Gorilla Trades is a long running stock picking service headed by Ken Berman.

He claims his alerts can make you serious money.

Is this true or all one big scam?

We'll get to the bottom of this question in this review.

Below you'll see what you get with your subscription, how much it costs and you'll get a look at the historical performance of this service.

You'll know if Gorilla Trades is worth it by the time you're done reading.

Let's get started!

Gorilla Trades Summary

Creator: Ken Berman

Price to join: Free for 30 days, $499 per year after

Do I recommend? Not really

Overall rating: 2.5/5

Ken Berman tries his best to sell his swing trading service and dress up his historically less than average results as amazing.

The truth is these short term trading strategies never really work out in the long run.

And any system that exclusively relies on technical analysis is doomed to lose to the market.

Is this swing trading service better than most?

Sure.

Still not worth it in my opinion because overtime I believe you'll make more just putting your money into a market index (less stressful and much easier).

Plus there's just better alternatives that are cheaper.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Warren Buffet Hates Technical Analysis

There's really no bigger authority than Warren Buffet when it comes to investing.

So when he has strong feelings about a topic that has to do with investing I tend to listen - and you should to.

One of the big red flags about Gorilla Trades is it exclusively focuses on technical analysis for its trades recommendations.

Technical analysis looks at the price movement of an asset and predicts where the asset will be over the next few days based on the price movement.

Here's an example of a chart based on technical analysis:

People who use technical analysis believe stock prices follow repeatable patterns and certain movements mean buy or sell.

It's pretty confusing stuff.

However, most serious investors don't take this stuff seriously.

Day trading and swing trading have grown in popularity over the years but you won't find billionaires and Wall Street investors doing this stuff.

And Buffet confirms this by saying the following about technical analysis:

Buffet is saying technical analysis doesn't actually tell you where a stock is going.

It's basically just confirmation bias and a guessing game.

The truth is you'll never be able to accurately guess where a stock's price will be in a few days.

The success rate of day trading proves this...

Less Than 1% Succeed With Day Trading

The success rate with day trading proves that technical analysis doesn't work.

According to studies that followed hundreds of thousands of day traders only 1% are able to make more than minimum wage.

And something like 97% lose money.

There's many reasons for this and the top reasons are:

High Fees Involves With Day Trading

Day trading is more expensive than long term investing.

Every trade you execute comes with a fee and each trade can cost you up to $100.

So you can actually execute a winning trade and still lose money.

On top of this taxes are higher for short terms trades.

28% of your returns are taxed for a trade if it's made and closed in less than a year.

Good luck profiting with these fees.

Tools And Alerts Cost Money

The tools involved with day trading are really expensive too.

You're going to need charting tools, stock screeners and if you don't want to treat day trading like a full time job you'll need to pay for alerts.

Something like Gorilla Trades gives you everything in one but it's still pretty expensive.

You're never supposed to spend more than 1% of your trading account on stock research.

If you do you'll be cutting into your gains too much.

If you spend too much on research you can make more winning trades than losing trades and still have lost money.

Because Gorilla Trades costs around $500 a year you need to have an account around $50,000 to not lose too much of your gains.

The Average Day Trader Loses Over 30% A Year

Add up everything we've talked about so far (technical analysis + high fees + impossibility of guessing where a stock's price will be in a few days) and the average day trader loses 36% of their account per year.

Compare that to people who just put their money into an market fund.

They make around 10% a year without needing to do anything.

Day trading is attractive to people for a lot of reason.

It promises fast money and alerts like Gorilla Trades promise that little work needs to be done by you.

Some people turn to day trading because they believe it will help them quit their job or get rich.

It's pretty clear by all the evidence that's out there that will never happen.

So please stay away from day trading.

Recommended: The Best Place To Get Stock Picks

What Is Gorilla Trades' Strategy

There's a specific strategy that Gorilla trades uses for their recommendations.

Here's a breakdown of the strategy:

Solely Relies On Technical Analysis

Like I mentioned before this service recommends trades based on technical analysis.

This is how all short term trading programs work.

The great majority of the stocks chosen by the platform's analysts, in particular, are displaying a bullish ascending triangle pattern.

When the shares break out above this pattern, a buying signal is "activated" for them. A buy alert is sent to members at this trigger price, which serves as the entrance price.

The approach used by Gorilla Trades also differs in that it largely relies on a volume indication to validate the breakout.

In many instances, traders are urged to hold off on purchasing a stock pick until a breakout is validated by above-average trading volume.

Trail Loss Of 7% To 10%

Many traders have what is called a trail loss on their trades.

A trail loss is a risk management strategy to prevent you from losing too much on a single trade.

So if Gorilla Trades recommends a stock and it falls to a certain level they automatically send a sell alert.

The trail loss is 10% at Gorilla Trades and most stocks don't go under 7% loss.

Buy And Sell In A Short Period Of Time

Gorilla Trades is a day trading/swing trading service so you'll be going for fast profits.

This means buying and selling most stocks in a few days to a few months.

This also means buying a lot of stocks in a year.

You can expect 100 or so trade alerts in a single year.

You have to be ready to punch in these trades right away.

If you wait to long when an alert goes out the price might change too much to make the trade.

Here's What You Get

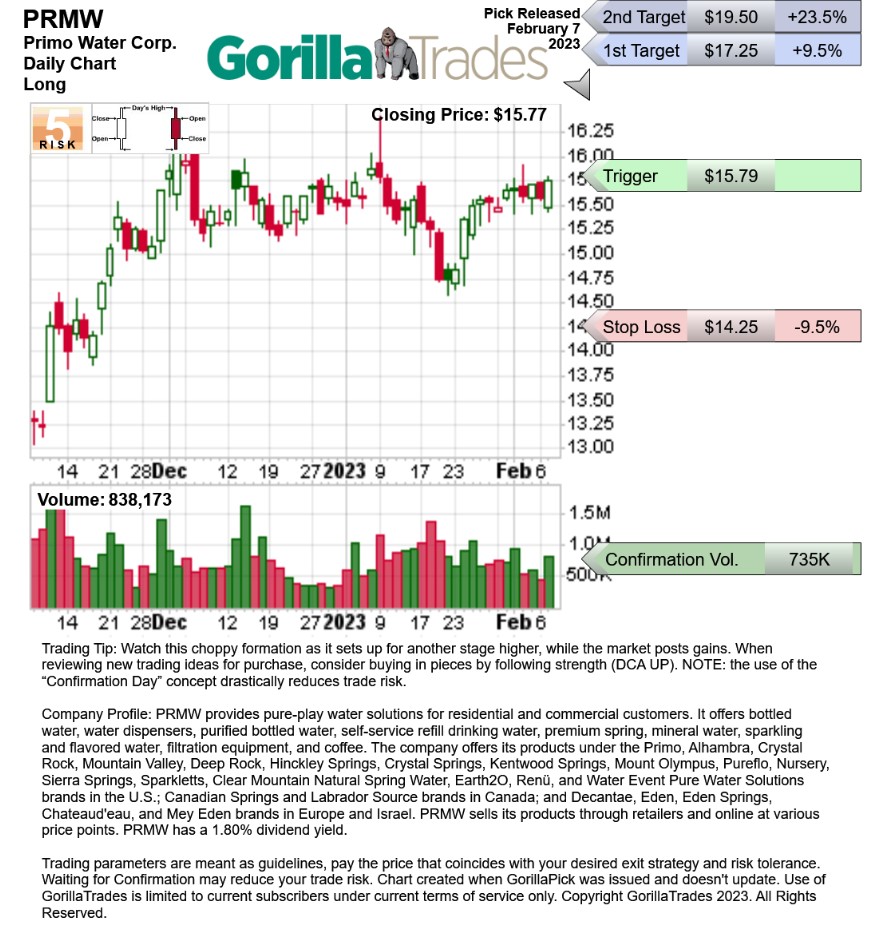

There's a few different components to Gorilla Trades.

Here's a breakdown of each feature:

New Stock Picks

This is mainly what you're paying for.

Almost every day a new buy alert will go out that focuses on a stock that meets the criteria for being recommended.

Along with each alert you get a chart and explanation on how to execute the trade.

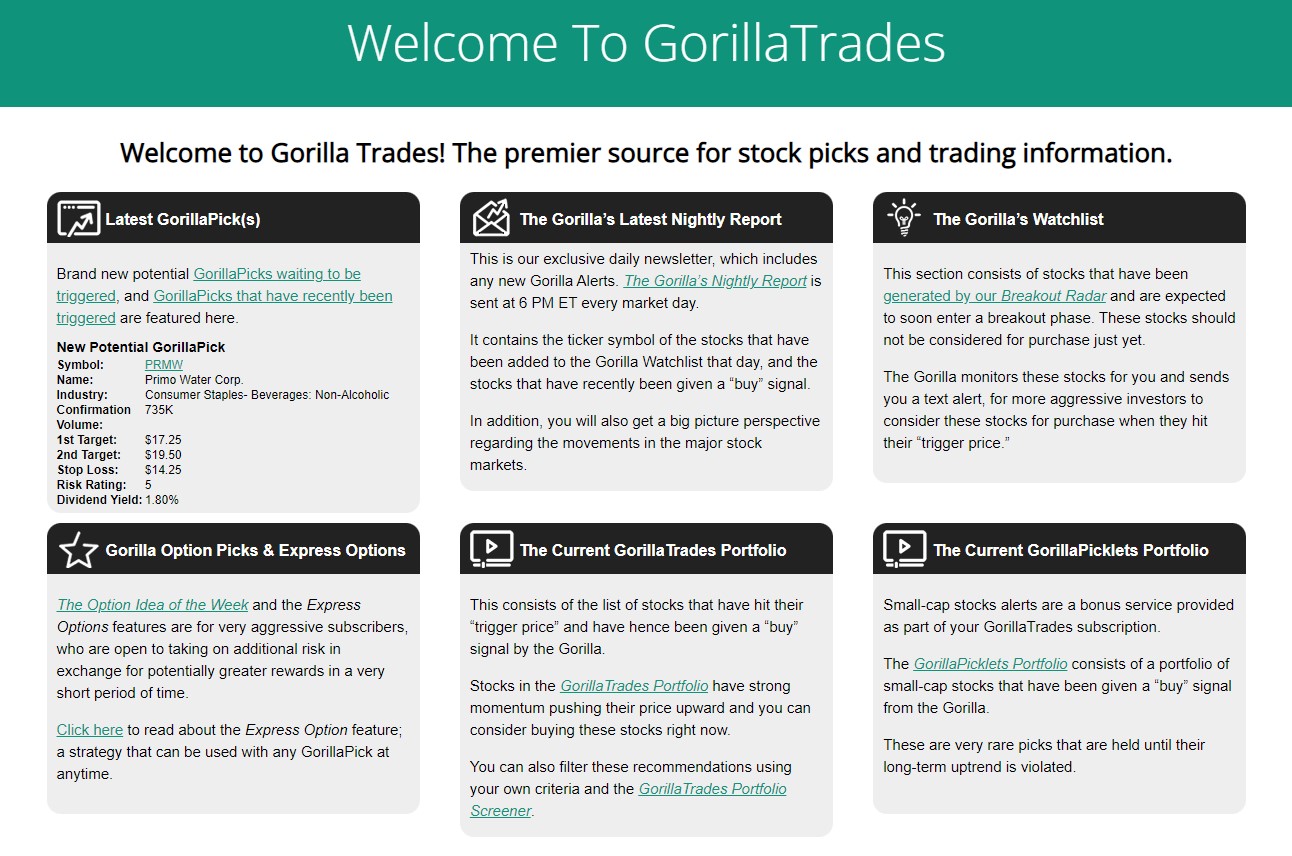

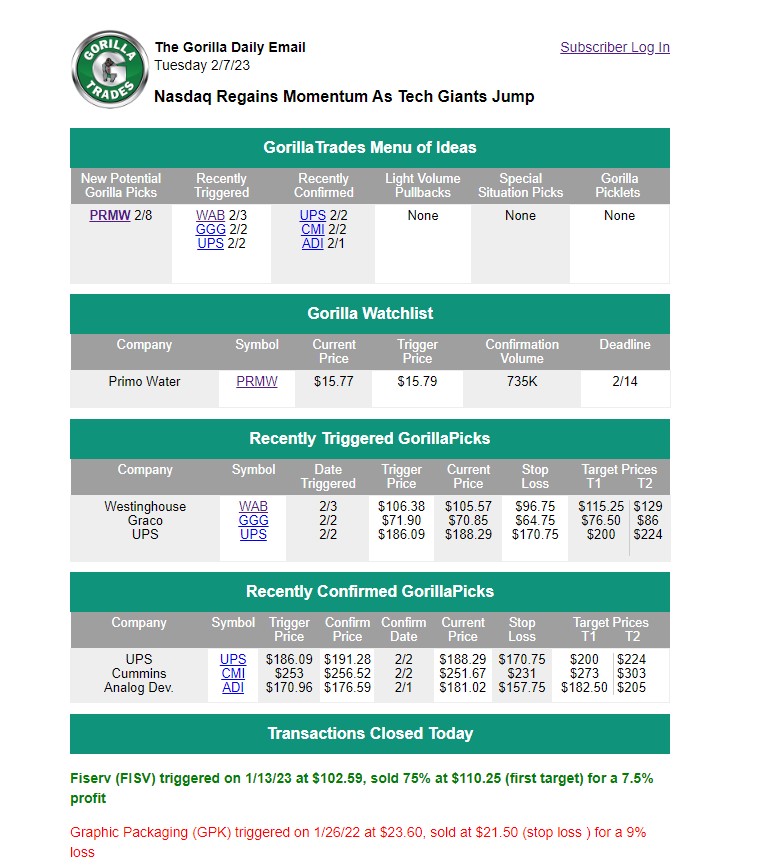

Here's an example of one of their recent trade recommendations:

As you can see you get the trigger price and the 1st and 2nd target.

The 1st target is where you sell 75% of your investment.

This ensures you'll profit on the trade.

After that there's a second trigger where you sell the remaining 25% of your investment.

Additionally, you get the stop loss price and in this case it's $96.75.

If the stock reaches that price you'll get an alert to sell.

Lastly, you get a brief overview of the company you're investing in and what they do.

Watchlist

Along with actual trade recommendations you get a watchlist of stocks that have the potential to be recommended.

These are stocks that are following the price movement they look for and just need to get to a certain trading volume and price to be triggered.

Here's an example of a stock that's on the watchlist:

As you can see it looks just like the trade recommendations.

You get the 1st and 2nd price targets, stop loss and the additional information on the company being recommended.

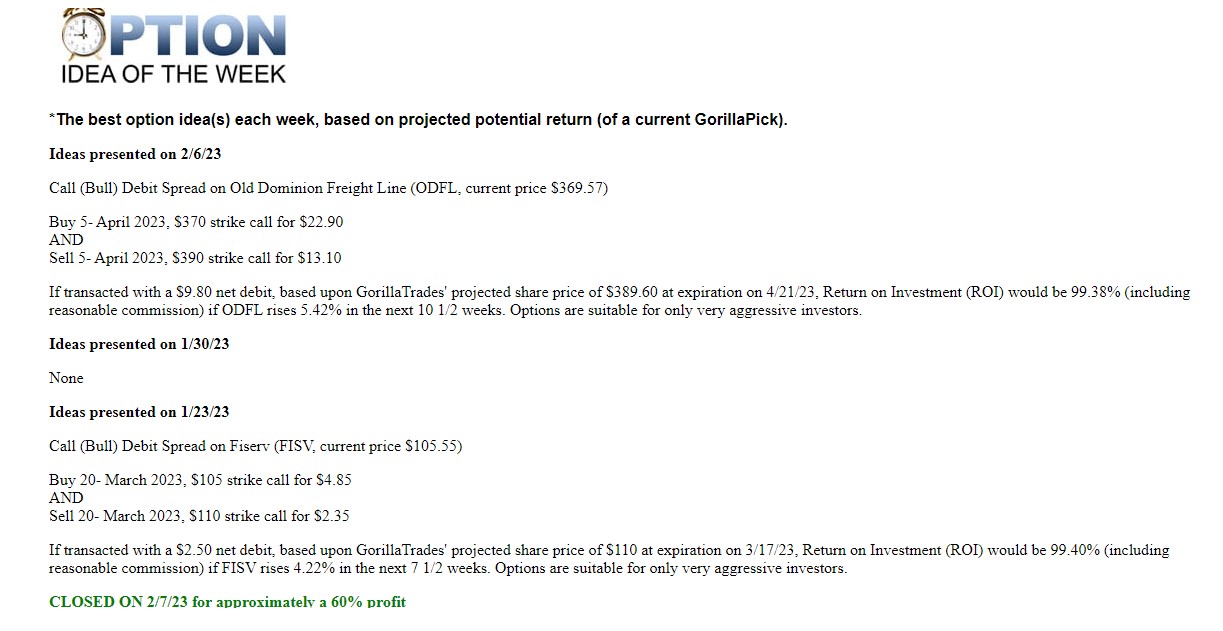

Option Idea Of The Week

Along with swing trade recommendations you also get option alerts.

Options are contracts that give an investor the opportunity to buy a stock at a certain price at a certain date.

Essentially you're predicting what a stock will cost in the future.

Options are a little more advanced and Gorilla trades puts this warning on all of their option trade recommendations:

"Options are suitable for only aggressive investors."

The reason for this is you lose 100% of your investment if you guess the stock price incorrectly.

Each alert comes with some information on how to make the trade:

Nightly Reports

The last main feature of Gorilla Trades is the the nightly report.

This goes out every night at 6 PM and is delivered to your inbox.

In each report you'll get updates on the portfolio and a look at how recent trade recommendations are performing:

Additionally, you'll get some insights on the market for the day and an explanation why stocks acted in the way they did.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

I Don't Believe Gorilla Trades Beats The Market

Gorilla trades does have a collection of all the trades they've made in the past but it's kind of hard to interpret.

They don't have a yearly return or anything like that.

It's just every trade on a giant list.

This service has been around for 20+ years so to determine the overall return of the recommendations I'd have to examine over 2000 trades.

I'm not going to do that.

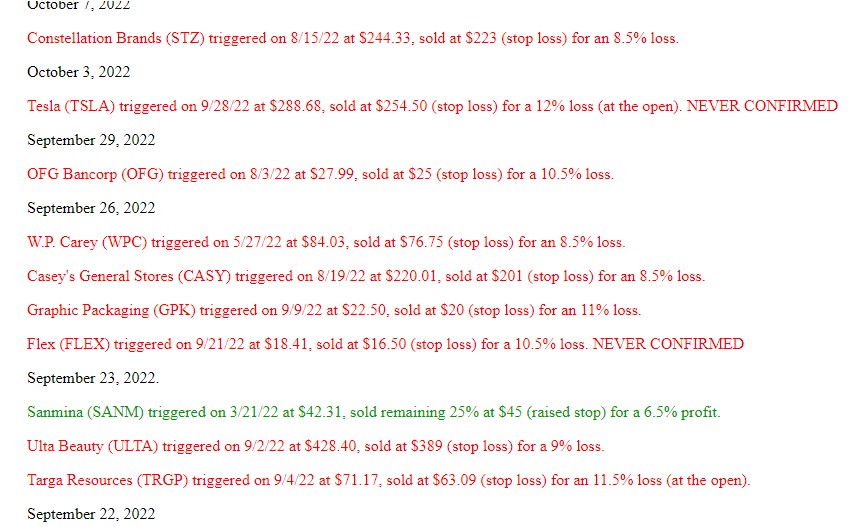

But there's one thing that you can tell from looking at the results.

When the market is in a bull run, the picks do well.

When the market is doing bad, the picks don't do well.

For example, here's a look at some of their recommendations from the end of 2019 when the market was doing well:

As you can see most of the trades did well.

Now let's take a look at 2022 when the stock market performed horrible:

As you can see when the market is down bad so are the stock picks.

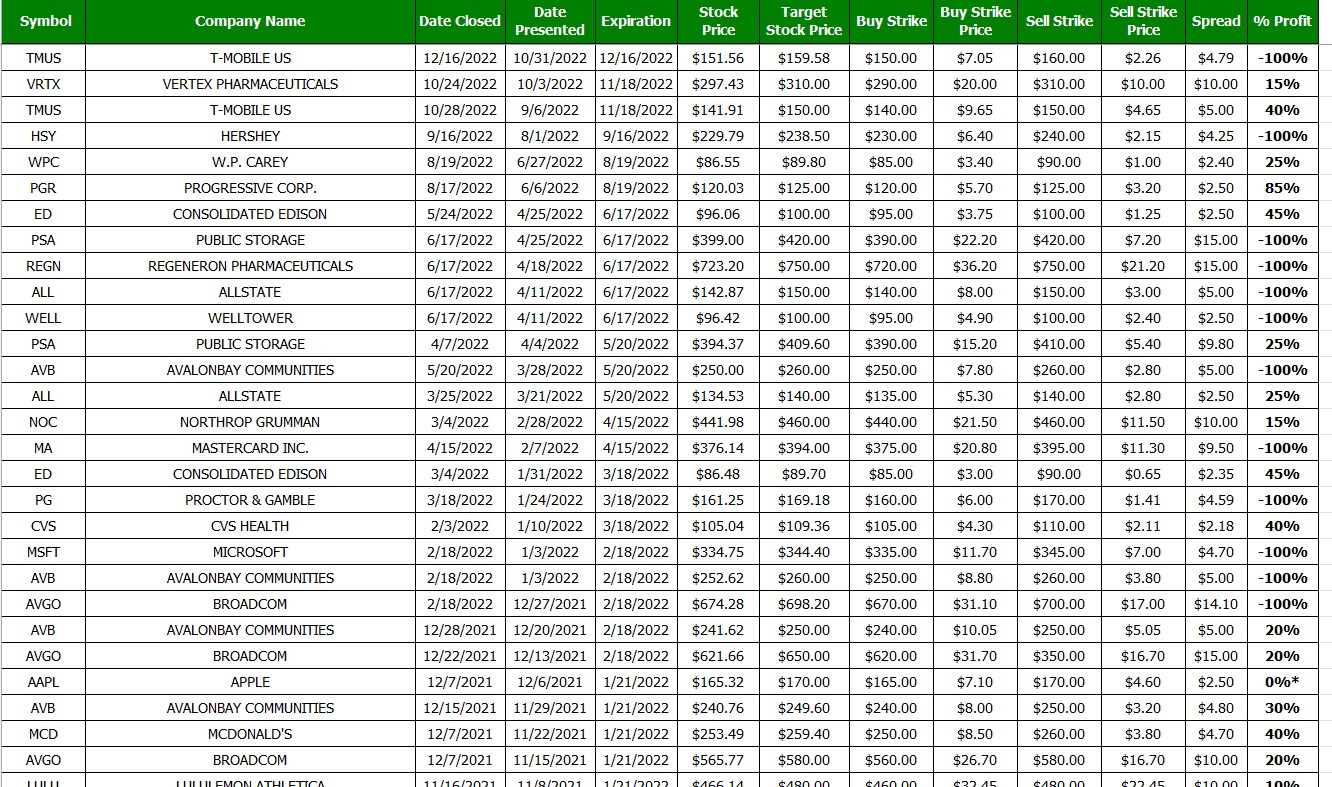

This is the same with the option alerts as well.

If we go to 2019 there's a lot more successful option trades than losers:

However, when you go to 2022 you'll see there's much more of those 100% loses:

So I always judge how a stock picking service does against the market.

The reason I do this is investing in the market is very easy and it pretty much guarantees 10% returns per year over the long run (the average market returns since 1970).

I haven't analyzed every stock pick made by Gorilla Trades but a Bloomberg writer followed this service for a while.

According to the article Gorilla Trades managed to "garner some buzz with splashy ads but the record fails to live up to the hype."

The writer claimed the service couldn't beat the market which is something I believe as well.

A service that can't beat the market is worthless.

Why stress yourself out by executing 100+ trades a year when you can just throw your money into a low fee index fund?

Or you can purchase a low cost newsletter that does actually beat the market.

Gorilla Trades FAQ's

Still have some questions about this service?

Here's answers to any remaining questions you might have about Gorilla Trades:

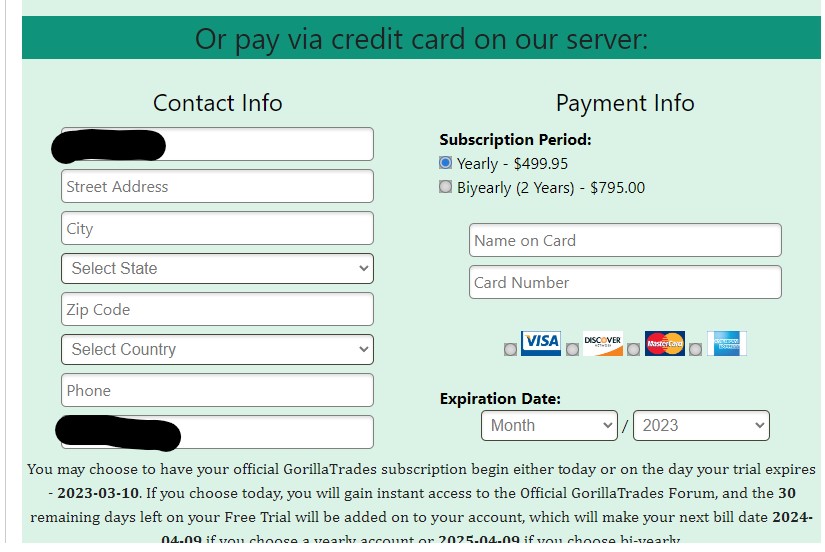

1) How Much Does Gorilla Trades Cost?

Gorilla Trades is $499 for one year or it's $795 for two years.

Remember you're not supposed to pay more than 1% to 2% of your trading account on stock research.

So this only makes sense if you're trading around $50,000.

Anything less than that and the research will eat into your gains.

Since you'll be buying many stocks per week you need an account set up for day trading as well.

Regulations in America limit day trading to people with $25,000 in their account.

So that's another thing to keep in mind.

2) Is There A Refund Policy?

Yes, you get 30 days after you pay to get your money back.

There's is a $69.95 processing fee, though, so you won't be getting all your money back.

This is fair because you get a free 30 day trial too.

It's pretty rare to see a program offer a 30 day trial AND a 30 day refund.

Typically you get one or the other.

So that's a good deal.

3) Is Ken Berman Legit?

Yes Ken Berman has real experience with investing.

He worked for well known companies like CitiGroup, Smith Barnet and UBS but he's been out of that world for a long time.

He's been running Gorilla Trades exclusively since 2003.

Something to keep in mind is Ken doesn't actually make the trades he recommends.

He claims it's because he doesn't want to be accused of pump and dumping his community.

I guess that excuse checks out.

The reason I'm a little skeptical of this is Ken mostly recommends large cap stocks.

It's hard to pump and dump stocks that have a price over $100.

It's only really possible to pump and dump penny stocks.

4) Is There Similar Services?

Yes, there's many similar newsletters out there.

Some include:

- The Distortion Report

- Stansberry Investment Advisory

- TradeStops

- True Wealth

- Retirement Watch

- Intelligent Income Investor

- The Opportunistic Trader

- Jeff Clark Trader

- Behind The Markets

- The Oxford Income Letter

- Power Gauge Report

- Chaikin Analytics

- The Ferris Report

- Extreme Value

There's many more stock picking services out there as well.

Recommended: The Best Place To Get Stocks

Gorilla Trades Pros And Cons

Gorilla Trades Conclusion

So that's the end of my Gorilla Trades review!

I hope all your questions were answered.

In the end I'm not really a fan of this service for a lot of reasons.

The biggest reason is I think the stock picking strategy is flawed.

Making trades based on the movements of a stock's price and not the company itself is a bad idea.

Like Warren Buffet says the day to day movement of a stock's price tells you nothing about the stock.

This is why Gorilla Trades' recommendations don't tend to beat the market.

And if a stock picking service can't beat the market it's not worth getting.

But if you're still curious you can try Gorilla Trades for free for 30 days - you don't even need to put in a credit card.

Here's A Better Opportunity

I'd pass on Gorilla Trades.

I don't think it'll beat the market and once the trial is up it's pretty expensive.

The good news is there's much better alternatives out there.

I've personally reviewed over 100+ stock picking services..

To see my favorite (that's very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: