The Oxford Income Letter is an investing service run by Marc Lichtenfeld.

This newsletter focuses on dividends and income opportunities in the stock market.

The question is - does it live up to the hype or is it another scam?

Well I have good news for you..

I spent the entire day reviewing this product and digging into everything.

I've reviewed many products like this before and know exactly what to look for.

Below you'll get important background information, an overview of what you get, a look at past performance and more.

You'll know if The Oxford Income Letter is right for you by the time you're done reading.

Let's get started!

The Oxford Income Letter Summary

Creator: Marc Lichtenfeld

Price to join: $49 to $129 per year

Do I recommend? Sort of (read summary)

Overall rating: 4/5

The Oxford Income Letter is a solid investing newsletter that focuses on creating income from your investments (dividend stocks and bonds).

The results have historically been very good.

Since 2020 the recommendations are up 31% compared to the market being up 20% in the same time period.

There's baggage with this newsletter, though.

It's owned by a horrible company (Agora, which owns Oxford Club) and they treat their customers poorly.

You'll be marketed upsells that cost thousands of dollars and don't get the same results.

The Oxford Income Letter is worth it if you can resist the marketing for the upsells.

If you're someone that falls for these kinds of things it's better to avoid altogether then spend thousands on a low quality product.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

14 Things To Know About The Oxford Income Letter

There's things you need to know about The Oxford Income Letter before buying.

Here's everything you need to consider about this newsletter:

1) I Actually Bought The Oxford Income Letter

Before we get into the details about The Oxford Income Letter I just want to assure you I actually own the newsletter.

There's a lot of places that have reviewed this product but I doubt most have even bought it.

Even less know anything about stocks and the market.

I've reviewed 100+ stock picking services and am very experienced in this field.

This is going to be an HONEST review.

Oxford Club doesn't pay me or anything like that.

So now that we've gotten that out of the way let's start with the review!

2) The BIG Red Flag With Oxford Club

The Oxford Income Letter is the flagship newsletter at the Oxford Club.

However, a larger company owns Oxford Club and many other investing newsletters.

That company's name is Agora.

Agora has a horrible reputation and they've truly earned it.

I hesitate to recommend The Oxford Income Letter because of how much I dislike Agora.

What kind of things have they done?

Well just two years ago they were fined $2 million for defrauding senior citizens:

You'd think getting caught doing something like would make Agora want to change.

However, it's been proven they're still up to their old tricks:

Do you trust your credit details with people willing to rip off seniors?

Things you can expect when you enter an Agora sales funnel include:

- Outrageous marketing promising massive returns

- Low quality products that lose customers money

- Outright lies and misleading statements

- Overwhelming amount of upsells

- Insane amount of promotional emails

And more.

So just be aware The Oxford Income Letter will expose you to all of this.

It's important that you resist all upsells and promotions.

Some of the products will cost $5000 to $10,000+.

None of these services will perform better than The Oxford Income Letter (that's their best product).

3) The Oxford Income Letter Focuses On Passive Income

One of the reasons I actually like The Oxford Income Letter is it focuses on one of the sweetest things in the world - passive income.

Passive income is when you're making money without actually working.

You can make passive income with rental properties, businesses that you automate and through investing.

The Oxford Income Letter only recommends investments that give you passive income.

So the portfolio is full of dividend stocks and bonds.

The good thing with these kinds of investments is you can eventually create a full time income if you invest enough money.

If you don't have a lot to invest you can reinvest your dividend payments back into the stocks.

There's strategies that can turn $25,000 into thousands a month over a 20 to 30 year period.

This is good for people that are planning for retirement when they're younger.

If you're about to retire and have a good amount of savings you can turn that into monthly income as well.

This is definitely the smartest way to invest for most people and is very low risk.

Recommended: The Best Place To Get Stock Picks

4) Marc Lichtenfeld Is Experienced And Worth Listening To

If you work with Agora you definitely have some loose morals.

So I don't want to gush over Marc too much..

But Marc is worth listening to and has gotten good results over the years.

And he doesn't have the resume of someone you'd expect to be running a successful investing newsletter.

Marc was a news anchor for ON24 before becoming and equity analyst for Avalon Research Group.

After Marc focused on retail investing and worked at well known investing brands Weiss Research and The Street.

During this time he wrote a popular book on dividend investing:

This book is well reviewed and has been read by many different people.

Back in 2007 Marc made his move to Oxford Club and that's where he's been for the last 16 years.

Outside of investing Marc is a boxing announcer for HBO, Showtime, and ESPN.

5) Revealing Some Of The Stock Picks

I can't just give you the stock picks in The Oxford Income Letter's portfolio - that's proprietary information.

The good news is Marc has been around for a while and does a lot of teaser campaigns for investment ideas.

This is how Marc markets The Oxford Income Letter.

He doesn't give away the stock he's hyping up and you have to buy his newsletter to learn it.

However, there's always enough clues to figure out the stock.

Here's a look at some of these investment ideas so you can get an idea of what stocks Marc recommends (these do come from many newsletters and not just Oxford Income Letter).

Paypal In 2019

In April 2019 Litchenfeld ran a teaser for a stock that could "hand you 859% gains in a year."

This was for his newsletter called Stock Sequence Trader.

The stock being teased here is Paypal and Marc claimed he was putting $5 million into the stock.

Here's how the stock has performed since this campaign launched:

As you can see the stock was pretty flat until covid.. when a lot of stocks shot up.

So the only way you would have made money is if you sold at the peak after covid.

However, if you held past that point you are down around 20% right now.

Collegium Pharmaceutical In April 2018

A year before the teaser we just discussed Litchenfeld ran a campaign called "Killer Hiding In Your Medicine Cabinet"

The title alludes to aspirin and how dangerous these drugs can be for your health.

The pitch revolves around a company called Collegium Pharmaceutical.

The reason Marc liked this company is they developed a "safer painkiller" and he predicted this stock could go up 1000%.

Here's how it's performed since:

The stock plummeted after Litchenfeld's prediction of 1000% gains.

It's recovered but never higher than what it was in April 2018.

I think it's safe to say this pick was a dud.

Intellia Therapeutics In August 2017

Back in August 2017 Litchenfeld ran a teaser titled "Genesis Cure" and hinted there is a new technology that could "wipe 48,000 incurable diseases off the face of the earth."

Sounds pretty crazy.

Even crazier is Marc claimed the revenue for this company could increase 303,316% over time .

The company? Intellia Therapeutics.

Here's how it's performed since August 2017:

This stock has performed really well.. however, you wouldn't have seen results for almost 4 years.

If you had the stomach to stick it out that long you would have made a lot of money from this stock.

AbbVie In February 2017

The last stock we're going to cover is another pharmaceutical company.

This one is called AbbVie and Litchenfeld at the time claimed this company had a "genius molecular discovery" about Alzheimer's.

He predicted big things for the company.

Here's how it turned out for him:

The stock shot up a good amount right after the prediction and doubled.

After dropping in price it's recently gone up a lot as well.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

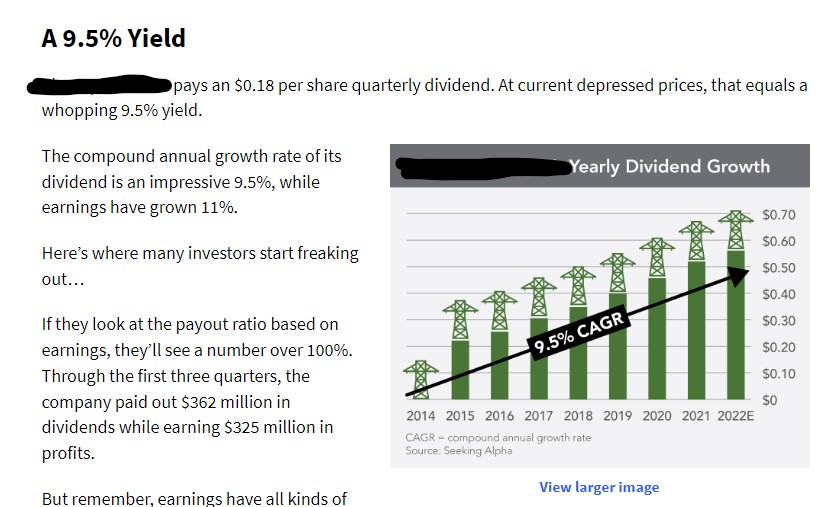

6) You Get A Monthly Newsletter

This is the main thing that you're paying for.

Every month you'll get a new newsletter with a stock recommendation in it.

This includes how much you should buy, what price you should buy up to and why Marc likes the stock.

The newsletters are pretty brief which is something that I like.

Many stock pickers drown you with information and figures.

Marc keeps it to what's important.

For example, here's an example of Marc making the case for a stock because the dividend is constantly growing:

As you can see this is very easy to digest.

There's a graph that shows the growth of the dividend year after year.

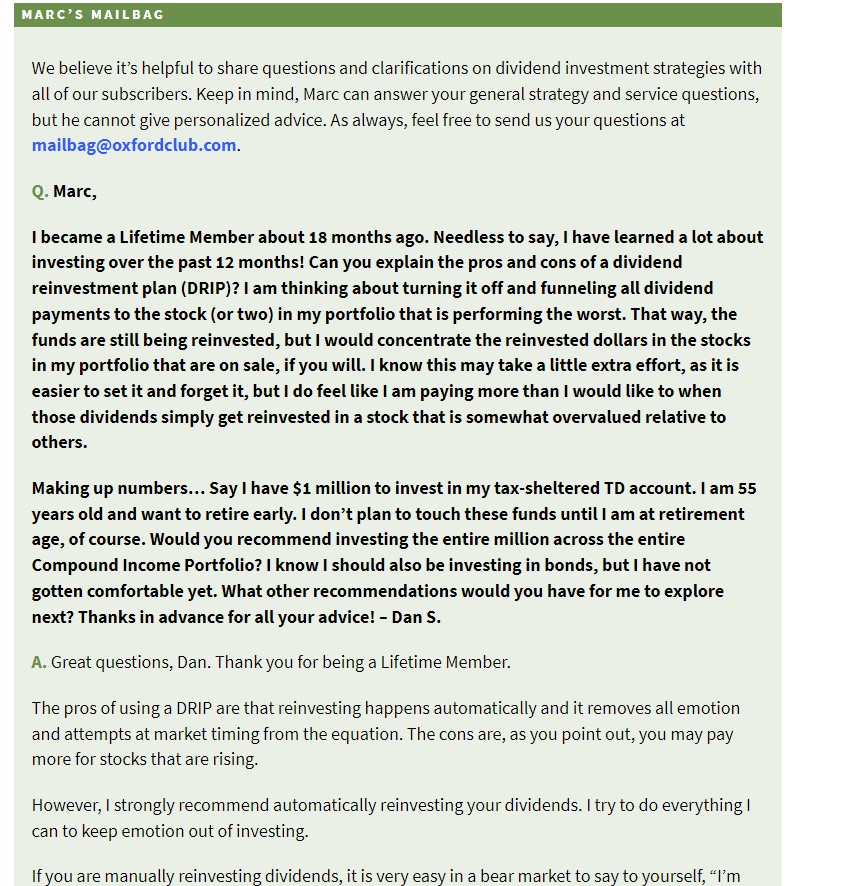

Additionally, at the end of every newsletter there's a section called Marc's Mailbag where Lichtenfeld answers questions from subscribers:

If you pay for the $49 subscription you get a digital copy of this newsletter.

If you pay $79 per month you get a digital and physical copy of the newsletter.

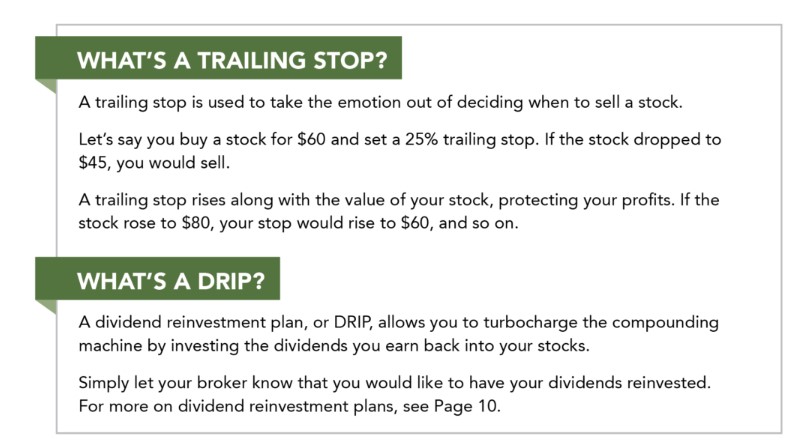

7) There's An Informative Training Series

Another thing I like about The Oxford Income Letter is you get a training series on Marc's investing strategy.

The training series starts with an overview of the investing strategy employed at this newsletter:

In this section you'll get an explanation on what the different portfolios mean and who they're for.

Additionally, you'll learn about different strategies Marc uses to increase your dividend payments and to mitigate loses:

You'll even get training on how to deal with the IRS and taxes.

The rest of the training series is there to teach you more investing principles and to ensure you're ready to properly invest.

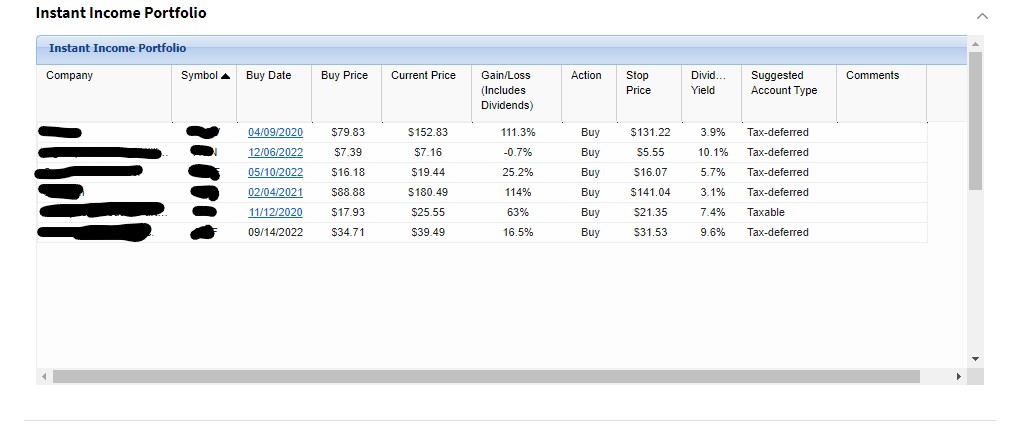

8) The Portfolio Has Historically Performed Well

There's four different portfolios that come with The Oxford Income Letter.

They are:

- Instant Income Portfolio: This is for investors who want to get results more quickly. The stocks in this portfolio have a record of strong dividend raises and the goal is to boost your income every year.

- Compound Income Portfolio: This portfolio is for people looking to grow wealth over time. It uses the DRIP strategy of reinvesting dividend payments back into the stocks to grow your portfolio through the years. The stocks here are very conservative.

- High Yield Portfolio: This portfolio focuses on stocks with a high yield rate but that come with more risk. So growth isn't the strategy here. You're looking to collect the dividends faster.

- Fixed Income Portfolio: This portfolio is for people that are close to retirement or retired. It's very conservative on reliable income product assets like government and corporate bonds.

Currently there is 6 stocks in the Instant Income Portfolio:

The market has returned 20% since 2020 and these 6 stocks are clearly beating that number.

Compound Income Portfolio is the biggest portfolio and has 25 stocks in it.

Here's a look at how some of them have performed:

The High Yield Portfolio is the smallest portfolio and only has 3 stocks:

Last is the Fixed Income Portfolio which is mostly full of corporate bonds and a few alternative bonds:

Recommended: The Best Place To Get Stock Picks

9) Stock Performance Since 2020

Some of the stocks in the portfolio were recommended a long time ago and the returns they've gotten since then won't benefit you much.

You really should judge an investing newsletter from the last couple years to now.

This will give you a good idea on what to expect.

Here's the returns of every recommendation made in the last two years:

- 111.3%

- -0.7%

- 25.2%

- 114%

- 63%

- 16.5%

- -16.4%

- -11.4%

- 0.5%

- 100%

- -7.8%

- 25.6%

- 114%

- 23.6%

- -17.8%

- -12%

- 64.2%

- 16.5%

- 39.2%

- 0.4%

- 48.3%

- 20.7%

- 1.7%

Out 23 stocks 17 are up and 6 are down.

Like I said before the market is up 20% since the start of 2020 and The Oxford Income Letter's new recommendations are up 31% since 2020.

This newsletter is beating the market and that's why I recommend it.

Investing in a market index is very simple so if a newsletter can't beat the market I can't recommend it.

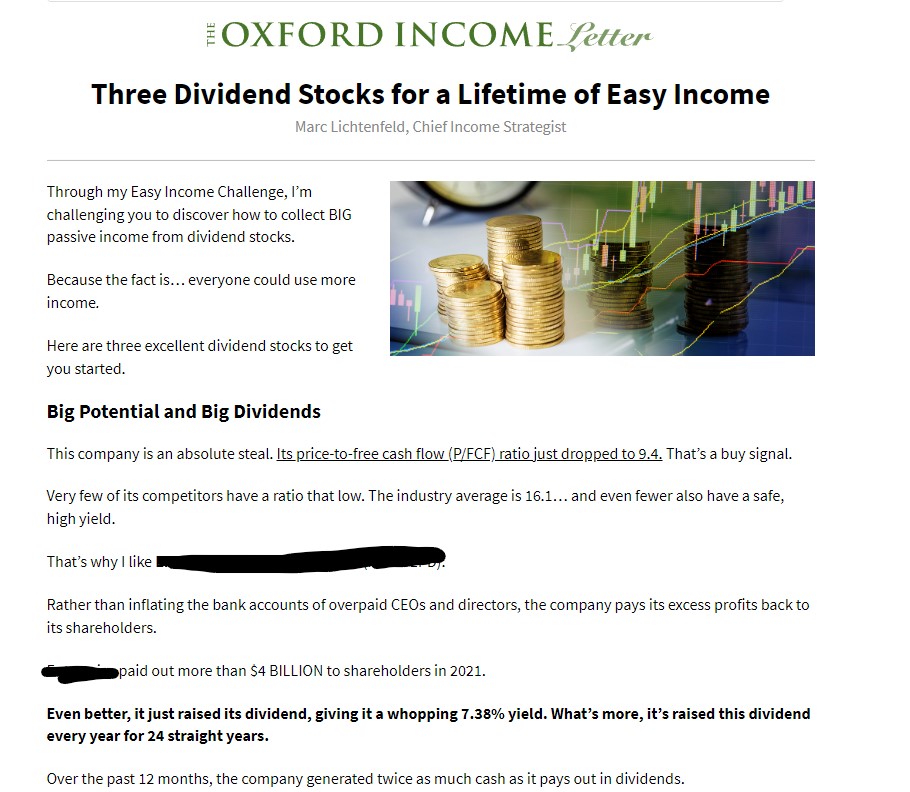

10) There's Plenty Of Special Reports

Another bonus of being a member of The Oxford Income Letter is you get a ton of special reports.

These reports are long form presentations that focus on a single stock or investing theme.

One of the latest reports covers "three dividend stocks for a lifetime of easy income."

In total there's 18 special reports.

Here's a glimpse of some of them:

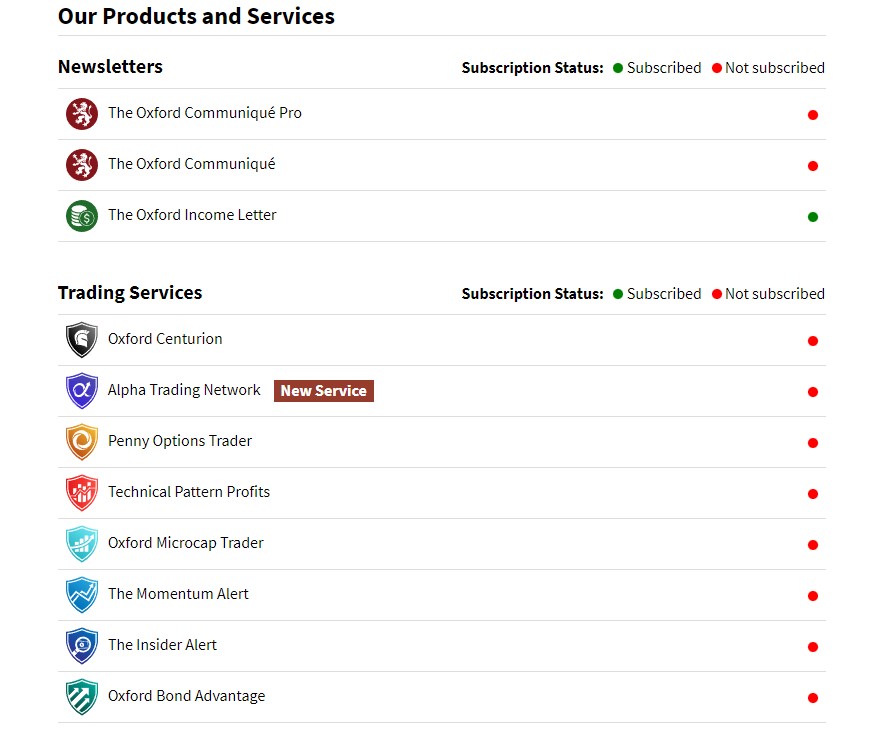

11) Let's Talk About The Upsells

I mentioned earlier that the downside of an Agora product is the upsells.

And Agora has A LOT of them.

For example, when you're in the membership area of The Oxford Income Letter you see this pop up:

This brings you to a stock presentation talking about the Russian/Ukraine war and how this effects natural gas exports in America.

The idea is America will fill the gap in natural gas exports to Europe because Russia is no longer supplying them.

This presentation promises to give you stocks to capitalize on this.. if you buy Oxford's other newsletter The Oxford Communique (I did a whole write up of this presentation and reveal the stocks here if you're interested).

Overall there's 10 upsells and most of them cost thousands of dollars:

For example, Oxford Microcap Trader costs $10,000 to join!

A good rule of thumb is never spend more than 1% to 2% of what you're investing on research.

Otherwise you'll end up paying more in research than what you're profiting.

So in order for a newsletter like Microcap Trader to be worth it you'd need $500,000 to $1 million to invest.

And to be completely honest none of these expensive upsells will perform as good as Oxford Income Letter.

Beating the market is very hard and very few stock picking services can do it.

The fact Oxford Income Letter can is impressive and I doubt any of these other services will be able to.

Recommended: The Best Place To Get Stock Picks

12) The Oxford Income Letter Is Very Affordable

One thing to really like about The Oxford Income Letter is it's very affordable.

You can find this newsletter for as low as $49 for the first year and then $79 for every year after.

To get market beating stock ideas for so little is an excellent deal.

However, please keep in mind you're entering a very sophisticated sales funnel and this service is meant to get you into the sales funnel.

Once you're in you'll be getting marketed very expensive products, which I showed you in the last section.

13) There's A Very Good Refund (With A Catch)

This newsletter comes with a good good refund policy and you get 365 days to get your money back.

However, keep in mind this product only costs $49.

The catch is Oxford Club only gives a money back refund to their cheap products.

Let's say you fall for one of the upsells that costs thousands of dollars per year.

Those don't come with a money back guarantee.

Those just come with a credit refund - this means you can only use the money to buy other Oxford products.

Just another thing to consider when Oxford pitches you one of their expensive upsells.

14) Here's Some Similar Newsletters

There's a bunch of newsletters that are pretty similar to The Dividend Hunter.

Some include:

- Behind The Markets

- The Distortion Report

- The Dividend Hunter

- Palm Beach Letter

- Stansberry Investment Advisory

- Strategic Intelligence

- Green Zone Fortunes

- Innovation Investor

- Stock Advisor

- Hidden Alpha

- Energy Investor

- The Near Future Report

And plenty of more - there's no shortage of investing newsletters!

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

The Oxford Income Letter FAQ's

Still have questions about this newsletter?

Here's answers to any remaining questions you might have:

1) What Is The Investing Strategy?

The Oxford Income Letter's investing strategy is very smart and one of the best there is.

It focuses on income generating assets in the form of dividend stocks and bonds.

This is a smart investing strategy because you grow your portfolio with the dividend payments you receive.

You do this so when you retire or later on in life you'll get thousands of dollars per month in dividend payments.

2) Is Marc Lichtenfeld Legit?

Yes!

He doesn't have the typical stock picking resume, though.

Marc didn't work for decades on Wall Street or anything like that.

Based on his Linkedin it actually looks like Marc spent little time in a professional investing setting.

Instead he worked for various investing publications while also being a boxing ringside announcer.

Marc is very knowledgeable, though, and wrote a popular book on dividend investing.

3) What Kind Of Results Can I Expect?

Most investing newsletters make insane promises about the returns they can generate.

I've seen people claim they'll get you over 400,000% returns on a single stock.

The industry is completely out of control (which is why I write reviews like this - so people can see what they're actually getting).

Since 2020 this newsletter has gotten 31% returns on new recommendations which beats the market by 11% over the same time period.

There's many triple digit returns in that time and most stock picks are up.

In 2022 the market was down a whopping 19%.

I'd say most of Marc's 2022 recommendations were down but not 19%.

The loses were much smaller.

So I think you can expect to beat the market with The Oxford Income Letter which is what you should be looking for.

4) Do You Recommend The Oxford Income Letter?

Yes I do but there's a caveat to this recommendation,

Don't buy the upsells.

I've said this a few times already and I'm just going to say it one more time.

The Oxford Income Letter is the best newsletter Oxford Club offers.

And the other services are wildly expensive.

So just stick with this newsletter.

The Oxford Income Letter Pros And Cons

The Oxford Income Letter Conclusion

So that's the end of my review of The Oxford Income Letter.

I really hope all your questions have been answered.

At the end of the day you only have to ask yourself one question:

Would investing in a stock picker's recommendations beat the market?

Investing in a market index is very simple and pretty much guarantees 10% annual returns over time.

So an investing newsletter would have to beat 10% a year for it to be worth it.

The Oxford Income Letter manages to do that.

Sure there's a lot of baggage with this newsletter and I've made that clear.

I don't like the company that owns this newsletter and I don't think any of the pricey upsells are worth it.

But this is a good newsletter that uses a rock solid investing strategy (focus on income generating stocks and reinvesting dividends back into the portfolio).

This won't make you rich but it'll help you pay your bills when you retire.

When done right and done early enough you can generate a full time income by the time you retire.

That'll make your life much easier.

Here's A Better Opportunity

The Oxford Income Letter is a good newsletter.

But there's newsletters that perform as well and don't have all the baggage.

I've personally reviewed over 100+ stock picking services..

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below: