Chaikin Analytics is an investment publisher from Marc Chaikin.

He has a few different offers and if you're here you're probably wondering if they're scams or not.

This review will answer that.

Below you'll find an overview of what's being offering, an examination of results and any red flags that I can find.

You'll know if Chaikin Analytics is right for you by the time you're done reading.

Let's get into it!

Chaikin Analytics Summary

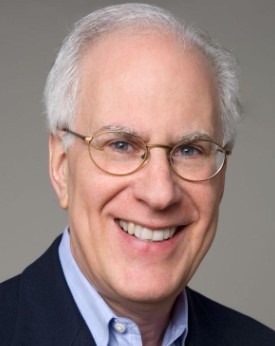

Creator: Marc Chaikin

Price to join: Depends on product (up to several thousands

Do I recommend? No.

Overall rating: 2.5/5

Marc Chaikin is deserving of respect.

He's had a long career on Wall Street and has some pretty big accomplishments.

His tools are used by some bigwigs and Marc has been a pioneer when it comes to analytics.

However, many of his services are overpriced and cost thousands of dollars per year.

His introductory newsletter is performing poorly since launching a little over a year ago and Marc makes his recommendations based on his tools.

So if he can't use his tools to find winners I have a hard time believing you will.

There's other red flags and baggage that come with buying from Chaikin.

When you add up everything I don't think you should buy.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

8 Things To Know About Chaikin Analytics

There's things you need to know about Chaikin Analytics and its founder Marc Chaikin before buying.

Here's everything you need to consider about Chaikin Analytics:

1) Another MarketWise Product (Not Good!)

The first thing you need to know about Chaikin Analytics and The Power Gauge Report is this is not an independent company.

Chaikin is owned by a much larger company called Marketwise that's a publicly traded company.

Marketwise owns popular publishers like Stansberry, Rogue Economics, Palm Beach Research Group, Brownstone, etc.

It is not a good thing that Chaikin is owned by Marketwise.

Here's a few reasons why:

Big, Manipulative Upsells

One thing you're going to have to deal with when buying from Chaikin and Marketwise is constant upsells.

I don't mean every once in a while they send you an email to upgrade.. it's multiple times a day.

It's so annoying that your email almost becomes useless because it's flooded with promotional offers.

These upsells will cost thousands of dollars and will be marketed to you in very manipulative ways.

You'll get stock presentations promising you the moon which are often times highly risky and speculative investments.

They'll try to scare you into thinking society is going to collapse and the only way to stay safe is by upgrading.

Marketwise Makes $100+ Million PER Quarter

Another reason you want to avoid a Marketwise publisher is because they treat customers more like targets than customers.

Since Marketwise is a public company you can look at their revenue and how much they make.

In the second quarter of 2022 they made $128 million in revenue.

Do you think they make this amount of money selling $49 subscriptions?

Of course not.

They make the majority of their revenue through upsells.

That's why they market to customers so heavily. The real money is in the products that costs thousands per year and the only people buying those services are the ones who bought the cheap ones first.

Promotes Products From Scammers

Another thing you need to understand is you're not just going to get promoted products from Chaikin if you buy The Power Gauge Report..

You'll be promoted ALL of the services under the Marketwise umbrella.

This includes products from really seedy characters.

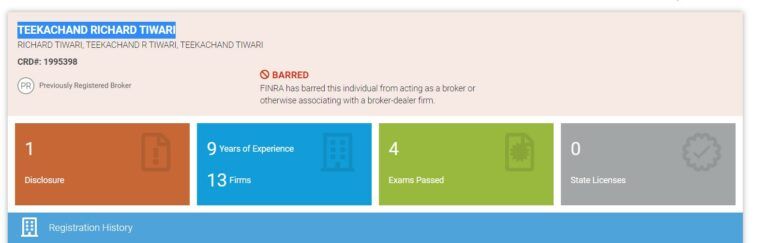

For example, Teeka Tiwari runs Palm Beach Research Group which is owned by Marketwise.

Teeka is a life long scammer that's worked for some of the worst brokerages imaginable.

He spent years swindling money from people and is now PERMANENTLY banned from Wall Street:

So Teeka can never again buy and sell securities for customers and can't work at any company that does this in any capacity.

Marketwise markets Teeka like a trusted expert and will send promotions for his products that cost thousands of dollars a year.

He's not the only bad character either.

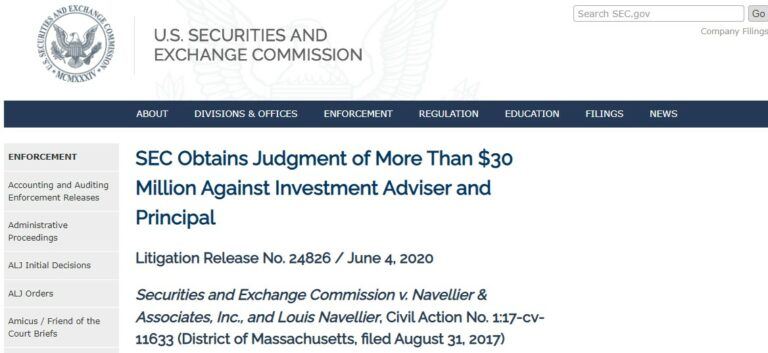

Louis Navellier runs InvestorPlace which is owned by Agora.

Louis was fined $30 MILLION for defrauding investors about a stock:

Yet Marketwise will tell you he's a beloved investor and that you should buy his services that cost thousands.

I guess the question you need to ask yourself is this:

Do I really want to give people like this my money and is Power Gauge Report worth the headache?

If you answered yes then I would at least sign up with a burner email account.

This way you won't ruin your regular email account.

Recommended: The Best Place To Get Stock Picks

2) Marc Chaikin Is Well Respected

It's actually a shame Marc has decided to be a part of Marketwise because there's a lot to like about him.

Here's what I think you should know about Marc:

A Long Career On Wall Street

There's a lot of people in the stock picking world that don't have much of a resume.

For example, one of the main guys at Marketwise is Matt McCall and he barely has any Wall Street experience.

He worked one year at Charles Schwab then immediately went into radio.

But Marc spent 40 years on Wall Street at legitimate brokers.

Most Known For His Tools

Marc is actually pretty well known in the investing world and is most known for is investing tools.

For example, in the early 80's Marc started to develop stock market indicators and economic indicators.

His products became the first real time analytics workstation for portfolio managers and traders.

Today they are a key part in Reuters institutional workstations.

Marc's indicators are heavily used on Wall Street today too.

Launched Chaikin Analytics In 2011

The last thing you should know about Marc is he launched Chaikin in 2011 for retail investors.

Basically he's giving individual investors access to the tools money managers have been using for years.

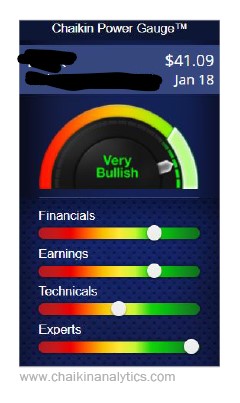

His tools give you a rating based on 20 different factors.

A stock can be very bullish, bullish, neutral, bearish and very bearish.

This will help you determine if a stock is worth investing in.

3) Here's How The Analytics Work

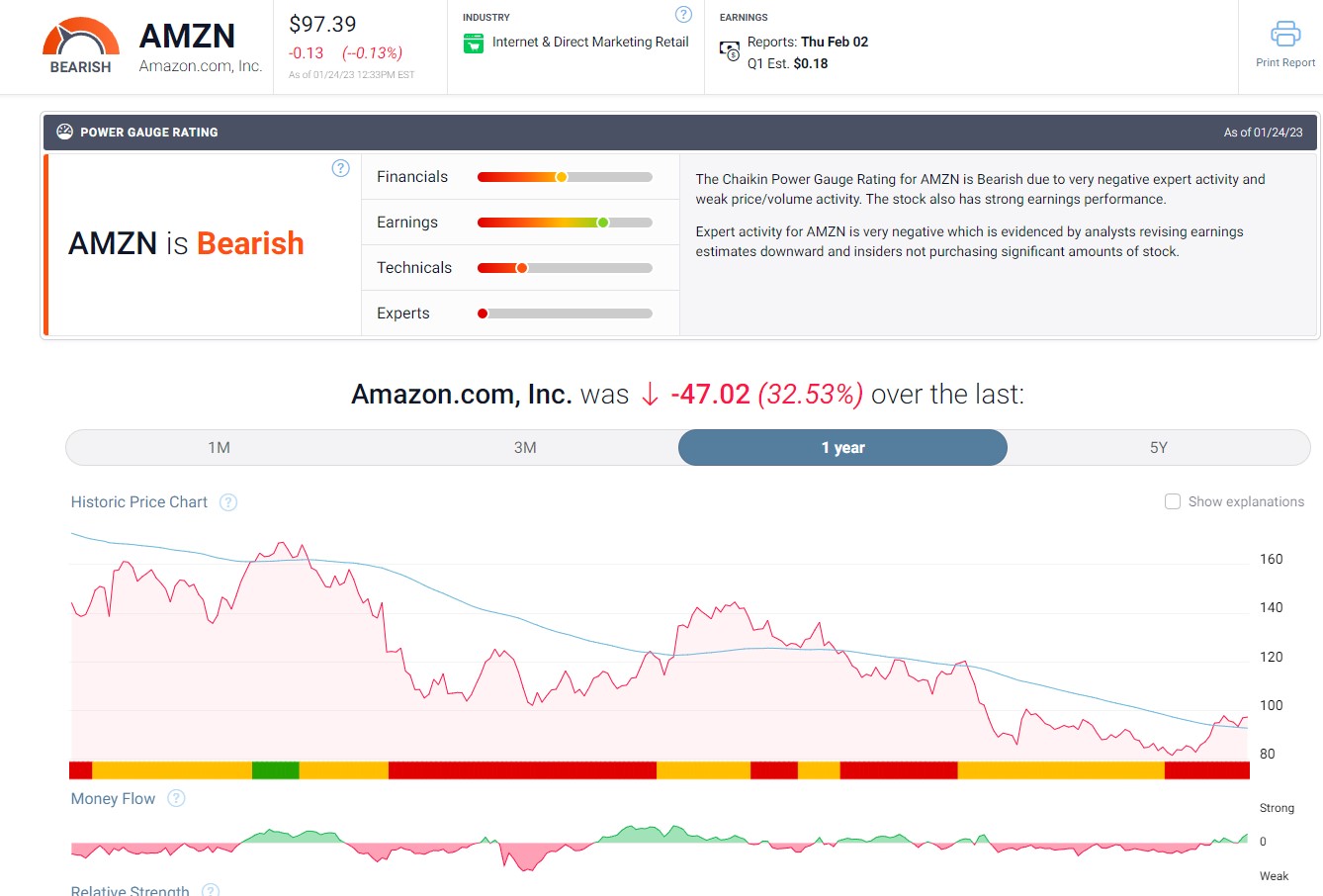

Chaikin Analytes revolves around its stock screener called the Power Gauge Rating.

The Power Gauge is a ranking system for over 5000 stocks.

There's 5 categories a stock can be in:

- Very Bearish

- Bearish

- Bullish

- Very Bullish

- Neutral

There's 5 colors for each category and red indicates bearish and green indicates bullish.

The Power Gauge uses 4 different metrics to rank a stock.

They are:

- Financials - Long term debt to equity, price to book, return on equity, price to sales, free cash flow.

- Earning - Earnings growth, earning surprise, earnings trend, projected p/e, earnings consistency.

- Technicals - Rel strength vs. market, Chaikin Money Flow, price strength, price trend ROC, Volume trend.

- Experts - Estimate trend, short interest, insider activity, analyst rating trend, industry rel strength.

Additionally, there's the Chaikin Money Flow.

This tool measures money flow volume over 21 days. As a result this tool will indicate if a stock is bullish (green) or bearish (red).

This is done by looking at closing performance and volume confirmation.

An example of a good stock according to Chaikin Money Flow is below:

I'm always a bit weary of people who pick stocks based on charting like this.

4) The Power Gauge Report Is The Introductory Newsletter

Every MarketWise publisher has a cheap newsletter they use to get people into the sales funnel.

For Chaikin Analytics this newsletter is the Power Gauge Report.

I did an entire in depth review of this newsletter that you can find here.

Here's an overview of everything you get:

- Power Gauge Report - This is a monthly report where you will get a stock pick about a mid or large cap stop from Marc. You'll also receive a portfolio of the top 5 stocks to buy.

- Special Updates - Anytime there's an update to a stock pick you'll get an email alert. This includes when to lock in gain and when to add or close a position.

- 1 Year Power Pulse System - This tool allows you to punch in a stock to see if it's bullish, bearish or neutral.

- 1 Year Of Marc's Warnings And Predictions - These are warnings and predictions about the market.

- 4 Power Picks For Retirement - These are 4 stock picks Marc believes you should buy and hold forever.

- Research Report - This report will teach you when the perfect time buy a stock is and what to look for when picking a stock.

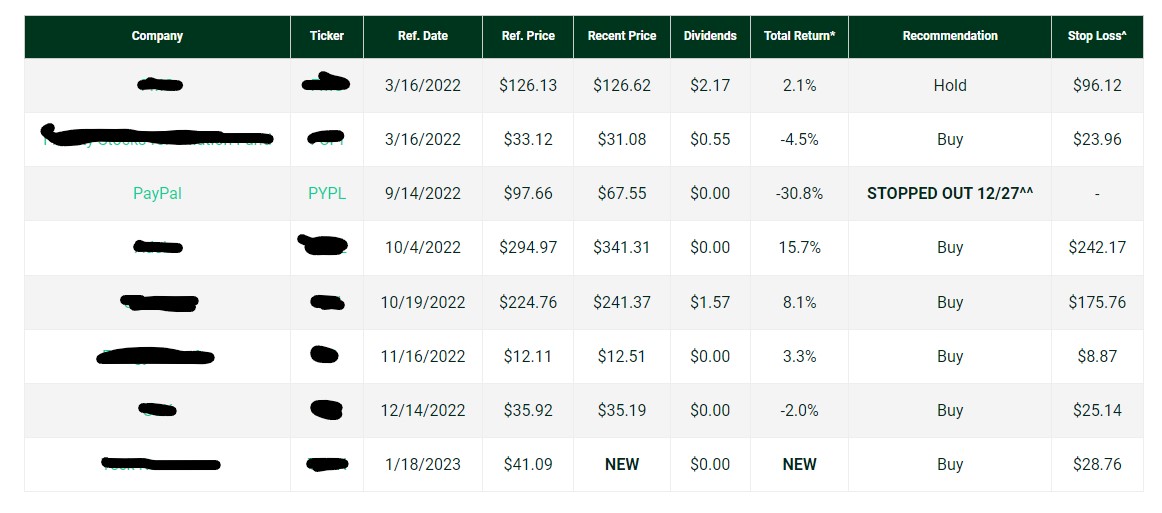

This newsletter launched back in October 2021 and it's had a rough start.

Marc automatically recommends selling a stock if it loses 30% of its value after he recommends it.

In a little over a year he's already had 5 stocks hit a 30% loss.

Additionally, he recommended selling the following stocks for a loss:

- Philipps 66 for a 18% loss

- Nasdaq for a 12% loss

The portfolio only has 7 stocks in it at the moment and one of the stocks Chaikin recommends holding and not buying:

There's two stocks that are losing in the portfolio at the moment as well.

The Power Gauge Report uses the Chaikin Analytic tools to recommend stocks.

For example here's a look at the rating system used in the latest stock recommendation sent out this month:

So if Marc Chaikin can't use his tools to beat the market what chance do you have?

It's something to consider.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

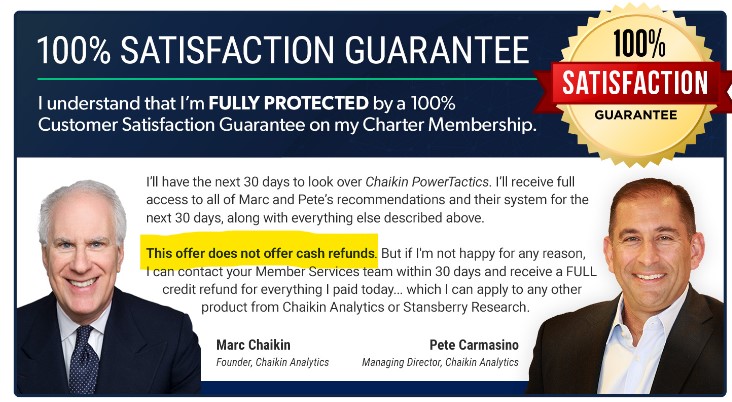

5) Chaikin PowerTactics Is The Expensive Upsell

There's always going to be very expensive upsells when you're dealing with MarketWise.

And Chaikin PowerTactics is one of the premium upgrades they off at Chaikin Analytics.

There's two rules you need to consider before you buy this newsletter:

- If Power Gauge Report isn't making money it's not likely this newsletter is.

- Never spend more than 1% to 2% of your portfolio on research (you risk cutting into your gains too much if you do).

Chaikin PowerTactics is $2500, so following the 1% to 2% rule you need $125,000 minimum to invest for this to be worth it.

With this newsletter you get:

- Monthly newsletter with new stock recommendations

- Updates to the portfolio

- Video updates

- The Power Gauge System (rates stocks)

- Discovery Engine (find similar stocks to ones you type in)

- Special Reports

This newsletter is run by both Marc Chaikin and Pete Carmasino.

It just launched so there's no information on how it's performed.

But I'd be willing to bet it's not better than Power Gauge Report and if it is it's just marginally better.

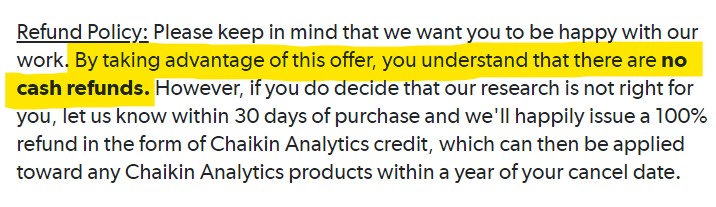

Also keep in mind there's NO cash refunds - just credit refunds you can use to buy other products at Chaikin:

6) The Analytics Cost $3,195 Per Year

You have the option to buy the Chaikin Analytics System separately as well.

This will cost you $3,195.

So for this to be worth it you'd need to be investing at least $160,000.

Anything less and the cost of the analytics will eat too much into your gains.

This subscription just gives you access to the Power Gauge Rating where you can look up information on 5,000 stocks.

The system gives you ratings ranging from very bearish to very bullish on each stock.

Once again there's no cash refunds:

7) Power Gauge Investor Costs $5,000 Per Year

The Power Gauge Investor is another very expensive upsell and costs $5,000.

So if you're investing anything less than $250,000 I wouldn't even consider this service.

This product acts like the other newsletters we've covered.

You get a monthly newsletter recommending stocks - this time you'll be getting small cap recommendations.

Additionally, you get access to the portfolio and analytics.

And in not so shocking news there's no way to get your money back:

8) Power Pulse System Is Watered Down Analytics

If you don't want to spend thousands on the full analytics system offered by Chaikin Analytics you can try the Power Pulse System.

This isn't quite as powerful as the other tools Chaikin offers but allows you to see a stock's ratings.

Here's what it looks like when you look up Amazon:

This product is much more reasonable at $120 per year.

And guess what?

There's actually a cash refund in this case:

This is a little trick all MarketWise publishers do.

They offer cash refunds on their cheap products and credit refunds on their expensive ones.

You don't make hundreds of millions a year giving people back $5,000!

Recommended: The Best Place To Get Stock Picks

Chaikin Analytics FAQ's

Still have some questions about this services.

Here's answers to any remaining questions you might have about Chaikin Analytics.

1) Who Is Chaikin Analytics For?

Well since the newsletters aren't making money right now I'd say it's for no one.

But putting that aside I think most of these tools are for people with big investment accounts.

Almost all the products cost several thousands of dollars and can cost up to $5000 per year.

You need need to be investing several hundred thousands for these tools to make sense.

Otherwise you'll be eating into your returns too much.

If you have $20,000 to invest and spend $5000 on tools you'd need to make 25% just to breakeven.

Most people don't make more than 10% a year.

The math just doesn't work out.

2) Are The Services Priced Fairly?

You have to understand that the services aren't priced based on what you get or the value.

There's zero difference between the newsletter that costs $49 and the one that costs thousands.

It's just a sales funnel with the goal of getting you to spend thousands.

To do this they offer a cheap product to lure you in then try to upsell you.

It's not like the more you pay the better returns.

In many cases it's the opposite!

Many publisher's best services are their cheapest.

3) Is Marc Chaikin Legit?

Definitely.

I don't like that he currently works for MarketWise but there's not too many ethical companies in the investing world to be completely honest.

Most are ripping off customers one way or another.

But Marc had a legitimate career on Wall Street and is very well known.

His tools are used by professionals .

4) What Is The Investing Strategy?

It depends on the service but usually you're not holding on to an asset for more than a year.

You're looking to buy and sell stocks pretty quickly.

Everything is based on the signals Marc receives from his tools.

When something is very bullish you buy.. and if it switches to very bearish you sell.

That's why there's only 7 stocks in the portfolio right now.

Either stocks were bought and sold quickly or they loss Marc's stop loss amount of 30% and he sold.

5) Are There Similar Products?

There's no shortage of investing newsletters and tools.

Some include:

- The Distortion Report

- Strategic Intelligence

- True Wealth

- Oxford Income Letter

- Jeff Clark Trader

- Fry Investment Report

- Hidden Alpha

- The George Gilder Report

- Safe Money Report

- The Ferris Report

- Extreme Value

- Tradesmith

And there's plenty more.

Recommended: The Best Place To Get Stock Picks

Chaikin Analytics Pros And Cons

Chaikin Analytics Conclusion

That's the end of my review of Chaikin Analytics.

Marc Chaikin has a good reputation but a good reputation isn't going to get you gains on the stock market.

Right now people are having a very hard time getting positive returns and the market was down about 19% in 2022.

So if you're going to spend money on stock research it better make you money.

I just don't think that's happening with Chaikin Analytics right now.

The Power Gauge Report had five 30% losers in the last year alone.

That's pretty bad.

I don't know how you can trust tools that are consistently wrong like this.

If the creator of Chaikin Analytics can't figure out how to use the data to profit I doubt you'll be able to.

Add on the fact all the expensive products don't come with a refund policy and I just can't recommend anything from Chaikin at the moment.

I'll check back next year to see how things are doing but right now it's not good.

Here's A Better Opportunity

I'd pass on Chaikin Analytics.

It's not performing well and dealing with their sales funnel is a headache.

The good news is there's still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

I guess technically not a “scam.” But misleading in that he and others like him that sell this crap, claiming “you too can make all this money on the stock market.” Ok, well if you’re making so much why are you selling “education materials?” Out of the goodness of your heart because you really wanna help people? Uh, no. It’s to make money of course – a LOT of money. So if you really wanna do what he does – get into the financial education business, not stocks.

I don’t really like this logic.. everyone does stuff to make money. A good product provides value and makes money.

I don’t find Chaikin Analytics useful for the money we paid. In general, the alerts will come after the market has been up or down.

Thanks for your insights!