Velocity Trader is an option alert service from Jim Fink.

He claims his product is "the only trading strategy that can double your money by Friday."

Is he telling the truth or is this all one big scam?

We'll get to the bottom of this question in this review.

Additionally, we'll delve into any red flags that I find and you'll get an overview of what exactly is being offered.

You'll know if Velocity Trader is worth it by the time you're done reading.

Let's get started!

Velocity Trader Summary

Creator: Jim Fink

Price to join: $1950 per year

Do I recommend? Nope.

Overall rating: 1.5/5

There's nothing really to like about Velocity Trader from Jim Fink.

The service is expensive and really would only work for people with a trading account around $200,000.

Anything less and the cost of the product will eat into your gains too much.

The marketing is aggressive at Investing Daily (the publisher) and you're going to be bombarded with promotions after you buy.

The testimonials are completely fake which I prove in the review.

And to top it off customer reviews are really bad for Velocity Trader.

I'd pass.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

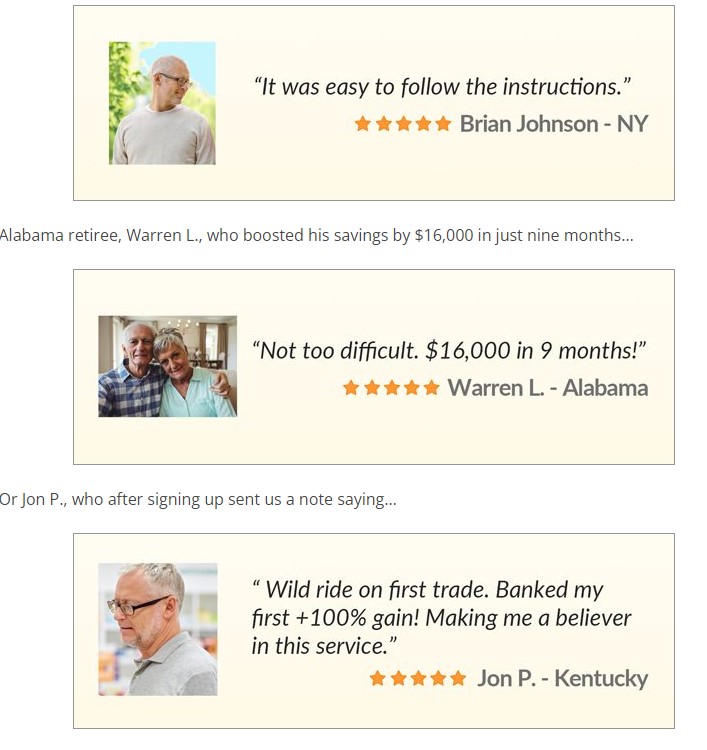

The Testimonials Are Fake

Before we get into what's being offered and who Jim Fink is, I want to talk about a major red flag that I found.

And that is the testimonials are fake.

It doesn't even seem like Investing Daily or Jim even tried to make them seem real.

Here's a screenshot of the three "customers" and their glowing reviews on the sales page:

These are clearly headshots and professionally taken photos.. unless all of Jim's elder customer have $5,000 cameras.

Anyway, you can do a reverse image look up on the photos to see where else they come up on the web.

You'll see the first photo is also used on a separate website about colon cancer:

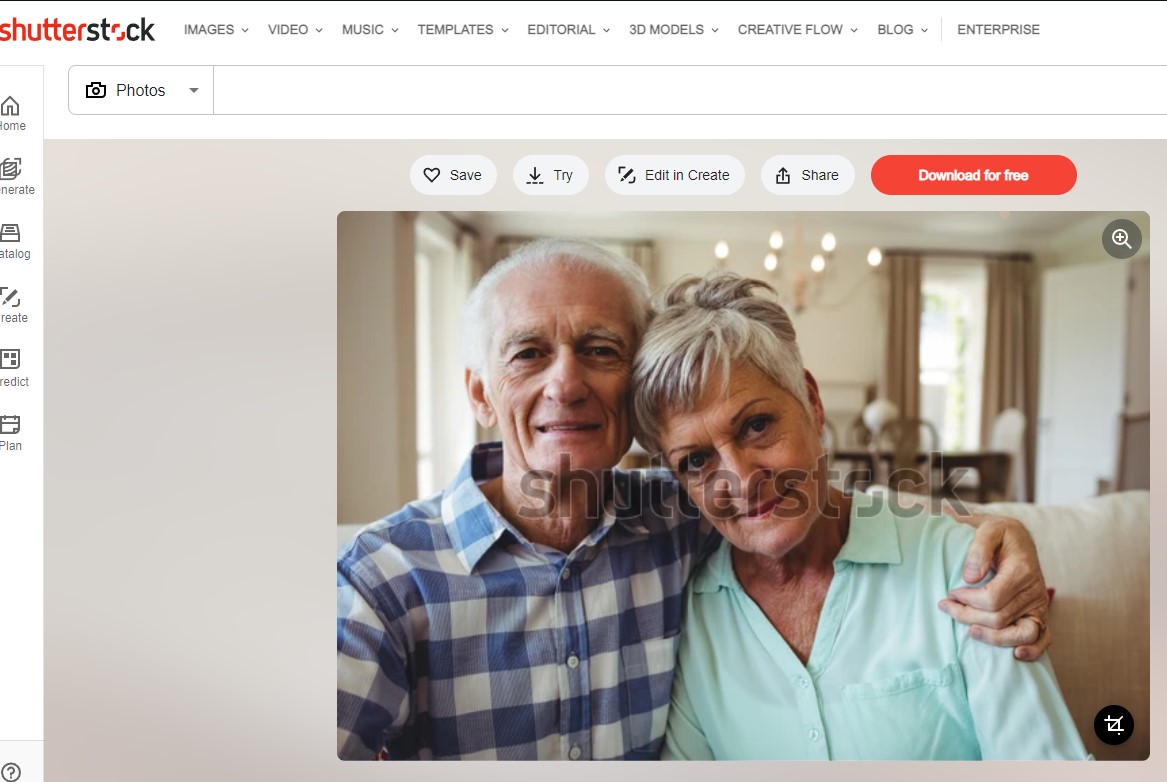

The second photo is just a stock photo that you can buy from Shutterstock.

It's saved as "senior couple relaxing on sofa:"

The last picture is of a man at the pharmacy.

This picture is used all over the internet on different health related websites:

Like I said.. Jim and his team did a really bad job faking these testimonials.

And judging by the age of each picture I'm assuming the target audience for Velocity Trader is pretty old.

Many investing publishers prey on elderly people because they're easier to get money from.

Customer Reviews Are Terrible

Another thing you need to consider before buying Velocity Trader is customers are very negative.

This is typically what you find with all option alert services.

It's very hard to make money with them because it's hard to execute the trades fast enough to profit.

By the time you're ready to make the trade the price of the stock has likely changed already.

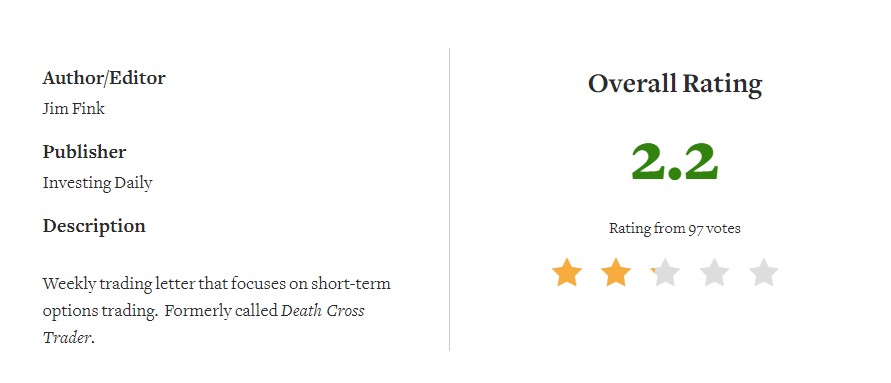

Additionally, the best place to find customer insights about an investing newsletter is Stock Gumshoe.

Over there nearly 100 customers have voted on this service and it only has a measly 2.2/5:

Velocity Trader has been around for a long time and used to go by the name Death Cross Trader.

At no point has this newsletter been well reviewed by customers.

Here's someone explaining the service has been a disaster for them back in 2011:

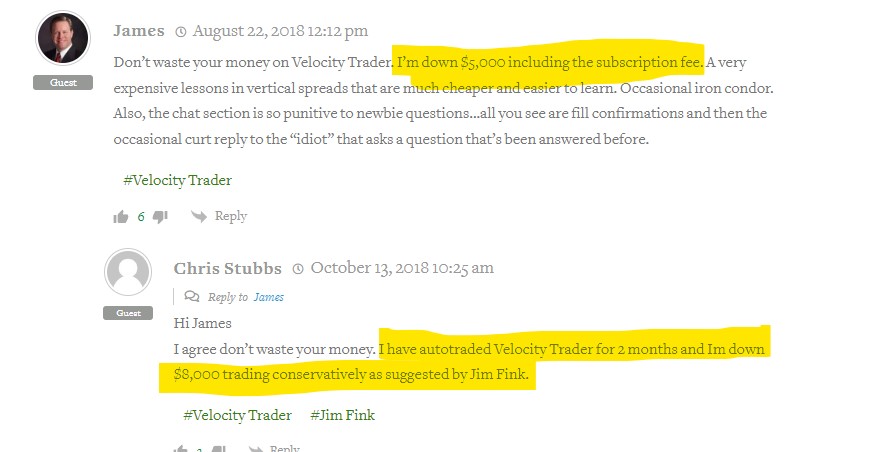

Here's customers complaining more recently they're down thousands of dollars after following Jim's trades:

And here's another customer even more recently claiming the newsletter is "an absolute con job" and that his account is down 17% after following Jim:

So I don't think things will be different for you.

I find it hard to believe you'll have a different outcome than 10 years worth of customers have had so far.

Recommended: The Best Place To Get Stock Picks

Don't Bother Unless You Have $200,000 To Trade

Another thing to consider before purchasing Velocity Trader is the cost.

This isn't a cheap service and this product will cost $1950 per year.

There's an investing rule you should follow - never spend more than 1% of your trading account on investing research.

Because if you do the cost of the research will eat in your profits too much.

For example, if you only have $30,000 to trade with Velocity Trader's price will account for 6.5% of your account.

That means just to break even you need to be positive 6.5% every year.

To beat the market you'd need to get around 16% returns every year (the market averages around 10% every year).

Do you see where the problem is if you don't have a big trading account?

So you'll want at least $200,000 to trade with if you're going to buy any investing service that costs this most.

The Strategy: Credit And Debit Spread Options

If you have any experience with investing I'm sure you know what an option is.

If you need a refresher of what an option is and the specific strategy Jim is using for Velocity Trader, here you go:

What Is An Option?

An option trade is an investment in which a buyer and seller agree to exchange a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price on or before a specific date.

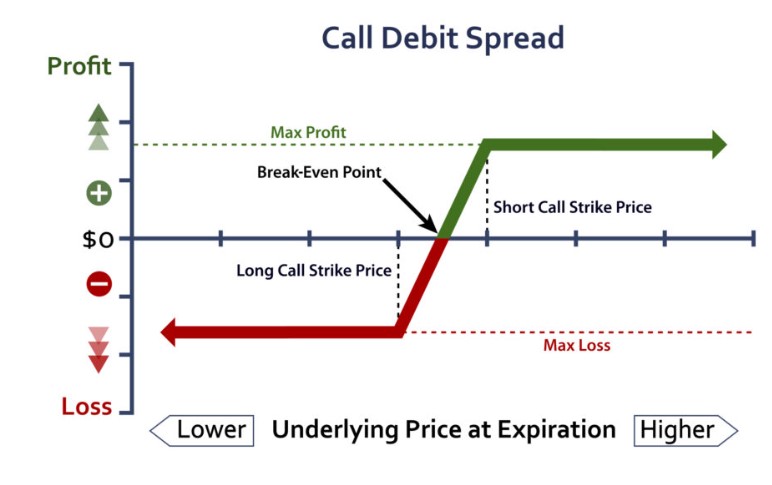

There are two types of options contracts: call options and put options.

A call option gives the buyer the right to buy the underlying asset at the strike price, while a put option gives the buyer the right to sell the underlying asset at the strike price.

Traders can profit from option trades by buying or selling options contracts at a favorable price and then selling or buying them back at a higher price.

You'll Be Buying Or Selling Credit & Debit Spread Options

Credit and debit options are two types of options trading strategies that involve buying and selling options contracts.

A credit option involves a trader selling an option contract with the aim of collecting a premium, which is the price paid by the buyer of the option.

A credit option is profitable if the price of the underlying security remains above a certain level (in the case of a call option) or below a certain level (in the case of a put option) at the time of expiration.

In a credit option strategy, the trader is assuming limited risk for limited profit potential.

On the other hand, a debit option is when the trader buys an option contract with the aim of profiting from a price movement in the underlying security.

A debit option strategy involves paying a premium to purchase the option, and the trader will only profit if the price of the underlying security moves significantly in the desired direction.

In a debit option strategy, the trader has unlimited profit potential but is also exposed to potentially significant losses.

Overall, credit and debit options are two different types of options trading strategies that involve different levels of risk and profit potential.

Both strategies can be used in a variety of market conditions, and traders will choose the strategy that best suits their investment goals and risk tolerance.

Jim's Secret To "Extending" Option Trades

In order to "prolong an options deal so you can earn money even when the stock market does the unexpected," according to Jim, he has a "secret."

In actuality, he is referring to a rollover into new spreads.

Here's how it operates:

A trading method known as a "spread roll over into new spreads" is closing out an active options spread position before starting a new spread position with a later expiration date.

A spread in options trading is a method of reducing risk and maybe making money by purchasing and selling options contracts with various strike prices and expiration dates.

By moving the position's expiration date ahead to a later date, a trader effectively extends the life of their position when they execute a spread roll over.

Consider a trader who currently holds an options spread position with a March 1st expiration date.

The trader may decide to close out the position when the expiration date draws near and then establish a fresh options spread position with an April 1st expiration date.

As a result, the trader would be able to maintain their options exposure for a longer length of time and maybe profit from changes in the underlying security's price.

When a trader wants to keep their options exposure for a longer period of time but does not want to face the risk of keeping a position that is close to expiration, a spread roll over might be helpful.

The trader may be able to lower risk and potentially boost profit potential over a longer time horizon by rolling over the position.

It is crucial to remember that trading options carries risk, thus before putting any trading strategies into practice, traders should thoroughly assess their investing objectives and risk tolerance.

As the results don't seem to be worth the work, most individuals find this to be an overwhelming amount of complexity.

Recommended: The Best Place To Get Stock Picks

Here's What You Get

As far as what's being offered, it's pretty typical for an option alert service.

Here's a breakdown of everything you get:

Jim's Accelerated Video Seminar

The firs thing you're going to get is a training series from Jim.

He'll walk you through the process of taking his alerts and executing them in your brokerage account.

Additionally, you'll get training on how the strategy works, which I explained in the last section.

You'll be buying or selling credit and debit spread options.

Additionally, you'll get alerts on when to spread roll over into your new spreads.

This might all sound complicated and this might for some reason make you think it's more legitimate.

But 10 years of customer reviews say it doesn't work.

Seasonal Velocity Trader

The scanner helps you find different option trades.

Jim claims he could charge $45,000 for this tool if he wanted to.

However, because he's so kind he'll throw it in for free.

Online Trader's Clubhouse

This is a hangout for all the members at Velocity Trader.

There will "experts" at the Clubhouse and sometimes Jim himself will be there.

This will give you an opportuntiy to ask Jim questions.

For example, you might want to ask "why am I down so much? You promised me I could double my money!!"

Two Current 310F Trades

These are trades that Jim claims he selects using his Seasonal Velocity Scanner.

And also claims they've been his most consistent winners.

They're option alerts that are cashed in within 3 to 10 days of going live.

New Trades Every Tuesday Morning

And finally you get what you're paying most for.

Every Tuesday you get two new option alerts (either by email or text) with Jim's two newest trades.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

Velocity Trader FAQ's

Still have some questions about this newsletter?

Here's answers to any remaining questions you might have:

1) Who Is Jim Fink?

Jim Fink is someone that's been in the stock picking game for a long time.

And honestly he has a pretty typical resume for a stock picker.

Back in the 90's he was a lawyer and then eventually switched over to finance.

After that he started working for Investing Daily and he's been there ever since.

He's been running various newsletters for Investing Daily for a while now and none of them really get good reviews.

He hasn't just focused on option trades either.

In the past Jim has offered services that have to do with small cap stocks and things like that.

2) What Is Investing Daily?

If Jim is a typical stock picker then Investing Daily is a typical investing newsletter.

There's dozens of places just like this one.

Typically a cheap newsletter is offered to a customer and then after they buy there's aggressive marketing to get them to spend thousands.

I personally wouldn't trust Investing Daily too much.

Especially after it's been proven they fake testimonials and have such bad customer reviews on certain products.

3) Do I think This Service Will Work?

No I don't.

Option alert services typically don't work too well.

One of the big reasons is the lag in time between when the alert get sent out to when you'll be able to punch them in.

Unless you're waiting by your computer and have lightning fast reflexes your trade will always differ from Jim's.

On top of this the results just haven't been good for 10+ years.

It's kind of strange this newsletter could last so long with such bad customer reviews.

4) Are There Similar Newsletters?

Yes, there's many similar newsletters out there.

Some include:

- The Distortion Report

- Stansberry Investment Advisory

- TradeStops

- Retirement Watch

- Intelligent Income Investor

- The Opportunistic Trader

- Jeff Clark Trader

- Behind The Markets

- The Oxford Income Letter

- Power Gauge Report

- Chaikin Analytics

- The Ferris Report

- Extreme Value

As you can see there's no shortage of stock pickers out there!

Recommended: The Best Place To Get Stock Picks

Velocity Trader Pros And Cons

Velocity Trader Conclusion

So that's the end of my review of Velocity Trader.

In the end this is just another option alert service that doesn't live up to the hype.

Honestly it's hard to find any that do.

In almost every case these kind of products lose customers money and customers always seem upset.

Beyond the decade of bad reviews there's other red flags too.

The main one being the fake customer reviews.

They didn't even try to make them look real to be honest.

I personally wouldn't want to buy this service.

It just seems like a way to lose money.

Here's A Better Opportunity

I'd pass on Velocity Trader - it's lost too many people money for me to recommend.

The good news is there's some good stock picking services out there.

I've personally reviewed 100+ of them..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: