Fry Investment Report is a stock picking service from Eric Fry.

He claims he can get your returns as high as 1000%.

Is this true or a scam?

We'll get to the bottom of this in this review.

Additionally, we'll look into any red flags I find and look at Eric's ability to pick stocks.

You'll know if Fry Investment Report is worth it by the time you're done reading.

Let's get started!

Fry Investment Report Summary

Creator: Eric Fry

Price to join: $49

Do I recommend? Not really

Overall rating: 3/5

It's a new year, and I've just finished updating this review for 2024.

Eric Fry's Fry Investment Report isn't the worst investing newsletter, and there are some things to like.

He's played AI decently well but overall his picks still trail the market.

Also, there's a lot of baggage with this newsletter.

The price is cheap because this is all just one big sales funnel.

Once you buy, you'll be heavily pressured into buying more expensive services that cost thousands of dollars a year.

It's really a headache to deal with.

My advice is that if you do buy this newsletter, ignore all the upsells because this is the best service Fry sells.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Video Review

4 Things To Know About Fry Investment Report

Before we get into what Fry Investment Report is offering, let's take a look at some background information.

Here's what I think is most important about this newsletter.

1) Fry Doesn't Beat The Market

There are a lot of ways to judge an investing newsletter, but it really just comes down to one thing:

Can they beat the market?

The reason I say this is because investing in a market ETF is very easy and simple.

And if a newsletter can't beat that, then it's essentially worthless because managing a stock portfolio can be stressful.

Unfortunately for Eric Fry, he doesn't beat the market.

He still does relatively better than most stock pickers because the stock picking industry is horrible.

But at the end of the day, you'll make more and get better gains (and have less stress) just by putting your money into a market ETF.

2) Home Of The Scammer Louis Navellier

Fry Investment Report can be found over at InvestorPlace, which is the home of Louis Navellier.

Louis Navellier is the main face of InvestorPlace, and this is a giant red flag.

A couple years ago, Louis was fined $30 million for defrauding investors about a trading tool.

Any respectable investing publisher would get rid of a guy like this.

But InvestorPlace has done the opposite.

They've created more newsletters with him and sell him more than ever.

Expect to get these products marketed to you if you buy the Fry Investment Report.

3) Expect Aggressive Upsells

The reason it matters that Louis is at InvestorPlace is you'll be promoted his products if you buy Fry Investment Report.

In fact, you'll be heavily promoted products that cost thousands of dollars from Louis and people just as unethical as Louis.

You see, InvestorPlace isn't an independent publisher and is owned by a massive company called Marketwise.

Marketwise is a publicly traded company that owns other popular investing publishers like Stansberry, Brownstone, Palm Beach Group, Rogue Economics, etc.

Marketwise made $100 million in revenue in the second quarter alone and will be close to $500 million in revenue for 2022.

They don't earn this much selling $49 subscriptions, which is what Fry Investment costs.

Marketwise uses cheap newsletters as bait.

Once you're in the sales funnel, you'll be bombarded with additional services that cost thousands of dollars.

Some will come from Louis Navellier, and others will come from people like Teeka Tiwari, who runs Palm Beach Group.

Teeka is literally banned from Wall Street for being involved in so many scams as a broker.

So the question you need to ask yourself is this:

Is Fry Investment Report good enough to deal with the headache of becoming a Marketwise customer?

Do you really want your inbox flooded with fear mongering and manipulative upsells that cost thousands of dollars a year?

Do you want your money to go to a company that hires legit criminals?

4) Fry Investment Report Focuses On Future Trends

This service doesn't focus on one sector or market.

You can find stock ideas that range from gold plays, technology, 5G, self driving cars, etc.

Eric is looking for which companies are going to disrupt markets and which trends are going to take off.

For example, in one of his stock presentations talking about "America's most expensive zip codes," he talks about these disruptors.

He mentions digital payment processors like Paycom and digital streaming services like Netflix overtaking Blockbuster.

So the whole point of this newsletter is to find the next big moves and invest before their prices are too high.

Recommended: The Best Place To Get Stock Picks

Eric Fry's Stock Picking Performance

Every once in a while Eric will put out a stock presentation where he hypes up a company but withholds its name.

You buy the newsletter to get ticker symbol.

These are supposed to be his best stock picks.

Here's a look at how a few of these presentations have performed over the last couple of years.

Project Omega

Project Omega was a stock teaser Eric Fry launched in the spring of 2023, and this thing was MASSIVE.

It's by far the most viewed thing I've written about in 2023.

In this pitch, Fry promised to give you all the best AI stocks to make money with.

The picks were Google, Intel, Amazon, Stem, Sabre, and Ivanhoe Electric.

Since around May 1st, the market is up around 30%.

Some of the stocks Fry recommended in Project Omega are beating that.

However, when combined those stocks are up around 20% and are trailing the market.

Here's a look at how each stock has performed about 7 months later:

Alphabet

AI stocks have done well since the release of ChatGPT and the big dogs in the space have really benefited from this.

And Alphabet (Google) is definitely one of the big dogs.

It's up 33% since Fry recommended it.

Intel

Intel has done very well since Fry recommended it back in May 2023 and is up over 50% so far.

Intel plays an integral part in AI by providing the chips needed to power AI.

AI requires specialized AI chips, and the companies that supply them have benefited from the explosion of AI.

Amazon

Amazon has many ways to benefit from the AI craze.

Their main contribution to AI is with the cloud, various products, and generative AI.

Amazon offers AI and machine learning through Amazon Web Services.

These cloud services are Amazon SageMaker, Amazon Rekognition, Amazon Lex, and more.

In terms of products, Amazon is integrating AI into all of their main consumer products, like Alexa, Kindle, and Prime Video.

They are using AI for voice assistance, recommending products on their platforms, and more.

They're up around 50% in the last 7 months.

Stem

The first three stock picks from Project Omega were safe AI picks and were in a report called "The Top 3 Stocks For The AI Revolution."

The last three stocks were in a report called "AI Moonshots."

These companies are smaller and more risky, but they offer a chance at higher returns.

The first of these stocks was Stem.

Stem is a clean energy company that provides AI-driven solutions and services.

Their main product involves energy storage on the grid.

Basically, it moves energy around the grid more optimally.

However, there hasn't been any gains for this stock yet.

Sabre

Sabre is in the travel industry, and they provide software and technology solutions for the global travel industry.

They work with airlines, agencies, and other travel partners.

The stock is up around 12%, which isn't horrible but trails the market by a lot.

As I'm writing this, the market is up around 30% since Project Omega launched.

Ivanhoe Electric

The last of the AI moonshots is Ivanhoe Electric.

This company uses AI to explore and develop metal projects in the US.

This includes finding copper, gold, silver, nickel, cobalt, and vanadium.

However, the stock is down about 20% since being recommended.

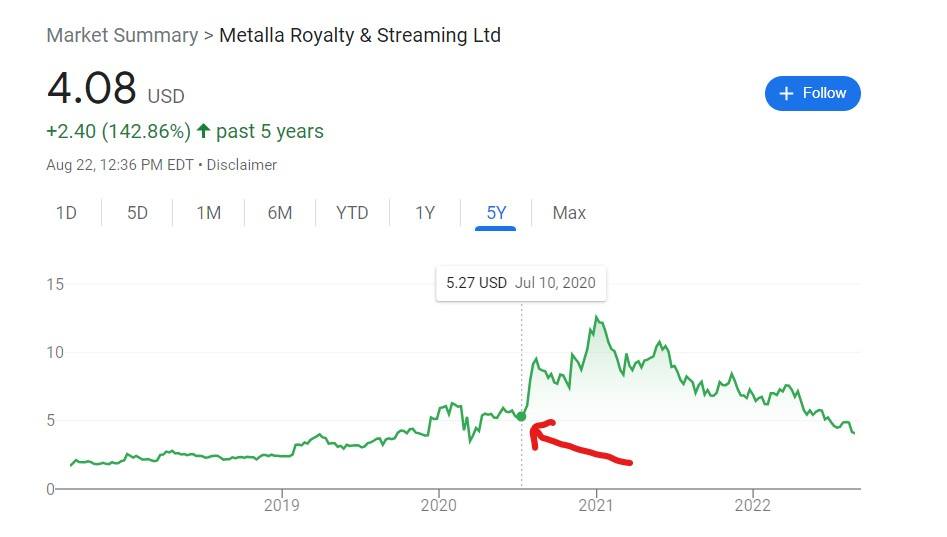

Metalla Royalty And Streaming In July 2020

Back in the summer of 2020 Eric pitched Metalla Royalty as "the #1 gold investment in America."

This company offers royalties, and here's how the stock has done over the last couple of years:

This is a smaller royalty company, and they can always be a bit volatile.

For a while, it did great and nearly tripled in price, but has come back down to reality since peaking in late 2020.

It's not a bad investment, though, because you're earning royalties.

Prosus, Ocado and Baidu In February 2020

This is the current teaser running for Fry Investment and what you'll see if you try to buy Fry Investment Report from InvestorPlace.

It's titled "secrets of the richest zip code" or "here in the richest zip code."

It's been running for years now.

The three stocks being promoted are Prosus, Ocado, and Baidu.

Here's a look at how each stock has performed, starting with Prosus:

Prosus is a global venture capital fund that focuses on food delivery and fintech.

The stock was up a decent amount in early 2021 and since lost about 50%.

Overall it's down a little.

Next up we have Ocado:

Ocado is a warehouse robotics company, and they have their own technology for food delivery in the UK.

They have deals with US grocery chains like Kroger as well.

The stock more than doubled for a while before losing about 30% overall.

There was plenty of time to sell and double your money, though.

Lastly, we have Baidu:

Baidu is China's version of Google, and the stock has been pretty consistent for a while.

There was a brief period where it tripled in price, but as of now, it's break even.

Sprott In February 2021

Sprott is an asset manager that specializes in natural resources.

Eric promoted them as a gold and silver speculator play for his other newsletter, The Speculator.

This company pays a dividend, and this is how the stock has performed:

The stock has been up and down but it's up overall.

Recommended: The Best Place To Get Stock Picks

Fry Investment Report Overview

Fry Investment Report is a pretty typical investing newsletter and is similar to the other newsletters sold by Marketwise.

Here's a breakdown of everything that you get:

Monthly Issues Of Fry Investment Report

This is the main part of the offer and basically what you're paying an annual fee for.

Every month, you'll get a new copy of the Fry Investment Report, and in these copies, you'll get new investment ideas.

You'll also get commentary on the open positions recommended by Eric.

Model Portfolio

This is the other main aspect that you're paying for.

Once you sign up, you'll get access to all the open positions in Eric's portfolio.

Special Reports

These special reports act as sweeteners.

The stocks we looked at earlier came from these special reports.

These are always changing, but as of now, the reports are:

- The Portfolio Purge

- The 1000% Portfolio

- The 3000% Technology Revolution

By the time you read this review, these reports might be different, though.

Additionally, you get access to all the previous special reports Eric has released.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Fry Investment Report FAQ's

Still have some questions about this newsletter?

Here are the answers to any remaining questions you might have:

1) How Much Does Fry Investment Report Cost?

This newsletter costs $49 per year.

Basically, all bait newsletters cost this much.

At the end of the day, this newsletter is priced this way to get you into the sales funnel.

The real money is targeting people who have already bought something cheap with more expensive newsletters.

So if you do buy, be mindful; you're going to get pummeled with upsells.

2) Is There A Refund Policy?

Yes, you get 30 days to get your money back.

This isn't enough time to see if the stock picks are bad, but you should be able to see if you like the service or not.

Another thing to keep in mind is that expensive upsells DON'T come with money-back guarantees, just credit refunds.

3) Is Eric Fry Legit?

There's a limit to how legit a person working at InvestorPlace can be, in my opinion.

They have questionable marketing techniques, and the main face is Louis Navellier.

However, Eric seems to pick pretty good stock picks which is the only thing that really matters.

The customer reviews seem solid as well.

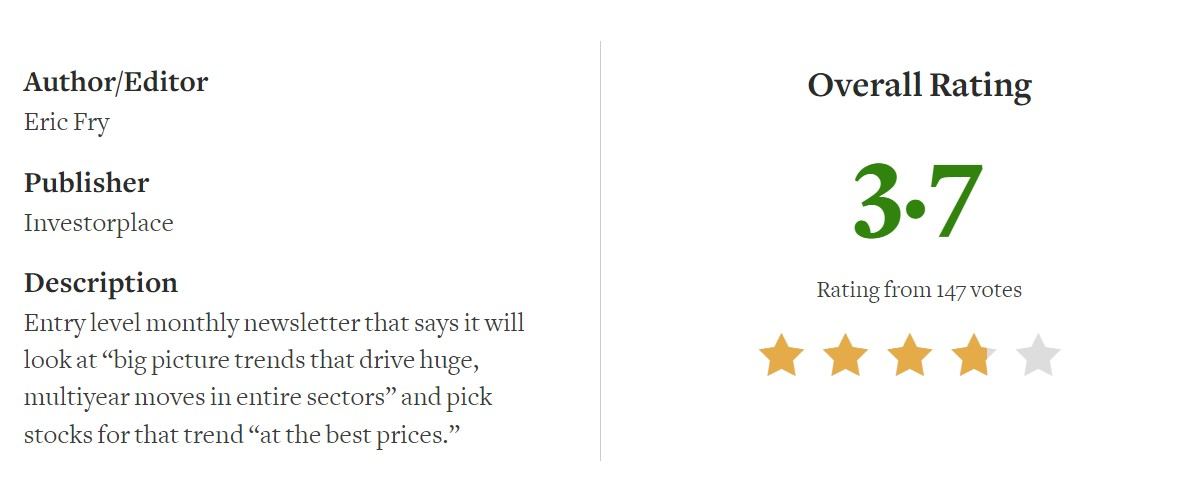

Over on Stock Gumshoe over 140 people have voted on the quality of this newsletter, and it gets a 3.7/5.

This is a pretty good overall score and probably slightly above average.

4) How Much Do I Need To Invest?

There's around 25 stocks in the portfolio, and if you wanted to invest in all of them, you'd probably need around $25,000.

However, I'm sure you're not going to want to invest in every stock in the portfolio.

I think a good number is $10,000 minimum, with more to spend monthly on the new picks.

That should be enough to get you going.

5) Who Is This Newsletter For And Not For?

This is considered a conversative stock picking service.

So you're going to be targeting sectors and stocks that are on the safe side.

If you're looking for speculative, high growth stocks, this probably isn't for you.

This is for people who want to build a safe portfolio and are patient.

6) Are There Similar Newsletter?

Yes, there are plenty of newsletters that are very similar.

Some include:

- Stansberry Investment Advisory

- True Wealth

- Near Future Report

- Innovation Investor

- The Distortion Report

- The George Gilder Report

- Safe Money Report

And many, many more.

Recommended: The Best Place To Get Stock Picks

Fry Investment Report Pros And Cons

Fry Investment Report Conclusion

I would sum up Fry Investment Report as the following:

A decent investing newsletter that does absolutely nothing to separate its self from the hundreds of other investing newsletter that are out there.

I mean the price, the marketing techniques, the investing style, the language used, the tone - it just copies what's already out there.

If it were an independent newsletter I'd probably say it's fine to buy if you can sift through the market beating stocks in the portfolio from the non market beating stocks.

But it comes with a ton of baggage.

Once you buy you're thrown into a very intricate sales funnel - the goal is to suck as much money from you as possible.

It's annoying to deal with to be honest.

If you decide to buy just use a burner email account so you don't have to see the email promotions every day.

Here's A Better Opportunity

Fry Investment Report isn't the worst newsletter.

The good news is that there are still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

I paid on line middle of aug. , why I do not have my report?

Cannot read emails. They come back as computer code? There is NO opportunity invest directly into a company. Its private.