Retirement Millionaire is a long running newsletter headed by David Eifrig.

David claims he can get you "stellar" returns.

Is this true or another investing scam?

We will get to the bottom of this question in this review.

Additionally, we'll investigate any red flags I find and take a look at how this newsletter has performed over the years.

You'll know if Retirement Millionaire is right for you by the time you're done reading.

Let's get into it!

Retirement Millionaire Summary

Creator: David Eifrig

Price to join: $49 to $79 for first year, $199 per year after

Do I recommend? Yes

Overall rating: 3.5/5

Overall Retirement Millionaire is a decent investing service.

It's been around for a while and has pretty good customer reviews.

The main issue is it's a part of a much larger scheme that exists to get you to spend a lot of money on upsells.

Plus some of the stock picks I looked at bombed pretty hard.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Understanding What You're Getting Into

I review investing services for a living and try to find ones that are worth recommending.

I've written hundreds of reviews and created another 100 videos on this topic.

I understand this industry better than 99.9% of people out there.

Think of me as your guide.

As a trusted guide it's important for me to warn you what you're getting yourself into if you decide to buy this newsletter.

Retirement Millionaire is sold by Stansberry Research which owned by a much larger company called Marketwise.

Marketwise is very big and is actually a publicly traded company.

They make over $500 million in revenue every year and own many popular publishers.

Here's everything you need to know when dealing with a Marketwise product:

Upsells, Upsells And Upsells

Do you think Marketwise is making $500 million in revenue every year by selling $49 subscriptions.

Of course not.

The $49 product is just the bait that gets you into their sales funnel.

Once your credit card details are entered into their system Marketwise will look to milk you of every penny.

You'll be getting promotions every single day for products that cost thousands of dollars.

Additionally, a lot the marketing is over hyped and unethical in my opinion.

You'll get sophisticated ads promising massive returns if you pay thousands of dollars.

The thing is the cheaper products are usually the best at Marketwise.

The reason is their investing styles are typically boring but perform well.

The products that cost thousands almost always focus on these weird strategies that end up losing.

So if you buy Retirement Millionaire just stick with that newsletter and don't fall for the upsells.

Loads Of Unsavory Characters

The newsletter investing industry attracts a lot of unsavory characters.

It's not really regulated and it takes a certain personality to do the kind of marketing these guys do - a personality with very flexible morals.

You'll find a lot of these guys at Marketwise and once you buy Retirement Millionaire you'll be recommended their products.

For example, Teeka Tiwari is under the Marketwise umbrella.

He lead such an unethical life he can never work on Wall street again - he's permanently banned from working at any company that manages people's money.

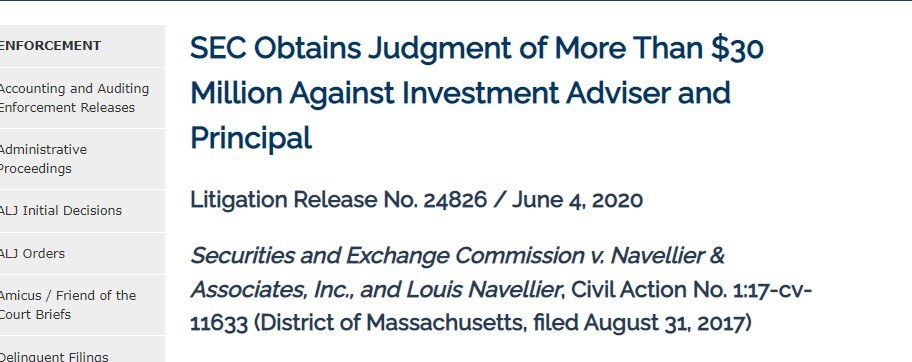

Another guy at Marketwise is Louis Navellier.

Louis is a life long grifter who had to pay $30 million for defrauding investors:

Louis mislead investors about the details of a stock to get them to buy.

A sane and moral company wouldn't let this guy within 100 feet of their business.

They are selling stock picks after all.

But Marketwise will tell you Louis is a trusted advisor that you should pay thousands to for advice.

Again, just avoid the upsells and don't fall for the marketing.

Recommended: The Best Place To Get Stock Picks

Retirement Millionaire Stock Performance

David Eifrig promotes his newsletter by doing stock presentations.

Basically he hypes up an investing opportunity in a free presentation and only reveals the stock if you buy Retirement Millionaire.

Typically these are supposed to be his best and most researched picks.

We can look back on these presentations to see how well this newsletter has done over the years.

Five Healthcare Stocks In May 2021

Back in spring of 2021 David ran a stock teaser presentation hyping up his favorite healthcare stocks.

They are Thermo Fisher Scientific, Precision BioSciences, AbCellera, CVS Health and Bausch Health.

Let's start with Thermo Fischer Scientific which David called his "#1 biotech stock:"

This stock has done pretty well in the last 17 months.

Especially when you consider the state the stock market is in right now.

Most people are probably just happy to be up anything on stocks they bought in 2021.

Next up we have Precision BioSciences:

This stock pick was a risky one and David recommended it because of their deal with Eli Lilly.

The deal was based around "gene editing."

The stock has absolutely TANKED, though.

It's down over 80%.

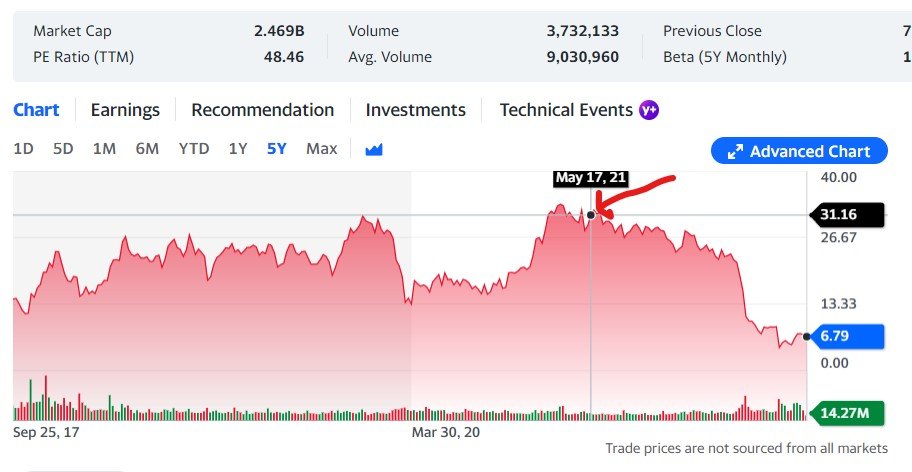

Next up we have AbCellera:

This is a company that was earning royalties based on their AI technology.

This technology identified drugs based on antibodies for Covid and other diseases.

Since covid mania has died down the stock has taken a severe beating dropping from $31 when recommended to $9 now.

After that we have CVS Health:

Everyone probably knows what CVS is and has gone into one of their stores in the last year.. either to buy some snacks or pick up their prescriptions.

This stock has done well if you account for the volatility of stocks lately.

Lastly we have Bausch Health:

This is another stinker.

The stock was recommended at $31 and is now between $6 to $7.

Overall this stock presentation has definitely lost people money because the gains were small and the loses were HUGE.

Microsoft In March 2017

Back in 2017 David made the pitch for Microsoft as a "block chain investment."

Blockchain is a small part of what Microsoft does but they are investing money into the development of blockchain.

Microsoft has done very well since being recommended.

It's not really because of blockchain but regardless it was up over 6X at one point.

Even after the fall in price it's still way up.

NXP Semiconductor And Broadcom In February 2015

In 2015 David recommended two chip makers as his top "NFC" stock picks.

NFC stands for near field communication and are devices that help with contact-less payments.

For example, Apple pay allows you to swipe your phone to pay for something at the store and these two companies help make chips for Apple iPhone.

Here's how NXP Semiconductor has done over the years:

This stock took a little while to get going but anyone that was patient and held has doubled their money.

Next up we have Broadcom:

This stock has done extremely well.

Over the years it's 4X'd.

Definitely a stock I wish I invested in!

Recommended: The Best Place To Get Stock Picks

What Is Retirement Millionaire Offering?

Retirement Millionaire works the same way pretty much all Stansberry products work (and Marketwise products).

Here's an overview of everything you get:

Monthly Issues Of Retirement Millionaire

This is the main part of the offer and what you're essentially paying for.

Every month you'll get a new copy of Retirement Millionaire.

In each edition you can expect to find market news, updates about open positions and new investment ideas.

Model Portfolio

This is the other part of the main offer.

Once you sign up you'll get access to the entire portfolio at Retirement Millionaire.

Each stock will come with a ticker and information on the company.

At any time there's between 20 to 25 stocks.

Special Reports

You also get a ton of special reports and the more you pay the more reports you get.

These reports are like the stock presentations we looked at in the last section.

They focus on a single stock or market and give you investment ideas.

They're constantly changing as well.

Subscription To Stansberry Innovations Report

This is a standalone subscription that is sold at Stansberry and it's included if you pay the $79 first year fee.

This is a conservative investment newsletter that goes out once a month.

There's 20 stocks in this model portfolio and you're expected to hold the stocks for 3 to 5 years.

Want The Best Stock Picks?

I've reviewed the best programs that do this.. to see my top pick, click below:

Retirement Millionaire FAQ's

Still have some questions about Retirement Millionaire?

Here's answers to any questions you still might have:

1) How Much Does This Newsletter Cost?

There's a few different price points for this newsletter and two options for the first year.

You can either pay $49 or $79 for the first year.

The $49 per year offer comes with the subscription and some special reports.

$79 comes with even more special reports and a subscription to Stansberry Innovations Report.

After the first year the cost goes up to $199 per year.

This is standard for an introductory newsletter and exactly what you'd expect to pay.

Just remember it's so cheap because they want you in the sales funnel.

Retirement Millionaire is one of the best newsletters Stansberry offers - it's honestly probably the best.

So there's no need to upgrade or buy any of the other upsells.

2) Is There A Refund Policy?

Yes, there's 30 days to get your money back.

This is enough time to look at the stock picks and see if you like the investing style.

BUT something you must understand is the more expensive products at Stansberry and all Marketwise publishers typically don't come with a money back guarantee.

So if you fall for one of the upsells you typically won't have an opportunity to get your money back.

3) Is David Eifrig Legit?

Yes, I believe so.

There's many reasons I believe this and none of it has to do with his resume or anything like that.

Firstly, this newsletter has been around for a while - this is a good sign.

Bad stock pickers are constantly being moved to different publishers and relaunching/rebranding their services.

The fact David hasn't done that is a good sign.

Secondly, he has some good stock picks from what I've seen.

The health care presentation was a bust but the other ones produced some big winners.

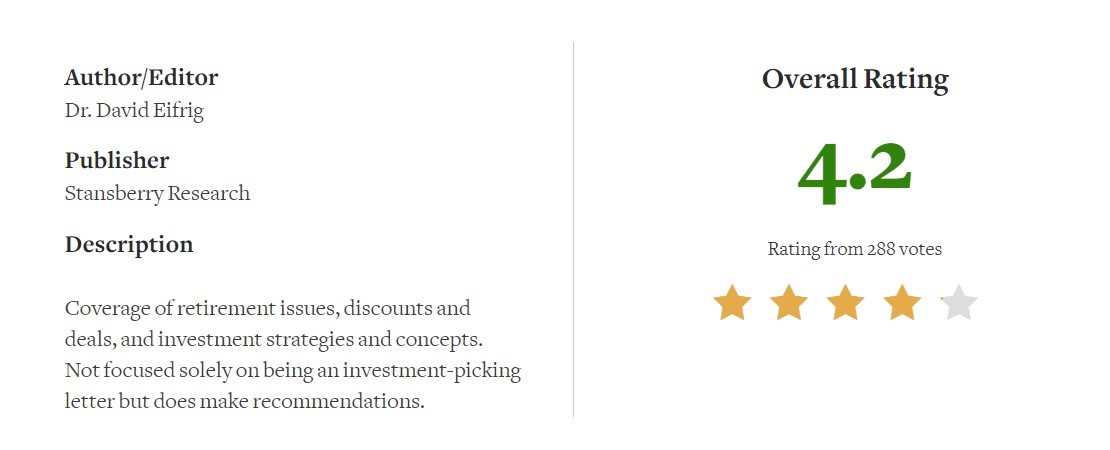

Lastly, the customer reviews are solid for Retirement Millionaire.

Stock Gumshoe is the best place to find customer insights about stock picking services.

Nearly 300 customer have rated this newsletter and it gets a 4.2/5:

This is a high score and shows customers really like what they're getting.

Of course there's some bad reviews but every service will have some bad reviews.

4) Are There Similar Newsletters

Yes, there's many Marketwise newsletters out there.

Here's a few I've reviewed in the past:

- The Distortion Report

- Rogue Economics

- Near Future Report

- Empire Financial Research

- Stansberry Investment Advisory

- Jeff Clark Trader

- The Opportunistic Trader

- The McCall Report

- Innovation Investor

- Crypto Investor Network

And more. As you can see there's no shortage of similar services.

Recommended: The Best Place To Get Stock Picks

Retirement Millionaire Pros And Cons

Retirement Millionaire Conclusion

I'm on the fence about recommending Retirement Millionaire.

On one hand it's affordable, been around for a while and has good customer reviews.

On the other hand it's owned by Marketwise and there's some really big stinkers in the past.

You never want to see stock recommendations lose 90% of their value.

If you do decide to buy this newsletter just don't fall for the upsells.

They're going to try every trick in the book to get you to spend thousands - don't.

This is one of the best newsletters in the entire Marketwise empire.

No matter what gains or returns they promise the other services being promoted to you will likely not do as well.

Here's A Better Opportunity

I think Retirement Millionaire is a pretty good investing newsletter and I'm not going to talk you out of getting it.

However, there's still better newsletters.

To see my favorite newsletter (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

This looks confusing but promising — sort of like the fog of War.