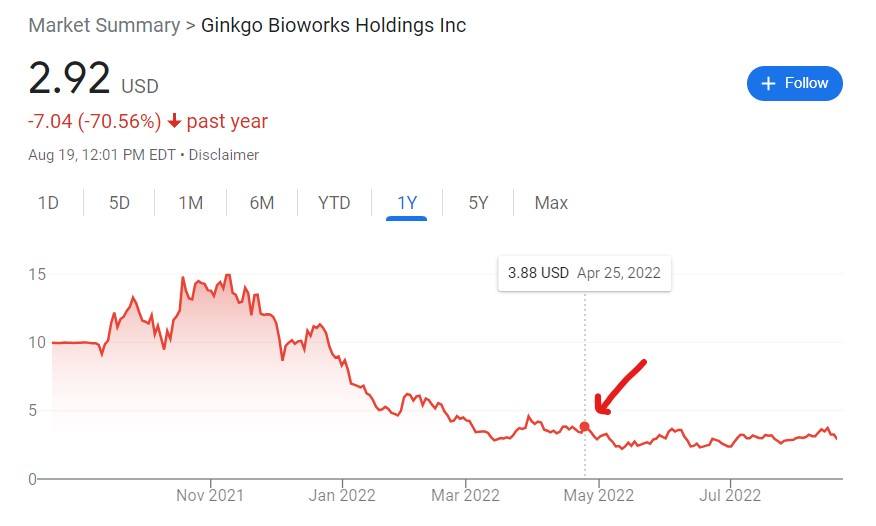

Scorpion Capital has a perfect track record of shorting stocks and Ginkgo has fallen over 70% since they shorted them:

One of the allegations Scorpion Capital makes is Ginkgo Bioworks is teaming up with hedge funds to pimp the stock.

Is that happening here?

I don't know for sure but it seems odd that three newsletters owned by Marketwise are pushing this stock so hard.

Makes you wonder if they're being compensated...

3) Joel Litman Is Lead Editor

To be honest there's not too much out there about Joel.

He spent a lot of time teaching at Hult Business School and is President of Valens Research.

This is a company that combines accounting with research.

But as far as I could find nothing too concerning.

Recommended: The Best Place To Get Stocks

Joel's Stock Picking Performance

Honestly the most important aspect of a stock picker is their ability to pick stocks.

Everything else is secondary.

Here's a look at how a handful of Joel's picks have performed from the last couple of years:

Illumina, Thermo Fisher Scientific, Ginkgo Bioworks In April 2022

This from the presentation that we looked at in the last section.

These three picks are Joel's top "Synbio" picks and called them "Steve Job's final prophecy."

He's hinting at a quote from Steve Jobs hinting technology and medicine would combine in the future.

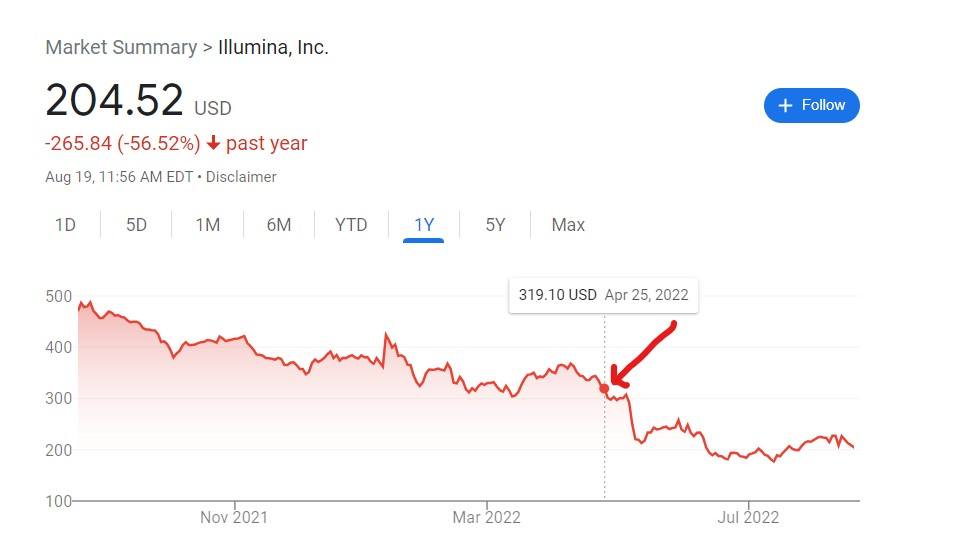

The first company he's pitching is Illumina which is the leader in DNA sequencing machines.

Here's how the stock has performed since April:

The stock is down around 30% since being recommended.

Next up we have Thermo Fisher Scientific.

This company is a major supplier for biotech firms.

Here's how the stock has done:

This stock is up a bit since being recommended.

The last stock is Gingko Bioworks.

We covered this stock in the last section and they make synthetic cells to treat disease and make food.

Here's how the stock has done:

This one is down around 30% as well.

These picks definitely have more time to recover and it's too early to make any judgments about their performance.

Several Companies In March 2021

Back in early 2021 Joel ran a pitch hinting at the "giants of online shopping" and "3 pillars of the internet."

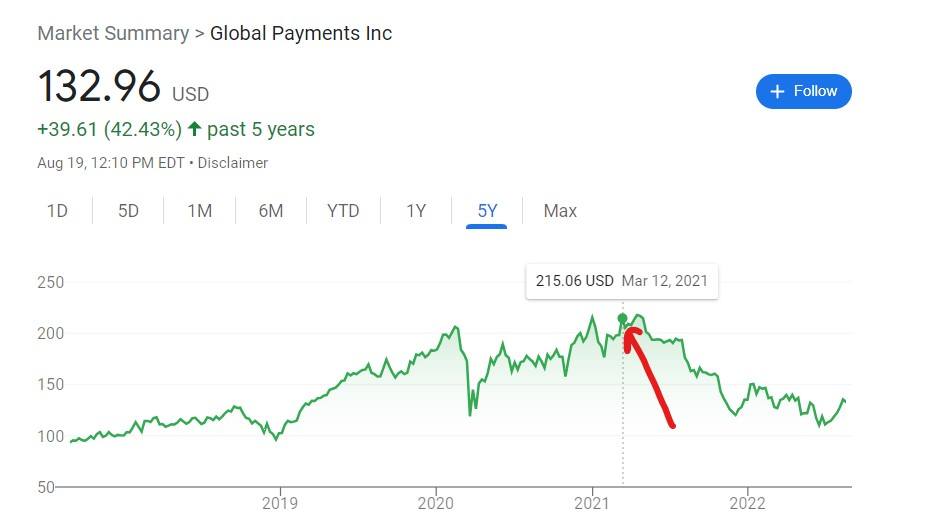

These were all pretty big companies which include Global Payments, Amazon, Alphabet, Dropbox and Charter Communications.

Here's how each performed starting with Global Payments:

Tech stocks have been hit hard in 2022 and Global Payments wasn't spared.

It's down about 50% since March 2021.

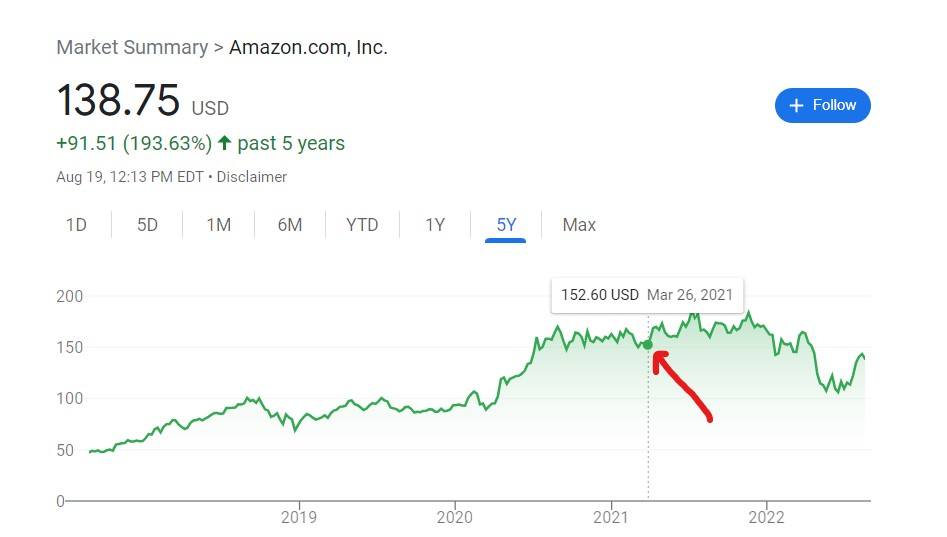

Next up we have Amazon:

Amazon is down as well but it's still a stock worth owning.

It'll definitely recover in time.

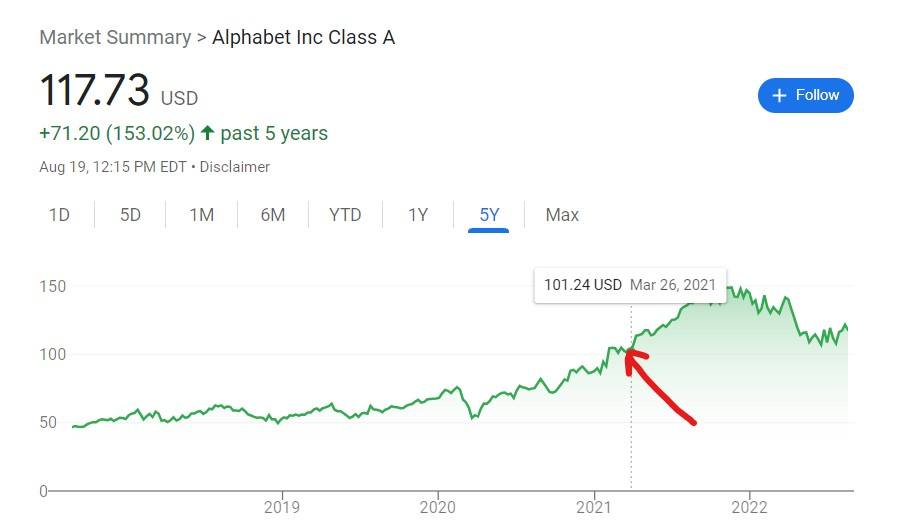

Next up we have Alphabet which owns Google:

Alphabet is up a bit since being recommended.

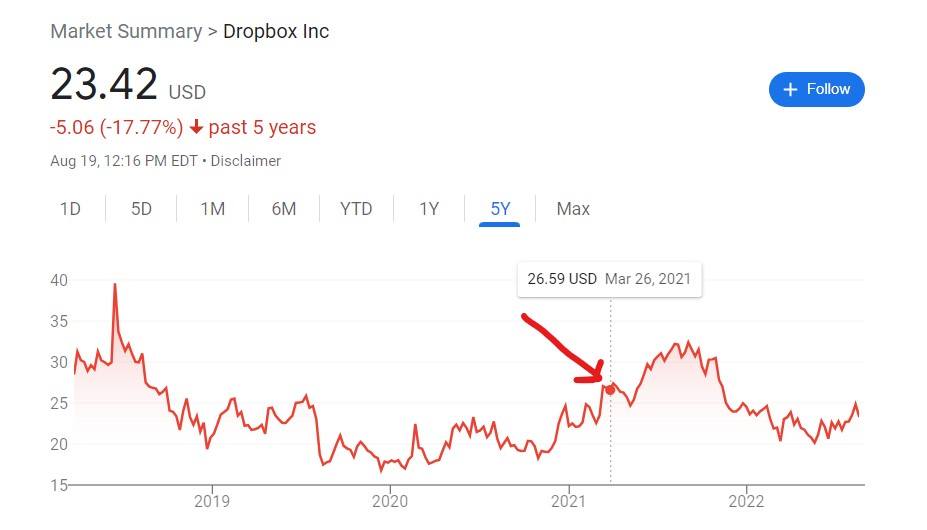

Dropbox is next:

This one is down a little as well.

Lastly, we have Charter Communications:

Overall I'd say these picks have been a bust overall.

Stocks like Amazon will definitely recover but who's knows about the rest.

Winnebago Industries In October 2019

Joel runs a newsletter called High Alpha as well and this stock pick was for that newsletter.

He called Winnebago a "tiny stock you've probably never considered before" and it had "500% upside."

Here's how this RV manufacturer has performed:

This stock has done very well since being recommended and at one point almost tripled.

Even with the stock being down from its peak it's still up 100%.

So not quite 500% but maybe one day.

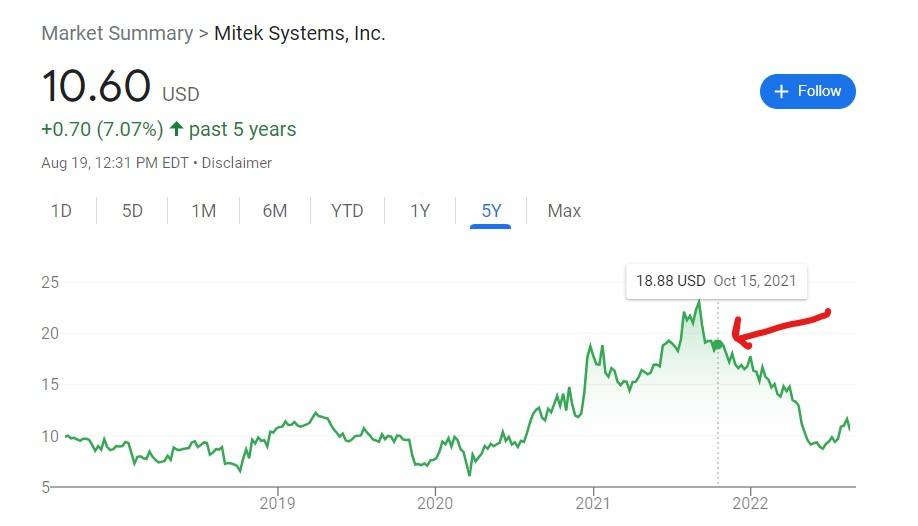

Mitek Systems In October 2021

The last stock we're going to look at is a pick Joel made for his newsletter Microcap Confidential.

This newsletter focuses on smaller stocks with more growth potential.

In late 2021 Joel called Mitek Systems "the only cybersecurity company you should be paying attention to right now."

Here's how the stock has done:

The stock is down over 40% since being recommended and is another loser from Joel.

Recommended: The Best Place To Get Stocks

What Is Hidden Alpha Offering?

Overall Hidden Alpha is very similar to other investing newsletters in what they offer.

It's especially similar to other Marketwise newsletters.

Here's a breakdown of everything that you get:

Monthly Issues Of Hidden Alpha

Every month you get a new issues of the Hidden Alpha newsletter.

In these newsletters you'll get new investment ideas, updates on the portfolio and market commentary.

This is the main thing you're paying for.

Model Portfolio

This is the other main part that you're paying for.

Once you sign up you'll get access to the model portfolio and be able to invest in a bunch of stocks right away.

Also, you'll get buy prices and information on each stock.

Lastly, you get a special report that teaches you how to allocate your portfolio correctly.

Special Reports

The special reports are the long form presentations we covered in the last section.

These reports act as sweeteners and are used to get people to buy the newsletter.

They're also constantly changing.

The special reports revolve around "Synbio" stocks and we already covered them.

The first report is "My Favorite Synbio Investment Right Now" and that's Illumina.

The second special report is "Profiting From The Next Big SynBio Wave" and there's two companies being recommended - Thermo Fisher Scientific and Ginkgo Bioworks.

Daily Email Updates

Along with everything else you get access to Altimetry Daily Authority.

This is a daily e-mail update you get before the market opens.

You'll find market insights and investment ideas here.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Hidden Alpha FAQ's

Still have some questions about Hidden Alpha?

Here's some answers to any remaining questions you might have:

1) How Much Is Hidden Alpha?

Hidden Alpha pretty much works like the other introductory newsletters at Marketwise.

Basically Hidden Alpha is a bait product and priced very cheap at $49 per year.

Marketwise isn't pulling in over $100 million per quarter selling $49 subscriptions, though.

They make hundreds of millions by heavily promoting to people that buy $49 subscriptions.

So once you buy Hidden Alpha you'll be bombarded with upsells for products that cost thousands of dollars a year.

That's where the real money is.

If you do end up buying Hidden Alpha you should avoid all promotions and upsells.

2) Is There A Refund Policy?

Yes, you get 30 days to get your money back.

This isn't enough to test out the stock picks or anything like that but it's better than nothing.

However, if you do fall for the upgrades they typically don't come with a money back guarantee.

So don't expect one if you do buy the upgrade.

3) Is Joel Litman Legit?

I think he is.

There's nothing overly concerning about his past and he seems like a smart guy.

Apparently Joel has been a professor for many years and has even taught at places like Harvard.

His accounting idea is unique as well.

He doesn't just look at the numbers companies put out and instead factors in many extra accounting principles.

Definitely interesting.

However, the stocks we looked at didn't perform all that well.

So not sure he's the guy you want to get your stock picks from.

4) How Much Do I Need To Get Started?

Many of the stocks that Joel recommend are large cap stocks that are pretty expensive.

Sometimes he recommends smaller stocks but typically they're going to be over $100.

So I'd say $10,000 is a good starting point.

You can probably go as low as a few thousand but $10,000 ensures you can buy a handful of stocks and build your portfolio.

5) Are There Similar Newsletters?

Yes there's many newsletters just like this one.

Some include:

There's many more services like this one out there as well.

Recommended: The Best Place To Get Stocks

Hidden Alpha Pros And Cons

Hidden Alpha Conclusion

Well that's the end of my review of Hidden Alpha.

I hope you found some value here and know if this newsletter is right for you by now.

I personally would steer clear of this service.

The stock picks I looked at have not been performing well and only a couple are up.

Some are down 50%.

Additionally, I don't like that Joel is also recommending Gingko Bioworks.

Why do three newsletters owned by the same company need to push the same sketchy stock?

That's a red flag to me.

Almost like someone is telling them to recommend the stock or they're getting paid to do so.

I'd pass personally.

Here's A Better Opportunity

I wouldn't buy Hidden Alpha.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

What’s your opinion on Charles Payne program that cost 4k ? Lots of class time for sure.

dont pay that much