InvestorPlace is an investing publisher where many stock picking newsletters and services are sold.

Some of them are affordable while others cost thousands of dollars.

Before spending any of your money on these products I'm sure you want to know if they're a scam or not.

I'll answer that in this review.

Additionally, you'll see any red flags that I find and get insights you won't find anywhere else.

You'll see if InvestorPlace is legit by the time you're done reading.

Let's get started!

InvestorPlace Summary

Creator: Louis Navellier

Price to join: $19 to several thousands

Do I recommend? No!

Overall rating: 1/5

InvestorPlace is not worth your money or time.

It's run by a man named Louis Navellier who was just fined $30 million for misleading investors about his trading performance.

The other characters at the publisher have poor track records and have recommended some awful stocks.

The marketing funnel is aggressive and the sole goal of InvestorPlace is to milk you for as much money as possible.

Avoid.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Louis Navellier - The $30 Million Scammer

Most people who write reviews about Louis Navellier and InvestorPlace will just say nice things.

There's a few reasons for this..

Someone like Louis can be litigious - meaning people like him might threaten to sue you if you say bad things.

Another reason is a lot of people writing reviews about investing service have zero clue what they're talking about.

So they just read what Louis has written about himself and regurgitate it like it's the truth.

But the actual truth is Louis Navellier is not someone you should trust.

Here's some things you should know about the creator of InvestorPlace:

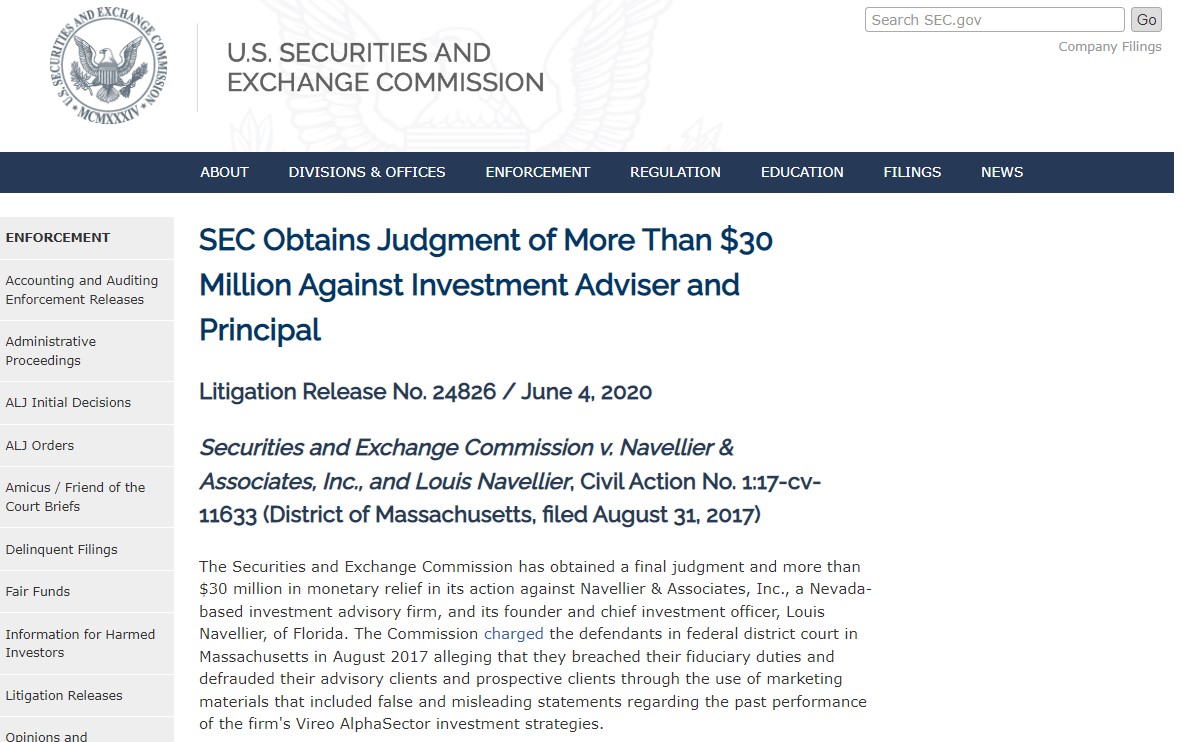

Fined $30 Million For Defrauding Investors

The first thing you need to know about Louis Navellier is he is a scoundrel.

He is someone that's more than willing to mislead his customers to buy products and invest in bad stocks.

This isn't my opinion either.

This has been proved in court and ended up with Louis being fined $30 million by the SEC.

Basically the scam went like this..

A 20 year old with zero investing experience created a program that traded automatically.

He didn't actually get real results and instead all results from this trading bot were completely hypothetical - meaning made up.

Boneheaded Louis bought the rights to the algorithm and acted like the hypothetical results were real and were passing them off as such.

He even uploaded his fake results into third party resources to make it seem like they were real.

In the end 6,000 thousand customers spent 1.3 billion on this misleading product and Louis made $15 million from it.

Is this someone you want to trust with you credit card details? Or your savings?

Either Louis is too dumb to understand the trading bot was completely fraudulent or he knew and sold it anyway.

Regardless both options aren't good.

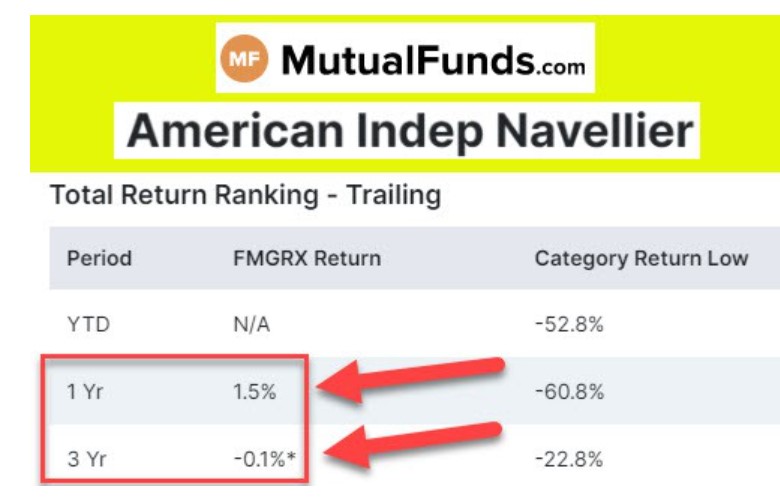

No History Of Success

Louis is a master at portraying himself as this successful investor.

He has popular books on the topic, sells products that cost over $10,000 and even claims he's beating the market by 9 to 1!

Pretty amazing since someone like Warren Buffet claims beating the market is basically impossible and has only made 10% a year.

However, if you dig into Louis' actual performance it doesn't seem as good as he portrays.

For example, is mutual funds are horrible.

If you look on MutualFunds.com you'll see over a 3 year period he actually lost money:

The market typically gains about 10% a year so the idea that Louis can beat the market by 9 times is absurd.

Keep in mind this was during a bull run when returns were higher than normal.

Recommended: The Best Place To Get Stock Picks

A MarketWise Publisher (Not Good!)

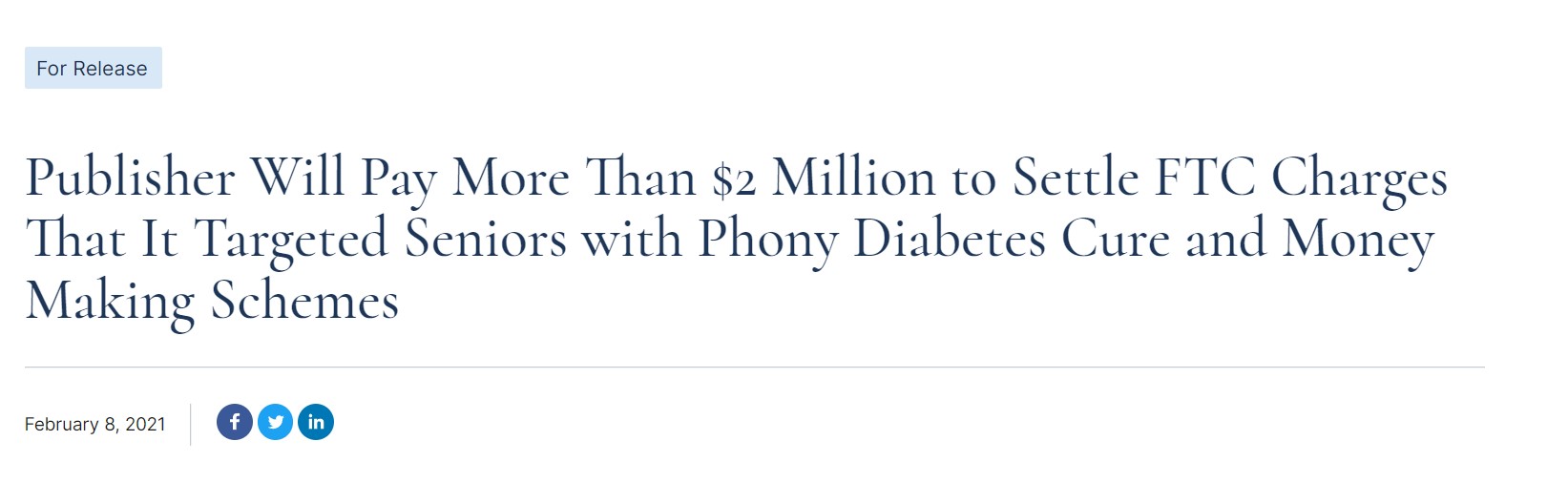

There's a company called Agora that was once king of the invseting newsletter world.

However, they've run into problems lately after being sued for $2 million by the FTC:

Agora was making something like $500 million a year but their reputation has been damaged incredibly.

They owned a bunch of publishers and many of them have fled.

However, there's so much money to be made in selling stock picks to retail investors that the former Agora publishers (along with InvestorPlace) came together to create a new publicly traded company.

This company is called MarketWise and it launched in 2021.

Despite being so new they're on track to make over $500 in revenue for 2022.

However, this company is almost an identical clone to Agora which should worry you.

Here's everything you need to know about MarketWise before joining:

Aggressive Sales Funnels

There's over a dozen publishers under the MarketWise umbrella and they all share one thing in common - they all offer at least one very cheap product.

Typically the cheap product costs anywhere from $10 to $49.

Do you think MarketWise makes over $500 million in revenue every year selling $19 subscriptions?

Of course not.

In reality the cheap newsletters are only bait products.

These services are just meant to get you into the sales funnel where you will be aggressively marketed to.

This is what will happen if you buy from InvestorPlace.

Expect your inbox to be flooded with promotional offers multiple times a day.

Many of these promotions will try to get you to spend thousands with manipulating and persuasive sales funnels.

You might spend thousand of dollars before you know it.

The biggest irony of all is the cheaper products are typically the best products from these publishers!

Louis Navellier's Growth Investor has been Louis' best newsletter and it only costs $49 per year.

Cross Promotions From Other Scammers

Another thing to keep in mind is MarketWise cross promotes services from one publisher to another.

This means once MarketWise gets your email address you'll be marketed products from other publishers as well.

Believe it or not MarketWise employs people even shadier than Louis.

For example, Palm Beach Research Group is run Teeka Tiwari.

MarketWise will tell you Teeka is a trusted expert when in reality he was thrown out of Wall Street.

He literally can't work for a company that manages money ever again.

Do your really want these products promoted to you?

I wouldn't.

Recommended: The Best Place To Get Stock Picks

Luke Lango Keeps Picking Losers

After Louis Navellier I'd say Luke Lango is the next biggest personality at InvestorPlace.

He has several products for sale at this publisher and they range in price.

Some are cheap and others will cost thousands.

Luke doesn't have quite the red flags that Louis has but he does have one big problem..

He keeps picking losing stock picks.

I've been following Louis' stock picks all year and the ones I've looked at have all been losers.

Here's a an overview of these stock picks.

Oxford Nanopore In April 2022

The first stock I've been following that Luke recommended is Oxford Nanopore.

Oxford Nanopre is a DNA sequencing company and Luke believed they were going to be the next medical "giant."

However, this year has been very bad for these biotech stocks and it's lost a pretty good amount of value in just 7 months:

Ginkgo Bioworks In April 2022

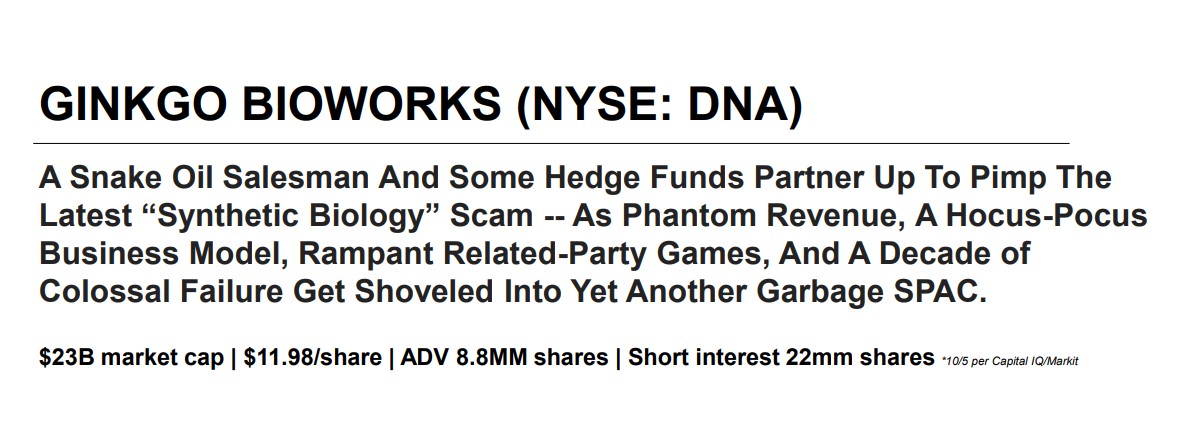

Ginkgo Bioworks is an interesting company.. not because I think it's a good stock but because many people think it's a complete scam of a company.

And curiously enough many people under MarketWise have been pushing this stock in 2022.

A successful hedge fund (Scorpion Capital) that has won 100% of its short trades claims this company is working with different hedge funds to pump the stock:

Additionally, Scorpion believes all revenue is fake and based on Ginkgo Bioworks buying third party companies - then selling them their own products.

So there really isn't any real revenue or use for its products.

I don't think it's out of the realm of possibility to believe Ginkgo Bioworks is paying MarketWise and InvestorPlace to promote the stock.

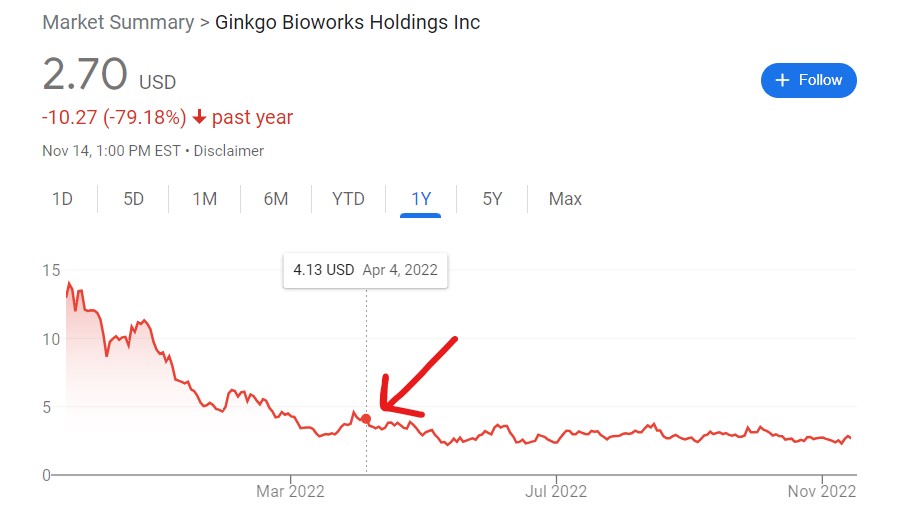

Regardless of what's happening behind the scenes the stock hasn't done well this year:

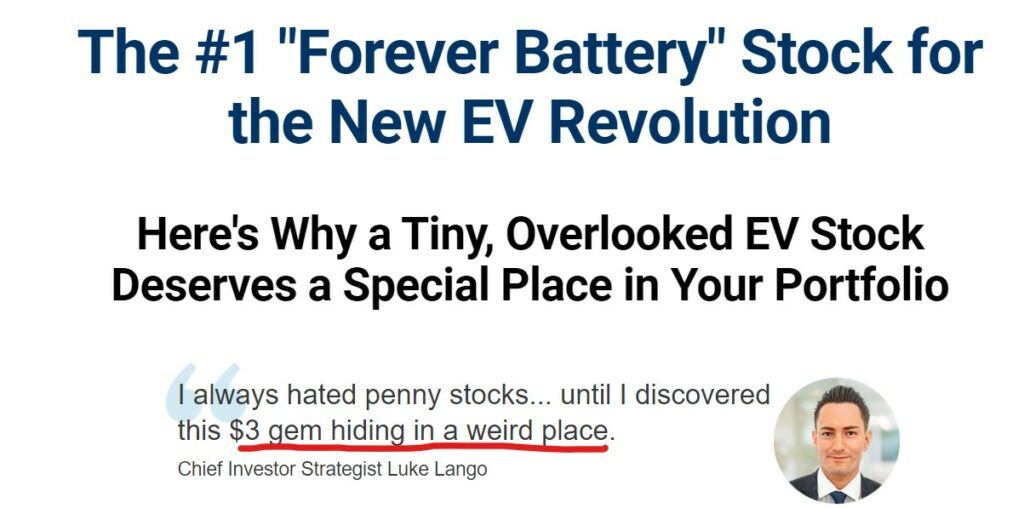

Ilika In February 2022

Many stock pickers are trying to find the next big stock in the electronic car industry.

Luke claims he found the company that will create "forever batteries" and he wanted you to buy a company called Ilika that creates solid state batteries:

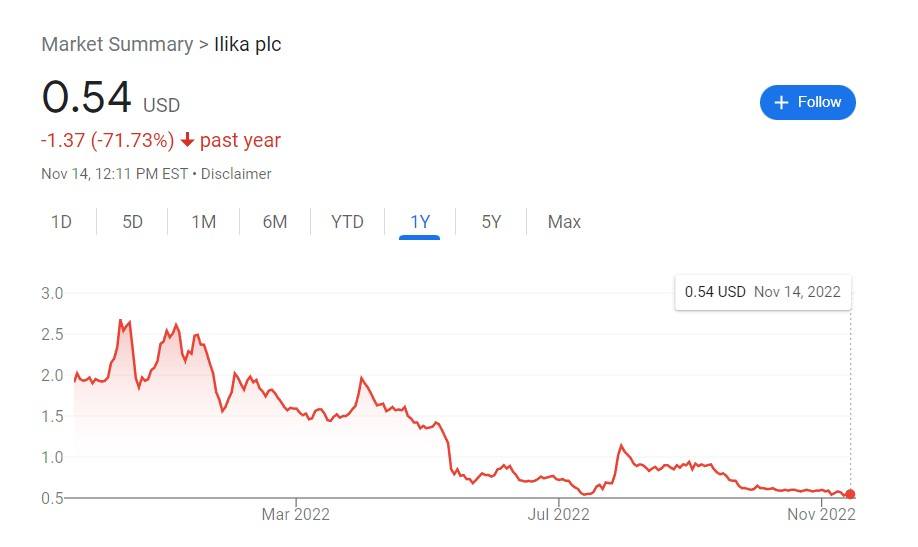

However, the stock has completely crashed this year is now trading at around $0.50:

Two Different Cryptos In March 2022

Luke doesn't just recommend growth tech stocks and biotech companies - he also has a service called Crypto Investor Network that recommends different small cap cryptos.

Small cap cryptos are a horrible idea to invest in and many just turn out to be ponzi schemes.

The first crypto is Chiliz which has to do with sports fan tokens.

It crashed right after being recommended and has gotten back to break even since:

Next up we have Cosmos:

This crypto is down a pretty significant amount since being recommended, from $28 to around $10.

That's a big loss.

If you would have followed Luke's advice this year you'd be down a serious amount of money.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

InvestorPlace FAQ's

Still have questions about InvestorPlace?

Here's some answers to common questions that should help:

1) How Much Does InvestorPlace's Services Cost?

It varies based on product but the pricing works the same way every other MarketWise publisher works.

Basically there's a cheap product to get you into the sales funnel.

Every internet marketer knows people online typically won't buy a product that costs several thousands of dollars unless they're familiar with the product.

If someone buys a product for $49 they're more likely to spend thousands down the road than a cold customer.

So there's going to be cheap products and then they upsell you after you buy.

The most expensive product at Investor place is around $10,000.

2) Is There A Refund Policy?

Only for the cheap products!

This is another Agora/MarketWise trick.

They offer good refunds on the products that cost $49 per year but not on the ones that cost thousands.

Typically the more expensive products just come with a credit refund.

So you can only use the money to buy other InvestorPlace products.

MarketWise isn't making hundreds of millions by refunding these expensive subscriptions.

3) Is Louis Navellier Legit?

No.

He's been around for a long time and he's an accomplished self promoter but that doesn't help you make money.

He's proven beyond a doubt he's willing to lie to customers and have them lose money if it makes him money.

He's been fined tens of millions for fraud and misleading customers.

Louis also likes to claim he's this amazing stock picker but that's not the case either.

Every indication that I've seen is he barely gets a return on his investments.

In many instances he loses money!

4) Is Anyone Legit At InvestorPlace?

A lot of bad apples are attracted to selling stock picks to retail investors.

There's less laws regulating this business than Wall Street - there's so much money to be made too.

The people at InvestorPlace range from fraudsters like Louis to bad stock pickers like Luke Lango.

It's hard to believe anyone that would work with Louis is legit.

5) Are There Similar Publishers

Yes, I've covered many MarketWise publishers on this website before.

Some of them include:

- Rogue Economics

- Opportunistic Trader

- Palm Beach Research Group

- Empire Financial Research

- Stansberry

- Brownstone

- Chaikin Analytics

As you can see I'm very familiar with how these publishers work.

Recommended: The Best Place To Get Stock Picks

InvestorPlace Pros And Cons

InvestorPlace Conclusion

InvestorPlace is a typical investing publisher but worst.

The main reason it's worst is because of Louis Navellier.

He's the head honcho at InvestorPlace and he is not a guy that is worthy of your trust.

In fact it's the opposite - he's proven untrustworthy.

He simply doesn't care about your portfolio or if you make money from his reocmmendation.

Louis just wants your money and the SEC has proven this in court.

There's no services from InvestorPlace I would recommend.

Even the ones that are half way decent come with too much baggage.

The aggressive marketing to get you spend thousands is such a turnoff and universally hated by customers.

In the end I would pass on InvestorPlace and all InvestorPlace products.

Here's A Better Opportunity

InvestorPlace isn't worth it and you shouldn't give them your money.

The good news is there's plenty of good places to get stocks picks.

I've reviewed hundreds of these services..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: