Marc Chaikin is the publisher of the investing newsletter Power Gauge Report.

If you're here, I'm guessing you want to know if it's a scam or legit.

We'll answer this question in this review.

Additionally, we'll breakdown who exactly Marc is, how the newsletter works, and any red flags that I find.

You'll know if the Power Gauge Report is worth it by the time you're done reading.

Let's get started!

Power Gauge Report Summary

Creator: Marc Chaikin

Price to join: $49 for first year

Do I recommend? No.

Overall rating: 3/5

I've been a member of Power Gauge for a few years now and think there's some things to like and dislike about this newsletter.

I think the investing strategy is sound, and you're investing in solid stocks in the long term.

Right now, there are only 11 open positions; almost all have been recommended in the last year.

Of the 11, 8 stocks are up and 3 are down.

And of the 11 picks, 5 are AI, and they've done pretty well (4 up and 1 down).

This newsletter definitely rebounded from a tough 2022.

However, the newsletter still isn't beating the market, from what I can tell.

In 2023, the market gained 24%, and there are only 3 stocks in the portfolio with higher gains.

So despite the improvements, I still don't really recommend this newsletter.

Better opportunity: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

8 Things To Know About Power Gauge Report

Before you buy Power Gauge Report there's things you need to know.

Here's everything you should consider about Power Gauge Report:

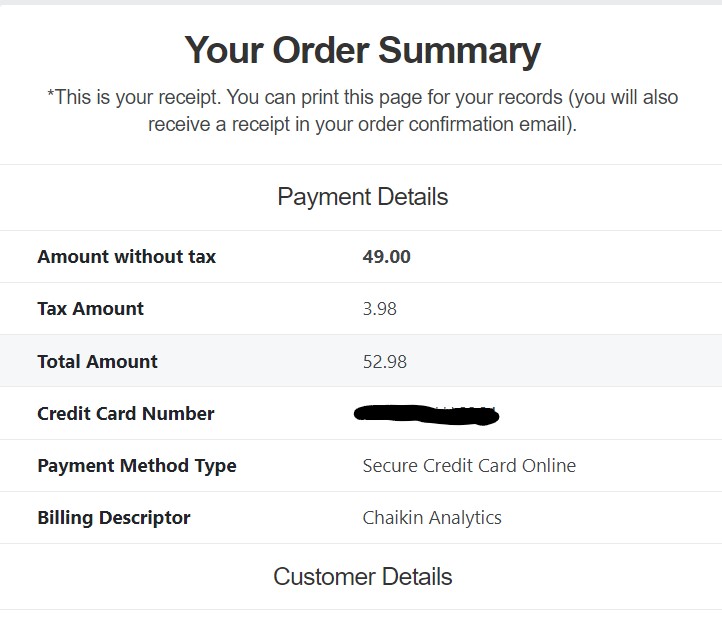

1) Here's My Proof Of Purchase

There's a lot of Power Gauge Report reviews floating around, and most aren't worth reading.

Either you find people who are making money from their reviews and won't tell you the truth about it, or you'll find people who just don't know what they're talking about.

I actually bought this newsletter, and I'm not receiving compensation for my review.

Additionally, I've reviewed over 100+ stock-picking services, so I know what to look for.

This is going to be an honest look at this newsletter.

Now that we've gotten that out of the way, let's get started with the review.

2) Another MarketWise Product (Not Good)

The first thing you need to know about Chaikin Analytics and The Power Gauge Report is this is not an independent company.

Chaikin is owned by a much larger company called Marketwise, which is a publicly traded company.

Marketwise owns popular publishers like Stansberry, Rogue Economics, Palm Beach Research Group, Brownstone, etc.

It is not a good thing that Chaikin is owned by Marketwise.

Here are a few reasons why:

Big, Manipulative Upsells

One thing you're going to have to deal with when buying from Chaikin and Marketwise is constant upsells.

I don't mean every once in a while they send you an email to upgrade.. it's multiple times a day.

It's so annoying that your email almost becomes useless because it's flooded with promotional offers.

These upsells will cost thousands of dollars and will be marketed to you in very manipulative ways.

You'll get stock presentations promising you the moon, which are oftentimes highly risky and speculative investments.

They'll try to scare you into thinking society is going to collapse and the only way to stay safe is by upgrading.

Marketwise Makes $100+ Million PER Quarter

Another reason you want to avoid a Marketwise publisher is because they treat customers more like targets than customers.

Since Marketwise is a public company, you can look at their revenue and how much they make.

In the second quarter of 2022 they made $128 million in revenue.

Do you think they make this amount of money selling $49 subscriptions?

Of course not.

They make the majority of their revenue through upsells.

That's why they market to customers so heavily. The real money is in the products that cost thousands per year, and the only people buying those services are the ones who bought the cheap ones first.

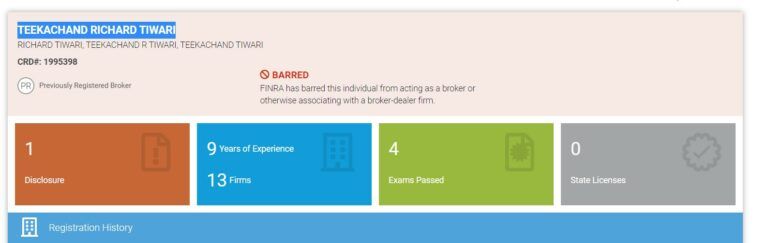

Promotes Products From Scammers

Another thing you need to understand is that you're not just going to get promoted products from Chaikin if you buy The Power Gauge Report.

You'll be promoted all of the services under the Marketwise umbrella.

This includes products with really seedy characters.

For example, Teeka Tiwari runs the Palm Beach Research Group, which is owned by Marketwise.

Teeka is a lifelong scammer who's worked for some of the worst brokerages imaginable.

He spent years swindling money from people and is now permanently banned from Wall Street.

So Teeka can never again buy and sell securities for customers and can't work at any company that does this in any capacity.

Marketwise markets Teeka is a trusted expert and will send promotions for his products that cost thousands of dollars a year.

He's not the only bad character, either.

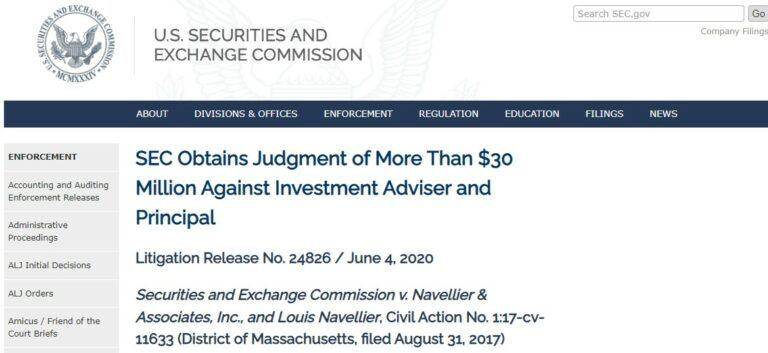

Louis Navellier runs InvestorPlace, which is owned by Agora.

Louis was fined $30 million for defrauding investors about a stock.

Yet Marketwise will tell you he's a beloved investor and that you should buy his services, which cost thousands.

I guess the question you need to ask yourself is this:

Do I really want to give people like this my money, and is the Power Gauge Report worth the headache?

If you answered yes, then I would at least sign up with a burner email account.

This way, you won't ruin your regular email account.

Recommended: The Best Place To Get Stock Picks

3) Mark Chaikin Is Well Respected

It's actually a shame Marc has decided to be a part of Marketwise because there's a lot to like about him.

Here's what I think you should know about Marc:

A Long Career On Wall Street

There are a lot of people in the stock-picking world who don't have much of a resume.

For example, one of the main guys at Marketwise is Matt McCall, and he barely has any Wall Street experience.

He worked one year at Charles Schwab, then immediately went into radio.

But Marc spent 40 years on Wall Street at legitimate brokers.

Most Known For His Tools

Marc is actually pretty well known in the investing world and is most known for is investing tools.

For example, in the early 1980s, Marc started to develop stock market indicators and economic indicators.

His products became the first real-time analytics workstation for portfolio managers and traders.

Today, they are a key part of Reuters institutional workstations.

Marc's indicators are heavily used on Wall Street today, too.

Launched Chaikin Analytics In 2011

The last thing you should know about Marc is he launched Chaikin in 2011 for retail investors.

Basically he's giving individual investors access to the tools money managers have been using for years.

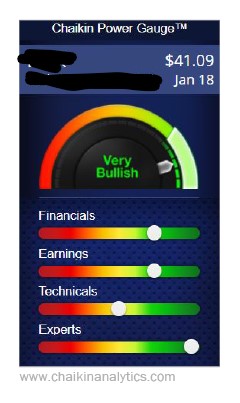

His tools give you a rating based on 20 different factors.

A stock can be very bullish, bullish, neutral, bearish, or very bearish.

This will help you determine if a stock is worth investing in.

Recommended: The Best Place To Get Stock Picks

4) The Upsells Once You Buy

All MarketWise newsletters will come with an upsell.. it's how they make their money.

The upsells for the Power Gauge Report aren't horrible, but they're there.

The first upsell is for a lifetime membership.

Marc offers to give you a lifetime subscription to Power Gauge Report for $500 ($450 extra if you subtract what you already paid):

One thing I don't like is how they have the buy button set up:

This is known as confirmshaming.

Truth In Advertising calls this a "dark marketing pattern," and it basically shames you into buying.

After you hit no, you're brought to one more upsell.

This time you get an offer to add a second year of Power Gauge Report for $49:

After you hit no here you can access Power Gauge Report.

Not the worst upsell process I have ever seen.

For example, last week I did a review that had 7 upsells!

5) You Get A Monthly Newsletter

This is the main part of the offer.

Every month, you'll get a new newsletter, and in each edition, there will be a new stock recommendation.

It will either be a mid-cap or large-cap stock.

Along with the recommendations, you'll get an analysis of the stock.

The analysis mostly comes in the form of Chaikin's stock screener.

In order for Marc to recommend a stock, it needs to have a very bullish rating from Marc's analytics.

For example, here's the rating from Marc's most recent stock recommendation (I have to blank out the name):

This is just the "overall" rating.

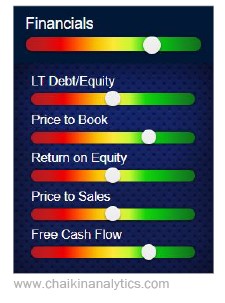

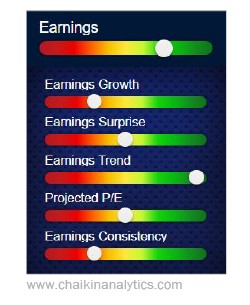

After this, you get an analysis of each of the sections in the "overall" category, including financials, earnings, technical, and experts.

The financial sections look at long-term debt and equity, price to book, return on equity, price to sales, and free cash flow.

Next, you'll get analysis of earnings which includes earnings growth, earnings surprise, earnings trend, projected P/E and earnings consistency:

After this you'll get a technical breakdown of the stock which includes relative strength vs market, Chaikin money flow, price strength, price trend ROC and volume trend:

Lastly, you'll get analysis from experts which includes earnings estimate trend, short interest, insider activity, analyst rating trend and industry rel strength:

In addition to the new stock recommendation, you'll get portfolio updates.

Marc will give you an update on the stocks he's recommended in the past, and he'll talk about the market as a whole.

If a stock needs to be sold, he'll tell you when to do that as well.

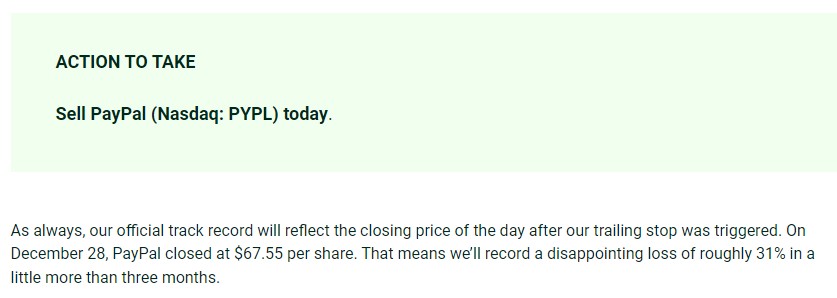

In the most recent edition, Marc recommended selling PayPal, which he told his subscribers to buy earlier.

The stock lost 31%.

Marc always recommends selling a stock if it loses 30%.

And you'll see in a little bit that Marc had quite a few 30% loses in the last year.

Want The Best Stock Picks Weekly?

I've reviewed the best programs that do this.. to see my top pick, click below:

6) There's Only 7 Stocks In Portfolio Right Now

A normal portfolio usually comes with 25 to 60+ stocks in it.

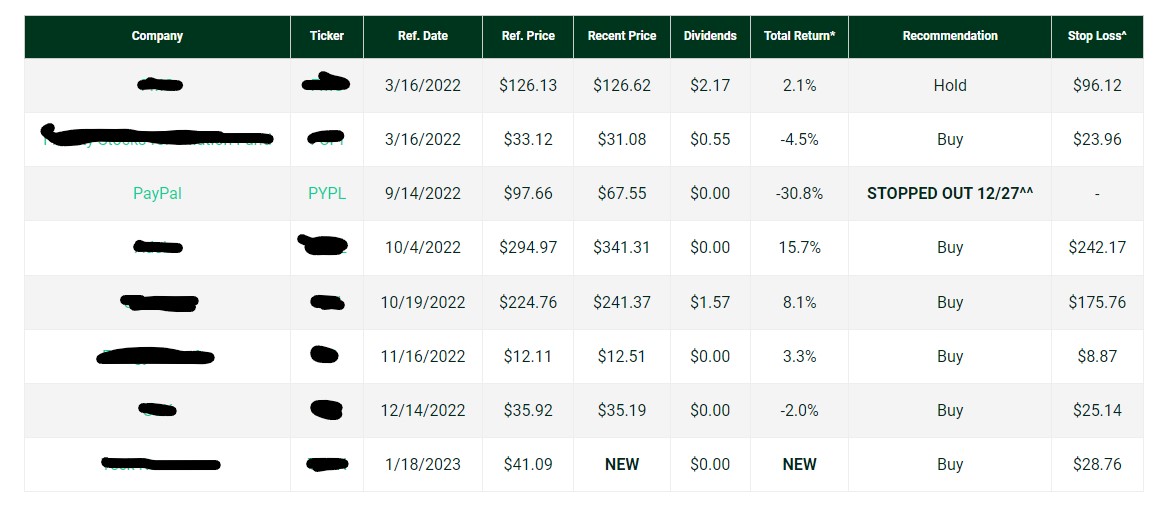

However, the model portfolio for Power Gauge Report only has 7 current recommendations and one of them is a "hold" and not a buy:

The reason there aren't more stocks is that Marc automatically recommends selling a stock if it loses over 30%.

This is just a trading rule that many stock pickers have.

By having a stop-loss rule, you can prevent yourself from taking even bigger losses.

If you include Paypal, which Marc sold, the portfolio is currently down 11%.

But the newsletter has performed much worse than that because Marc has issued many sell alerts.

We'll look at them now.

Edit: There's now 11 open positions in the portoflio.

Most of these new open positions come from a new portfolio launched in Power Gauge, which recommends 5 AI stocks.

I wrote an entire breakdown of these stocks, which you can read here.

The five stocks that he recommended to take advantage of A.I. are Alphabet, IBM, CrowdStrike, Box, and Adobe.

These stocks have had some decent success so far, and all are up besides Box, which is down around 20% since being recommended.

However, I don't think these stocks have beaten the market since being recommended.

So again, just putting your money into an index fund would have been more profitable.

7) There's Been A Lot OF BIG Losers So Far

At first glance, you might look at the portfolio and think it's not so bad.

It's down 11%, but the market was down about 16% at the time these stocks were recommended.

However, Marc doesn't include most of the stocks he told his readers to sell after losing 30%.

I had to dig through the previous newsletters to get a real idea of how well this newsletter has performed.

Here's the list of stocks Marc has recommended selling so far and their losses, gains, and reasoning why a sell alert went out:

- Sell alert for Williams Companies for entering "bearish" territory. There was a 6% gain on this stock.

- Sell alert for Occidental Petroleum for entering "bearish" territory. There's was a 11% gain on this stock.

- Sell alert for Chemours for 30% trailing stop loss (so 30% loss on this stock). Another sell alert on the same day for Phillips 66 with a loss of 18%.

- Sell alert for Catalent for a 30% trailing stop loss (so a 30% loss on this stock).

- Sell alert for Nasdaq for a 12% loss.

- Sell alert for The Trade Desk for a 30% trailing stop loss (so a 30% loss on this stock).

- Sell alert for Mimecast for being bought and going private. There was a 26% gain on this stock.

- Sell Alert for Blackstone for a 30% trailing stop loss (so a 30% loss on this stock).

So of all the stocks sold, the following were positive gains:

- Williams Companies for a 6% gain

- Occidental Petroleum for 11% gain

- Mimecast for a 26% gain

But the losses were much steeper.

Here's the stocks that were sold for losses:

- Chemours for 30% loss

- Philipps 66 for 18% loss

- Catalent for 30% loss

- Nasdaq for 12% loss

- The Trade Desk for a 30% loss

- Blackstone for a 30% loss

Because of these big losses, this newsletter has definitely trailed the market since its inception in October 2021.

Recommended: The Best Place To Get Stock Picks

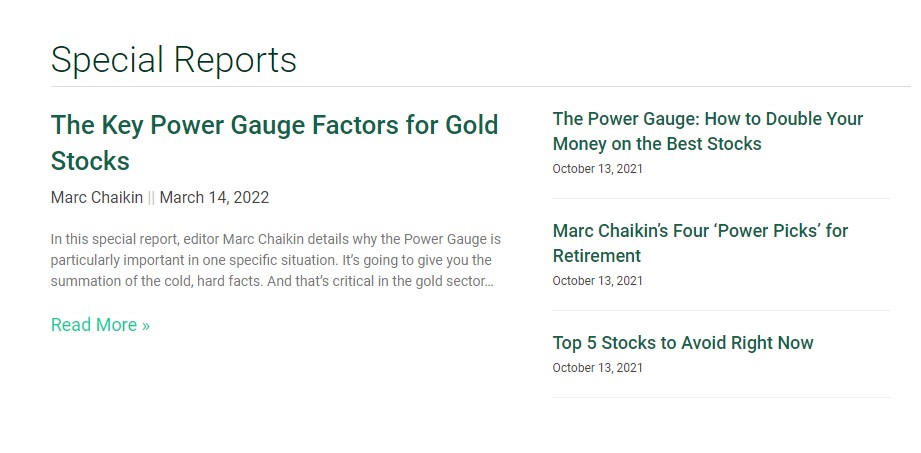

8) You Get 4 Special Reports

Along with the monthly newsletter, portfolio, and updates, you get four special reports, and they are:

- The Key Power Gauge Factors for Gold Stocks

- The Power Gauge: How to Double Your Money on the Best Stocks

- Marc Chaikin's "Four Power" Picks for Retirement

- Top 5 Stocks to Avoid Right Now

The first report covers gold and using the Power Pulse tool to figure out good stocks.

You use the same analytics you use for all stocks, which are exerts, technicals, money flow indicators, and relative strength oscillators.

Basically, the second special report about doubling your money is the same thing.

The third report covers four stocks for retirement.

According to Chaikin, a long-term stock pick you hold for life needs to have major competitive advantages and the ability to grow without the need for massive capital investment.

Marc claims to have identified four of these stocks that you can hold until retirement based on those two factors.

Lastly, there are 5 stocks that Chaikin believes you should avoid.

All of these stocks are "very bearish" based on Chaikin's tools.

Power Gauge Report FAQ's

Still have some questions about this newsletter?

Here are the answers to any questions you might have about the Power Gauge Report.

1) How Much Does Power Gauge Report?

The Power Gauge Report will cost $49 for the first year and then $199 for every year after.

There's an offer to become a lifetime member for $500 after you buy, and an offer to get a second year for $49 as well.

This is how MarketWise prices all their introductory products.

The main goal is to get you into the sales funnel so they can upsell you more expensive products.

Marc Chaikin has products that cost thousands of dollars per year.

2) Is There A Refund Policy?

Yes, and it's 30 days to get your money back.

This isn't enough time to test the stock picks, but you should get an idea if you like the service or not.

Another thing you need to keep in mind is the upsells don't come with a refund policy.

You only get credit.

So if you fall for the upsells at Chaikin, you'll only be able to get a refund to buy other Marketwise products.

3) Is Marc Chaikin Legit?

Yes.

Typically, I put a caveat on stockpickers that work for these massive (in my opinion) unethical companies.

Obviously, I'm not a fan of the marketing for Chaikin and the fear-mongering tactics.

That kind of stuff is beneath Marc.

But at the end of the day, he has quite the resume.

He worked in the investing world for 40 years, and major players use his tools.

These massive firms wouldn't be using his indicators and tools if they were bad.

4) What Is The Investing Strategy?

Everything is based on the Power Pulse system and its ratings based on earnings, financials, experts, and technicals.

If the stock is very bullish, Marc will recommend it to his readers.

The stocks aren't held for too long, though.

You're only holding the stocks for 6 to 12 months and then selling them.

Everything is based on the rating system, so once a bullish stock turns bearish, Marc recommends that you sell it.

5) How Much Do I Need To Get Started?

Since there's only six positions in the portfolio Marc recommends buying, you won't need much to get started (npw there's 11 open positions in 2024)

Chaikin recommends $5000 to get started, and I think that's fair.

However, you should have about $1000 per month for each new recommendation.

This will allow you to participate completely.

6) Are There Similar Newsletters?

There's a million newsletters just like this one.

Some of them include:

- The Distortion Report

- Strategic Intelligence

- True Wealth

- Oxford Income Letter

- Jeff Clark Trader

- Fry Investment Report

- Hidden Alpha

- The George Gilder Report

- Safe Money Report

- The Ferris Report

- Extreme Value

And there's plenty more.

Recommended: The Best Place To Get Stock Picks

Power Gauge Report Pros And Cons

Power Gauge Report Conclusion

Alright, that's my review of the Power Gauge Report.

The market is in a tough place right now, and many stocks are losing.

Since the beginning of 2022, the market has been down 16%.

In order for me to recommend a newsletter, it must beat the market.

The reason for this is that putting your money into an index fund is very simple and easy.

So at the very least, you need to outperform the S&P to be considered worth it.

The Power Gauge Report has not done this since its inception.

Their stocks are down pretty big, and many of them have had 30% losses.

Right now, there are only six positions in the portfolio, and none of them are up too much.

So until Chaikin can turn things around, I'd stay away from this newsletter.

I'd pass on the Power Gauge Report for now.

It's not performing well, and dealing with their sales funnel is a headache.

The good news is that there are still a lot of good places to get stock picks.

I've reviewed all the best places to get good stock ideas.

To see my favorite (which is very affordable), click below:

Get High Return Stocks!

I've reviewed 100+ stock picking services. To learn more about my favorite, click below:

Thanks for giving me a accurate report on the, Power Gauge Report by Mark Chaikin. Many years ago there was a product similar to this that simply gave you a green, yellow, or red light for a particular stock symbol that you punch in to their system. They are going down to town giving seminars at hotels all over the country. Only after spending a couple of hours did you find out that it cost $3,000. But people were buying it. Eventually, people realize it was a total scam. Fortunately, I was able to try out the system without having to spend any money and found out first hand that it didn’t work. For all I know, this could be the same program / algorithm that they put out many years ago. I wish I could remember the name of that product, but it was a long time ago. Thanks again.

No problem!